Annual Information Statement (AIS) - A Complete Guide for Indian Taxpayers

Have you ever wondered why your tax consultant knows about income sources you haven't told them about? Or why the Income Tax Department seems to know exactly how much interest you've earned across different banks?

The answer lies in a powerful document called the Annual Information Statement (AIS).

As someone who's helped thousands of Indians - those living in the UAE and other countries - navigate their tax obligations, I can tell you that understanding your AIS isn't just helpful; it's essential for stress-free tax compliance.

Here's the reality: The Income Tax Department receives detailed information about your financial transactions from banks, mutual funds, stock brokers, property registrars, and even your employer.

This information is compiled into your AIS, creating a comprehensive picture of your financial activities.

Ignoring your AIS is like walking into an exam without knowing what's on the syllabus - you're setting yourself up for unpleasant surprises.

This guide will answer every question you have about AIS, from basic access to advanced compliance strategies.

Whether you're an NRI in Dubai wondering about foreign remittance entries or a resident Indian trying to understand dividend discrepancies, you'll find practical solutions here.

The Big Question: What Exactly Is Your Annual Information Statement?

Your AIS is essentially the Income Tax Department's comprehensive record of your financial life. Think of it as your financial autobiography, but written by third parties who report your transactions to the government.

Quick Answer: Your Financial Transparency Report

The Annual Information Statement is a detailed document that consolidates information about your income, TDS/TCS deductions, high-value transactions, investments, and much more - all reported by various entities throughout the financial year.

It's the upgraded version of Form 26AS, providing a 360-degree view of your financial activities.

Bottom line upfront: AIS contains information that the tax department will use to cross-verify your ITR. Any significant omissions or mismatches can trigger notices, penalties, or detailed scrutiny.

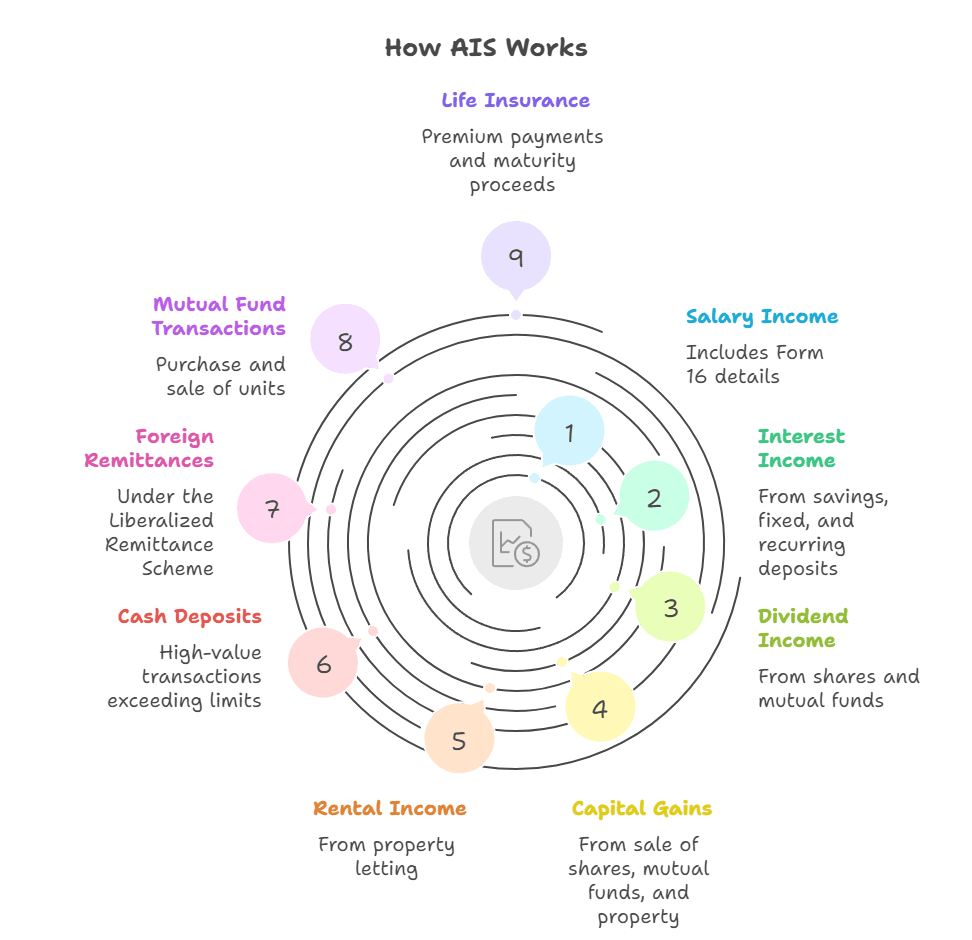

The Full Picture: How AIS Works

Unlike Form 26AS, which primarily focused on TDS and TCS details, your AIS captures a much broader spectrum of financial information. Here's what makes it comprehensive:

