Best Credit Card in UAE - Complete Comparison Guide

You've just moved to Dubai. Your salary hits your UAE account every month. You're building a life here, but every purchase reminds you - you need a credit card that actually works for you.

The challenge? Over 200 cards in the UAE market.

Each bank promises the best rates, the best rewards, the best everything. But which one genuinely fits your lifestyle?

At Belong, we've helped thousands of NRIs navigate financial decisions across borders. We know you're not just looking for any card - you want one that complements your spending habits, protects you from hidden charges, and helps you build wealth smartly.

Whether you're saving for a home back in India, planning your next vacation, or simply want cashback on groceries, this guide answers every question you have about credit cards in the UAE.

We've researched rates, compared features, and spoken to NRIs across Dubai, Abu Dhabi, and Sharjah. This is everything you need to know.

Why Choosing the Right Credit Card Matters More Than You Think

Your credit card isn't just plastic. It's a financial tool that, when used correctly, can save you thousands of dirhams annually through rewards, protect your purchases, and build your credit history in the UAE.

The wrong card? That costs you through high interest rates (often 30-36% annually in the UAE), annual fees that never get waived, and rewards you'll never use.

Here's what separates a good card from a mediocre one:

Your spending pattern determines the value. If you spend AED 3,000 monthly on groceries, a card offering 5% cashback on supermarkets returns AED 150 monthly - that's AED 1,800 yearly. A generic 1% cashback card only gives you AED 360.

Interest rates matter if you carry balances. The difference between a 2.5% monthly rate and 3.5% monthly rate on a AED 10,000 balance is AED 1,200 annually.

Hidden charges add up quickly. Late payment fees, foreign transaction fees, and annual charges can cost AED 500-2,000 yearly if you're not careful.

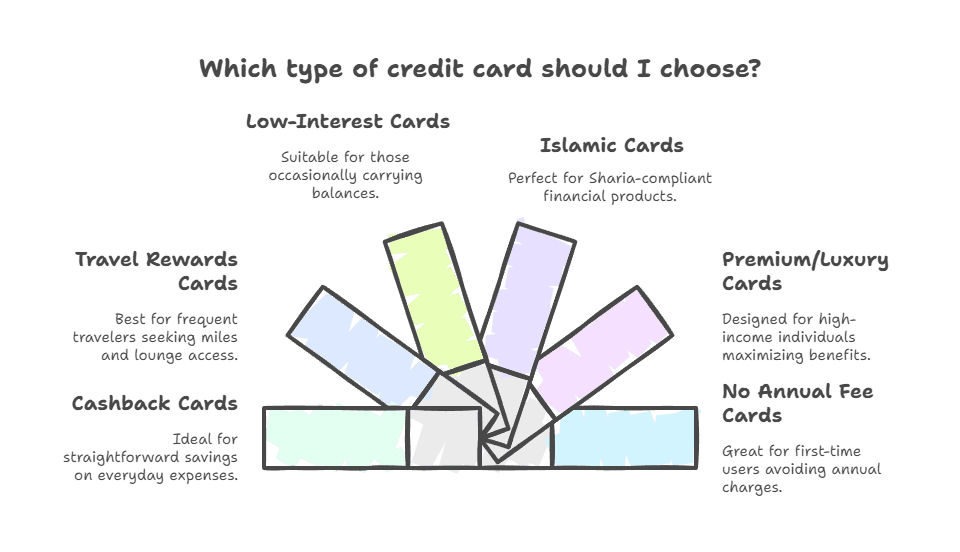

Understanding Different Types of Credit Cards in UAE

Before we dive into specific cards, you need to understand the landscape.

UAE banks offer six main categories of credit cards:

Cashback Credit Cards

These return a percentage of your spending as cash. Simple, transparent, and perfect if you prefer direct savings over reward points.

Popular cashback cards in UAE offer 5-6% cashback on dining and groceries, with some providing up to 20% cashback at select merchants.

Best for: NRIs who want straightforward savings on everyday expenses.

Travel Rewards Credit Cards

Earn air miles, hotel points, or travel credits. Many include airport lounge access and travel insurance.

Premium travel cards offer complimentary airport lounge access, valet parking at major malls, and the ability to earn 2-3 miles per USD spent.

