Best NRE Savings Accounts for UAE NRIs - Complete Guide

If you're an NRI in the UAE staring at multiple WhatsApp forwards about "best NRE account rates" and feeling more confused than confident, you're not alone.

Last month, I helped a software engineer in Dubai choose between HDFC, ICICI, and SBI for his NRE account - and the "best" choice wasn't what he expected.

Here's the reality: There's no single "best" NRE savings account.

But there's definitely a best one for your specific situation. By the end of this guide, you'll know exactly which NRE account fits your needs, how much you'll actually earn after fees, and how to open it digitally from the UAE without flying to India.

What Exactly is an NRE Savings Account?

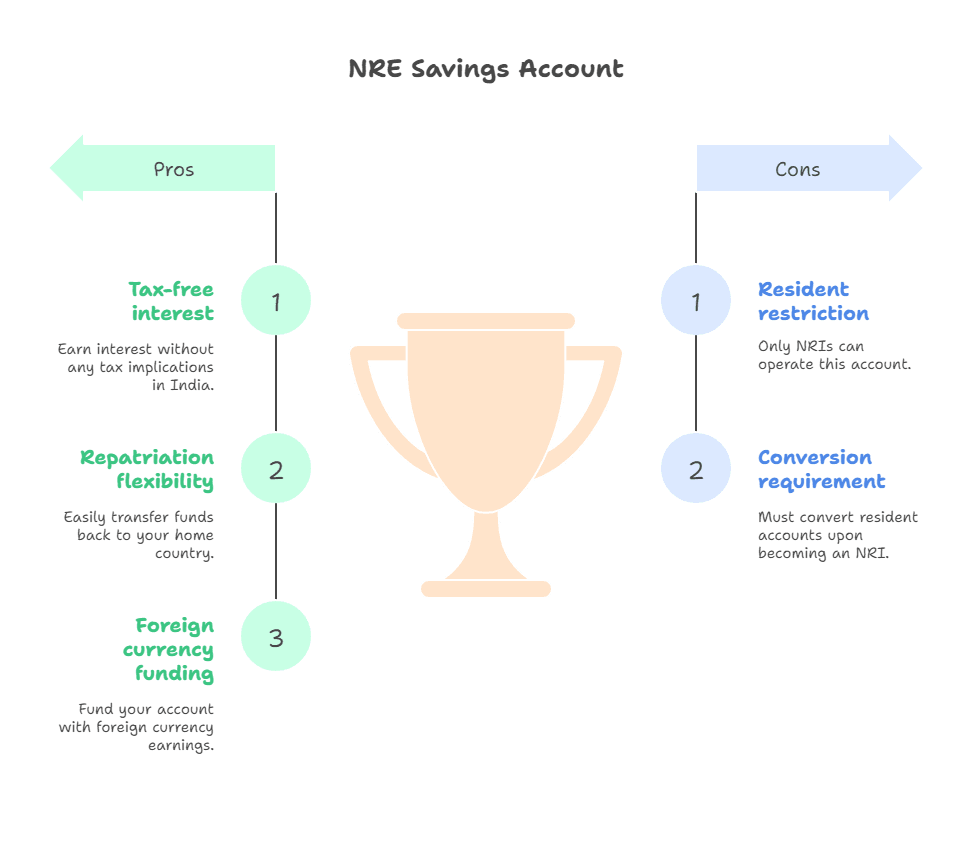

An NRE (Non-Resident External) savings account is your gateway to managing foreign earnings in India. Think of it as a regular savings account, but with superpowers designed specifically for NRIs.

Here's what makes it special: You deposit your UAE salary (converted to rupees), earn completely tax-free interest in India, and can repatriate everything back to the UAE whenever you want. The account is denominated in Indian rupees but funded with your foreign currency earnings.

Key difference from regular accounts: A resident Indian can't operate an NRE account, and an NRI can't keep a regular resident savings account.

The moment you become an NRI (staying outside India for more than 182 days), you must convert your resident savings account as an NRO (Non-Resident Ordinary) account or close your existing accounts.

👉 Tip: Use our RNOR Status Calculator to confirm your residential status before choosing account types.

NRE vs NRO vs FCNR: The Complete Breakdown

This confusion trips up 90% of NRIs I speak with. Let me clear it up:

Feature | NRE Account | NRO Account | FCNR Account |

|---|---|---|---|

Purpose | Foreign earnings | Indian earnings | Foreign currency deposits |

Tax on Interest | Zero | 30% TDS + surcharge | Zero |

Repatriation | Fully repatriable | up to $1M/year ((this limit includes both principal and interest), after applicable taxes are paid | Fully repatriable |

Currency Risk | Yes (rupee fluctuation) | Yes | No (locked in foreign currency) |

Example: Rajesh works in Abu Dhabi, earns AED 20,000 monthly, but also receives ₹50,000 rent from his Mumbai flat. He needs an NRE account for his UAE salary and an NRO account for the rental income. The NRE interest is tax-free; the NRO interest will be taxed.

Also read, "NRE vs NRO vs FCNR: Which is Right for You?"

