Best NRI Fixed Deposit Accounts India Complete Tax & Rate Guide

"I have ₹25 lakhs sitting in my UAE savings account earning 1.5%. Should I move it to an NRI FD in India?"

This exact question came up in our UAE NRI WhatsApp group last week. The person asking was a project manager in Dubai, frustrated with low UAE bank rates but worried about Indian banking complexities, tax implications, and whether he'd actually get better returns after all the fees and hassles.

Here's what most articles won't tell you: NRI FDs can give you 6-7% returns, but only if you choose the right type and avoid the common mistakes that cost NRIs thousands of rupees annually.

The "best" FD isn't always the one with the highest advertised rate.

By the end of this guide, you'll know exactly which NRI FD type suits your specific situation, how to minimize tax impact, which banks offer the smoothest digital experience from the UAE, and most importantly - whether FDs are even the right choice for your goals.

Quick Answer: The Summary Verdict

For UAE NRIs in 2025, here's the practical reality:

NRE FDs are best for foreign-earned money you want to grow tax-free (up to 7.50% returns in some banks like SBI).

NRO FDs work for Indian rental income or dividends (but face 30% TDS + 4% cess, effective ~31.2%, potentially reducible to 12.5% under India-UAE DTAA).

FCNR FDs provide currency hedging but lower returns (up to 5.20% for USD in some banks like IDBI).

Top banks for digital experience: ICICI Bank (fastest processing), HDFC Bank (premium service), IDFC FIRST (highest rates with user-friendly app), Axis Bank (good digital opening), SBI (tab-based digital onboarding

The catch: Most UAE NRIs choose based on interest rates alone and ignore tax efficiency, currency risk, and premature withdrawal penalties - leading to lower actual returns than expected.

Our recommendation: Start with NRE FDs for foreign income, use NRO only for Indian income, and consider FCNR for currency hedging on large amounts above $25,000, noting that both principal and interest in NRO can be repatriated up to USD 1 million per financial year after taxes.

What Are NRI Fixed Deposits and Why They Matter

An NRI Fixed Deposit is essentially a time deposit account where you lock your money for a specific period (1-10 years) at a predetermined interest rate. Unlike regular FDs, these come in three types designed for different income sources and tax treatments.

The core appeal: Indian banks offer 6-7% interest rates compared to 1-3% in most international markets. For a UAE resident earning 1.5% on savings, this represents a potential 300-400% increase in returns.

But here's the complexity: The type of NRI FD you choose dramatically impacts your final returns due to tax treatment, repatriation rules, and currency conversion costs.

Real example: Arjun, a Dubai-based consultant, had ₹30 lakhs to invest. He chose a 7% NRO FD without understanding tax implications. After 30% TDS, his effective rate dropped to 4.9%. An NRE FD would have given him the full 7% tax-free.

👉 Tip: The "best" FD rate becomes meaningless if you lose 30% to taxes. Always consider post-tax returns, not advertised rates.

The Complete Breakdown: NRE vs NRO vs FCNR FDs

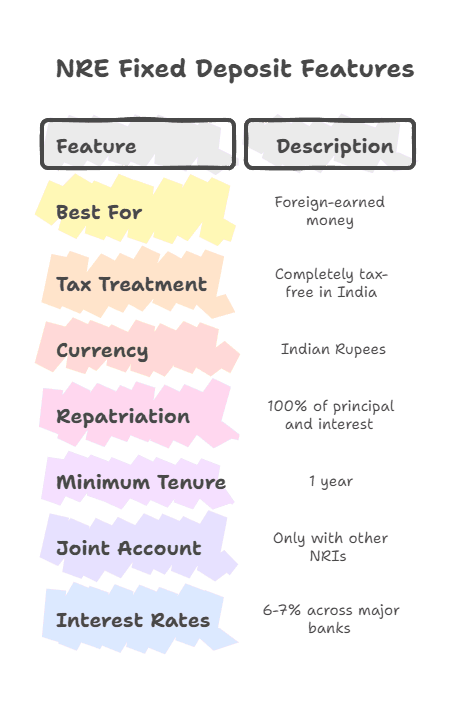

NRE Fixed Deposits: Tax-Free Growth for Foreign Income

Best for: Foreign-earned money (UAE salary, freelance income, overseas investments)

