Best NRI Account in India – How to Choose: Complete Guide

Picture this: You're sitting in your Dubai apartment, salary credited to your UAE bank account, but you need to send money to your parents in Mumbai and save for that dream apartment in Gurgaon. Which Indian bank account should you choose? NRE? NRO? FCNR?

If this sounds familiar, you're not alone. 73% of NRIs struggle with choosing the right Indian bank account, often ending up with the wrong choice that costs them thousands in taxes and charges.

Here's the complete answer you've been searching for.

The Big Question

Which is truly the best NRI account in India for someone living in the UAE?

This isn't just about interest rates. It's about tax implications, repatriation ease, minimum balance hassles, and whether you can actually use the account seamlessly from abroad.

Quick Answer (Summary Verdict)

👉 Tip: For most UAE-based NRIs earning foreign income: NRE account with SBI, HDFC, or ICICI is your best bet. For managing Indian rental income: NRO account. Want currency protection? FCNR-B deposits.

Bottom line: NRE accounts offer tax-free interest and full repatriation, making them ideal for parking foreign earnings in India. But the "best" depends on your specific income sources and financial goals.

The Full Picture

What Are Your NRI Account Options?

You have three main types of NRI accounts, each serving different purposes:

1. NRE (Non-Resident External) Account

- Currency: Indian Rupees (your foreign currency gets converted)

- Purpose: For income earned outside India, such as salary from UAE

- Tax Status: Interest earned is exempt from Indian income tax

- Repatriation: Entire balance is repatriable overseas without limitations

2. NRO (Non-Resident Ordinary) Account

- Currency: Indian Rupees

- Purpose: For income earned in India, such as rental income, pensions, or interest on investments

- Tax Status: Interest earned is subject to taxes in India

- Repatriation: Limited to USD 1 million per financial year

3. FCNR-B (Foreign Currency Non-Resident) Account

- Currency: Various foreign currencies like USD, GBP, EUR, SGD

- Purpose: Term deposits (1-5 years) in foreign currency

- Tax Status: Interest earned on FCNR accounts is tax-free in India

- Repatriation: Both principal amount and interest can be repatriated

Comparison Table: NRE vs NRO vs FCNR

Feature | NRE Account | NRO Account | FCNR-B Account |

|---|---|---|---|

Best For | Foreign salary/income | Indian rental/pension income | Long-term foreign currency deposits |

Currency | INR (converted from foreign) | INR | Foreign currency (USD, GBP, etc.) |

Tax in India | Tax-free interest | Taxable interest | Tax-free interest |

Repatriation | Unlimited | Up to $1M/year | Unlimited |

Minimum Tenure | No lock-in (savings) | No lock-in (savings) | 1-5 years (fixed deposit) |

