Should You Invest in Gold or Stocks in 2025? Full Comparison

The world of wealth management has a wide range of investments like FDs, stocks, mutual funds, gold, real estate and much more. Each has its advantages and drawbacks, catering to different investors based on their financial goals and risk appetites.

A common comparison made is between gold and stocks. Gold in an Indian context is more than just a traditional store of value, it is a deep-rooted sentiment with a long history associated with royalty, temples, dowry and most importantly as a symbol of wealth and security passed down through generations.

On the other hand, although stock exchanges have been around for over a century, the age of technology and financial literacy has made it more accessible and preferable for younger investors. Here’s our take on this long-standing comparison.

What Are You Really Investing In?

Investing in gold implies buying the precious metal in hopes of its price appreciating. Although it generates no interest or dividends, it is still a very sought-after investment option not only in India but also worldwide.

Investing in stocks, on the other hand, means purchasing ownership in companies. This gives the investor a share of the company’s profits, resulting in dividend payouts in addition to the capital appreciation of the stock.

Gold vs. Stocks: Benefits, Drawbacks, and Returns Compared

1. Historical Returns Comparison - Gold vs. Stocks

- Historical Returns of Gold: The long-term returns from gold have often been below 5% annually when averaged over multiple decades. This is a modest and volatile growth trajectory. In 2000, the price of 24-karat gold was around ₹4,400 per 10 grams. By June of 2025, the same has crossed ₹1,00,000. However, in the short-term periods of uncertainty, gold has outperformed equity. During events such as the 2008 financial crisis, the COVID-19 outbreak and geopolitical conflicts, investors flocked to invest in gold.

- Historical Returns of the Stock Market: The long-term returns from equity investment range from 14% to 16%. Indian equity (Nifty 50 TRI) has been 14.5% over the last 20 years. Stocks are, however, highly volatile and can be impacted by multiple factors. As the investment is dependent on the performance of the company, thorough research and a decent risk appetite are necessary to earn these returns.

2. Liquidity and Cost of Investment

- Gold - Physical vs ETF-Based Investing: To invest in gold, there are physical and ETF-based options. While the physical metal is less liquid, the ETF has provided the same liquidity as any other stock. A significant downside of physical gold is the security and storage concerns that come with it. It requires additional expenses to access bank vaults and insurance that are not required for ETFs and stocks. Gold ETFs have, however, eliminated logistics and led to increased market participation.

- Stocks - Low Entry Barriers and High Liquidity: Stocks, on the other hand, assure instant liquidity. They can be easily bought and sold via trading platforms. Although it comes with trading fees and brokerage charges, the cost incurred is lower than that when investing in physical gold.

3. Risk Factors - Volatility and Economic Uncertainty

It is safe to say that gold tends to be less volatile than stocks. Although with occasional fluctuations, the price of gold has gradually gone up over the decades. Stocks, on the other hand, respond more to market conditions. Not only does one have to keep in mind the company’s performance, but macroeconomic factors like interest rates, inflation, and geopolitical events also cause drastic price changes, making it more volatile. Gold also responds better during economic uncertainties. During the pandemic, the returns from gold in India were around 11%, whereas the stock market crashed around 30-40%.

This is why gold is often seen as a safe haven during periods of uncertainty. However, over the long term, equity has historically delivered higher returns. As a result, gold typically plays the role of a hedge against inflation within a diversified investment portfolio, rather than being its primary growth option.

Investor Trends and Evolving Preferences

In India, senior citizens tend to favour low-risk investment options, with fixed deposits and recurring deposits being the most popular. These are usually followed by insurance products and then gold. This preference comes from their lower risk tolerance and a desire for stable and more secure returns. In contrast, however, younger Indians are showing a growing appetite for riskier and higher-return investments.

According to a survey by StockGro and 1Lattice, 45% of 50,000 young Indians under the age of 35 stated stocks as their preferred investment vehicle. This transition from traditional savings tools is driven by increasing financial literacy and access to digital investing platforms. Even affluent women with net worths exceeding ₹10 crore now prefer listed equities over gold and real estate, according to the HERitage report by Waterfield Advisors. This reflects a wider shift in the Indian investor mindset.

While India is increasingly embracing equity, Americans continue to prefer traditional investment options. A Gallup survey found that real estate remains the top choice for most U.S. investors. This is followed by gold and then stocks despite the fact that, over the 30-year period ending in April 2024, the S&P 500 delivered an annualised return of 10.29%, outperforming real estate at 8.78% and gold at 7.38%, according to Morningstar Direct.