Key features:

- Tax treatment: Completely tax-free in India (0% TDS)

- Currency: Maintained in Indian Rupees (conversion risk applies)

- Repatriation: 100% of principal and interest

- Minimum tenure: 1 year (no interest if withdrawn before 1 year)

- Joint account: Only with other NRIs, not resident Indians

- Interest rates: 6-7% across major banks

Real scenario: Priya transfers AED 100,000 (₹22.5 lakhs at current rates) from her UAE salary to an NRE FD at 6.5%. After one year, she earns ₹1.46 lakhs interest with zero tax deduction. Total: ₹23.96 lakhs, fully repatriable.

The hidden risk: If the rupee weakens to ₹25/AED, her ₹23.96 lakhs converts back to only AED 95,840 - a net loss despite 6.5% Indian interest.

NRO Fixed Deposits: For Indian Income (But Watch the Tax)

Best for: Indian rental income, dividends, pension, or Indian business profits

Key features:

- Tax treatment: 30% TDS plus cess and surcharge (effective 31-33%)

- Currency: Indian Rupees only

- Repatriation: Principal non-repatriable, interest up to $1 million/year after tax deductions and subject to RBI conditions

- Minimum tenure: 7 days to 10 years

- Joint account: Allowed with resident Indians

- Interest rates: 6-7% (but after-tax returns are 4.2-4.9%)

Tax-saving opportunity: If your total Indian income is below ₹3 lakhs, you can file ITR and claim full TDS refund, making it effectively tax-free.

Real scenario: Ramesh has ₹15 lakhs from selling his Mumbai flat. In an NRO FD at 7%, he earns ₹1.05 lakhs gross interest. After 30% TDS (₹31,500), he nets ₹73,500 - effective rate 4.9%.

Also Read - https://getbelong.com/blog/sell-indian-property/CNR Fixed Deposits: Currency Hedging with Lower Returns

Best for: Large amounts where currency protection matters more than maximum returns

Key features:

- Tax treatment: Completely tax-free in India

- Currency: Maintained in foreign currency (USD, GBP, EUR, AUD, CAD, JPY)

- Repatriation: 100% of principal and interest in original currency

- Minimum tenure: 1-5 years only

- Interest rates: 3-5% depending on currency

- Currency risk: Zero (deposits remain in original currency)

When it makes sense: If you have USD 50,000+ and expect significant rupee depreciation, FCNR protects your capital while providing modest returns.

Trade-off analysis: FCNR USD at 4% vs NRE at 7%. If rupee depreciates more than 3% annually, FCNR wins. If rupee is stable or strengthens, NRE provides better returns.

2025 Interest Rate Reality Check: What Banks Actually Pay

Here are the current rates from major banks (as of August 2025):

Bank | NRE FD Rate | NRO FD Rate | FCNR USD Rate | Digital Opening |

|---|---|---|---|---|

IDFC FIRST | 7.3% p.a. | 7.3% p.a. | ~4.75% % p.a. | Yes |

ICICI Bank | 7.3% p.a. | 7.3% p.a. | 4.85% p.a. | Yes |

HDFC Bank | 6.50% p.a. | 6.50% p.a. | 4.00% p.a. | Partial |

Axis Bank | 7.25% p.a. | 7.250% p.a. | ~4.90% p.a. | Yes |

SBI | 7.50% p.a. | 7.50% p.a. | ~4.5% p.a. | Limited |

*Note: Rates vary by tenure; these are indicative maximums.

Rate reality: These are indicative maximum rates; actual rates vary by tenure (e.g., higher for 2-5 years), deposit amount, and bank policies. For smaller amounts and shorter tenures, rates may drop by 0.5-1.5%.

The fine print: Most banks offer 0.25-0.50% higher rates for senior citizens (60+), but NRIs are not eligible for senior citizen benefits.

👉 Tip: Don't chase the highest rate if it comes with poor service or hidden charges. A 0.25% rate difference often costs less than bank switching hassles.

Tax Implications: The Make-or-Break Factor

NRE FD Taxation: The Clean Option

In India: Zero tax, zero TDS. Interest earnings are completely exempt.

