Best FCNR Deposits for NRIs: Grow Your Savings

Indian banks offer a wide array of financial products to cater to the diverse needs of NRIs around the globe. One of the key product offerings for this international clientele is Foreign Currency Non-Resident (FCNR) Deposits. Similar to GIFT City FDs, a key feature of these deposits is that they are denominated in foreign currencies such as US Dollar (USD), British Pound (GBP) and Euro (EUR).

This allows you to earn interest on these deposits with Indian banks without having to worry about the risk of fluctuations in the value of foreign currency against the Indian Rupee (INR). Here, we’ll take you through the features and benefits of FCNR deposits in detail and provide the latest interest rates offered by top Indian banks across various international currencies.

What are FCNR Deposits (Foreign Currency Non-Resident Deposits)?

FCNR deposits are a special kind of term deposit that allow NRIs to make a bank deposit in India in a foreign currency. Typically this foreign currency would be the one in which you earn your foreign income (such as USD, GBP, EUR, etc). These term deposits held in foreign currency come with unique features and benefits.

Key Features of FCNR Deposits

- FCNR deposits can be offered in most major foreign currencies, such as the US Dollar (USD), British Pound (GBP), Euro (EUR), UAE Dirham (AED), Singapore Dollar (SGD), Canadian Dollar (CAD), and Australian Dollar (AUD). The currency options available would vary between various banks.

- There is minimal currency exchange rate risk from depreciation in the value of the Indian Rupee, as the deposits are held in a foreign currency.

- The tenure of FCNR deposits ranges between a minimum of 1 year to a maximum of 5 years as per RBI regulations.

- The interest rates on FCNR deposits are typically linked to the Overnight Alternative Reference Rate (ARR) for the respective currency), and may change based on rate notifications from the Reserve Bank of India from time to time. This makes FCNR deposit rates globally competitive. The interest rates vary from bank to bank depending on the currency and the deposit duration.

- The interest earned on FCNR deposits is tax-free in India.

- FCNR deposits are fully repatriable, including the principal and interest. That means you can transfer it back to your country of residence without any restrictions.

- You can transfer money freely between your FCNR and NRE accounts without any prior approval from the RBI.

- FCNR deposits also offer liquidity with a premature withdrawal facility. This would typically, however, come with an associated penalty on the interest earned from the deposit, though the principal amount usually stays intact. The specific terms for premature withdrawal may vary from bank to bank.

- Indian Rupees or foreign currency loans can usually be availed against FCNR deposits.

- FCNR deposit accounts can be opened individually or jointly with other Non-Resident Indians, Persons of Indian Origin (PIO), or Overseas Citizens of India (OCI).

Know how NRI Fixed Deposits in GIFT City offer attractive interest rates with tax benefits.

Tax Implications of FCNR Deposits

One of the most attractive features of FCNR deposits is their tax efficiency. Interest from FCNR deposits is completely tax-free in India as long as you qualify as a non-resident (NRI). Also, the maturity proceeds are repatriable to your country of residence without any restrictions. With this major tax benefit, you can benefit from India's stable banking environment and competitive interest rates.

However, interest income from FCNR deposits may be taxable in your country of residence. Make sure to clarify the compliance requirements with a tax professional, including the applicability of related provisions available under the DTAA (Double Taxation Avoidance Agreement) between both countries.

Understand FD taxation for NRIs to manage your savings effectively.