Best for: Frequent travelers between UAE and India, or those planning annual international trips.

Low-Interest Credit Cards

While typical credit cards in UAE charge 2.5-3% monthly interest, low-interest cards offer rates as low as 1.5% per month.

Best for: Those who occasionally carry balances or need flexibility during large purchases.

Islamic Credit Cards

Sharia-compliant cards that avoid interest (riba). \These operate on murabaha or tawarruq principles - the bank purchases goods on your behalf and sells them to you at a higher price rather than charging interest.

Best for: Muslims seeking Sharia-compliant financial products or anyone preferring fixed markup over variable interest.

Premium/Luxury Credit Cards

High annual fees but extensive benefits: concierge services, golf privileges, spa access, and exclusive dining experiences.

Best for: High-income NRIs (AED 30,000+ monthly) who can maximize premium benefits.

No Annual Fee Credit Cards

Several UAE banks offer cards with zero annual fees, including Liv Cashback Card, FAB Blue Infinite, and Emirates NBD Lulu 247 Titanium.

Best for: First-time credit card users or those wanting to avoid annual charges.

👉 Tip: Match the card type to your largest expense category. If you spend AED 2,000 monthly on dining, a dining-focused cashback card will outperform a generic rewards card.

Top Credit Cards in UAE for NRIs (2025)

Based on features, rates, and real user feedback, here are the cards worth considering:

Best Overall: Emirates NBD Lulu 247 Titanium

Minimum Salary: AED 5,000

Annual Fee: AED 0

Interest Rate: 2.99% monthly

Why it stands out:

This card offers 3.5% LuLu points on daily spends, complimentary airport lounge access, and 0% interest balance transfers. For NRIs shopping regularly at LuLu Hypermarkets (and who doesn't?), the rewards accumulate fast.

What you get:

- Instant cash withdrawals from 80,000 ATMs worldwide

- Flexible payment plans

- No annual fee means no pressure to spend a minimum amount

Best for Cashback: Liv Cashback Card

Minimum Salary: AED 5,000

Annual Fee: AED 0

Interest Rate: Variable

Why it stands out:

Offers 6% cashback on dining and food delivery and 5% on fuel, capped at AED 200 monthly.\ Plus, new cardholders get an AED 800 Amazon gift card when spending AED 10,000 within 60 days.

Perfect for: Young professionals who order food frequently and drive regularly.

Best for Travel: Emirates Islamic Skywards Credit Card

Minimum Salary: AED 5,000

Annual Fee: AED 199 (waived first year with AED 3,000 spend in 90 days)

Interest Rate: Sharia-compliant (no interest, fixed markup)

Why it stands out:

Earn up to 2 Etihad Guest Miles per USD spent, with annual fee waiver if you spend AED 10,000 yearly. Includes discounts on dining, travel, and shopping.

Perfect for: NRIs flying frequently between UAE and India or planning international travel.

Best for Low Interest: FAB Low-Rate Credit Card

Minimum Salary: AED 8,000

Annual Fee: AED 200

Interest Rate: 1.5% monthly for UAE Nationals, 1.99% for expatriates

Why it stands out: Among the lowest interest rates in the UAE. Offers 0% balance transfer for up to 12 months for expatriates and 18 months for UAE nationals.

Perfect for: Those who need to carry balances occasionally or want to consolidate debt.

Best Premium: RAKBANK World Elite

Minimum Salary: AED 20,000

Annual Fee: AED 1,500

Interest Rate: 2.99% monthly

Why it stands out:

Earn up to 10% cashback on dining, travel, and grocery spends. Includes concierge services, complimentary golf, and airport transfers.

Perfect for: High-earning NRIs who want luxury benefits and can maximize the rewards through high spending.