In UAE: Since UAE has no personal income tax, your NRE FD interest remains tax-free globally.

In other countries: Check local tax laws. Some countries tax worldwide income regardless of source.

Documentation required: None for tax purposes in India. Keep records for your home country compliance.

NRO FD Taxation: Complex but Manageable

TDS rates for NRO:

Flat 30% + 4% cess (31.2%) on interest, regardless of income level; surcharge may apply if total income exceeds ₹50 lakhs.

Refunds can be claimed via ITR based on applicable slab rates (e.g., no tax if total income \< ₹3 lakhs).

DTAA benefits: UAE residents can claim lower TDS (10-15%) by submitting Tax Residency Certificate (TRC) from UAE Federal Tax Authority.

ITR filing requirement: Mandatory if total Indian income exceeds ₹3 lakhs or if you want to claim TDS refund.

FCNR FD Taxation: Simple and Clean

In India: Completely tax-free, no TDS.

Currency-specific considerations: Interest rates vary by currency strength and local central bank policies.

Home country tax: Some countries tax foreign deposit interest. Check with a tax advisor in your country of residence.

Digital Opening Process: What Actually Works from UAE

Having tested the online FD opening process from Dubai, here's the reality:

Best Digital Experience: ICICI Bank

Process timeline: 3-5 working days

What works:

- Existing customers can open FDs through mobile app

- Video KYC available for new customers

- Money2India integration for seamless funding

- Real-time status updates via SMS/email

What's frustrating:

- High minimum amounts for premium rates (₹25 lakhs+)

- Customer service during UAE hours is limited

Real walkthrough: I tested opening an NRE FD online. Applied at 2 PM Dubai time, received verification call the next day, account activated in 4 days. Debit card delivered to Dubai address in 8 days.

Premium Service: HDFC Bank

Process timeline: 7-10 working days

Advantages:

- Relationship managers for accounts above ₹10 lakhs

- UAE branch support for document verification

- WhatsApp banking for ongoing management

- Premium debit cards with travel benefits

Limitations:

- Higher minimum balance requirements

- More paperwork compared to digital-first banks

Highest Rates: IDFC FIRST Bank

Process timeline: 5-7 working days

Unique features:

- 7% rates on NRE FDs (highest in market)

- Zero account opening fees

- 24/7 customer service

- Advanced mobile app with UAE-specific features

Trade-offs:

- Newer bank with smaller branch network

- Limited UAE market presence

Currency Risk Management: The FCNR Advantage

When currency hedging matters:

If you have USD 50,000+ and any of these apply:

- Expect significant rupee depreciation (>5% annually)

- Planning major USD expenses (US education, property)

- Want to eliminate currency conversion costs

- Prefer capital preservation over maximum returns

FCNR currency options and strategies:

USD FCNR: Most popular, rates 3.5-4.5%. Best when expecting rupee weakness.

GBP FCNR: Higher rates (4-5%) but limited to 1-year tenure at most banks.

EUR FCNR: Lower rates (2.5-3.5%) but good for European expenses.

Currency diversification strategy: Split large amounts across NRE (for returns) and FCNR (for hedging). Example: ₹50 lakhs total - ₹30 lakhs in NRE FD at 7%, ₹20 lakhs in USD FCNR at 4%.

👉 Tip: FCNR makes sense only for amounts above $25,000. Smaller amounts face disproportionately high processing fees.

Premature Withdrawal Rules: The Fine Print That Matters

NRE FD Withdrawal Penalties

Before 1 year: Zero interest paid, full penalty

After 1 year: Interest paid at reduced rate minus 0.5-1% penalty

Example: ₹10 lakh NRE FD at 7% for 3 years, withdrawn after 18 months. Interest calculated at 18-month rate (say 6%) minus 1% penalty = 5% effective rate.

NRO FD Withdrawal Terms

More flexible: Can be withdrawn after 7 days with penalty

Penalty structure: 1% on interest earned, not principal

Better liquidity: Suitable if you might need emergency access

FCNR FD Restrictions

Strictest rules: Most banks don't allow premature withdrawal

Alternative: Some banks offer loan against FCNR FD (up to 90% of deposit value)

Planning required: Only deposit amounts you won't need for the full tenure

Also Read - Common Mistakes NRIs Make While Choosing an NRE Banking Account

FD Laddering Strategy: Maximizing Returns and Liquidity

The concept: Instead of putting all money in one long-term FD, create multiple FDs with staggered maturity dates.