Currency Risk | Yes (INR fluctuation) | Yes (INR fluctuation) | No risk |

Interest Rates | 3.0% - 7.0% p.a. | 3.0% - 7.0% p.a. | 2.0% - 6.0% p.a. |

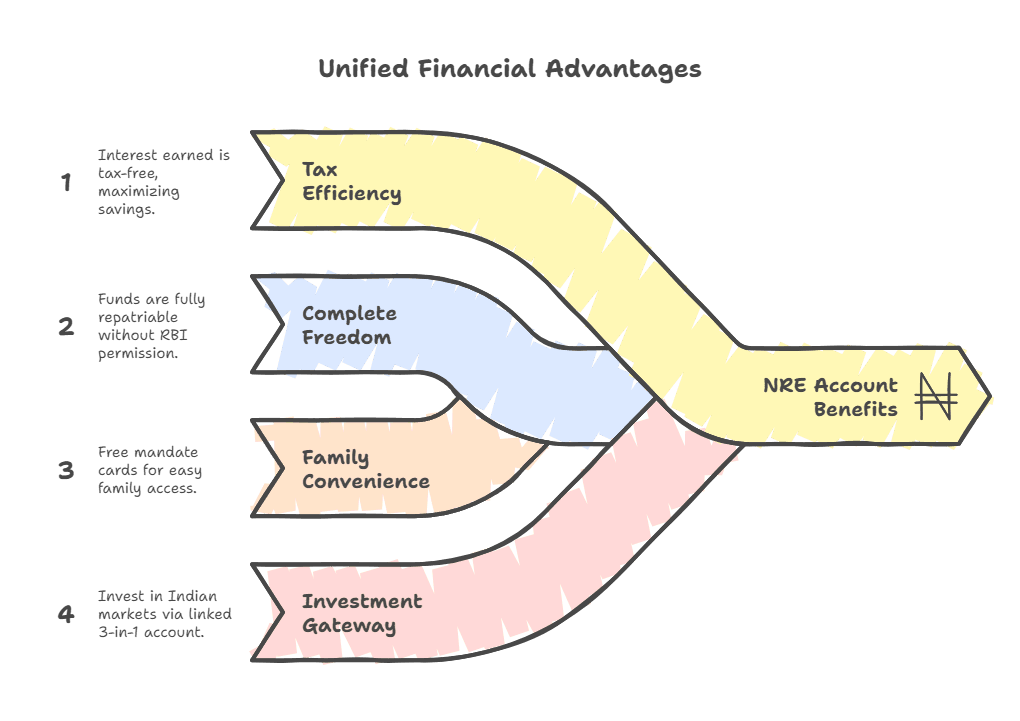

Advantages for NRIs

Why NRE Accounts Win for Most UAE NRIs

Tax Efficiency: Interest earned on NRE accounts is tax-free in India, making it a tax-efficient way to save. This means more money in your pocket compared to regular savings accounts.

Complete Freedom: Funds in NRE accounts are fully repatriable, allowing NRIs to transfer both the principal amount and the accrued interest freely. No RBI permission needed.

Family Convenience: Banks typically provide free mandate cards and cheque books for your family members in India, so your parents can access funds easily.

Investment Gateway: Invest in Indian Stock Markets through Stocks, ETFs, Mutual Funds and IPOs using an integrated 3-in-1 Account linked to your NRE account.

When NRO Accounts Make Sense

If you're earning income in India – rental from that Pune apartment, pension from your previous Indian employer, or returns from Indian investments – NRO accounts are ideal for managing income earned in India.

👉 Tip: Many NRIs need both NRE and NRO accounts. Use NRE for your Dubai salary transfers, NRO for Indian rental income.

FCNR-B: The Currency Protection Champion

FCNR accounts are term deposit accounts that allow you to maintain your funds in foreign currency and earn interest on them. Perfect if you're worried about rupee depreciation.

Example: Deposit $50,000 in FCNR-B at 4% USD interest. No matter how much the rupee falls, your principal stays at $50,000 plus USD interest.