Comparison Table: Top 5 Credit Cards in UAE

Card Name | Min. Salary | Annual Fee | Interest Rate | Key Benefit |

|---|---|---|---|---|

Emirates NBD Lulu 247 | AED 5,000 | AED 0 | 2.99%/month | 3.5% LuLu points |

Liv Cashback | AED 5,000 | AED 0 | Variable | 6% dining cashback |

Emirates Islamic Skywards | AED 5,000 | AED 199* | Sharia-compliant | 2 miles per USD |

FAB Low-Rate | AED 8,000 | AED 200 | 1.99%/month | Lowest interest |

RAKBANK World Elite | AED 20,000 | AED 1,500 | 2.99%/month | 10% cashback on dining/travel |

*Annual fee waived with minimum spend

More Strong Contenders Worth Considering

ADCB Talabat Platinum

Minimum Salary: AED 8,000

Annual Fee: AED 0

Get 35% cashback on first 10 Talabat orders monthly, AED 500 welcome bonus for AED 2,500 spend in 45 days, plus unlimited free delivery with Talabat Pro.

If you're ordering food delivery 2-3 times weekly, this card pays for itself in month one.

Mashreq Cashback Credit Card

Minimum Salary: AED 5,000

Annual Fee: AED 0

Offers AED 500 welcome bonus when you spend AED 5,000 in first 2 months, plus 20% cashback at select merchants. Includes up to 57 days interest-free period.

Dubai First Cashback

Minimum Salary: AED 5,000

Annual Fee: AED 0

Features 6% instant cashback and monthly interest of only 1.5%, one of the lowest in the UAE. Fully digital application through mobile app.

Who Qualifies? UAE Credit Card Eligibility Explained

UAE banks generally require a minimum monthly salary of AED 5,000 to qualify for a credit card, though premium cards require AED 15,000 or more.

Basic Requirements for All Applicants

Age: \Most banks require applicants to be at least 21 years old.

Residency: Valid UAE residency visa and Emirates ID are mandatory.

Employment: Steady employment with proof of income. Salaried employees need salary certificates and last 3 months' salary slips. Self-employed individuals must show trade licenses and bank statements.

Credit Score: Scores between 300-619 are considered low and may only qualify for secured cards. Scores above 650 significantly improve approval chances.\

Documents You'll Need

For Salaried Employees:

For Self-Employed:

Minimum average balance of AED 50,000 for the last 3 months for premium cards

👉 Tip: Before applying, check your AECB credit score. A score above 700 qualifies you for the best cards and terms.

Breaking Down the Real Costs: Fees and Interest Rates

The advertised benefits look attractive. But what will you actually pay? Let's get specific.

Interest Rates in UAE: Why They're Higher

Credit card interest rates in UAE typically range from 2.5% to 3% monthly. This translates to 30-36% annual interest - significantly higher than many other countries.

Example: If you carry a AED 5,000 balance at 3% monthly for one year:

- Monthly interest: AED 150

- Yearly interest paid: AED 1,800

With a 2.5% monthly rate, carrying AED 1,000 for a month means around AED 25 in interest.

The good news: \Most cards offer a grace period of 21-25 days from the billing cycle end. If you pay the full balance within this period, you pay zero interest.

Common Fees to Watch For

Annual Fee: AED 0 to AED 1,500+.

Many banks waive this for the first year or if you meet minimum spending thresholds.

Late Payment Fee: AED 150-300 if you miss the minimum payment deadline.

Cash Advance Fee: Typically 3-4% of the withdrawal amount plus higher interest rates starting immediately.

Foreign Transaction Fee: 1-3% on purchases made outside UAE, though some premium cards waive this.

Over-Limit Fee: AED 100-200 if you exceed your credit limit.

Balance Transfer Fee: Typically 3.99% to 6% as a one-time processing fee.

👉 Tip: Set up auto-pay for at least the minimum amount due. This simple step saves you from late fees and protects your credit score.

How to Choose the Right Credit Card for Your Lifestyle

Here's a practical framework we use at Belong when advising NRIs:

Step 1: Calculate Your Monthly Spending by Category

Track one typical month:

- Groceries: AED ___

- Dining/Food delivery: AED ___

- Fuel: AED ___

- Shopping: AED ___

- Utilities/Bills: AED ___

- Travel: AED ___

Step 2: Match Benefits to Your Largest Expense

If groceries = AED 2,500/month → Choose Emirates NBD Lulu card (3.5% returns = AED 87.5 monthly)

If dining = AED 2,000/month → Choose Liv Cashback (6% returns = AED 120 monthly)

If travel booking = AED 1,500/month → Choose travel rewards card

Step 3: Consider Your Payment Behavior

If you pay full balance monthly: Focus on rewards and cashback cards. Interest rates don't matter to you.