Example strategy for ₹25 lakhs:

- Year 1: ₹5 lakhs FD (1 year) + ₹5 lakhs FD (2 years) + ₹5 lakhs FD (3 years) + ₹5 lakhs FD (4 years) + ₹5 lakhs FD (5 years)

- Year 2: When 1-year FD matures, reinvest in new 5-year FD

- Result: After 5 years, you have ₹5 lakhs maturing every year with highest rates

Benefits:

- Liquidity: Regular access to funds without penalties

- Rate optimization: Continuously benefit from highest long-term rates

- Flexibility: Can adjust strategy as rates or needs change

Digital management: Most banks allow auto-renewal with rate updates, making ladder management easier.

Auto-Renewal Pitfalls: Why Automatic Isn't Always Better

The default trap: Most banks set FDs to auto-renew at current rates, which might be lower than your original rate.

What to monitor:

- Rate changes: Banks can reduce rates at renewal

- Tax status changes: If you become resident, NRE FDs might convert to regular FDs with different tax treatment

- Better opportunities: New investment options might offer better returns

Smart auto-renewal strategy:

- Set calendar reminders 30 days before maturity

- Compare current rates across banks

- Consider switching to other investment options if available

Alternative approach: Set FDs to mature into savings account, then manually reinvest after reviewing options.

Customer Service Reality: UAE Support Quality

Based on mystery shopping calls from Dubai:

Best UAE Support: ICICI Bank

Response quality: 85% of queries resolved in first call

UAE knowledge: Agents understand Emirates ID, DEWA bills, UAE address formats

Contact options: UAE toll-free number, WhatsApp support, email response within 24 hours

Language support: Hindi, English, Tamil available

Premium Relationship Banking: HDFC Bank

Dedicated managers: For accounts above ₹25 lakhs

UAE office support: Physical presence in Dubai for document verification

Response time: Premium customers get priority, others wait 5-10 minutes

Issue escalation: Clear hierarchy for complex problems

Challenges Across Banks

Time zone issues: Most customer service optimized for India hours (9 AM - 6 PM IST)

Document understanding: Junior agents often unfamiliar with UAE document formats

Transfer frequency: Complex queries often require multiple transfers

👉 Tip: Call banks between 12 PM - 4 PM Dubai time for best agent availability and shortest wait times.

Mobile App Experience for FD Management

Critical features for UAE users:

ICICI iMobile Pay: Most Comprehensive

FD-specific features:

- Open new FDs with existing funds

- Track interest earnings in real-time

- Set maturity alerts and auto-renewal preferences

- Calculate returns with built-in FD calculator

International features:

- Works seamlessly from UAE IP addresses

- Multiple language options

- UAE time zone display

- International fund transfer integration

HDFC Mobile Banking: Investment Focus

Advanced features:

- FD to mutual fund conversion options

- Goal-based FD planning tools

- Tax calculation and reporting

- Investment advisory integration

Limitations:

- Occasional login issues from international locations

- Limited offline functionality

IDFC FIRST Mobile: User-Friendly Interface

Standout features:

- Simplest FD opening process

- Clear interest rate display across tenures

- Integrated tax planning tools

- 24/7 customer chat support

Also Read -

Hidden Charges That Reduce Your Returns

Account maintenance fees:

Bank | Annual Fee | Waiver Conditions | International Usage |

|---|---|---|---|

ICICI Bank | ₹750 | Balance >₹25K | ₹125 + 3.5% markup |

HDFC Bank | ₹1,000 | Relationship value >₹2L | ₹100 + 3% markup |

IDFC FIRST | ₹0 | Always free | ₹150 + 3.25% markup |

FD-specific charges:

- Premature withdrawal: 1% penalty on interest earned

- Partial withdrawal: ₹500 processing fee per transaction

- Statement charges: ₹25 per physical statement beyond 4 annually

- SMS alerts: ₹25-100 per month for transaction notifications

Currency conversion fees (for FCNR):

- Inward remittance: 0.25-0.50% of transfer amount

- Outward repatriation: 0.50-1% plus GST

Real impact calculation: On a ₹10 lakh FD earning 7%, annual fees of ₹1,000 reduce effective rate to 6.9%. For smaller amounts, the impact is proportionally higher.

