Best Banks in UAE for NRIs - Which One Can You Trust

Last week, I received a WhatsApp message from Priya, a member of our NRI WhatsApp group and an IT consultant in Dubai.

"Ankur, I've been banking with the same UAE bank for 3 years. My AED savings earn barely 1.5%, but I'm scared to switch. Which bank should I trust with my money?"

Her question hits home for thousands of NRIs across the UAE.

You work hard, save diligently, but your money sits in accounts that barely beat inflation. Meanwhile, you're constantly wondering: Am I with the right bank?

Could I be earning more? Is my money truly safe?

The Big Question

Which UAE bank offers the best combination of safety, returns, and NRI-friendly services in 2025?

Also: Should you even be limiting yourself to UAE banks when better options exist?

Quick Answer (Summary Verdict)

For UAE banking, Emirates NBD leads for digital experience, FAB excels for high-net-worth services, and ADCB offers competitive savings rates up to 4.5%.

But here's the twist: Smart NRIs are increasingly moving beyond traditional UAE banking to GIFT City USD fixed deposits, which offer up to 5.8% tax-free returns with zero currency risk.

If you're earning in AED but planning to eventually move your wealth to India or other countries, this changes everything.

The Full Picture

UAE Banking Landscape: What You're Really Getting

The UAE banking sector is mature and well-regulated. Banks like FAB, ADCB, and Emirates NBD rank among the top banks in the GCC in terms of assets and stability.

But let's be honest about what you're actually experiencing:

The Good: Rock-solid institutions, extensive ATM networks, decent mobile apps, and regulatory protection.

The Reality Check: Most UAE banks offer savings rates between 0.25% to 2.5%, with promotional rates reaching 4-6% for limited periods.

Your AED deposits are safe, but they're not working as hard as they could.

Top 5 Banks in UAE for NRIs

Let me break down the leaders based on three years of analyzing NRI banking experiences:

1. Emirates NBD

Best for: Digital-savvy NRIs who want seamless banking

Emirates NBD is the largest banking group in the UAE by assets, serving over 14 million customers across 13 countries. Their digital platforms are genuinely impressive.

Key Features:

- Smart Saver Account: Up to 2.75% p.a.

- Minimum balance: AED 3,000

- Excellent mobile app (Liv. platform)

- Multi-currency options

- Strong NRI support team

Why NRIs Love It: Emirates NBD is recognized as one of the top banks in UAE in 2025, known for its exceptional customer service and commitment to client satisfaction.

👉 Tip: Their Liv. Goal Account can earn up to 4% p.a. for balances under AED 500,000, perfect for building emergency funds.

2. First Abu Dhabi Bank (FAB)

Best for: High-net-worth NRIs seeking premium services

FAB is the largest bank in the UAE by total assets, formed in 2017 from the merger of First Gulf Bank and National Bank of Abu Dhabi.

Key Features:

- FAB iSave Account: Up to 4.50% p.a. promotional rates

- No minimum balance requirement

- Unrestricted withdrawals

- Strong international presence

- Premium wealth management

The Advantage: FAB's global network makes it easier to manage finances across multiple countries.

3. Abu Dhabi Commercial Bank (ADCB)

Best for: Rate-conscious savers and tech users

ADCB caters to over a million retail customers with a focus on innovation, personalised service, and wide-reaching digital capabilities.

Key Features:

- Active Saver Account: No minimum balance

- Millionaire Destiny Account: Regular cash prize draws

- TouchPoints loyalty program

- Multi-currency support

- Advanced mobile banking

Standout Feature: Their digital banking app consistently wins awards for user experience.

4. HSBC Middle East

Best for: NRIs with global banking needs

With over 150 years of global experience, HSBC brings serious international expertise to UAE banking.

Key Features:

- Global account linking

- Premium relationship banking

- Competitive NRE account rates (for India)

- Trade finance expertise

- Multi-country presence

Perfect For: NRIs who frequently move money between UAE, India, UK, and other countries.

