Best NRI Fixed Deposit Rates in India

"Which bank offers the best NRI fixed deposit rates right now, and which one actually works smoothly for someone like me living in Dubai?"

If you're sitting in Abu Dhabi, Riyadh, or Kuwait City with ₹25 lakhs to invest, this question probably keeps you up at night.

You've seen conflicting WhatsApp forwards about 8% rates, heard horror stories about banks freezing accounts, and frankly, you're tired of clicking through bank websites that seem designed to confuse rather than help.

I get it.

After helping NRIs navigate Indian investments, we have seen the same pattern: smart, successful professionals who can close million-dirham deals but feel lost when trying to open a simple FD in India.

By the end of this guide, you'll know exactly which banks offer competitive rates, how the tax actually works for UAE residents, and most importantly - which ones you can trust with your money and your sanity.

Also read - Best NRI Fixed Deposit Accounts in India

Quick Answer: The Current Leaders (September 2025)

Here's what you need to know right now:

Highest Rates:

- DCB Bank: Up to 7.25% on NRE FDs

- Bajaj Finance: Up to 6.95% for general customers

- GIFT City USD FDs: 4-5% in USD (tax-free)

Best for Gulf NRIs:

- HDFC Bank and ICICI Bank for digital experience

- Axis Bank for GIFT City USD FDs with mobile app access

Tax Impact:

- NRE FDs: Completely tax-free in India

- GIFT City FDs: Tax-free in India, no tax in UAE

- NRO FDs: 30% TDS upfront

Bottom Line: If you want simplicity and tax efficiency, go with NRE FDs at HDFC/ICICI or explore GIFT City USD options for currency protection.

The Complete Picture: Understanding Your Options

What Are NRI Fixed Deposits, Really?

Think of NRI FDs as India's way of welcoming your foreign earnings home. Unlike regular FDs that Indians use, these are specifically designed for the unique challenges we face - currency conversion, tax complications, and the need to move money back abroad.

The three main types work differently:

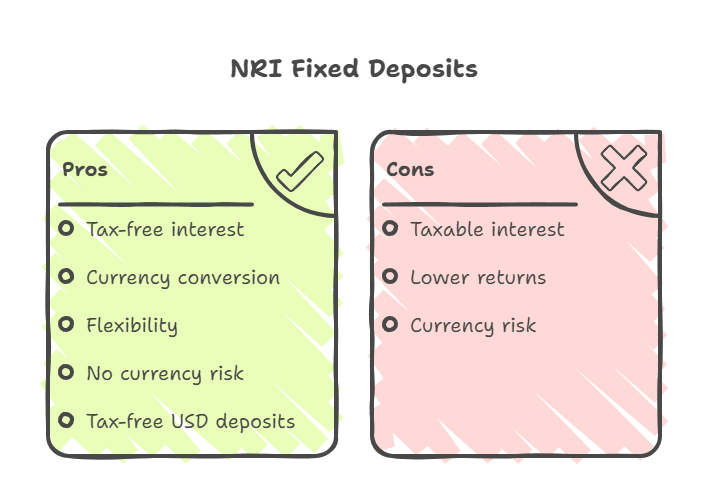

NRE (Non-Resident External) FDs: Your dollars get converted to rupees, earn interest, and everything stays tax-free. Perfect if you believe the rupee will strengthen.

NRO (Non-Resident Ordinary) FDs: For rupees you already have in India - rental income, pension, or money you forgot about. Higher flexibility but you pay tax.

FCNR FDs: Keep your money in the original currency (USD, EUR, GBP). No currency risk, but usually lower returns.

GIFT City FDs: The new kid on the block. USD-denominated deposits that are completely tax-free and offer protection against rupee depreciation.

👉 Tip: Most UAE-based NRIs benefit most from NRE FDs or GIFT City options because of the tax advantages.

Current Interest Rate Comparison (September 2025)

Bank | NRE FD (1-2 years) | NRO FD (1-2 years) | GIFT City USD | Digital Experience |

|---|---|---|---|---|

DCB Bank | 7.25% | 7.25% | Not Available | Average |

ICICI Bank | Up to 6.60% | Up to 6.60% | Available | Excellent |

HDFC Bank | Up to 6.50% | Up to 6.50% | Available | Excellent |

Axis Bank | Up to 6.30% | Up to 6.30% | 4-5% USD | Very Good |

SBI | Up to 6.00% | Up to 6.00% | Available | Good |

Important: Interest rates can change without notice, so always verify current rates before investing.

Also Read - GIFT City - Everything You Need to Know

GIFT City: The Game-Changer for Gulf NRIs

Let me tell you about something that's revolutionizing NRI banking. GIFT City allows you to park money in USD, earn 4-5% interest, and pay zero tax in both India and UAE.

Why this matters for UAE residents:

Currency Protection: Your AED 100,000 stays protected against rupee volatility.