Joint Account Considerations: Family Financial Planning

NRE FD Joint Accounts

Allowed combinations:

- NRI + NRI (any relationship)

- NRI + OCI (Overseas Citizen of India)

Operational modes:

- Jointly: Both signatures required for all transactions

- Either or Survivor: Anyone can operate independently

- Former or Survivor: Primary holder has priority

Tax implications: Interest income can be distributed between joint holders for tax optimization (in countries that tax global income).

NRO FD Joint Accounts

Broader options:

- NRI + Resident Indian (close relatives only)

- NRI + NRI

- NRI + OCI

Estate planning benefits:

- Automatic transmission: Funds transfer to survivor without probate

- Emergency access: Resident relative can handle urgent transactions

- Tax efficiency: Interest income attribution to lower-earning partner

Documentation required:

- Relationship proof (birth certificate, marriage certificate)

- Joint application with all KYC documents

- Nomination details for all holders

Loan Against FD: Emergency Liquidity Option

Availability:

- NRE FDs: Up to 90% of deposit value

- NRO FDs: Up to 90% of deposit value

- FCNR FDs: Up to 85% of deposit value (limited banks)

Interest rates: Typically FD rate + 1-2%

Processing time: 24-48 hours for existing customers

Repayment flexibility: Can be repaid anytime without prepayment penalty

Use cases:

- Emergency medical expenses

- Property down payments

- Educational expenses

- Business working capital

Advantage over premature withdrawal: Your FD continues earning interest while you access funds.

Real example: Suresh has a ₹20 lakh NRE FD at 7%. Instead of breaking it for ₹5 lakh emergency, he takes a loan at 9%. His FD continues earning 7%, net cost is only 2% on the loan amount.

Economic Timing: When to Invest in FDs

Interest Rate Cycle Considerations

Rising rate environment (current scenario): Wait for higher rates if you can, or opt for shorter tenures to reinvest at higher rates later.

Falling rate environment: Lock in longer tenures to secure current high rates.

RBI policy impact: Monitor repo rate changes - FD rates typically follow within 3-6 months.

Currency Timing for FCNR

USD FCNR considerations:

- US Fed rate hikes: Higher US rates mean better FCNR USD rates

- Rupee outlook: If expecting significant depreciation, prioritize FCNR over NRE

Rupee strength indicators to watch:

- India's current account deficit

- Oil prices (India is a major importer)

- Foreign institutional investor (FII) flows

- US dollar index movements

Seasonal Patterns

March-end rush: Banks often offer marginally higher rates in Q4 to meet deposit targets

Post-budget period: Interest rate expectations change based on government fiscal policy

Festival seasons: Some banks offer promotional rates during Diwali, New Year periods

👉 Tip: If rates are rising, consider shorter tenures (1-2 years) to reinvest at higher rates later. If rates are falling, lock in longer tenures (3-5 years).

Comparing FDs with Other NRI Investment Options

NRE FDs vs NRI Mutual Funds

Factor | NRE FDs | NRI Mutual Funds |

|---|---|---|

Returns | 6-7% guaranteed | 10-15% potential (with risk) |

Risk | Zero capital risk | Market risk applies |

Liquidity | Low (penalties apply) | High (can exit anytime) |

Tax | Tax-free | Capital gains tax applies |

Minimum amount | ₹1,000 | ₹500 |

When to choose FDs: Capital preservation priority, guaranteed returns needed, specific maturity date planning.

When to choose mutual funds: Long-term goals (5+ years), higher return appetite, inflation protection needed.

NRE FDs vs GIFT City Investments

GIFT City advantages:

- Higher potential returns (8-12%)

- International financial center status

- Access to global investment products

FD advantages:

- Guaranteed returns

- Simpler documentation

- Established banking relationships

NRE FDs vs Indian Real Estate

Real estate complexity: Legal compliance, property management, tenant issues, transaction costs.

FD simplicity: Completely passive, no management required, instant liquidity (with penalty).

