The Complete DTAA Guide for NRIs: Avoid Double Taxation on Indian Income

DTAA Basics: What Every NRI Needs to Know

If you're an NRI earning income in India -from fixed deposits, property rent, dividends, or capital gains -you've probably heard conflicting advice about taxes. Should you pay 30% TDS? Can you claim DTAA benefits? Which forms do you need?

Here's the reality: Most NRIs overpay taxes in India because they don't understand how Double Taxation Avoidance Agreements (DTAA) work.

I'm Ankur Choudhary, and I've helped hundreds of NRIs navigate this exact maze. Whether you're in Dubai paying zero personal income tax, or in New York dealing with complex US-India tax treaties, this guide will clear up every confusion.

By the end, you'll know:

Whether DTAA benefits apply to your specific situation

How to choose between DTAA rates and Indian domestic tax rates

The exact documents you need and when to submit them

Real examples showing potential tax savings of ₹50,000-₹5,00,000 annually

Common mistakes that trigger IT department notices

Let's dive in.

What is DTAA and Why Every NRI Should Care

Double Taxation Avoidance Agreement (DTAA) is a treaty signed between India and other countries to prevent the same income from being taxed twice -once in the country where you earn it (source country) and again in the country where you're a tax resident.

Think of it this way: You're working in Dubai, earning AED 25,000 monthly, and you also have a rental property in Mumbai generating ₹50,000 monthly. Without DTAA, both UAE and India could tax your rental income. With DTAA, you pay tax only once.

India has signed comprehensive DTAAs with more than 90 countries, including UAE, USA, UK, Canada, Australia, Singapore, Germany, France, and many others.

👉 Key Point: DTAA doesn't mean you avoid taxes entirely. It means you avoid paying higher taxes in both countries.

What is DTAA in Income Tax?

Let me explain this with a real example:

Meet Arjun, working in Dubai. He earns AED 20,000 monthly in the UAE and also has a fixed deposit in India earning ₹1 lakh annual interest. Here's what happens without DTAA knowledge:

- UAE tax on his Dubai salary: Zero (UAE has no personal income tax

- India tax on his FD interest: 30% TDS = ₹30,000

- Total tax burden: ₹30,000

But with DTAA (India-UAE treaty):

- UAE tax on his Dubai salary: Still zero

- India tax on his FD interest: 12.5% under DTAA = ₹12,500

- Total tax burden: ₹12,500

Annual savings: ₹17,500 — just by understanding and applying DTAA correctly.

Why Does Double Taxation Happen?

Countries tax income based on two principles:

- Source-based taxation: "We'll tax income earned in our country"

- Residence-based taxation: "We'll tax our residents on their global income"

The problem: When both countries apply their rules, you get taxed twice on the same money.

DTAA's solution: These agreements create clear rules about which country gets to tax what type of income, and at what rates.

What DTAA Covers (And What It Doesn't)

DTAA typically covers:

- Salary and employment income

- Business profits

- Interest from deposits and bonds

- Dividend income

- Capital gains from investments

- Rental income from property

- Professional fees and royalties

DTAA doesn't cover:

- Penalties and interest on tax defaults

- Wealth tax (where applicable)

- Gift tax between non-relatives

- Some types of indirect taxes

👉 Key Point: DTAA is not automatic. You need to actively claim these benefits by following specific procedures - something most NRIs never do.

The Real Question: Will DTAA Help Your Specific Situation?

DTAA will likely benefit you if:

- You're a tax resident of a country that has DTAA with India (UAE, USA, UK, Canada, Singapore, Australia, etc.)

- You earn income in India (interest, dividends, rent, capital gains)

- You're currently paying standard NRI tax rates (20-30% on most income)

DTAA may not help if:

- Your resident country doesn't have DTAA with India

- Your total Indian income is below ₹2.5 lakh (you're already in the zero tax bracket)

- You're claiming benefits incorrectly and triggering penalties

The bottom line: Most NRIs in major countries like UAE, USA, UK, and Singapore can significantly reduce their Indian tax burden through proper DTAA planning.

But here's what the tax blogs won't tell you: The documentation and compliance requirements are tricky.