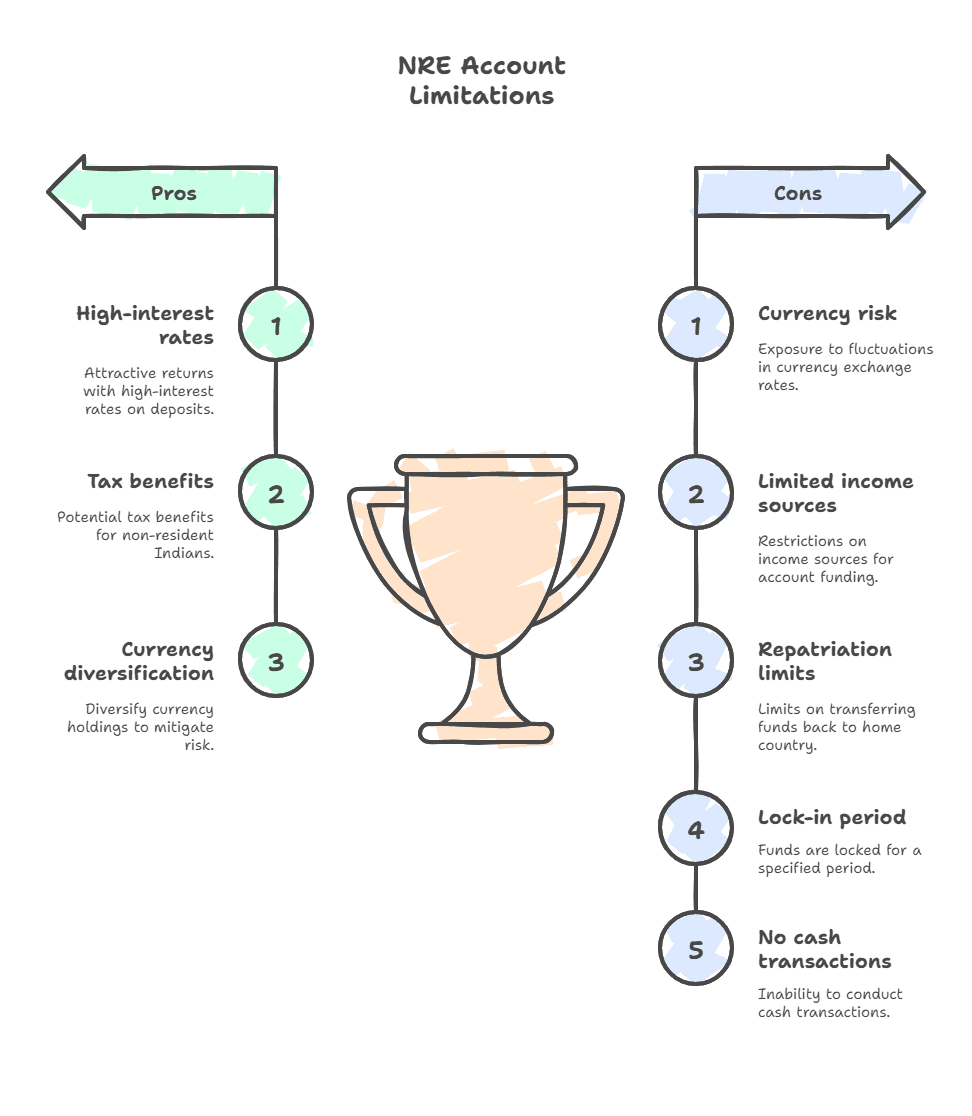

Downsides You Must Consider

NRE Account Limitations

Currency Risk: Funds in NRE accounts are subject to currency exchange risk, which means the value of your deposits can fluctuate based on exchange rate movements. If rupee weakens, your money loses value.

Limited Income Sources: You can only deposit foreign-earned income. Your Indian rental income can't go into NRE accounts.

NRO Account Restrictions

Tax Burden: Interest earned on NRO accounts is taxable in India. TDS at 30% is deducted upfront (though you can claim refunds).

Repatriation Limits: You can repatriate up to USD 1 million every financial year from this account. For most people, this isn't a problem, but worth knowing.

FCNR-B Drawbacks

Lock-in Period: Any premature withdrawals you make will attract a penalty. These are term deposits, not savings accounts.

No Cash Transactions: You cannot deposit or withdraw cash in your FCNR account. Everything must be via bank transfers.

Step-by-Step How-To: Choosing Your Best Account

Step 1: Identify Your Income Sources

- Foreign salary/business income → NRE Account

- Indian rental/pension/dividends → NRO Account

- Long-term savings in USD/foreign currency → FCNR-B Account

Step 2: Pick the Right Bank

Based on our research of current offerings:

Top Choice for UAE NRIs:

- HDFC Bank - Competitive rates (3%–3.5% for NRE savings)

- Bank of Baroda - excellent UAE presence, standard NRE/NRO accounts require Rs. 10,000 (metro/urban) or Rs. 5,000 (semi-urban/rural) Rs. 25,000 minimum balance for Prime account

- ICICI Bank -Interest rates start at 3% for NRE savings (balances under Rs. 1 lakh), with a minimum balance of Rs. 10,000 in metro/urban branches or Rs. 5,000 in semi-urban/rural for standard NRE/NRO accounts.