Financial transaction coverage includes:

- Salary income with complete Form 16 details

- Interest from savings accounts, fixed deposits, and recurring deposits

- Dividend income from shares and mutual funds

- Capital gains from sale of shares, mutual funds, and property

- Rental income from property letting

- Cash deposits and high-value transactions exceeding specified limits

- Foreign remittances under the Liberalized Remittance Scheme (LRS)

- Purchase and sale of mutual fund units

- Life insurance premium payments and maturity proceeds

For NRIs specifically, your AIS will show:

- TCS collected on foreign remittances (if you were a resident when you sent money abroad)

- Interest income from NRO accounts and Indian investments

- Capital gains from Indian asset sales

- Any TDS deducted on Indian income sources

The system receives this information from over 50 different types of reporting entities, creating an unprecedented level of financial transparency.

How Does AIS Transform Your Tax Filing Experience?

Understanding how AIS impacts your tax filing process is crucial for avoiding complications and penalties.

Benefits That Actually Matter

Pre-filled ITR accuracy: When you file your return through the income tax portal, many fields get automatically populated with information from your AIS. This reduces manual errors and saves time, but only if your AIS information is accurate.

Early mismatch detection: By reviewing your AIS before filing, you can identify discrepancies between what you plan to report and what the department already knows. This prevents post-filing notices and penalties.

Complete income discovery: Many taxpayers discover forgotten income sources - a small savings account opened years ago, dividend income from inherited shares, or interest from an old company deposit.

The Compliance Reality Check

Here's what changes with AIS: The tax department now has detailed information about your financial activities before you file your return. This shifts the burden of proof. Instead of the department having to discover discrepancies post-filing, they already know what to expect from you.

Practical impact for UAE residents: If you've sent money to India for property purchases, education, or family support, these transactions appear in your family members' AIS (if they were recipients) and in your AIS (if TCS was collected when you were a resident).

👉 Tip: Review your AIS at least 30 days before filing your ITR to allow time for providing feedback on any discrepancies.

What Information Will You Find in Your AIS?

Your AIS contains information divided into two main parts, each serving a specific purpose in the tax ecosystem.

Part A: General Information

This section acts as your taxpayer profile within the AIS system:

- PAN and masked Aadhaar number

- Complete name as per PAN database

- Date of birth (for individuals) or incorporation (for entities)

- Registered mobile number and email address

- Address as per latest tax records

For NRIs: Ensure your address reflects your current status. If you've recently become an NRI, your address might still show your previous Indian address until you update it through proper channels.

Part B: Detailed Financial Information

This comprehensive section includes four crucial categories:

TDS/TCS Information:

- All tax deducted at source by employers, banks, and other entities

- Tax collected at source on foreign remittances, property sales, and specified transactions

- Details include TDS/TCS certificate numbers, deduction dates, and amounts

- Information about the deductor/collector with their TAN details

SFT (Statement of Financial Transaction) Information:

- Cash deposits exceeding ₹2.5 lakh in savings accounts or ₹12.5 lakh in current accounts

- Credit card payments exceeding ₹2 lakh (annual aggregate)

- Purchase of shares, mutual funds, or debentures exceeding ₹1 lakh

- Property purchases and registrations

- Foreign currency purchases or forex card loadings exceeding specified limits

Tax Payments:

- Advance tax payments made during the financial year

- Self-assessment tax payments

- Any additional tax payments through challan

Other Information:

- Interest payments by banks on savings and fixed deposits

- Dividend payments from shares and mutual funds

- Life insurance premium payments and policy maturity proceeds

- Mutual fund transactions (purchase, redemption, and switch transactions)

- Foreign remittance data: Details of money sent abroad under LRS

- GST turnover information for businesses

- Share and commodity trading details

Special Focus: Foreign Remittance Information for UAE Residents

If you were an Indian resident during any part of the financial year and sent money abroad, these transactions will appear in your AIS:

Outward remittance details include:

- Amount remitted in Indian rupees

- Purpose of remittance (education, medical, tourism, investment, etc.)