Tax Efficiency: No TDS in India, and since UAE has no income tax, you keep 100% of earnings.

Flexibility: Unlike FCNR deposits, these work like savings accounts - add or withdraw anytime.

Higher Returns: 4-5% annually is significantly higher than what you'd get in US banks.

Why NRIs Are Choosing These Options Right Now

For Maximum Returns: Traditional NRE FDs

If you're comfortable with currency risk and want the highest returns, NRE FDs still make sense. Here's why:

Tax Benefits: Interest earned on NRE FDs is completely exempt from tax in India.

Higher Rates: You can earn up to 7.25% annually, which beats most international options.

Easy Repatriation: Both principal and interest are fully repatriable without restrictions.

For Currency Protection: GIFT City USD FDs

Smart money is moving here because:

No Currency Risk: Your dollars stay dollars.

Competitive Returns: 4-5% annually in USD terms beats most global deposit rates.

Zero Tax: Perfect for UAE residents who face no income tax.

For Existing India Income: NRO FDs

If you have rental income or other India-sourced money:

Flexibility: Shorter tenures available.

Existing Funds: Use money already sitting in India.

Repatriation: Up to USD 1 million annually can be transferred abroad.

👉 Tip:Always calculate post-tax returns for NRO FDs since you'll pay 30% TDS upfront.

The Hidden Challenges You Need to Know

What Banks Don't Tell You Upfront

Digital Experience Varies Wildly

I tested the online application process for five major banks. HDFC and ICICI were smooth - took 15 minutes each. SBI's website crashed twice.

DCB Bank required a branch visit despite promising online service.

Customer Service for Gulf NRIs Is Hit or Miss

HDFC and ICICI have dedicated NRI helplines with UAE timing. SBI's international helpline often has long wait times. Smaller banks rarely understand Gulf-specific queries.

Hidden Charges Can Erode Returns

Bank | Account Maintenance | Wire Transfer | Early Closure |

|---|---|---|---|

ICICI | Free for NRE | $35 outward | 1% penalty |

HDFC | Free for balances >₹25,000 | $30 outward | 1% penalty |

Axis | Free for NRI accounts | $40 outward | 1% penalty |

Also Read - Hidden Charges in NRI Accounts - What Banks Don't Tell You

Premature Withdrawal: The Fine Print

This is where many NRIs get trapped:

NRE FDs: No interest if withdrawn before 1 year. Absolutely none.

NRO FDs: Usually 1% penalty, but you keep the interest for the period held.

GIFT City FDs: Many banks offer callable deposits with premature withdrawal options.

FCNR FDs: No interest if withdrawn before 1 year, similar to NRE FDs.

👉 Tip: Never put emergency funds in NRE or FCNR FDs. The 1-year lock-in is real.

Step-by-Step: How to Apply from the UAE

Method 1: Online Application (Recommended)

For HDFC/ICICI NRE FDs:

KYC Preparation: Have your passport, UAE visa, Emirates ID, and Indian PAN ready as PDFs.

Income Proof: Salary certificate and 6-month bank statements from your UAE bank.

Application: Visit the bank's NRI portal, not the regular website.

Funding: Transfer from your UAE account directly (SWIFT transfer).

Timeline: 5-7 working days for account activation.

Method 2: GIFT City USD FDs via Axis Bank

Axis Bank now allows complete digital opening through their mobile app. Here's how:

Download: Axis Bank's "Open by Axis Bank" app.

Documentation: Same as above, but everything happens in-app.

USD Transfer: Direct USD transfer from your UAE bank account.

Verification: Video KYC call (they accommodate UAE timing).

Timeline: 3-5 days for activation.

What About Branch Applications?

Some banks still require branch visits for large deposits (₹1 crore+) or complex cases. HDFC and ICICI have representative offices in Dubai and Abu Dhabi that can help with documentation.

Also Read - Best NRI Fixed Deposit Accounts India Complete Tax & Rate Guide

👉 Tip: Call the bank's NRI helpline before starting any application. They'll tell you exactly what's needed for your specific case.

Tax Implications for UAE Residents

The Good News: Most Options Are Tax-Efficient

NRE FDs: Completely tax-free in India for qualifying NRIs. No TDS, no income tax filing required.

GIFT City FDs: Tax-free in India, and since UAE has no income tax, you keep everything.

NRO FDs: 30% TDS is deducted upfront, but you can claim benefits under India-UAE DTAA.

Also Read - Best NRI Fixed Deposit Accounts India Complete Tax & Rate Guide

How India-UAE DTAA Helps

If you invest in NRO FDs, you can claim reduced tax rates:

- Interest income is taxable at lower of domestic rates or treaty rates

- Usually works out to12.5% effective tax instead of 30%

- Requires filing Form 10F and Indian tax returns

For detailed DTAA guidance, check our India-UAE DTAA guide.