5. Dubai Islamic Bank (DIB)

Best for: Sharia-compliant banking

As the world's first full-service Islamic bank, Dubai Islamic Bank revolutionized banking by sticking to Sharia-compliant principles.

Key Features:

- Profit-sharing accounts (not interest-based)

- Islamic home financing

- Ethical investment options

- AI-driven mobile app

- Strong digital innovation

Top 3 UAE Banks Comparison

Feature | Emirates NBD | FAB | ADCB |

|---|---|---|---|

Best Savings Rate | Up to 2.75% p.a. | Up to 4.50% p.a. (promo) | Up to 4.5% p.a. |

Minimum Balance | AED 3,000 | AED 0 | AED 0 |

Mobile App Rating | 9/10 | 8.5/10 | 8/10 |

NRI Support | Excellent | Very Good | Good |

Global Network | 13 countries | Strong international | Regional focus |

Processing Time | 3-5 days | 5-7 days | 3-4 days |

The Currency Risk Nobody Talks About

Here's what every NRI in UAE needs to understand: Your AED deposits face currency conversion risk.

When you eventually repatriate money to India, send funds to family, or move to another country, you're exposed to exchange rate fluctuations.

The AED is pegged to USD, which provides some stability, but INR volatility can still impact your real returns.

Example: You earn 4% on AED 100,000. But if INR weakens by 3% against AED during the year, your effective return in INR terms is just 1%.

Advantages for NRIs in UAE Banks

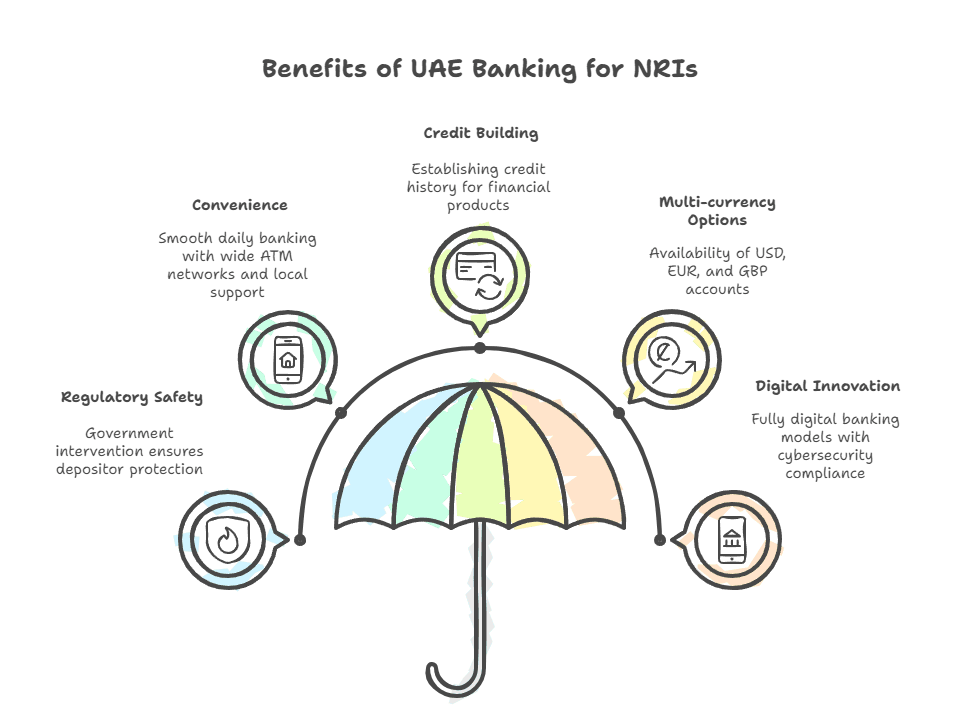

Let me be balanced here. UAE banks do offer genuine benefits:

Regulatory Safety: While the UAE doesn't have a formal deposit insurance scheme like the FDIC in the US, the government has historically intervened to protect depositors in systemic crises.

Convenience: Wide ATM networks, easy salary transfers, and local language support make daily banking smooth.