Tax Implications: What UAE NRIs Must Know

Interest earned on NRE accounts is completely exempt from Indian income tax, making it one of the most tax-efficient ways to save in India. But there are nuances:

In India: Zero tax on principal and interest. No need to file ITR if NRE is your only Indian income source.

In UAE: Since the UAE has no personal income tax, your NRE interest remains tax-free globally - a rare double benefit.

DTAA Benefits: Under the India-UAE Double Taxation Avoidance Agreement, you won't face double taxation even if you have other Indian income sources.

Important caveat: If you convert back to resident status, your account will be redesignated and taxed as per resident rates.

👉 Tip: Keep separate records of your NRE transactions for annual FEMA compliance, even though no ITR filing is required.

Top NRE Savings Accounts: 2025 Interest Rates Comparison

Based on current rates and digital experience for UAE NRIs:

Bank | Interest Rate | Min Balance | Digital Onboarding | Mobile App Rating |

|---|---|---|---|---|

IDFC FIRST | Up to 7.00% p.a. | ₹25,000 | Yes, from UAE | 4.4/5 |

DBS | Up to 3.55% p.a. | ₹1,50,000 AQB | Yes, For existing DBS customers in select regions (like Singapore and Hong Kong) | 4.1/5 |

Axis Bank | Up to 7.00% p.a. | ₹10,000 | Yes, with video KYC | 4.0/5 |

HDFC Bank | Up to 2.50% p.a. | ₹25,000 | Partial digital | 4.2/5 |

ICICI Bank | 2.50-3.00% p.a. | ₹1,00,000 | Yes, via Money2India | 4.1/5 |

SBI | Upk to 2.50% p.a. | ₹1,00,000 | Limited digital | 3.8/5 |

Reality check: IDFC FIRST offers the highest rates with daily interest calculation and monthly payouts, but their UAE customer support is limited compared to HDFC or ICICI.

How Digital Onboarding Actually Works from UAE

Having tested this process myself, here's what really happens:

Easiest: ICICI Bank's Money2India portal. You can complete 80% of the process online, but you'll need to courier attested documents to India.

Fastest: DBS Bank if you're already a DBS Singapore customer. SBI Dubai and Abu Dhabi offices offer instant NRI account numbers with activation in 2-3 working days.

Most Digital: Axis Bank allows video KYC for UAE residents, reducing paperwork significantly.

Process timeline: 5-15 working days depending on the bank and your document preparation.

👉 Tip: Start with banks where you already have relationships in the UAE. HSBC UAE customers get faster processing for HSBC India NRE accounts.

Documentation Checklist for UAE Residents

Essential documents (all must be attested):

- Passport: First 2 and last 2 pages

- UAE residence visa/Emirates ID: Valid with at least 6 months remaining

- Salary certificate or employment contract: From UAE employer

- UAE address proof: DEWA bill, Etisalat bill, or bank statement (within 3 months)

- PAN card: If you don't have one, submit Form 60

- Passport-size photographs: Recent color photos

- Initial funding proof: Bank statement showing source of funds

Attestation options in UAE:

- Indian Consulate in Dubai/Abu Dhabi (most reliable)

- Notary from authorized UAE notaries

- Indian bank branches in UAE (for their own customers)

Additionally, you may require a FATCA declaration for US persons or CRS declaration for other countries.

Hidden Fees and Charges: What Banks Don't Advertise

Every bank has fee structures that can eat into your returns:

Monthly/Quarterly charges:

- Non-maintenance of minimum balance: ₹500-₹1,500 per month

- SMS charges: ₹25-₹100 per month

- Debit card annual fee: ₹500-₹1,500

Transaction charges:

- NEFT/RTGS for repatriation: 0.25-0.50% of amount

- Foreign currency conversion: 1-3% markup on exchange rates

- Cheque book: ₹200-₹500 per book

Real example: On a ₹10 lakh balance earning 3% interest, poor fee management can reduce your effective rate to 2.2%.

👉 Tip: Choose Premium/Elite variants if your balance is high. They often waive most fees and offer better exchange rates.

Also read, "Hidden Charges in NRI Accounts - What Banks Don't Tell You"

Setting Up a Mandate Holder: Why Your Family Needs This

A mandate holder allows your family in India to operate your NRE account on your behalf. This is crucial for:

- Emergency fund access when you're unreachable

- Bill payments and local transactions

- Account maintenance and re-KYC completion

Process: Submit a Letter of Mandate form signed by all account holders, along with the mandate holder's KYC documents to any HDFC Bank branch in India. Similar processes apply to other banks.

Best practice: Choose a financially responsible family member and set transaction limits (usually ₹50,000-₹2,00,000 per day).

Account Maintenance: The Re-KYC Reality

Banks need to ensure that you update the KYC details for your NRE accounts at regular intervals through a Re-KYC process. This typically happens every 2-3 years or when your documents expire.

What you need for Re-KYC:

- Updated passport and UAE residence visa

- Fresh salary certificate

- Current UAE address proof

- FATCA/CRS declarations (if applicable)

In case you fail to complete your Re-KYC within the stipulated time frame, the bank could temporarily freeze your account.