- SBI - Rs. 1 lakh minimum for metro areas, Rs. 50,000 for other areas

Good News: Bank of Baroda, Canara Bank, and PNB have removed minimum balance requirements in 2025 for most savings accounts, including some NRI accounts.

Step 3: Minimum Balance Reality Check

Bank | NRE Account Minimum Balance | NRO Account Minimum Balance |

|---|---|---|

HDFC Bank | Rs. 25,000 (Prime) | Rs. 25,000 (Prime) |

ICICI Bank | Rs. 25,000 (Account level) | Rs. 25,000 (Account level) |

SBI | Rs. 1,00,000 (Metro/Urban) | Rs. 1,00,000 (Metro/Urban) |

Axis Bank | Rs. 10,000 - Rs. 25,000 | Rs. 10,000 - Rs. 25,000 |

Canara Bank | Zero balance (2025 update) | Zero balance (2025 update) |

👉 Tip: If minimum balance is a concern, consider Canara Bank or PNB, which have recently waived these requirements.

Step 4: Application Process

Most major banks now offer online NRI account opening:

- Visit Bank Website → Go to NRI banking section

- Choose Account Type → NRE/NRO based on your needs

- Fill Application → Provide KYC documents digitally

- Document Verification → Bank calls to verify details

- Account Activation → Usually within 7-10 days

Required Documents:

- Passport with valid visa

- Overseas address proof

- Income proof from UAE employer

- Initial deposit as per bank requirements

👉 Tip: HDFC and ICICI generally have transparent fee structures. Always ask for the complete fee schedule before opening an account.

Final Recommendation

For most UAE-based NRIs, here's your action plan:

- Primary Account: Open an NRE account with HDFC or ICICI for your Dubai salary transfers

- Secondary Account: If you have Indian rental income, open an NRO account with the same bank for convenience

- Long-term Savings: Consider FCNR-B deposits in USD for amounts you won't need for 2-3 years

Your next step: Instead of opening accounts based on WhatsApp forwards or random advice, use data-driven tools to compare options.

Take Action Today

Ready to make an informed decision? Here's how Belong can help you navigate NRI banking better:

🔧 Use Our Tools:

- FD Rate Explorer - Compare current NRI FD rates across banks

- Compliance Compass - Check tax implications for your specific case

- Repatriation Calculator - Calculate costs of transferring money back

📚 Read More:

- Step-by-Step Guide to Open NRI FD in India from UAE

- NRE vs NRO vs FCNR: Which is Right for You?

- Hidden Charges in NRI Accounts – What Banks Don't Tell You

💬 Join Our Community:

- UAE NRIs WhatsApp Group - Get real-time advice from fellow UAE-based NRIs

- Tax & Compliance Group - Ask questions about DTAA, TDS, and more

🚀 Try Belong's USD Fixed Deposits: Unlike traditional NRE accounts, Belong's USD FDs offer:

- Tax-free returns (5.0% in USD)

- No currency risk (stay in USD)

- Easy repatriation (simplified process)

- GIFT City benefits (IFSCA regulated)

Download Belong App and start with USD deposits designed specifically for UAE-based NRIs.

About the Author: Ankur Choudhary is an IIT Kanpur alumnus, SEBI-registered investment advisor, 2x fintech founder, and CEO of Belong. He has over 12 years of experience helping NRIs make smarter financial decisions.

Last Updated: August 18, 2025 | Sources: RBI, HDFC Bank, ICICI Bank, SBI official websites

Comments

Your comment has been submitted