Best Fixed Deposit Rates in UAE - Why This Dubai Engineer Switched His Strategy

Here's a story from one of our NRI Community member - Pritam.

Three months ago, Pritam, a senior software engineer in Dubai, walked into Emirates NBD with AED 500,000 ($136,000) from his end-of-service benefits. His relationship manager smiled and offered him their "premium" fixed deposit at 3.2% per annum for 12 months.

"That's AED 16,000 in returns," she explained confidently.

Pritam nodded, but something felt off. After 8 years in Dubai, watching his salary grow from AED 12,000 to AED 35,000, was this really the best his money could do?

Two weeks later, after researching alternatives, Pritam made a different choice. Instead of locking his money in AED at 3.2%, he discovered USD fixed deposits that offered 5.8% tax-free returns with better liquidity and zero currency risk.

Today, his money works harder, and he sleeps better.

Here's how he did it - and how you can too.

What Fixed Deposit Rates Actually Mean in UAE

Fixed deposits in UAE are time deposits where you park money for a predetermined period at guaranteed interest rates. Unlike savings accounts, your money is locked for the agreed tenure, but you earn higher returns.

Current UAE FD landscape (September 2025):

Top performers: Dubai Islamic Bank leads with 3.95% for 12-month AED deposits, while promotional rates can reach 6.5% for limited periods.

Reality check: Most UAE banks offer 2.5-4% on standard FDs, with higher rates requiring large minimums or shorter promotional periods.

Currency options: Major banks offer FDs in AED, USD, EUR, and GBP, each with different rate structures.

Here's what you need to understand: UAE FD rates are decent, but they come with hidden limitations that many NRIs overlook.

How It Works for NRIs

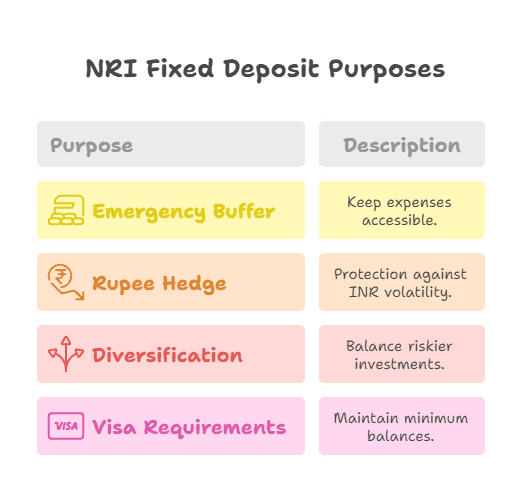

As an NRI in UAE, fixed deposits serve multiple purposes in your financial strategy:

Emergency buffer: Keep 6 months of expenses in liquid UAE FDs for easy access.

Rupee hedge: If you're planning to return to India, AED FDs provide some protection against INR volatility.

Diversification: FDs balance riskier investments like stocks or real estate.

Visa requirements: Some UAE banks require minimum balances, and FDs can help maintain these without keeping cash idle.

But here's the critical question: Are you optimizing for convenience or returns? Because there's a significant difference between the two.

Key Advantages of UAE Fixed Deposits

Let me be fair about what UAE FDs do well:

Guaranteed returns: Your principal and interest are protected, regardless of market conditions.

EIBOR-linked options: Some banks offer rates tied to Emirates Interbank Offered Rate, which can increase with rising interest rates.

Multi-currency flexibility: You can diversify across AED, USD, EUR, and GBP within the same banking relationship.

Local convenience: Easy access to funds, no cross-border compliance issues, and familiar banking procedures.

Relationship benefits: Higher FD balances often unlock premium banking services, higher credit limits, and preferential loan rates.

Sharia-compliant options: Islamic banks like Dubai Islamic Bank and Emirates Islamic offer profit-sharing deposits that comply with Islamic principles.

Top UAE Banks FD Rates Comparison

Bank | 6-Month Rate | 12-Month Rate | Minimum Deposit | Special Features |

|---|---|---|---|---|

Dubai Islamic Bank | 3.80% p.a. | 3.95% p.a. | AED 25,000 | Highest rates, Sharia-compliant |

Emirates NBD | 3.50% p.a. | 3.75% p.a. | AED 10,000 | Strong digital platform |

FAB | 3.25% p.a. | 3.65% p.a. | AED 25,000 | Premium relationship perks |

ADCB | 3.40% p.a. | 3.70% p.a. | AED 10,000 | Upfront interest option |

Mashreq | 3.60% p.a. | 3.85% p.a. | AED 10,000 | Flexible tenures (1 week-1 year) |

Note: Rates are for AED deposits and subject to change. Promotional rates may offer higher returns for new customers or large deposits.

👉 Tip: Banks often offer better rates for "new money" - funds brought from outside their ecosystem. Always negotiate if you're transferring large sums.

What to Watch Out For

UAE fixed deposits aren't perfect. Here are the downsides every NRI should know:

Rate volatility: UAE banks frequently change FD rates. Your renewal might be at significantly lower rates.

Early withdrawal penalties: Most banks charge 1-2% penalty for breaking FDs before maturity, effectively wiping out several months of interest.