👉 Tip: Set calendar reminders 6 months before your UAE visa expires to start the Re-KYC process proactively.

Mobile App Experience: Where Banks Actually Differ

Having used all major NRI banking apps from Dubai, here's the real user experience:

Best overall: ICICI iMobile Pay - seamless money transfers, good UAE exchange rates integration, and responsive customer chat.

Most features: HDFC MobileBanking - comprehensive but sometimes slow. Great for investment tracking.

Simplest: IDFC FIRST Mobile - clean interface, but limited NRI-specific features.

Most frustrating: SBI YONO - frequent login issues for international users, though improving.

Hidden winner: DBS digibank - if you're already in their ecosystem, it's remarkably smooth.

Currency Exchange Risks: What NRIs Often Ignore

Your NRE account balance fluctuates with the rupee-dirham exchange rate. Funds in NRE accounts are subject to currency exchange risk, which means the value of your deposits can fluctuate based on exchange rate movements.

Example: You deposit AED 50,000 when the rate is ₹22.50/AED (= ₹11.25 lakhs). Six months later, if the rupee weakens to ₹24/AED, your balance is still ₹11.25 lakhs, but it's worth only AED 46,875 - a 6.25% loss.

Hedging strategies:

- Diversify: Split between NRE (rupee) and FCNR (foreign currency) accounts

- Dollar timing: Transfer during rupee strength periods

- SIP approach: Transfer fixed amounts monthly to average out exchange rates

What Happens When You Return to India

After returning to India, you need to inform the bank of your return. The NRI savings account will then be converted to a resident Indian savings account once relevant documentation is submitted.

Key changes:

- Interest becomes taxable as per resident rates

- Higher minimum balance requirements often apply

- Repatriation restrictions kick in

- Investment options change (PIS no longer needed)

Timeline: Most banks require conversion within 30 days of becoming a resident.

Upon your return, the NRE FD can continue until maturity at the contracted interest rate.

However, the interest earned after your return to India (i.e., after you become a resident) will be taxable.

On maturity, the proceeds will be credited to your resident account.

Also read, "RBI Rules for NRI Accounts You Must Know"

Common Mistakes UAE NRIs Make

1. Choosing banks based only on interest rates: A 0.5% higher rate means nothing if you face months of KYC delays or poor customer service.

2. Ignoring minimum balance requirements: That 7% rate comes with a ₹10 lakh minimum balance. Calculate your effective rate on your actual balance.

3. Not planning for Re-KYC: Your UAE visa expires in 18 months, but you forgot to factor Re-KYC timeline.

4. Mixing account types: Using NRE accounts for Indian rental income or NRO accounts for UAE salary creates compliance issues.

5. Poor mandate holder selection: Choosing someone who doesn't understand banking can create access problems during emergencies.

Step-by-Step: Opening Your NRE Account from UAE

Week 1: Preparation

- Gather all documents listed above

- Get attestation from Indian Consulate (book appointment 1-2 weeks ahead)

- Research banks based on your balance and needs

Week 2: Application

- Submit online application on chosen bank's website

- Upload attested documents (PDF format, good quality scans)

- Pay processing fee (usually ₹500-₹1,000)

Week 3: Verification

- Bank verification call (ensure you're available during IST hours)

- Document verification in India

- Initial funding arrangement

Week 4: Activation

- Account number and debit card dispatch

- Mobile/internet banking activation

- First fund transfer to activate account

👉 Tip: Start the process at least 6 weeks before you need the account. UAE postal services can add delays.

Smart Funding Strategies for Your NRE Account

Option 1: Direct Bank Transfer (SWIFT)

- Costs: AED 50-150 per transfer + exchange rate markup

- Timeline: 1-3 working days

- Best for: Large, infrequent transfers

Option 2: Online Money Transfer (UAE Exchange, Al Ansari)

- Costs: Lower fees, better exchange rates

- Timeline: 2-4 hours to same-day

- Best for: Regular monthly transfers

Option 3: Bank's Own NRI Services

- ICICI Money2India, HDFC QuickRemit

- Costs: Competitive rates for existing customers

- Timeline: 1-2 working days

- Best for: Building relationship with the bank

Your Next Steps: Making the Right Choice

Here's what you now know:

- NRE accounts offer tax-free interest but come with currency exchange risks

- IDFC FIRST and Axis Bank offer the highest rates but evaluate total cost including fees

- Digital onboarding is possible but plan for 4-6 weeks total process time

- Choose your bank based on your specific needs - relationship banking, digital experience, or pure rates

- Set up mandate holders early and keep Re-KYC timelines in mind

Your action plan:

- Use our Residential Status Calculator to confirm your NRI status

- Compare effective rates after fees using our NRE Calculator

- Choose 2-3 banks based on your priorities and start applications simultaneously

- Join our UAE NRI WhatsApp Group for real-time updates on rates and processes

The "best" NRE account is the one that aligns with your goals, balance, and banking habits. Focus on the complete picture - rates, fees, service quality, and long-term relationship - rather than just the headline interest rate.

Sources:

Comments

Your comment has been submitted