Get it wrong, and you'll face notices, penalties, and potentially higher taxes than if you'd never claimed DTAA benefits at all.

That's exactly why the rest of this guide walks you through the specifics - not just what DTAA is, but how to use it safely and effectively.

Why Every NRI Should Care About DTAA

Double Taxation Avoidance Agreement (DTAA) is a treaty signed between India and other countries to prevent the same income from being taxed twice - once in the country where you earn it (source country) and again in the country where you're a tax resident.

India has signed comprehensive DTAAs with more than 90 countries, including UAE, USA, UK, Canada, Australia, Singapore, Germany, France, and many others.

👉 Key Point: DTAA doesn't mean you avoid taxes entirely. It means you avoid paying higher taxes in both countries.

The Real Problem NRIs Face

Here's what typically happens:

Sample Scenario 1 - Rajesh in Dubai:

Earns ₹2 lakh annually from NRO fixed deposits. His bank deducts 30% TDS (₹60,000).

But under India-UAE DTAA, he should only pay 12.5% tax (₹25,000). He's overpaying ₹35,000 every year.

Scenario 2 - Anitha in US

Sold a property in India and paid the 12.5% long-term capital gains tax (₹2.5 lakh) in India. She was shocked when her US tax preparer calculated an additional US tax of ₹3 lakh on the same gain. She later discovered that the India-USA DTAA allowed her to claim a full credit for the Indian tax paid. Her US preparer was not initially aware of this specific treaty benefit, a mistake that could have cost her an extra ₹2.5 lakh in double tax..

These aren't rare cases. They're happening to thousands of NRIs right now.

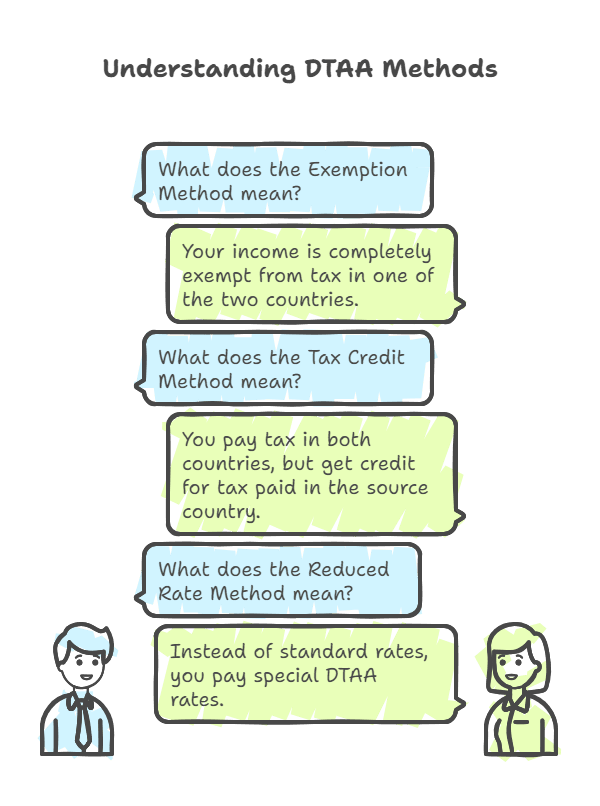

How DTAA Actually Works: The Three Methods Explained

DTAA provides relief through three methods: Exemption, Tax Credit, and Deduction. Most articles explain these poorly.

Here's what they really mean:

1. Exemption Method

What it means: Your income is completely exempt from tax in one of the two countries.

Example: If you're a UAE resident earning salary in Dubai, this salary is:

Not taxed in UAE (because UAE has zero personal income tax)

Not taxed in India (because of DTAA Article 15 - salary taxable only in residence country)

Result: Zero tax on your Dubai salary

2. Tax Credit Method

What it means: You pay tax in both countries, but get credit for tax paid in the source country.

Example: You're a US resident earning ₹5 lakh rental income from India:

India taxes at 30% = ₹1.5 lakh

USA taxes same income at 25% = ₹1.25 lakh

You pay ₹1.5 lakh in India, claim ₹1.25 lakh credit in USA

Result: Total tax = ₹1.5 lakh (not ₹2.75 lakh)

3. Reduced Rate Method

What it means: Instead of standard rates, you pay special DTAA rates.

