How Belong Helps NRIs Invest in India via GIFT City

Investing in India as an NRI can sometimes feel like navigating a never-ending maze. Sorting the bank account requirements, physical KYC demands, and confusing FEMA compliance is like putting together a part of a puzzle, only to look up and find out you've just begun. But hold on, not all hope is lost, there is a way for you to invest without an NRE or NRO account, repatriation concerns or breaking a single FEMA rule.

This is exactly what Belong makes possible. A one-stop solution for all your NRI problems, we at Belong are building a finance app to help you invest via GIFT City.

What is GIFT City?

GIFT City or Gujarat International Finance Tec-City, is India’s very first operational International Financial Services Centre (IFSC). Although it is located between Ahmedabad and Gandhinagar in Gujarat, it operates as an offshore financial jurisdiction at par with global financial centres like Dubai and Singapore. To add to this list, it is also the nation's first functioning smart city and is completely regulated by the International Financial Services Centres Authority (IFSCA), which is the governing body of GIFT City and the equivalent of the RBI and SEBI under one roof.

GIFT City and FEMA

The entities set up in GIFT City, be it banks, fund houses, etc, are all treated as “non-resident” under FEMA, India’s Foreign Exchange Management Act. That means financial transactions through GIFT are considered offshore in nature even though they’re happening within India’s borders. This design is especially useful for NRIs and global investors who want to access India's economy via an offshore structure that is completely regulated. GIFT City becomes your simplified and liberal investment channel.

What does Belong do?

Belong is a one-stop app for NRIs to save and invest in India via GIFT City. It is built solely for NRIs to help simplify India for them. Belong cuts out the usual hassles of NRE/NRO accounts, TDS, repatriation, currency conversion, etc. We operate with offices in both GIFT City and Bangalore, and our infrastructure is built specifically to cater to NRIs who want to invest in India while staying fully compliant with FEMA.

Belong Licenses

Belong operates with compliance at its core. So far, we have secured the following licences:

1. Payment Service Provider license

This license has been issued by IFSCA (the regulatory body of GIFT City). This license allows us to securely move and manage money for investing via GIFT City.

2. Broking license

Also issued by the IFSCA, authorises us to provide trading and investment services on the NSE International Exchange (NSE IX), which operates within GIFT City. This means you’ll soon be able to invest in a range of mutual funds, US stocks, AIFs, and more, all from one app.

What are the benefits of investing through Belong?

1. No NRO/NRE account requirement

Since Belong operates through GIFT City, which is considered offshore, you don’t need an Indian bank account to invest in Belong. You can make all transfers directly from your foreign bank account.

2. No FEMA compliance concerns

As GIFT City is treated as an offshore jurisdiction under FEMA, all financial activity in it is considered “non-resident” in nature. That means investments made through Belong are fully FEMA-compliant by design. You don’t need to worry about complex rules or separate permissions. We’ve studied every regulation you need to be aware of and manage it all on your behalf.

3. Simplified KYC

We’ve found the way to make the KYC mandate painless and easy. Once your KYC on the app has been completed (which takes around 5 minutes at most), if you’re in the UAE, we come to your home for verification. If you’re in India, we do it via a simple video call. No more couriering documents or boarding planes just to sort out KYC.

4. Full repatriation of your tax-free earnings

Yes, you read it right. All investments made via GIFT City are completely tax-free in India. And since your money stays offshore (within GIFT), your returns are fully repatriable.

| Also Read - Learn more about GIFT City and why it’s a game-changer for NRI investing

What products does Belong offer?

