10 Best Government Company Stocks in India for NRI Investors

Here's a striking fact: Public Sector Undertaking (PSU) stocks have delivered over 20% returns in 2024, with Coal India leading dividend yields at 7% and Indian Oil Corporation offering 9.1% dividend yield.

For NRIs in the UAE seeking stable, government-backed investments, these numbers reveal why PSU stocks deserve serious attention.

As an investment advisor who's guided hundreds of NRIs through India's financial landscape, I've seen first hand how government company stocks provide the perfect balance of stability and growth.

Unlike volatile private stocks, PSUs offer predictable dividends, government backing, and exposure to India's critical infrastructure sectors.

PSU stocks represent companies where the Indian government holds a majority stake, typically over 51%. They operate across essential sectors like banking, energy, defense, and infrastructure – sectors that form India's economic backbone.

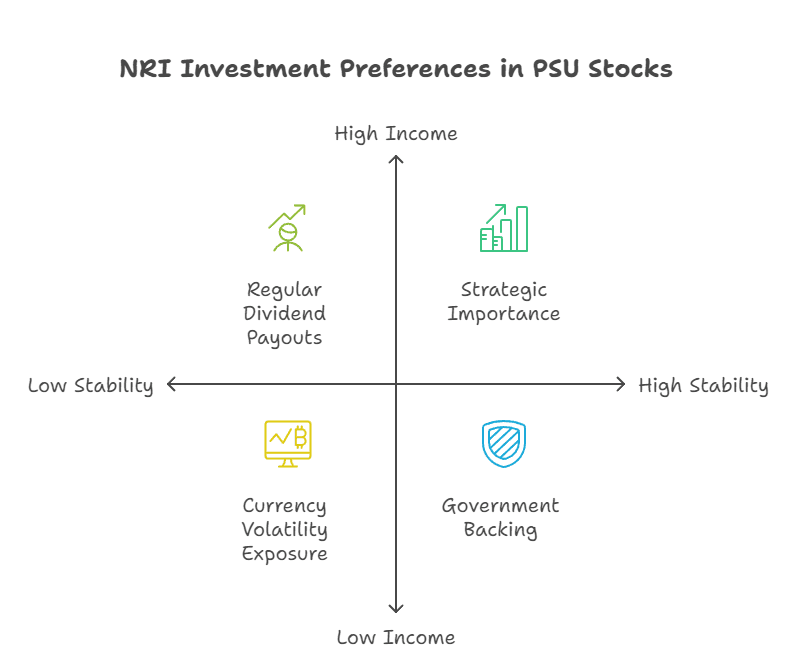

Why NRIs Are Choosing PSU Stocks

The appeal is clear: PSUs operate across diverse sectors like banking, energy, and infrastructure, offering investors a chance to benefit from their steady performance and attractive dividends. For NRIs dealing with currency volatility and seeking rupee exposure, PSU stocks provide:

- Government backing ensuring stability during market downturns

- Regular dividend payouts offering steady income streams

- Lower volatility compared to private sector stocks

- Strategic importance making them "too big to fail"

👉 Tip: PSU stocks are ideal for NRIs wanting stable, tax-efficient investment options without the complexity of direct property investments.

1. State Bank of India (SBI) - Banking Powerhouse

India's largest PSU bank with impeccable credit growth and digital journey, SBI dominates retail and corporate banking. With over 22,000 branches and growing digital presence, it's expanding financial inclusion across India.

Why NRIs love it: Strong dividend yield, consistent profitability, and easy account linking for NRE/NRO account holders.

Investment case: Consistent growth in profits, backed by improved asset quality and strong loan demand. High dividend yield and stable long-term returns.

2. NTPC Limited - Clean Energy Pioneer

India's largest power generating company with plans for a clean energy future, NTPC is transitioning from coal to renewable energy. With 70+ power stations, it's India's energy backbone.

Why it matters: India's massive infrastructure spending and renewable energy push directly benefit NTPC. The company's diversification into solar and wind positions it for long-term growth.

NRI advantage: Exposure to India's green transition while earning stable dividends from existing thermal capacity.

3. Oil and Natural Gas Corporation (ONGC) - Energy Giant

India's largest producer of crude oil and natural gas, accounting for around 70% of the country's domestic production. ONGC is essential for India's energy security.

Current metrics: Dividend yield of 5.5% as of March 2025, with revenue CAGR of 3.4% and net profit CAGR of 8.7% over five years. The company has declared 59 dividends since 2000.

Strategic position: 25 major projects amounting to more than Rs 1 billion under implementation, with gas production targeting 10 MMSCMD by FY25-end.

4. Coal India Limited - Dividend Champion

Coal India continues to reign supreme among high-dividend PSU stocks with an impressive dividend yield of approximately 7%. The world's largest coal producer supplies 80% of India's coal needs.

Dividend track record: Distributed ₹26.35 per share over the past year, making it a reliable income generator for NRIs seeking regular cash flows.

Strategic importance: Despite global green trends, India's immediate energy needs ensure Coal India's relevance for years to come.