- TCS collected (if applicable based on amount and purpose)

- Bank or money transfer operator used

- Date of transaction and foreign exchange reference number

This information is particularly important for UAE residents who may have sent money for property purchases, education expenses, or family support before becoming NRIs.

How Do You Access and Download Your AIS?

Getting access to your AIS requires following specific steps through the income tax e-filing portal.

Step-by-Step Access Process

Step 1: Login to the Income Tax Portal

- Visit www.incometax.gov.in

- Click on "Login" and enter your PAN as User ID

- Enter your password (if you've forgotten it, use the "Forgot Password" option)

- Complete the captcha verification

Step 2: Navigate to AIS Section

- After successful login, look for "Annual Information Statement (AIS)" in the main menu

- Alternative route: Click on "e-File" menu → "View Annual Information Statement (AIS)"

- Click on the "Proceed" button

Step 3: Access the Compliance Portal

- You'll be redirected to the compliance portal automatically

- On the homepage, you'll see both "Taxpayer Information Summary (TIS)" and "Annual Information Statement (AIS)" tiles

- Select the relevant financial year from the dropdown menu

Step 4: View and Download

- Click on the "AIS" tile to view your statement online

- For download, click the download icon available in the respective tiles

- AIS can be downloaded in PDF, JSON, or CSV formats

- TIS can be downloaded in PDF format

Understanding the AIS Password Format

When you download your AIS in PDF format, it comes password-protected for security. Getting the password format right is crucial:

For Individual Taxpayers:

- Format: PAN in lowercase + Date of birth in DDMMYYYY format

- No spaces or special characters

- Example: If PAN is ABCDE1234F and date of birth is 15th March 1985, password is: abcde1234f15031985

For Non-Individual Taxpayers:

- Format: PAN in lowercase + Date of incorporation/formation in DDMMYYYY format

- Same rules apply for format and spacing

Common password mistakes to avoid:

- Using PAN in uppercase letters

- Adding spaces or hyphens in the password

- Using wrong date format (remember it's DDMMYYYY, not DDMMYY)

- Using registration date instead of date of birth/incorporation

👉 Tip: If your PDF won't open, double-check your date of birth as recorded in your PAN database - this might differ from other documents if there were corrections made during PAN application.

What Should You Do When You Find Errors in Your AIS?

Finding discrepancies in your AIS is common and manageable if you know the right process.

The Feedback Mechanism

The AIS system allows you to provide feedback on incorrect, duplicate, or irrelevant information. This feedback system is crucial for ensuring your tax filing accuracy.

Types of feedback you can provide:

- Information is incorrect: Wrong amount, wrong taxpayer, wrong financial year

- Information is duplicate: Same transaction reported multiple times

- Information relates to another person: TDS/TCS wrongly tagged to your PAN

- Information is not relevant: Transactions that don't constitute income

Step-by-Step Feedback Process

Step 1: Identify the Incorrect Information

- Review each section of your AIS carefully

- Cross-reference with your own records (bank statements, investment statements, etc.)

- Note the specific information code and description of the incorrect entry

Step 2: Submit Online Feedback

- In the AIS portal, locate the "Feedback" column next to each information entry

- Click on "Optional" button for the relevant information

- Select the appropriate feedback type from the dropdown menu

- Provide detailed remarks explaining the issue

- Attach supporting documents if available

Step 3: Track Your Feedback Status Since May 13, 2024, the system shows the status of your feedback:

- Feedback Shared for Confirmation: Shows whether your feedback has been sent to the reporting source

- Feedback Shared On: Date when feedback was forwarded

- Source Responded On: Date of response from the reporting entity

- Source Response: Final decision on your feedback (accepted, partially accepted, or rejected)

Step 4: Monitor the Updated Values

- After feedback submission, AIS shows both "Reported Value" and "Modified Value"

- The modified value reflects your feedback and gets used in the Taxpayer Information Summary (TIS)

- TIS derived values are used for pre-filling your ITR

Dealing with Complex Discrepancies

Foreign remittance errors: If TCS was wrongly collected or the purpose code is incorrect, you can provide feedback with supporting documents like Form A2, bank statements, and remittance receipts.

