Choosing which type of FD to invest in as an NRI is a process that is layered, as there are several options available to the discerning NRI as it stands today. Which one is truly best? Is there just one, or do the multiple options offer tailored advantages specific to each?

Let’s do a head-to-head comparison of the traditional INR deposits (NRO/NRE FDs), the foreign currency deposits offered by Indian banks (FCNR Deposits) and the deposits offered by GIFT City to give you a comprehensive idea of what’s on offer in terms of investments, as an NRI.

Types of NRI Fixed Deposits Compared

GIFT City Deposits

GIFT City (Gujarat International Finance Tec-City) has been at the forefront of financial news in the past few years for a host of reasons, such as fintech innovation, a novel regulatory framework, and even its sustainable design.

GIFT City IFSC is envisioned as a global financial and IT services hub, comparable to financial centres like Singapore and Dubai. It is designed to be investor-friendly and offers a simplified process for setting up businesses, with quick approvals and minimal bureaucratic hurdles.

GIFT City FD Explained

These are the fixed deposits offered to NRIs by banks (both Indian and foreign) located in GIFT City. These IFSC Banking Units (IBUs) operate under the regulatory framework of the International Financial Services Centres Authority (IFSCA), an umbrella banking, insurance, investments and PF regulator established by Indian law specifically for GIFT City.

Read our detailed guide on GIFT City FD for more.

FCNR Deposits

FCNR deposits are the term deposits tailored for NRIs to park their foreign earnings in their familiar currency without converting to Indian rupees. These deposits are offered by banks in India and are regulated by the Reserve Bank of India (RBI), ensuring security and trust in these foreign currency savings instruments.

NRO Fixed Deposits

NRO FDs are designed to help NRIs manage their income earned in India, such as rent, dividends, pensions, etc. These RBI-regulated deposits are offered by most major banks in India. Repatriation of NRO deposits is regulated as per FEMA (Foreign Exchange Management Act) rules.

NRE Fixed Deposits

NRE FDs are offered to NRIs to park their foreign earnings in India in Indian Rupees. Most major banks in India offer these RBI-regulated deposits.

Comparison Table: GIFT City FD vs Other FD for NRIs

| | GIFT City FD | FCNR FD | NRO FD | NRE FD |

| Duration | 7 days to 5 years | 1 year to 5 years | 7 days to 10 years | 1 year to 10 years |

| Currency | Major international currencies like USD, GBP, Euro, etc. | Major international currencies like USD, GBP, Euro, etc | INR denomination | INR denomination |

| Repatriation | Freely repatriable (principal + interest) outside India | Freely repatriable (principal + interest) outside India | The repatriation limit set by FEMA (1 million USD in a year) | Freely repatriable (principal + interest) outside India |

| Taxation | Tax-free in India and is subject to the taxation norms of your resident country | Tax-free in India, and is subject to the taxation norms of your resident country | Subject to taxation in India according to the tax slab + 30% TDS on interest | Tax-free in India and is subject to the taxation norms of your resident country |

| Premature withdrawal | Premature withdrawal is allowed with penalty | Premature withdrawal is allowed, but you will not receive the interest amount | Most banks allow premature withdrawal. Check with the specific bank for the T&C | Premature withdrawal is allowed with a penalty. Check with the bank for more details |

| Key benefits | Globally competitive interest rates, no need for currency conversion and fluctuation, no tax in India and easy repatriation. | No currency depreciation risk, no tax and easy repatriation | Competitive interest rates, easy deposit of indian income like interest, dividend, rent etc | Competitive interest rate, tax-free and freely repatriable |

At the outset, FCNR and GIFT City fixed deposits may seem similar. But there are two distinct advantages which GIFT City fixed deposits have over FCNR deposits.

The minimum tenure of FCNR deposits is for 1 year, while the tenure for GIFT City deposits starts as low as 7 days. The second advantage is related to premature withdrawal. The entire interest amount is forfeited in case of premature withdrawal on FCNR deposits. For the GIFT City deposits, there is a penalty deducted for premature withdrawal. The investor gets the rest of the interest amount.

