Alternative Investment Funds (AIFs) in India: Types, Benefits & Who Can Invest

Alternative Investment Funds, or AIFs are basically private investment vehicles meant for wealthy individuals, institutions or experienced investors. They aren’t like mutual funds that are open to the general public. AIFs are privately pooled and come with their own set of strategies and risks.

These funds are regulated by SEBI and managed by professional fund managers. AIFs target high-net-worth individuals (HNIs) and other savvy investors who are okay with taking on more complex opportunities. The minimum ticket size of investment in AIFs is usually high at Rs. 1 crore.

AIFs give access to a wider set of assets beyond the usual stocks and bonds. That’s why they are gaining traction. And the numbers back it up. At the end of 2024, investor commitments to AIFs had already reached ₹13 trillion (roughly $142 billion).

Types of Alternative Investment Funds in India

SEBI classifies AIFs into three categories, each with specific investment mandates:

Category I AIF

These funds usually put money into areas that have a positive social or economic impact. These sectors get support or incentives from the government. We're talking about things like start-ups, small and mid-sized businesses, infrastructure projects, or even affordable housing. So if a fund is backing early-stage tech companies or investing in projects that boost public welfare, it likely falls under Category I AIFs. These are designed to support sectors that matter for the country’s growth.

Category II AIF

This category includes funds not classified as Category I or III, provided they do not employ leverage beyond routine operational borrowing. Category II funds include private equity funds, real estate funds, credit/debt funds, fund of funds (that invest in other AIFs), and similar vehicles. These funds invest in unlisted equity or debt of companies (often mid- to late-stage ventures) and may also invest in unlisted debt instruments, without special incentives attached.

Category III AIF

These funds engage in diverse or complex trading strategies and may use leverage, including investing in listed or unlisted derivatives. Category-III AIFs are hedge funds that use aggressive, fast-moving strategies that aim to make money no matter where the market goes.

Funds of funds that invest in other mutual funds also come under the Category-3 AIFs.

Who Can Invest in AIFs?

AIFs are generally targeted at sophisticated and high-net-worth investors. The individual should be able to invest Rs. 1 crore into a single scheme. The employees or directors of an AIF fund can invest lower amounts starting at Rs. 25 lakhs. These funds usually attract high-net-worth folks - the HNIs and UHNIs along with family offices, pension funds, university endowments, insurance companies, sovereign funds, and banks.

SEBI has an accredited investor requirement. AIFs are typically high risk investments. The accredited investors are allowed to invest in AIFs with lower amounts than the 1 crore minimum requirement. If you’re an individual, you typically need to earn ₹2 crore or more a year or have a net worth of at least ₹7.5 crore. Out of this Rs. 7.5 crore in assets, at least ₹3.75 crore of that must be in financial assets like stocks, bonds, or mutual funds.

If you're applying as a company, trust, or family office, the threshold is even higher, net worth needs to be around ₹50 crore. SEBI automatically considers big institutions like sovereign wealth funds, qualified institutional buyers (QIBs), multilateral agencies, and certain foreign investors as accredited.

Non-resident investors: If you’re an NRI, OCI, or even a foreign investor, yes, you can invest in Indian AIFs. But it’s not as simple as just wiring the money. Your invest it through your NRE/NRO accounts. Some AIFs are specially structured to make it easier for overseas investors like being registered as Category I FPIs or under IFSCA for offshore funds. These setups help bring foreign capital into India while staying compliant with the rules.

Key Benefits of Investing in AIFs

- The return potential: A lot of AIFs go after high-growth areas like early-stage start-ups or big infrastructure projects. Others use trading strategies to make money regardless of market direction. The green-field nature of the investment results in higher returns if they work out.

- Diversification that’s not the usual stuff: AIFs open the door to like start-ups, private companies, real estate, commodities, and hedge-type strategies. These are asset classes which a regular retail investor does not get access to.

- Professional management: These funds are run by serious professional people who have got dedicated teams, networks, and years of experience. So when you invest, you’re also backing the fund manager’s ability to spot opportunities most people don’t even hear about.

- Regulatory oversight: AIFs come under the regulatory oversight of SEBI and IFSCA (in GIFT City). There are rules like what they have to disclose, how the fund works, and how long you have to stay invested.

How to Invest in an AIF?

Alternative Investment Funds aren’t your typical mutual funds, they’re tailored for seasoned investors looking for unique strategies, higher returns, or long-term wealth creation. Here’s how the investment process looks:

1. Research and due diligence:

There are different types of AIFs: some aim for aggressive growth with high risks, while others invest in the greenfield sector. Start by identifying the fund category and strategy that suits you. Once you’ve shortlisted a specific AIF, request its Placement Memorandum (PPM)- think of it as the rulebook for that fund. Go through where they plan to invest, their historical performance (if available), the fund manager’s credentials, fees (like management and carry), lock-in periods, and exit options. And don’t hesitate to speak directly with the fund manager.

2. Eligibility and accreditation:

AIFs are meant for investors with high risk appetite. That’s why they have a higher ticket size of investment. Even for accreditation there's a higher net worth requirement. The ticket size for non-accredited investors is Rs.1 crore. The accredited investors may be allowed to invest in lower ticket sizes.

3. Account setup and KYC:

Once you’ve chosen the fund, you’ll need to open an account either with the fund manager or a registered platform. Like any financial investment, there’s paperwork i.e. KYC documents, anti-money laundering checks, PAN, proof of address, maybe even income or net worth proofs. Most investors transfer their funds through cheques or bank transfers to the fund’s trustee. It’s a standard process, but make sure everything’s in place before you send the money.

4. Subscription:

Fill out the subscription form and commit the minimum investment amount (₹1 Cr for most investors, ₹25 L for qualifying employees). Funds often require lump-sum contributions, though some allow instalments up to a closing date.