If you carry balances occasionally: Prioritize low-interest cards like FAB Low-Rate or Dubai First.

If you're building credit history: Start with no-annual-fee cards to minimize costs while establishing your credit profile.

Step 4: Factor in Additional Benefits

Do you travel 6+ times yearly? → Airport lounge access saves AED 50-100 per visit

Do you dine out 2-3 times weekly? → Dining discount cards can save 20-30% at partner restaurants

Do you have family in UAE? → \Most cards allow up to 5 supplementary cards at no extra cost

The Application Process: What Actually Happens

Most UAE banks now offer digital applications that take 10-15 minutes. Here's the typical flow:

Step 1: Choose your card online or through the bank's mobile app

Step 2: Fill in personal details, employment information, and salary details

Step 3: Upload required documents (Emirates ID, salary certificate, bank statements)

Step 4: Submit application

Step 5: Application processed in 3-5 working days. Card delivered in 1-2 working days for local addresses.

Approval Factors Banks Actually Look At

Debt-to-Income Ratio: Your credit limit will usually be set at two or three times your monthly salary. If you're earning AED 10,000, expect a limit of AED 20,000-30,000.

Employment Stability: Banks prefer applicants employed for 6+ months with their current employer.

Existing Credit: Having other credit cards or loans isn't necessarily negative. Banks want to see responsible credit management.

Salary Transfer: Banks offering your card often provide better terms if you transfer your salary to them.

👉 Tip: Apply for only one card at a time. Multiple applications within a short period can lower your credit score as each application triggers a hard credit inquiry.

Smart Usage Tips to Maximize Your Credit Card Benefits

Getting the card is step one. Using it wisely is where the real value lies.

Never Pay Just the Minimum

If you make only the minimum payment each period, you pay significantly more in interest and it takes much longer to clear your balance.

Example: AED 10,000 balance at 3% monthly interest with AED 300 minimum payments:

- Time to clear: 56 months

- Total interest paid: AED 6,500

Pay the full amount instead:

- Time to clear: 1 month

- Total interest: AED 0

Use Category-Specific Cards Strategically

Keep 2-3 cards for different purposes:

- Groceries → LuLu card

- Dining → Liv card

- Everything else → General rewards card

This strategy can double your rewards compared to using one card for everything.

Take Advantage of 0% Installment Plans

Many UAE retailers offer 0% interest installments through specific cards. A AED 3,000 purchase can be split into 6 monthly payments of AED 500 with zero extra charges.

Set Up Transaction Alerts

Enable SMS or app notifications for every transaction. This helps you:

- Track spending in real-time

- Detect fraudulent transactions immediately

- Stay within budget

Use Balance Transfers Wisely

If you have high-interest debt on one card, \transferring the balance to a card offering 0% interest for 12-18 months can save substantial interest charges.

But watch out: Balance transfer fees typically run 3-6%, so calculate whether you'll actually save money.

Common Credit Card Mistakes NRIs Make in UAE

After helping thousands of NRIs with financial decisions, we've seen these patterns repeatedly:

Mistake 1: Ignoring the Fine Print on "Free" Cards

That AED 0 annual fee? \Often it's only free for year one, with charges kicking in from year two unless you meet minimum spending requirements.

Mistake 2: Using Credit Cards for Cash Withdrawals

Cash advances attract immediate interest (no grace period) plus a 3-4% withdrawal fee. A AED 1,000 cash withdrawal costs you AED 30-40 immediately, plus daily interest.

Mistake 3: Missing the Minimum Payment

Even by one day. Late fees are harsh in UAE - AED 200-300 typically. Plus, it damages your credit score.

Mistake 4: Not Reading Foreign Transaction Fees

Taking your UAE credit card to India or elsewhere?

Each transaction outside UAE typically incurs a 1-3% fee as a percentage of your spend.

A AED 10,000 vacation means AED 100-300 in foreign transaction fees alone. Some premium cards waive this - worth checking before you travel.

Mistake 5: Closing Old Cards Without Understanding Impact

Your credit score factors in your credit history length. Closing your oldest card can actually lower your score, even if you're trying to simplify your wallet.