Investment transaction errors: For mutual fund or share transaction discrepancies, submit feedback with transaction statements from your broker or fund house.

Income attribution errors: If income from HUF (Hindu Undivided Family) or partnership firm is wrongly shown in your individual AIS, provide feedback with supporting legal documents.

What Happens After Feedback?

Immediate impact: Your feedback creates a "Modified Value" that appears alongside the "Reported Value" in your AIS. This modified value flows to your TIS and can be used for pre-filling your ITR.

Long-term resolution: The reporting entity reviews your feedback and may accept, partially accept, or reject it. Their decision is final and updates the permanent record.

ITR filing strategy: Even if your feedback is pending resolution, you should file your ITR based on the correct information with proper supporting documents. Don't wait for feedback resolution if filing deadlines are approaching.

How Does AIS Impact Your ITR Filing Strategy?

Your AIS fundamentally changes how you should approach ITR preparation and filing.

Pre-Filing Checklist Using AIS

30 days before filing:

- Download and review your complete AIS

- Cross-verify each income source with your records

- Submit feedback for any discrepancies

- Gather additional documents for income not reflected in AIS

15 days before filing:

- Check if your feedback has been processed

- Update your records with any newly discovered income sources

- Prepare explanations for any income that differs from AIS values

Before clicking "Submit" on your ITR:

- Ensure your declared income includes all sources shown in AIS

- Account for any additional income not captured in AIS

- Verify that your total TDS claimed matches AIS records

Strategic Considerations for Different Income Types

Salary Income: Your AIS should perfectly match your Form 16. Any discrepancies might indicate:

- Multiple Form 16s from different employers during the year

- Previous employer's delayed TDS deposits

- Arrears payment in the current year for previous years

Investment Income: AIS captures interest and dividends comprehensively, but timing differences can create confusion:

- Interest accrued vs. interest paid basis difference

- Dividend dates might not match your personal records due to record date vs. payment date differences

- Capital gains might include transactions you've forgotten about

Rental Income: AIS might not capture rental income if tenants pay cash and no TDS is deducted. You're still required to report this income even if it's not in AIS.

Business Income: For professionals and business owners, AIS provides third-party validation of:

- TDS deducted by clients

- High-value cash transactions

- Digital payment receipts

- GST turnover information

Handling Income Not Shown in AIS

Critical principle: AIS is not exhaustive. You must report ALL income, whether it appears in AIS or not.

Common missed income sources:

- Cash rental income

- Professional fees received in cash

- Agricultural income (though exempt, it affects tax rates)

- Income from freelancing or consulting

- Gifts received exceeding ₹50,000

- Lottery winnings, gambling income

Documentation strategy: Maintain separate records for income sources not captured in AIS. This includes bank statements, payment receipts, and contracts.

Special Considerations for NRI Taxpayers

NRIs face unique challenges when dealing with AIS, particularly regarding the timing of residential status changes and foreign remittance reporting.

Understanding Your AIS as an NRI

Residential status timing matters: Your AIS reflects transactions based on when they occurred, not your current residential status. If you became an NRI mid-year, your AIS will show:

- Indian income earned during your resident period

- TCS on foreign remittances made while you were a resident

- TDS on income earned during your NRI period

Income categorization: Your AIS doesn't automatically separate income by residential status periods. You need to:

- Manually calculate income earned during resident vs. NRI periods

- Apply appropriate tax rates based on residential status during earning period

- Claim DTAA benefits where applicable

Foreign Remittance Entries in AIS

TCS implications: If you sent money abroad under LRS while resident, TCS collected will appear in your AIS:

- Educational remittances: TCS may be nil up to ₹10 lakh, then 5% on excess

- Medical remittances: TCS may be nil up to ₹10 lakh, then 5% on excess

- Other purposes: 20% TCS on amounts exceeding ₹10 lakh per financial year

NRI exemptions: Once you become an NRI, you're exempt from TCS on foreign remittances from your NRE/NRO accounts. However, remittances made before attaining NRI status will still appear in your AIS.

Repatriation vs. Remittance: AIS doesn't distinguish between fresh remittances and repatriation of previously earned income. Maintain separate records to support your tax positions.