Conclusion: Diversification is Key

Investor preferences and market conditions evolve with time, making it difficult to declare any investment as superior. The choice between stocks and gold ultimately depends on an individual's preferences, financial goals, and the prevailing economic scenario. In such a landscape, building a diversified portfolio aligned with one’s risk tolerance and long-term objectives remains the best-suited approach.

You may also read:

- NRI Real Estate Investments in India from the UAE

- Detailed Comparison: GIFT City FD vs FCNR FD vs NRE FD vs NRO FD

...............................................................................................................................

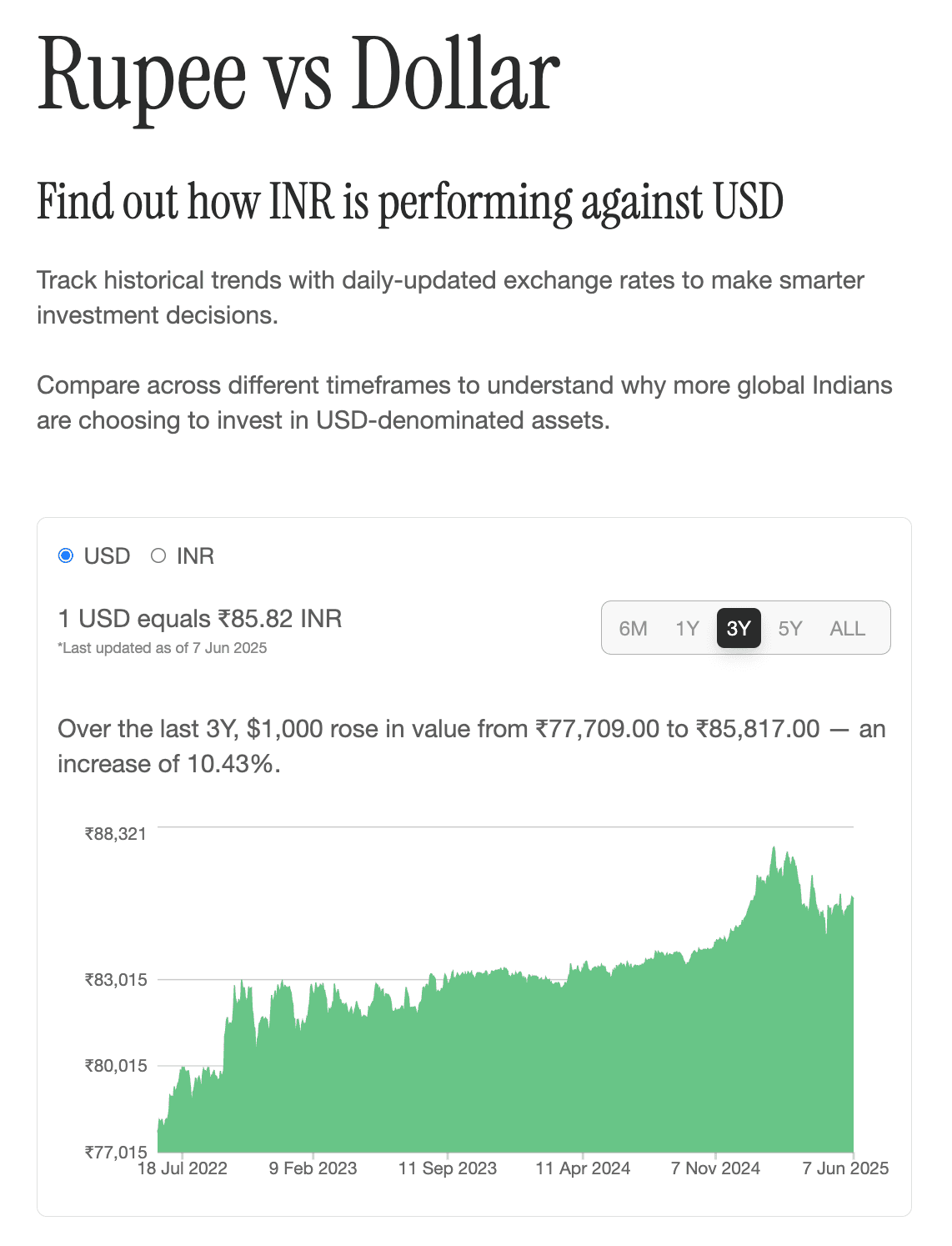

Monitor daily INR-USD trends. Make smarter cross-border decisions with the Belong Rupee vs Dollar Tracker

Comments

Your comment has been submitted