Special Considerations for NRIs

Building Credit History in UAE

If you're new to UAE, you might not have a local credit score yet. \Several banks provide credit cards to new residents, but may require higher minimum salaries or salary transfer accounts.

Strategy: Start with a secured credit card or a bank where you maintain your salary account. After 6-12 months of responsible use, you'll qualify for better cards.

Managing Credit Across Two Countries

Many NRIs maintain credit cards in both India and UAE. This requires:

Tracking due dates carefully: Set reminders for both sets of cards

Understanding currency implications: Paying Indian credit card bills from UAE involves forex conversion and transfer fees

Maintaining separate emergency funds: Keep some funds accessible in both currencies

Planning for Repatriation

If you're planning to return to India eventually, your UAE credit score doesn't transfer. This is where building strong financial documentation helps.

At Belong, we help NRIs plan for this transition through products like GIFT City fixed deposits that work for both UAE residents and returning Indians.

Using Credit Cards to Build Wealth

Your credit card isn't just for spending - it's a wealth-building tool when used strategically:

Cashback cards return 3-6% on spending. That's AED 2,000-4,000 annually on AED 5,000 monthly expenses.

Travel cards save you on every trip home. Airport lounge access alone saves AED 600-800 yearly if you fly 4 times annually.

Purchase protection covers damaged goods. Many premium cards offer 90-120 day purchase protection.

Building credit history qualifies you for better loans. When you're ready to buy property or invest in India, a strong UAE credit history helps with documentation.

But here's the bigger picture: The AED 2,000-3,000 you save annually through smart credit card usage can be redirected to high-return investments.

We've seen NRIs at Belong invest these savings into GIFT City AIFs or USD fixed deposits that offer tax-free returns and protection against rupee depreciation.

👉 Tip: Use our FD Rates Comparison Tool to see how your credit card savings can grow when invested wisely.

Credit Cards vs. Debit Cards: When to Use Which

A debit card is linked directly to your bank account, deducting funds instantly. You can only spend what you have. A credit card allows you to borrow money up to a set limit and repay later.

Use Credit Cards for:

- Online purchases (better fraud protection)

- Hotel and car rentals (holds don't freeze your bank balance)

- Large purchases you want to pay in installments

- Earning rewards on necessary expenses

Use Debit Cards for:

- Daily small expenses

- When you want to avoid any debt risk

- ATM withdrawals (no cash advance fees)

Quick Comparison: Best Cards by Category

Best for Groceries

Winner: Emirates NBD Lulu 247 (3.5% LuLu points + no annual fee)

Best for Dining

Winner: Liv Cashback (6% dining cashback up to AED 200/month)

Best for Fuel

Winner: Liv Cashback (5% fuel cashback)

Best for Travel

Winner: Emirates Islamic Skywards (2 Etihad miles per USD + lounge access)

Best for Low Interest

Winner: FAB Low-Rate (1.99% monthly for expats)

Best No Annual Fee

Winner: Three-way tie: Liv Cashback, Emirates NBD Lulu 247, ADCB Talabat Platinum

Best for High Spenders

Winner: RAKBANK World Elite (10% cashback on dining/travel with high limit)

Understanding Islamic Credit Cards

About 30% of NRIs we work with at Belong prefer Sharia-compliant financial products. If you're considering an Islamic credit card, here's what makes them different:

Islamic cards operate on murabaha or tawarruq principles. The bank purchases goods or services on your behalf and sells them to you at a higher price instead of charging interest.

Key differences:

- No interest (riba) charged

- Fixed monthly profit rate instead of variable interest

- Same usage as conventional cards (accepted at 22+ million locations worldwide)

- Often still include annual fees and other service charges

Popular Islamic cards:

- Emirates Islamic Skywards

- Dubai Islamic Bank Johra

- Abu Dhabi Islamic Bank Smiles

How UAE Credit Cards Differ from Indian Credit Cards

If you've used credit cards in India, UAE cards work similarly but with important differences:

Higher Interest Rates: India averages 2-3% monthly on credit cards; UAE is similar but with fewer promotional 0% offers

Annual Fees: UAE banks are more flexible with fee waivers based on spending

Foreign Transaction Fees: Generally higher in UAE

Credit Limits: UAE banks typically set limits at 2-3x your monthly salary, regardless of your credit history. In India, limits can be much higher with good credit history.