DTAA Benefits and AIS

Documentation requirements: While AIS shows TDS deducted, it doesn't automatically apply DTAA benefits. You need to:

- Obtain Tax Residency Certificate from your country of residence

- File Form 10F with your ITR

- Claim appropriate DTAA rates for different income types

Common DTAA rates for UAE residents:

- Interest income: 5% for bank deposits, 12.5% for others (vs. 20% without DTAA)

- Dividend income: 10% (vs. 20% without DTAA)

- Capital gains: Potential complete exemption based on specific circumstances

Managing Multiple Country Tax Obligations

AIS as supporting documentation: Your Indian AIS can serve as supporting documentation for:

- Foreign tax credit claims in your country of residence

- Proof of Indian tax payments for avoiding double taxation

- Documentation for tax advisory consultations

Coordination with overseas returns: Ensure your Indian tax filings align with your overseas tax obligations, particularly for countries requiring disclosure of worldwide income.

Recent Updates and Changes in AIS (2024-25)

The AIS system continues to evolve with new features and expanded coverage that affect how you should approach tax compliance.

New Feedback Status Functionality

Enhanced transparency: Since May 13, 2024, taxpayers can track whether their feedback has been accepted, rejected, or partially accepted by the reporting source. This provides closure on disputed transactions and helps in future tax planning.

Impact on tax strategy: Knowing the final status of your feedback helps determine:

- Whether to include disputed amounts in current year returns

- Need for additional documentation to support your position

- Potential requirement for professional tax advice

Expanded Information Coverage

New reporting entities: The system now captures information from additional sources:

- Payment gateway transactions above specified thresholds

- Cryptocurrency exchanges (as regulations evolve)

- Co-operative banks and credit societies

- NBFC lending transactions

Enhanced property transaction tracking: Property sales and purchases are now captured with greater detail, including:

- Circle rates vs. transaction values

- Development of properties over time

- Rental agreements registered with authorities

Integration with GST Data

Business income validation: For business entities, AIS now includes GST turnover information, creating cross-validation between direct and indirect tax systems:

- Turnover reported in GST returns vs. income tax returns

- Input tax credit claims vs. business expense reports

- Export-import data correlation

Professional service tracking: For professionals providing services, GST data helps validate:

- Service income reporting accuracy

- TDS vs. GST payment reconciliation

- Client-wise income distribution

Mobile Application Updates

Convenience features: The AIS mobile app now offers:

- Push notifications for new information additions

- Simplified feedback submission process

- Downloadable reports for offline review

- Integration with common PDF readers for password entry

Compliance Enforcement Enhancement

Automated mismatch detection: The system now automatically flags:

- Significant variations between AIS information and filed returns

- Patterns suggesting potential tax avoidance

- Unusually high cash transactions relative to reported income

Risk-based scrutiny: AIS data feeds into risk assessment algorithms that determine:

- Probability of detailed tax scrutiny

- Requirement for additional documentation during processing

- Selection for tax audit

Common Mistakes That Cost Taxpayers Money

Learning from others' experiences can save you significant penalties and stress.

Filing Without AIS Review

The expensive oversight: Rajesh, a Dubai-based software engineer, filed his ITR based only on his Form 16, not realizing his AIS showed ₹3.2 lakh additional interest income from multiple bank accounts. The department issued a notice demanding ₹1.1 lakh in additional tax plus penalty and interest.

Lesson learned: Always review your complete AIS before filing. The 30 minutes spent reviewing can save months of correspondence and thousands in penalties.

Ignoring Foreign Remittance TCS

The NRI trap: Priya sent ₹15 lakh to her daughter in Canada for education while she was still a resident Indian. She moved to UAE later that year but forgot about the ₹1 lakh TCS collected on the remittance. She filed as an NRI without claiming the TCS refund, losing ₹1 lakh unnecessarily.

Prevention strategy: Maintain a detailed record of all foreign remittances and TCS collected. Claim appropriate refunds in your tax filings.

Feedback Submission Errors

The documentation disaster: Sunil provided feedback that a ₹5 lakh TDS entry belonged to his father with a similar name. However, he didn't provide adequate supporting documentation. The feedback was rejected, and he had to report income that wasn't his, creating a tax liability of ₹1.56 lakh.

Best practice: When submitting feedback, provide comprehensive supporting documentation including:

- Bank statements proving the transaction wasn't yours

- Identity documents showing name differences

- Statutory declarations where necessary

Misunderstanding Reported vs. Modified Values

The calculation confusion: Meera assumed that once she provided feedback on incorrect dividend income, she could ignore it entirely in her ITR.