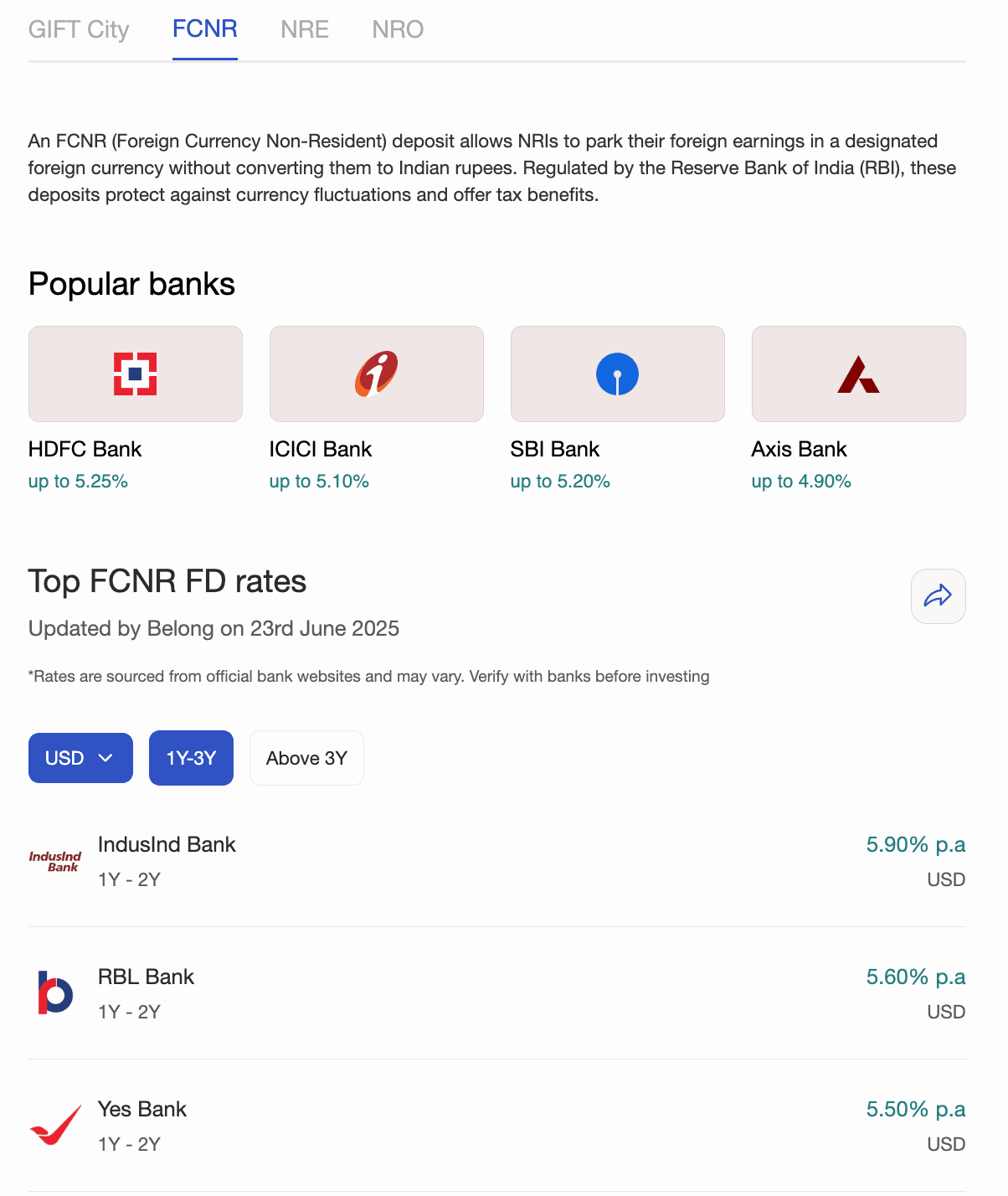

Current FCNR Deposit Rates In India

Interest rates offered by banks are subject to change from time to time. You can refer to the banks' official websites to learn the current applicable rates.

By investing in FCNR deposits, NRIs can benefit from India's stable banking environment and higher interest rates on deposits than in their country of residence, while at the same time protecting their investment against the risks of currency fluctuations.

You can find the best interest rates & FD types using Belong's NRI FD Comparison Tool -

FCNR vs GIFT City FD: Which is better?

GIFT City FD differ from FCNR deposits in terms of tenures and premature withdrawal penalties.

Tenure and Premature Withdrawal

Unlike FCNR which has a minimum tenure of 1 year, GIFT City FDs have lower tenures like 7 days, 3 months etc.

If you withdraw FCNR deposits prematurely (i.e., before 1 year), you forfeit all the interest earned. In contrast, with GIFT City FDs, there's usually a fixed penalty for early withdrawal, which may still allow you to retain part of the accrued interest depending on when you exit.

The best FD for you depends on your needs. If you are looking for shorter tenures along with the benefits of repatriability and international denomination then GIFT City is your best bet.

Comments

Your comment has been submitted