Documentation: UAE process is more straightforward with digital applications

Repatriation: UAE credit card debt doesn't affect your Indian credit score (and vice versa), since the credit bureaus don't share data.

What to Do If Your Application Gets Rejected

Rejection happens. It's not personal. Here's what to do:

Step 1: Request the specific reason from the bank. Common causes:

- Insufficient salary for that particular card

- Low credit score

- Too many recent credit applications

- Incomplete documentation

Step 2: Wait 3-6 months before reapplying. Multiple applications in quick succession further damage your chances.

Step 3: Work on the weak areas:

- Build salary history at current employer

- Clear existing debts to improve credit score

- Consider applying for a secured credit card first

Step 4: Try a different bank or a lower-tier card first. Entry-level cards have easier approval criteria.

Managing Multiple Credit Cards

Is having 2-3 cards smart or risky? It depends on your discipline.

Benefits of multiple cards:

- Maximize category-specific rewards

- Higher total credit limit (improves credit utilization ratio)

- Backup if one card is lost or blocked

Risks:

- Easy to lose track of multiple due dates

- Can lead to overspending

- More accounts to manage

Our recommendation: Keep 2-3 cards maximum. One for everyday spending, one for category-specific rewards, and possibly one premium card if you can justify the annual fee.

Use the other cards occasionally (once every 3-6 months) to keep them active, but don't close them unless they have high annual fees you can't justify.

The Role of Credit Cards in Your Broader Financial Plan

This is where we come back to Belong's core philosophy: Every financial decision should fit your bigger picture.

Your credit card choice matters, but it's one piece of your financial puzzle:

For Daily Expenses: Use the right credit card for 3-6% returns

For Short-term Savings: Keep 3-6 months' expenses in high-yield UAE savings accounts

For India-linked Savings: Consider GIFT City USD fixed deposits offering 5%+ tax-free returns

For Long-term Wealth: Explore GIFT City AIFs or Indian mutual funds

For Retirement: Build a diversified portfolio across geographies and asset classes

How We Help at Belong

At Belong, we've built tools specifically for NRIs in the UAE:

- NRI FD Rates Comparison: Compare fixed deposit rates across NRE, NRO, FCNR, and GIFT City FDs

- Residential Status Calculator: Understand your tax status in India

- Compliance Compass: Check if you're following all necessary rules

- Rupee vs Dollar Tracker: Monitor currency trends to make informed decisions

Final Recommendations: Our Top 3 Picks

After all this research, if you're still unsure, here are our straightforward recommendations:

For Most NRIs:

Emirates NBD Lulu 247 Titanium - Zero annual fee, decent rewards, no strings attached. Perfect starting point.

For Frequent Diners and Food Delivery:

Liv Cashback - 6% dining cashback pays for itself quickly. Zero annual fee sweetens the deal.

For Building Long-term Value:

Emirates Islamic Skywards - If you fly 4+ times yearly, those air miles and lounge access are worth far more than cashback percentages.

Take the Next Step

Choosing the right credit card is just one part of your financial journey as an NRI.

At Belong, we're building a comprehensive financial platform for NRIs like you - offering tax-free USD fixed deposits through GIFT City, smart investment tools, and a community of like-minded global Indians who understand your unique financial situation.

Ready to make smarter financial decisions?

📱 Download the Belong App to access exclusive GIFT City investment opportunities and financial planning tools

💬 Join our WhatsApp Community to connect with other NRIs, ask questions, and get expert advice

Whether you're just starting your UAE journey or planning your return to India, we're here to help you navigate every financial decision with confidence.

Sources

- yallacompare - Credit Cards UAE

- Soulwallet - Best Credit Cards UAE

- Emirates NBD Credit Cards

- Paisabazaar UAE - Best Credit Cards 2025

- Paisabazaar UAE - Credit Card Interest Rates

- ADCB - Credit Card Interest Guide

- Emirates NBD - Credit Card Eligibility

- Emirates Islamic - Credit Cards

- First Abu Dhabi Bank - Low Rate Credit Card

- Commercial Bank of Dubai - Credit Cards

Comments

Your comment has been submitted