She didn't realize that her feedback created a "Modified Value" of zero, but the original "Reported Value" remained. The department processed her return using the reported value, creating a significant mismatch.

Correct approach: Understand that providing feedback doesn't automatically fix your AIS. File your ITR based on correct information with proper documentation, regardless of AIS values.

Password and Access Issues

The last-minute panic: Amit tried to download his AIS one day before the filing deadline but couldn't remember the password format.

He used uppercase PAN instead of lowercase, wasted hours trying different combinations, and ultimately filed without reviewing his AIS. He later faced a mismatch notice that could have been avoided.

Simple solution: Note down the correct password format: PAN in lowercase + date of birth in DDMMYYYY format. Test access well before filing deadlines.

Advanced Strategies for AIS Optimization

For sophisticated taxpayers, AIS can be leveraged for tax planning and compliance optimization.

Using AIS for Tax Planning

Income timing strategies: Review your AIS patterns from previous years to:

- Identify optimal timing for investment redemptions

- Plan TDS optimization through appropriate investment choices

- Structure income to minimize tax impact across financial years

Investment allocation optimization: AIS data helps determine:

- Which investments generate the most tax-efficient income

- Optimal asset allocation between growth and income investments

- Timing of capital gains realization for tax optimization

Multi-Year AIS Analysis

Trend identification: Comparing AIS across multiple years reveals:

- Growth patterns in different income sources

- Effectiveness of tax-saving strategies

- Opportunities for better investment structuring

Compliance risk assessment: Historical AIS review helps identify:

- Recurring reporting issues that need systematic solutions

- Patterns that might attract tax department attention

- Areas where documentation needs strengthening

Professional Service Integration

CA collaboration: Share your AIS with your chartered accountant to:

- Ensure comprehensive income capture

- Validate tax-saving strategies

- Plan future investment structures

Investment advisory integration: Use AIS data to:

- Evaluate investment performance net of tax impact

- Optimize asset allocation for tax efficiency

- Plan retirement corpus building with tax considerations

Your Action Plan: Making AIS Work for You

Transform your understanding into actionable steps for better tax compliance and financial management.

Immediate Actions (This Week)

- Log into the income tax portal and access your current year AIS

- Download the PDF and save it with the correct password format noted

- Compare AIS information with your personal financial records

- Identify any discrepancies and prepare supporting documentation

- Submit feedback for any incorrect information

Short-term Actions (Next 30 Days)

- Set up a systematic review process for quarterly AIS monitoring

- Create a comprehensive record-keeping system for all financial transactions

- Establish relationships with tax professionals if you handle complex investments

- Document your DTAA eligibility if you're an NRI

- Review and update your investment portfolio for tax efficiency

Long-term Strategy (Next Financial Year)

- Plan investment timing to optimize tax implications

- Structure foreign remittances to minimize TCS where legally possible

- Maintain detailed documentation for all financial transactions

- Consider professional tax planning services if your situation is complex

- Stay updated on AIS system enhancements and regulatory changes

For UAE Residents Specifically

- Document your NRI status transition carefully with banks and financial institutions

- Claim DTAA benefits systematically for all applicable income types

- Plan repatriation strategies to optimize tax and compliance obligations

- Maintain clear records of income earned during resident vs. NRI periods

- Consider professional assistance for complex cross-border tax situations

Conclusion: Mastering Your Financial Transparency

The Annual Information Statement represents the future of tax compliance in India - a system where transparency isn't optional but built into the framework.

For Indian taxpayers, especially those living abroad, AIS mastery isn't just about compliance; it's about taking control of your financial narrative.

The key takeaway: AIS empowers informed decision-making. When you understand what information the tax department has about you, you can plan better, file more accurately, and avoid unnecessary complications.

Your path forward involves:

- Regular AIS monitoring and review

- Proactive feedback on discrepancies

- Integration of AIS insights into tax planning

- Maintenance of comprehensive supporting documentation

- Professional guidance when needed

The system will only become more sophisticated over time, with additional data sources and enhanced analytics. Those who master AIS today will find themselves well-positioned for the evolving tax landscape tomorrow.

Remember, successful tax compliance isn't about avoiding the system - it's about working within it intelligently. Your AIS is your roadmap to that success.

Ready to optimize your tax compliance? Join our WhatsApp community for expert insights and peer support. Download the Belong app for comprehensive NRI financial management solutions.

Sources:

Comments

Your comment has been submitted