Risks and Considerations of Investing in AIFs

Investing in AIFs comes with the potential for high returns but it’s not without risks. Here are some key risks and considerations to keep in mind before investing in an AIF:

1. Liquidity Risk:

Most AIFs are close-ended vehicles. Category I and II AIFs must have a minimum tenure (often ≥3 years) and do not permit easy redemption. Investors typically cannot withdraw capital until the fund matures or reaches specified exit windows. Even Category III funds (hedge funds) may impose lock-in periods or notice periods before redemption. This limited liquidity means investors should lock in funds for the long term.

2. High minimum ticket size:

The ₹1 crore entry point (₹25 lakh for fund employees) is very high, limiting AIFs to wealthy or institutional investors (thc.nic.in). This concentration means less liquidity and higher risk if the fund’s strategy underperforms.

3. Concentration and strategy risk:

AIFs often pursue focused strategies like targeting specific sectors, asset classes, or using leverage (especially in Category III funds). This strategic concentration can deliver outsized returns if things go well, but it also means higher risk if the chosen sector underperforms or the strategy fails. Investors should view this as a high-risk, high-reward game and must thoroughly understand the fund’s thesis, risk exposure, and past performance before committing.

4. Exit limitations:

AIFs can be either open-ended or closed-ended, and the exit flexibility depends heavily on which one you choose. Open-ended AIFs allow periodic redemptions (monthly or quarterly, depending on the fund’s structure), offering greater liquidity and flexibility to investors. In contrast, closed-ended AIFs come with a fixed tenure, and even after the fund matures, exits may be delayed, especially if it holds illiquid assets like real estate or private equity. While a few secondary markets exist for selling AIF units, they’re not very active. That’s why it’s essential to match the fund’s structure and expected duration with your personal liquidity needs.

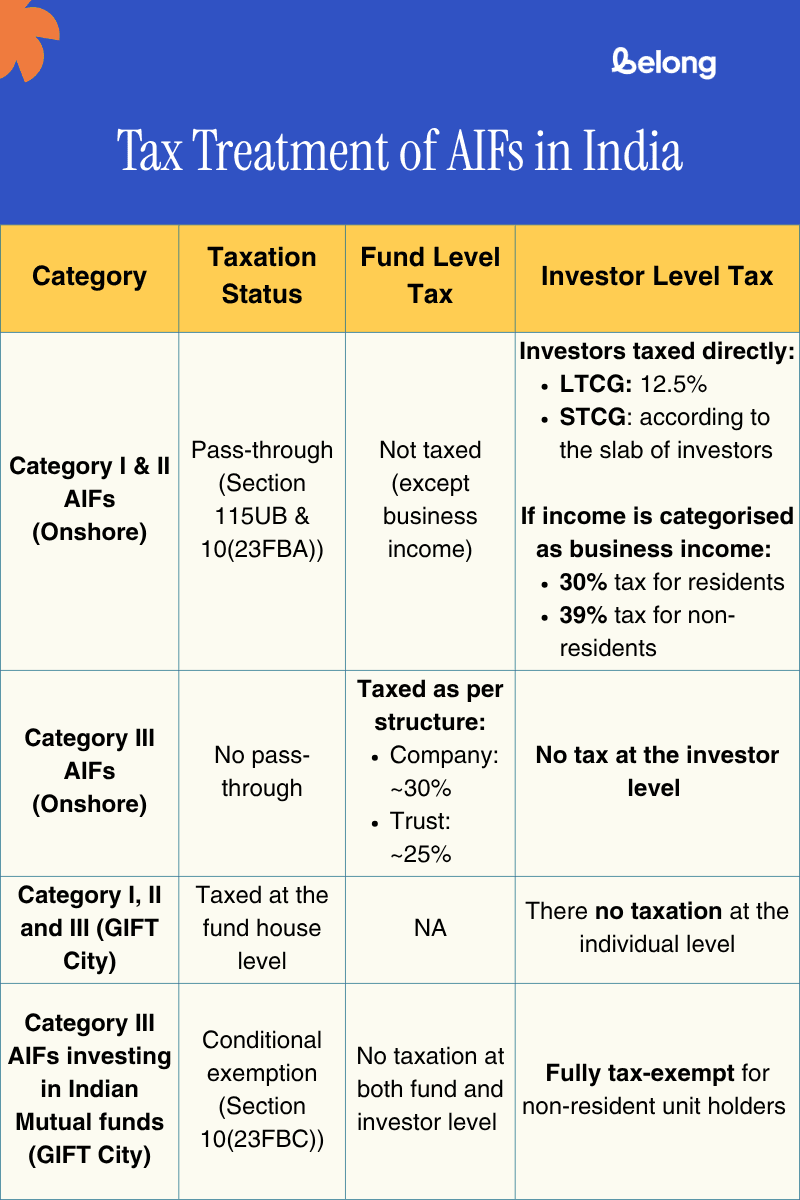

Tax Treatment of AIFs in India

Alternative Investment Funds (AIFs) in India are subject to different tax treatments based on their category and location. While Category I and II AIFs enjoy pass-through taxation, Category III AIFs are taxed at the fund level. Special exemptions also apply to Category III AIFs set up in GIFT City, offering complete tax relief to eligible non-resident investors. The table below captures the updated tax framework as of 2025:

Is AIF an Instrument for Sophisticated Investors?

In summary, Alternative Investment Funds are investment vehicles for sophisticated investors. But they are the typical high-risk and high-reward investments. They let sophisticated investors invest in green-field sectors like startups, real estate, hedge strategies, etc.

You can also read about:

Comments

Your comment has been submitted