Example: Interest from Indian fixed deposits:

Standard rate for NRIs: 30%

Under India-UAE DTAA: 12.5% (or 5% for bank loans)

Result: Significant tax savings

Income Types and DTAA Treatment: What Applies to What

Not all income gets the same DTAA treatment. Here's the breakdown:

Income Type | India-UAE DTAA Rate | India-US DTAA Rate | India-Singapore DTAA Rate | Standard NRI Rate |

Interest (FDs, Bonds) | 12.5% | 15% | 15% | 30% |

Dividends | 10% | 15%/25% | 5% | 20% |

Capital Gains (Property) | Taxed in India | Taxed in India | Taxed in India | 12.5% LTCG |

Capital Gains (Shares) | Taxed only in UAE (effectively zero) | Taxed in India | Taxed in India | 12.5% LTCG |

Capital Gains (Mutual Funds) | Recent rulings suggest zero tax | Taxed in India | Taxed in India | 12.5% LTCG |

Rental Income | Taxed in India | Taxed in India | Taxed in India | Slab rates |

Salary | Taxed only in residence country | Taxed in residence country | Taxed in residence country | Slab rates |

🚨 Important: These rates apply only if you meet all DTAA requirements and submit proper documentation.

- These rates apply only if you meet all DTAA requirements and submit proper documentation.

- Property Gains: The domestic LTCG rate was reduced from 20% to 12.5% for sales on or after July 23, 2024.

- India-Singapore DTAA: For shares/mutual funds acquired on or after April 1, 2017, India has the right to tax capital gains. The old exemption no longer applies to new investments.

- Shares/Mutual Fund Gains: The domestic LTCG rate increased from 10% to 12.5% (on gains over ₹1.25 lakh) for sales on or after July 23, 2024.

The Decision Tree: DTAA vs Domestic Law

This is where most NRIs get confused.

Section 90(2) of Income Tax Act gives you the choice - you can opt for either DTAA rates or domestic tax rates, whichever is more beneficial.

Here's how to decide:

For Interest Income:

- DTAA beneficial: Almost always (12.5%-15% vs 30%)

- Domestic law beneficial: Rarely, only if you have high deductions

For Dividend Income:

- DTAA beneficial: Usually (5%-15% vs 20%)

- Domestic law beneficial: If your total income is below ₹2.5 lakh

For Capital Gains:

- DTAA beneficial: For UAE/Singapore residents on mutual funds

- Domestic law beneficial: For most other cases

For Salary Income:

- DTAA beneficial: For UAE residents (zero tax)

- Domestic law beneficial: Rarely

👉 Pro Tip: You can choose different methods for different types of income in the same financial year.

Step-by-Step: How to Claim DTAA Benefits

Step 1: Confirm Your Tax Residency

You must be a tax resident of a country that has DTAA with India. Key requirements:

For UAE residents:

Stay in UAE for at least 183 days in a calendar year

Have a valid UAE residence visa

UAE should be your primary residence

For US residents:

Meet US tax residency tests (Green Card or 183-day rule)

File US tax returns

Step 2: Obtain Tax Residency Certificate (TRC)

This is mandatory for claiming DTAA benefits.

UAE TRC:

Apply through UAE Tax Authority online portal

Costs approximately AED 1,000

Takes 7-10 working days

Valid for one financial year

US TRC:

Form 6166 from IRS

Costs $50 per certificate

Takes 45-60 days

Can be obtained for multiple years

Step 3: File Form 10F Online

Form 10F must be filed electronically on the Indian income tax e-filing portal before claiming DTAA benefits.