Return comparison: Real estate potential 8-12% but with much higher risk and effort.

Repatriation Rules and Documentation

NRE FD Repatriation

Limits: No limits on principal and interest repatriation

Documentation: Simple online request through bank portal

Timeline: 3-5 working days for international transfer

Costs: 0.25-0.50% transfer fee plus currency conversion charges

NRO FD Repatriation

Limits: Both principal and interest up to USD 1 million per financial year, after taxes and with Form 15CA/CB for large amounts.

Documentation required:

- Form 15CA (online declaration)

- Form 15CB (CA certification for amounts >$25,000)

- Tax payment proof

- Original FD receipt

Process complexity: More paperwork, 7-10 working days

Strategy: Transfer NRO interest to NRE account first, then repatriate from NRE (simpler process).

FCNR FD Repatriation

Advantage: Repatriate in original currency, no conversion charges

Limits: No restrictions on amount

Timeline: 2-3 working days (fastest among all types)

Documentation: Minimal - just maturity instruction

Safety and Regulatory Protection

Deposit Insurance Coverage

DICGC coverage: ₹5 lakhs per depositor per bank (including principal and interest)

Coverage calculation: If you have multiple FDs with same bank, total coverage is ₹5 lakhs, not per FD.

Planning implication: Spread large amounts across multiple banks for full insurance coverage.

Example: ₹25 lakhs split as ₹5 lakhs each in 5 different banks = Full ₹25 lakhs insured vs ₹5 lakhs insured if kept in single bank.

Regulatory Oversight

RBI supervision: All NRI FD products regulated by Reserve Bank of India

Banking ombudsman: Complaint resolution mechanism for disputes

FEMA compliance: All transactions automatically compliant with foreign exchange regulations

Audit trails: Complete documentation for tax and regulatory purposes

Also Read - RBI Rules for NRI Accounts You Must Know

Bank Stability Indicators

Public sector banks: Government backing but slower digitization

Private sector banks: Better service, higher efficiency, competitive rates

Financial health metrics to check:

- Capital adequacy ratio (>12% is good)

- Net NPA ratio (\<3% is good)

- Credit rating from agencies like ICRA, CRISIL

Making Your Decision: The Final Framework

Choose NRE FDs if:

- You're investing foreign-earned money

- Tax-free returns are priority

- You want full repatriation flexibility

- You can handle currency conversion risk

- You have funds for minimum 1-year lock-in

Choose NRO FDs if:

- You're investing Indian-earned money (rent, dividends)

- Your total Indian income is below ₹3 lakhs (can claim TDS refund)

- You have DTAA benefits to reduce TDS

- You need joint account with resident Indian family

- You want more flexible withdrawal terms

Choose FCNR FDs if:

- You have large amounts ($25,000+) to invest

- Currency protection is more important than maximum returns

- You expect significant rupee depreciation

- You have expenses planned in original currency

- You want the simplest repatriation process

Digital Opening Priority:

- ICICI Bank - Best overall digital experience

- IDFC FIRST - Highest rates with good digital platform

- HDFC Bank - Premium service for high-value deposits

- Axis Bank - Good balance of features and rates

Amount-Based Strategy:

- Under ₹5 lakhs: IDFC FIRST for highest rates

- ₹5-25 lakhs: ICICI Bank for best service

- Above ₹25 lakhs: HDFC Bank for relationship banking + FCNR diversification

Your Next Steps

Here's what you now know about NRI Fixed Deposits:

The basics are clear - NRE for foreign income (tax-free), NRO for Indian income (taxable), FCNR for currency hedging.

Rates matter, but so does tax treatment - A 7% NRO FD becomes 4.9% after tax, while a 6.5% NRE FD stays 6.5%.

Digital opening is real - You can open FDs online from UAE, but processing times and experiences vary significantly by bank.

Currency risk exists - NRE and NRO FDs expose you to rupee fluctuation; FCNR eliminates this risk.

Hidden charges impact returns - Account fees, premature withdrawal penalties, and repatriation costs can reduce effective returns.

Laddering strategy works - Multiple FDs with staggered maturities provide better liquidity and rate optimization.

Sources:

Comments

Your comment has been submitted