UAE Tax Perspective

Since UAE doesn't tax global income for residents, your FD interest won't create any local tax obligations. This makes NRE and GIFT City options extremely attractive.

👉 Tip: Keep all bank statements and interest certificates. Even tax-free income should be documented for potential UAE reporting requirements.

Currency Risk: The Elephant in the Room

Understanding the Rupee Risk

When you invest in NRE or NRO FDs, you're essentially betting on the rupee. Here's what this means:

If the rupee strengthens: Your 6% FD return becomes 8-10% in dollar terms. Great!

If the rupee weakens: Your 6% return becomes 2-3% or even negative in dollar terms. Not so great.

Historical Context

Over the past 5 years, the rupee has generally weakened against major currencies:

- USD/INR moved from ~73 to ~83 (about 13% depreciation)

- AED/INR followed similar patterns

This means traditional NRE FDs have actually delivered negative real returns in foreign currency terms for many periods.

How GIFT City Solves This

GIFT City USD FDs eliminate currency risk entirely. Your dollars stay dollars, earning 4-5% without any conversion risk.

For diversification, consider splitting funds:

- 60% in GIFT City USD FDs (currency protection)

- 40% in high-rate NRE FDs (upside if rupee strengthens)

Special Considerations for Different Gulf Countries

UAE Residents

Best Options: NRE FDs and GIFT City USD FDs due to zero local tax.

Banking: HDFC, ICICI, and Axis have strong UAE presence.

Transfers: Use established money exchangers like UAE Exchange for better rates than bank SWIFT transfers.

Saudi Arabia Residents

Tax Consideration: Saudi has introduced income tax for some residents. Check with local advisors.

Banking: Most major Indian banks accept Saudi transfers, but documentation requirements are stricter.

Currency: Consider SAR-denominated options if available, though USD remains the most liquid.

Kuwait & Qatar Residents

Similar Benefits: Like UAE, these countries generally don't tax global income.

Banking: Remote account opening is possible but may require video verification.

Documentation: Salary certificates need attestation from respective authorities.

👉 Tip:If you're planning to move between Gulf countries, choose banks with strong regional presence to avoid hassles.

Also check our Dollar vs Rupee tracker.

Beyond Traditional FDs: What's Coming Next

Mutual Funds in GIFT City

GIFT City is expanding to offer India-focused mutual funds in USD denomination. This could offer higher returns than FDs while maintaining currency protection.

Insurance Products

USD-denominated life and health insurance policies are already available from Tata AIA and HDFC Life.

Stock Market Access

NSE IFSC in GIFT City allows trading in Indian stocks using foreign currency. Higher risk, but potentially higher returns.

For comprehensive GIFT City investment options, read our GIFT City investments guide.

Making the Final Decision

Choose NRE FDs If:

- You want maximum returns and can handle currency risk

- You have strong conviction about rupee stability

- You prefer the simplicity of established products

- You're comfortable with 1-year lock-in periods

Choose GIFT City USD FDs If:

- Currency protection is your top priority

- You want tax-free returns without conversion risk

- You value flexibility (no lock-in periods)

- You're comfortable with slightly lower returns for safety

Choose NRO FDs If:

- You have existing rupee income in India

- You need shorter tenures or more flexibility

- You can optimize tax through DTAA benefits

- You're willing to handle tax compliance

Avoid These Red Flags:

- Banks promising unrealistic rates (above 8%)

- Schemes requiring multiple intermediaries

- Any FD that's not directly with a scheduled bank

- Products that promise tax benefits beyond standard rules

Bottom Line: Your Next Steps

Here's what you should do right now:

Within the next week:

- Check current rates on bank websites (they change monthly)

- Calculate post-tax returns based on your specific situation

- Gather your KYC documents (most take 2-3 days to arrange)

Before you invest:

- Diversify across 2-3 options rather than putting everything in one place

- Start with smaller amounts to test the bank's service quality

- Set up online access before making large deposits

For ongoing management:

- Monitor currency trends if you're in rupee-denominated FDs

- Set calendar reminders for maturity dates

- Review your allocation every 6 months as your situation changes

The bottom line? There's no single "best" option for everyone. Your choice depends on your risk tolerance, currency views, and how much hassle you're willing to handle.

But here's what I know for certain: doing nothing while your money sits in 0.1% UAE savings accounts is definitely the wrong choice.

Want expert guidance on your specific case? Join our NRI investment WhatsApp group where over 5,000 Gulf-based NRIs share real experiences and get answers from our team.

Sources:

State Bank of India, International Financial Services Centres Authority, Income Tax Department of India, Reserve Bank of India, ICICI Bank, HDFC Bank, Axis Bank, DCB Bank, Bajaj Finance

Disclaimer: Interest rates and regulations mentioned are based on information available as of September 2025 and are subject to change. Always verify current rates and terms directly with banks before investing. This article is for educational purposes and should not be considered personalized investment advice.

Comments

Your comment has been submitted