👉 Tip: Consider Coal India for steady dividend income while diversifying into renewable energy PSUs for future growth.

5. Power Grid Corporation - Infrastructure Monopoly

A power transmission monopoly having stable cash flows, Power Grid operates India's electricity highways. It's essential infrastructure with regulated returns.

Investment appeal: Predictable cash flows, government-regulated tariffs, and essential role in India's power sector expansion make it a defensive play.

Growth driver: India's renewable energy expansion requires massive transmission infrastructure – Power Grid's specialty.

Comparison of Top Banking & Energy PSUs

Company | Sector | Dividend Yield | Market Position | Key Advantage |

|---|---|---|---|---|

SBI | Banking | 5-6% | Largest PSU bank | Digital transformation |

NTPC | Power | 4-5% | Largest power generator | Clean energy transition |

ONGC | Oil & Gas | 5.5% | Largest oil producer | Energy security play |

6. Indian Oil Corporation (IOC) - Retail Energy Leader

Leading the BSE PSU pack with a dividend yield of 9.1%, IOC is India's largest oil marketing company with extensive distribution network and refining capacity.

Financial strength: Investment of Rs 720 billion to enhance refining capacity by 25% to 88 MMTPA, with expansions contributing to profitability from FY27.

NRI relevance: As fuel demand grows with India's economic expansion, IOC benefits from both refining margins and retail growth.

7. Bharat Electronics Limited (BEL) - Defense Technology

PSU in defense electronics with healthy order book and R\&D strengths, BEL manufactures advanced radar systems, missiles, and communication equipment for India's armed forces.

Growth catalyst: Strong order book from defense contracts and government initiatives under India's self-reliance push in defense manufacturing.

Strategic advantage: Rising defense budgets and technology indigenization create long-term demand for BEL's products.

8. GAIL (India) - Natural Gas Infrastructure

Natural gas behemoth at the forefront of infrastructure and clean fuel propagation, GAIL operates India's largest gas pipeline network and is expanding LNG infrastructure.

Clean energy play: As India transitions to cleaner fuels, GAIL's pipeline infrastructure becomes increasingly valuable.

Business model: Regulated pipeline business provides stable cash flows while trading operations offer growth upside.

9. REC Limited - Power Finance Specialist

A key financial institution focusing on power sector financing, offering roughly 5% dividend yield by distributing ₹20.4 per share.

Strategic role: Finances India's power infrastructure development, directly benefiting from government's electrification and renewable energy programs.

Growth outlook: Strategic importance in facilitating India's energy transition offers potential long-term stability.

10. Bharat Petroleum Corporation (BPCL) - Integrated Oil Major

Trading with a dividend yield of 7.6%, BPCL stands as one of the highest-paying dividend stocks in the Nifty 50. The company operates across oil refining, exploration, and marketing.

Dividend consistency: Declared 41 dividends since 2001, with ₹31.5 per share in the past 12 months.

Business strength: Maintains robust dividend payouts while investing in transformative projects including refining capacity expansion and renewable energy ventures.

👉 Tip: For NRIs in oil-rich UAE, investing in Indian oil PSUs provides exposure to both countries' energy sectors while earning regular dividend income.

Comparison of Infrastructure & Specialty PSUs

Company | Sector | Dividend Yield | Unique Advantage | Growth Driver |

|---|---|---|---|---|

Power Grid | Transmission | 4-5% | Infrastructure monopoly | Renewable integration |

BEL | Defense | 3-4% | Technology leadership | Defense indigenization |

REC | Finance | 5% | Power sector focus | Energy transition funding |

Action Plan for NRI Investors

Building a PSU portfolio requires careful planning. Here's how to start:

Step 1: Assessment Evaluate your risk tolerance and income needs. PSU stocks suit conservative NRIs seeking steady returns over aggressive growth.

Step 2: Diversification

Don't concentrate in one sector. Mix banking (SBI), energy (ONGC, IOC), and infrastructure (Power Grid) PSUs for balanced exposure.

Step 3: Account Setup Ensure your NRE or NRO account supports equity investments. Most major Indian banks offer integrated trading accounts for NRIs.

Step 4: Tax Planning Understand NRI taxation rules for dividend income and capital gains. DTAA benefits can reduce your tax burden significantly.

Step 5: Regular Review Monitor government policies, disinvestment plans, and sector-specific developments affecting your PSU holdings.

PSU stocks offer NRIs a unique combination of stability, government backing, and dividend income. While they may not provide explosive growth like tech stocks, they deliver consistent returns with lower risk – perfect for NRIs building long-term wealth while maintaining strong India connections.

Ready to start your PSU investment journey? Join our WhatsApp community where fellow NRIs share insights on Indian investments, or download our app to explore tax-efficient investment options including GIFT City opportunities.

Disclaimer: This article is for educational purposes only and not personalized investment advice. Please consult with a qualified financial advisor before making investment decisions. Past performance doesn't guarantee future results.

Comments

Your comment has been submitted