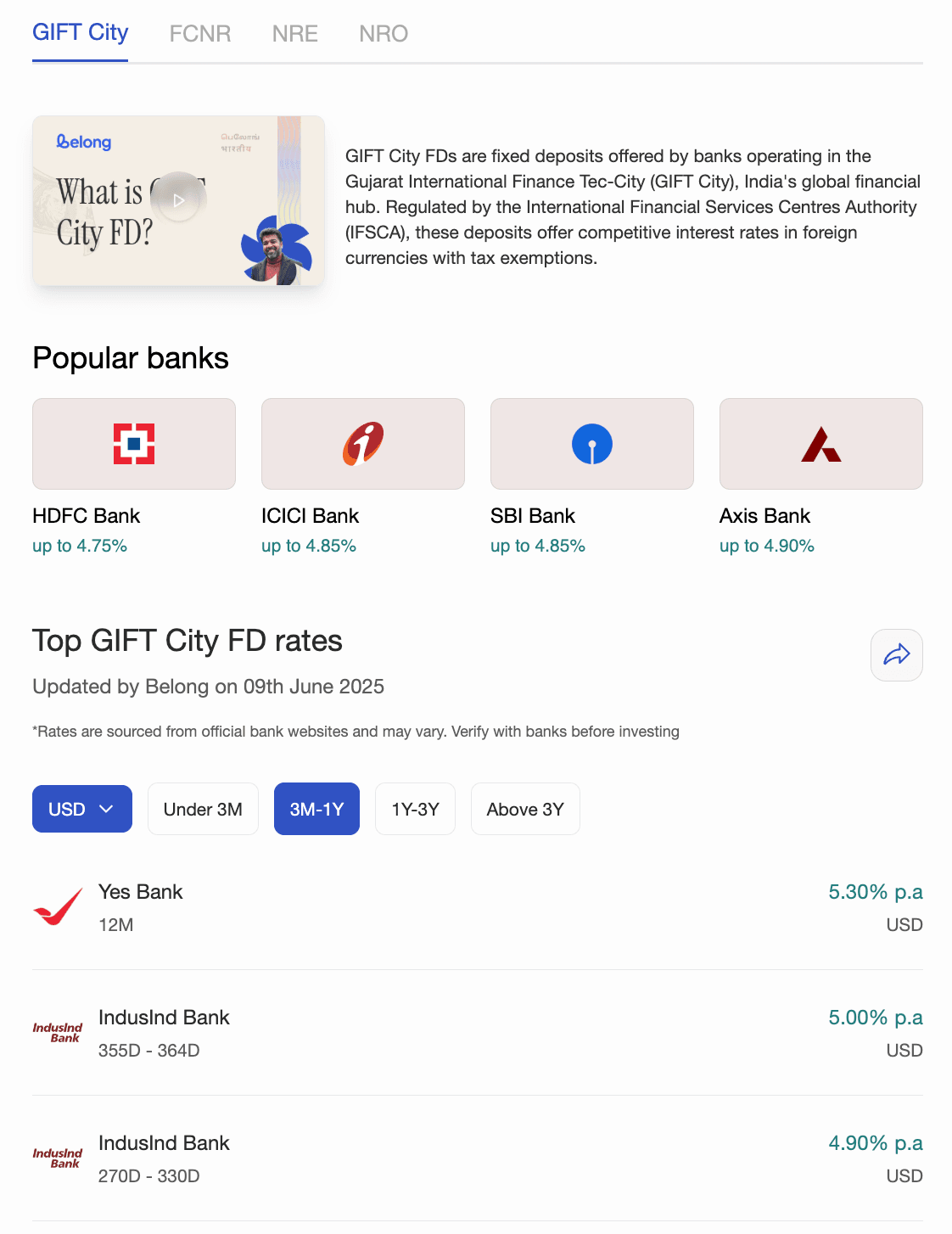

The first product Belong is set to launch is a USD Fixed Deposit. These FDs are backed by regulated banks in GIFT City and offer returns in USD, safeguarding your money from INR depreciation. Like FCNR deposits, they are not taxable in India and fully repatriable to your resident country. However, FCNR deposits have a minimum tenure of 1 year and forex conversion rates by banks from non-USD currencies to USD can drag the returns down by 1-1.5%. GIFT City FDs, on the other hand, offer shorter tenures starting from 7 days. With Belong, you also get much better conversion rates that help you keep more of what you earn with the fixed deposit. Soon, you will also be able to invest in mutual funds, AIF and even US stocks listed on NSE IX.

Is Belong safe?

Yes, all investments with Belong are safe and secure. Belong app is operated by Betafront Technologies Pvt Ltd and its subsidiary, Betafront Financial Services (IFSC) Private Limited, which is a licensed Payments Services Provider (PSP) under IFSCA (the regulator of GIFT City). All transactions made via Belong are secured by bank-grade security that you have come to trust. Even the FD is made directly under your name and contact details with the partner bank in GIFT City. You will also receive an official FD receipt from the bank by email after booking your FD, giving you full ownership and transparency.

To add to this, the founders of Belong are second-time fintech entrepreneurs. Their last company, Goalwise, an app-based SEBI-registered investment advisor, was acquired by Niyo. So this isn’t their first rodeo.

What Belong means for NRIs

With Belong, investing in India no longer means navigating Indian banking hassles. By leveraging the GIFT City framework and staying fully regulated under IFSCA, Belong makes investing easy, fast, and fully compliant for NRIs. We will be starting with NRIs in the UAE and soon moving across oceans. So if you're an NRI on the lookout to invest in India, Belong gives you the best of both worlds: global convenience and Indian opportunity without the red tape.

Comments

Your comment has been submitted