Credit Building: UAE banking relationships help build credit history for loans, mortgages, and credit cards.

Multi-currency Options: Most major banks offer USD, EUR, and GBP accounts alongside AED.

Digital Innovation: Banks like Mashreq Neo, Liv., and Wio Bank operate fully digital banking models that comply with CBUAE's cybersecurity and digital banking regulations.

What to Watch Out For

Every UAE bank has potential downsides you should know:

Hidden Charges: Monthly maintenance fees, transaction charges, and minimum balance penalties can eat into returns.

Rate Changes: Promotional rates often last 6-12 months, then drop significantly.

Documentation Requirements:Converting resident accounts to NRI status can be complex when you leave UAE.

Repatriation Delays: Moving large sums internationally can involve lengthy compliance checks.

Limited Investment Options: UAE banks offer basic mutual funds and bonds, but lack sophisticated investment products available in India or other markets.

Next 3 UAE Banks Worth Considering

Bank | Best Feature | Target Audience | Key Benefit |

|---|---|---|---|

Mashreq Bank | Digital innovation | Tech-savvy millennials | Neo platform with 6.5% promotional rates |

Standard Chartered | Global connectivity | International professionals | Seamless cross-border banking |

Wio Bank | Pure digital experience | Digital natives | No fees, fully app-based |

Step-by-Step Process to Choose Your UAE Bank

Step 1: Define your primary need - high savings rates, international transfers, or premium services.

Step 2: Compare actual costs. Calculate annual fees, minimum balance requirements, and transaction charges.

Step 3: Test the mobile app. Download and explore the interface before committing.

Step 4: Visit the branch. Speak with NRI relationship managers to understand their support level.

Step 5: Start small. Open with minimum deposit, test services for 3 months, then increase exposure.

👉 Tip: Always maintain accounts with 2-3 banks to avoid single points of failure and maximize earning opportunities.

The GIFT City Alternative: Why Smart NRIs Are Looking Beyond UAE Banks

Here's where the conversation gets interesting. While UAE banks offer stability, a growing number of informed NRIs are diversifying into GIFT City fixed deposits for a compelling reason.

GIFT City USD Fixed Deposits through platforms like Belong offer:

- 5.8% annual returns (tax-free)

- USD denomination (no currency risk)

- Easy repatriation (simplified KYC and documentation)

- RBI regulation (Indian government backing)

- Digital process (open from UAE without flying to India)

Let me put this in perspective with a real example:

Scenario: You have AED 100,000 (approximately $27,200) to invest for 3 years.

UAE Bank FD: 4.5% p.a. in AED = AED 14,400 total returns

GIFT City USD FD: 5.8% p.a. in USD = $4,728 total returns

The GIFT City option gives you:

- Higher absolute returns

- Zero tax liability

- USD stability

- Easy repatriation to any country

This is why smart NRIs are choosing GIFT City investments as a complement to their UAE banking relationship.

What This Means for You

UAE banks are safe, convenient, and suitable for daily banking needs. Emirates NBD excels in digital experience, FAB serves high-net-worth clients well, and ADCB offers competitive rates with good technology.

But if you're serious about maximizing your NRI wealth while maintaining liquidity and minimizing tax liability, consider a hybrid approach:

- Keep 20-30% in UAE banks for daily expenses and convenience

- Allocate 50-60% to GIFT City USD fixed deposits for higher tax-free returns

- Reserve 10-20% for Indian mutual fund investments for long-term growth

The smartest NRIs aren't asking "Which UAE bank is best?" They're asking "How do I optimize my entire financial strategy across jurisdictions?"

That's exactly what we help NRIs achieve at Belong. Our USD fixed deposits in GIFT City complement your UAE banking relationship, giving you the best of both worlds: local convenience and optimized returns.

Ready to explore your options? Join our WhatsApp community where over 2,000 UAE-based NRIs share real experiences and strategies. Or download the Belong app to see how GIFT City USD FDs can fit into your wealth plan.

Sources:

Comments

Your comment has been submitted