Currency risk: AED deposits expose you to exchange rate fluctuations when you eventually repatriate funds.

Inflation erosion: With UAE inflation around 2-3%, real returns on 3-4% FDs are minimal.

Tax implications: If you're tax resident in another country, FD interest might be taxable there.

Limited liquidity: Unlike savings accounts, FDs lock your money. Emergency access is expensive.

Hidden Costs That Banks Don't Highlight

Account maintenance fees: Some banks charge monthly fees that can reduce your effective returns.

Transfer charges: Moving FD proceeds internationally involves wire transfer fees and unfavourable exchange rates.

Renewal traps: Auto-renewal often happens at lower rates than what attracted you initially.

Minimum balance requirements: Breaking an FD might affect your account's minimum balance, triggering additional charges.

The GIFT City Alternative: Why Smart NRIs Are Switching

Here's where Pritam's story gets interesting. While researching UAE FD rates, he discovered GIFT City fixed deposits - and the numbers were eye-opening.

GIFT City USD Fixed Deposits offer:

- 5.8% annual returns (significantly higher than UAE rates)

- Tax-free status (zero Indian tax liability)

- USD denomination (no AED-to-target-currency conversion risk)

- RBI regulation (Indian government backing for safety)

- Easy repatriation (to any country, not just India)

Let's run the numbers on Pritam's AED 500,000:

UAE FD (Best rate - DIB): 3.95% p.a. = AED 19,750 annual interest GIFT City USD FD: 5.8% p.a. = $7,888 annual interest (approximately AED 28,958)

The difference: GIFT City generates 46% higher returns while eliminating currency risk and tax liability.

Multi-Currency FD Comparison

Currency | Best UAE Rate | Best GIFT City Rate | Annual Return on $50,000 |

|---|---|---|---|

AED | 3.95% (DIB) | N/A | $1,975 |

USD | 3.50% (Various) | 5.8% (GIFT City) | $2,900 |

EUR | 3.25% (Various) | N/A | $1,625 |

GBP | 3.40% (Various) | N/A | $1,700 |

The USD advantage through GIFT City is clear: higher returns, tax efficiency, and currency stability.

How to Apply/Invest

For UAE Fixed Deposits:

Step 1: Research current rates across 3-4 banks. Rates change monthly, so timing matters.

Step 2: Negotiate with relationship managers. Mention competitor rates to get better deals.

Step 3: Consider ladder strategy. Split deposits across different tenures to manage rate risk.

Step 4: Read fine print carefully. Understand penalties, auto-renewal terms, and minimum balance requirements.

Step 5: Keep digital copies of all documents. UAE banks are generally efficient, but documentation is crucial.

For GIFT City USD Fixed Deposits:

Step 1: Understand eligibility. NRIs and OCIs can invest up to $250,000 per financial year.

Step 2:Complete KYC digitally. The process is entirely online - no need to visit India.

Step 3: Transfer funds through authorized channels. Most UAE banks facilitate wire transfers to GIFT City.

Step 4: Monitor through digital platforms. Belong's app provides real-time tracking and management tools.

👉 Tip: Don't put all your eggs in one basket. Consider a hybrid approach: keep 30% in UAE FDs for liquidity, allocate 50-60% to GIFT City for higher returns, and reserve 10-20% for growth investments.

Smart FD Strategies for UAE NRIs

Laddering technique: Instead of one large FD, create multiple smaller FDs maturing at different times. This provides flexibility and allows you to reinvest at potentially higher rates.

Promotional rate hunting: Banks regularly offer special rates for new customers or large deposits. Time your investments around these offers.

Currency diversification: Mix AED FDs (for local expenses) with USD options (for international repatriation).

Tax optimization: Structure deposits to minimize tax liability in your country of tax residence while maximizing net returns.

Repatriation planning: Choose FDs that align with your long-term residency and repatriation plans.

Bottom Line: Where Smart Money Goes

UAE fixed deposits serve their purpose: safety, convenience, and relationship building with local banks. If you need emergency funds accessible within UAE or want to maintain banking relationships for credit products, UAE FDs make sense.

But if you're optimizing for returns while maintaining safety and liquidity, the math favors a different approach.

The winning strategy for 2025:

- 30% in UAE FDs for local liquidity and banking relationship

- 50% in GIFT City USD FDs for higher tax-free returns

- 20% in growth investments for long-term wealth building

This hybrid approach gives you the best of all worlds: local convenience, optimized returns, and portfolio diversification.

Pritam's decision wasn't about abandoning UAE banking - it was about making his money work smarter. He kept AED 150,000 in Emirates NBD for convenience and moved $200,000 to GIFT City for superior returns.

The result? His annual investment income increased by 47% while reducing currency risk and eliminating tax liability.

Ready to explore your options? Understanding GIFT City benefits for NRIs could transform your savings strategy. Join our WhatsApp community where over 2,000 UAE-based NRIs share real experiences and strategies.

Or download the Belong app to see how GIFT City USD fixed deposits compare with your current UAE FD returns. Your money deserves to work as hard as you do.

Sources:

Comments

Your comment has been submitted