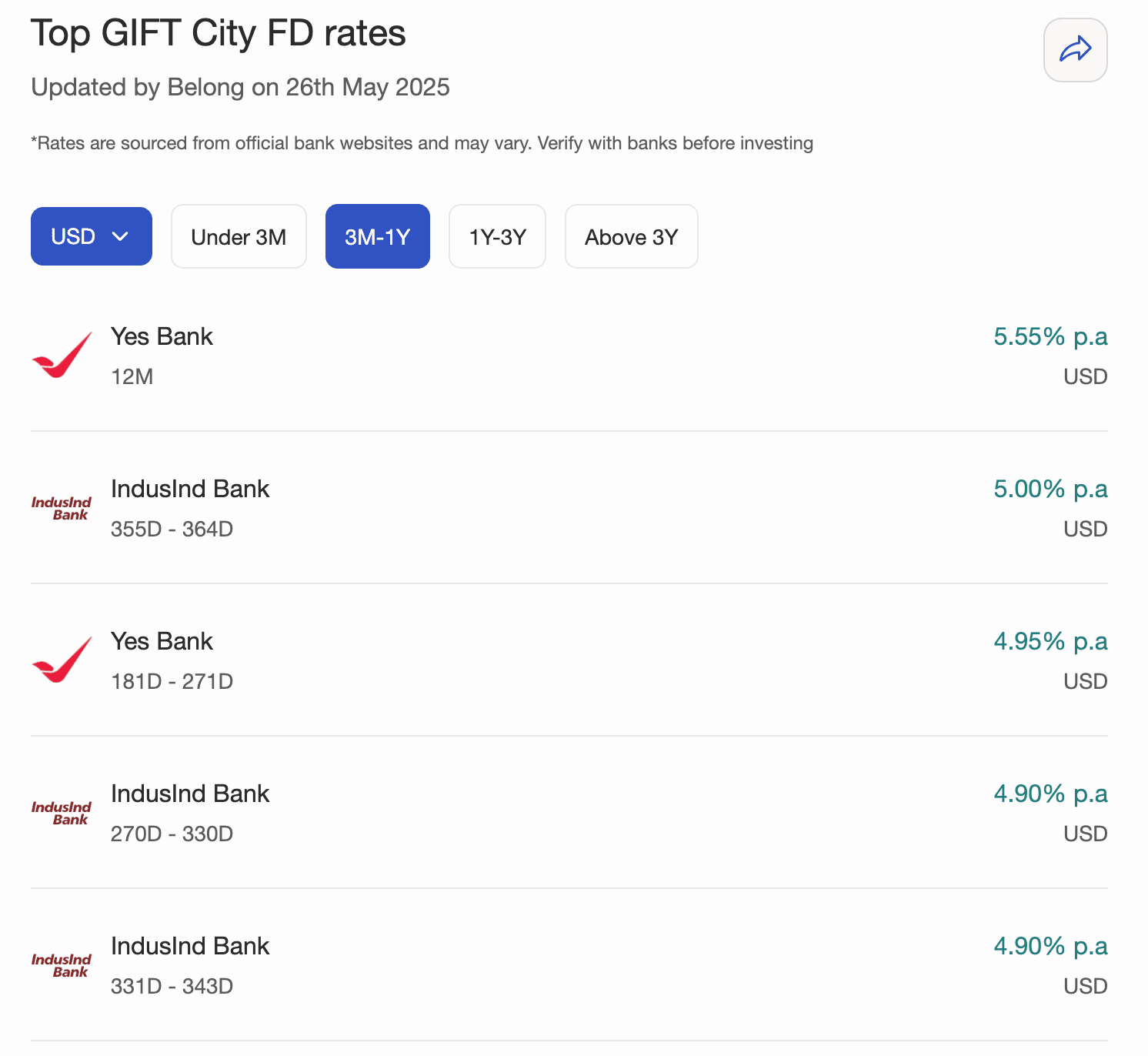

Use the NRI FD Rate Comparison Tool

Now that you have seen the comparison between all four of the fixed deposits, let’s turn our attention to the deal breaker, i.e., interest rates. Interest rates are subject to change in different time periods based on bank policies and rates being offered at the moment. An important factor to consider, along with the interest rate, is the Rupee depreciation. Rupee depreciation will eat into your interest earnings when you redeem and take your money abroad.

Choosing the right NRI FD depends on your goals: tax-free returns, ease of repatriation, or protection from currency risk. Use Belong's NRI FD Comparison Tool to compare live rates and make the smartest decision for your money.

Things to Consider Before Choosing an NRI FD

GIFT City Fixed Deposits are great if you are looking to go with adjustable tenures, special taxation treatment, and no restriction on repatriation, alongside avoiding currency depreciation risk.

Traditionally, FCNR deposits are an option for you to grow your foreign earnings in foreign currency in India, along with earning repatriable and tax-free interest. NRO deposits can help you grow your Indian income with flexible tenures. NRE deposits allow you to grow your foreign earnings in Indian Rupees and earn tax-free interest in India with full repatriation benefit.

Each deposit option can accordingly be chosen to fit the relevant income source and your overall financial goals. You can choose from the listed deposit options to suit any given source of income and your financial goals.