Key details to include:

Name and status of taxpayer

Country of residence

Tax identification number

Period for which benefits are claimed

Address and contact details

Step 4: Submit Documents to Payer

If you're claiming reduced TDS, submit these to your bank/company:

TRC (original or certified copy)

Form 10F acknowledgment

Self-declaration of beneficial ownership

Bank account details

Step 5: File ITR and Claim Credit

Even if correct TDS is deducted, you must:

Report income in correct ITR schedules

Schedule FSI for foreign source income, Schedule TR for tax relief

File Form 67 if claiming foreign tax credit

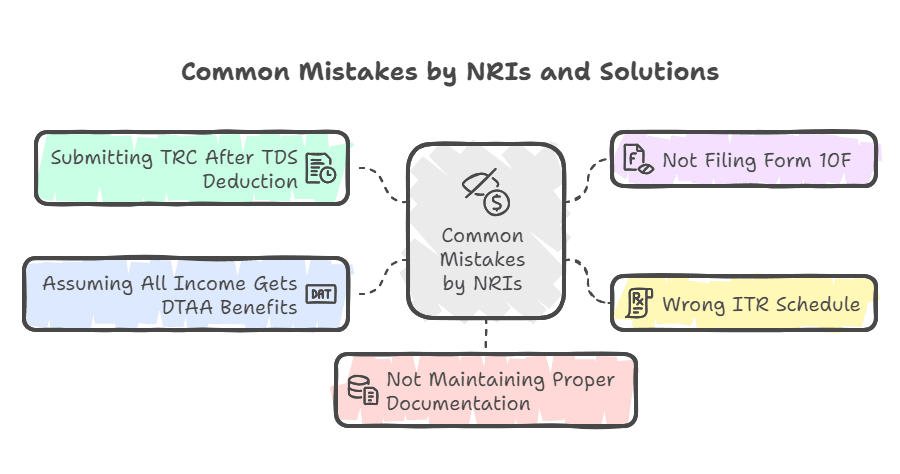

Common Mistakes That Cost NRIs Thousands

Mistake 1: Submitting TRC After TDS Deduction

What happens: Bank deducts 30% TDS, then you submit TRC. You have to claim refund through ITR.

Solution: Submit TRC before any payment/maturity date.

Mistake 2: Not Filing Form 10F

What happens: IT authorities may deny DTAA benefits during assessment.

Solution: File Form 10F immediately after getting TRC.

Mistake 3: Wrong ITR Schedule

What happens: DTAA income reported under normal income heads triggers incorrect tax calculation.

Solution: Use specific schedules for DTAA income and exemptions.

Mistake 4: Assuming All Income Gets DTAA Benefits

What happens: Claiming DTAA on salary income when you worked in India for 180+ days.

Solution: Understand source rules for each income type.

Mistake 5: Not Maintaining Proper Documentation

What happens: Assessment notices, penalties, and loss of benefits in future years.

Solution: Keep TRC, Form 10F, bank statements, and correspondence for 8 years.

2025 Updates: What's Changed for NRIs

Income Tax Bill 2025

The new Income Tax Bill 2025 maintains all existing DTAA provisions while simplifying compliance procedures. Key unchanged aspects:

- RNOR status benefits continue

- DTAA rates and exemptions remain same

- TRC and Form 10F requirements unchanged

Recent Tribunal Rulings on Mutual Funds

Mumbai ITAT confirmed that mutual fund units are not equivalent to shares, making capital gains from mutual fund sales potentially tax-free for UAE and Singapore residents under respective DTAAs.

Impact: If you're a UAE or Singapore resident with mutual fund investments, you might be eligible for complete capital gains tax exemption.

Enhanced Tax Recovery Powers

New provisions give authorities increased powers to recover outstanding tax dues from NRIs' Indian assets. This makes proper DTAA compliance even more critical.

Country-Specific DTAA Highlights

UAE NRIs: Maximum Benefits Available

Unique advantages:

- Zero tax on Dubai/Abu Dhabi salary

- Capital gains on Indian shares taxed only in UAE (zero tax)

- Reduced rates on interest (12.5%) and dividends (10%)

- No inheritance tax on UAE assets

Best for: NRIs with salary income, property investments, and equity portfolios

Read our detailed India-UAE DTAA guide →

US NRIs: Complex but Rewarding

Unique aspects:

- Foreign Tax Credit mechanism

- 15% rate on interest and dividends

- Social Security totalization benefits

- Estate tax treaty advantages

Best for: High-income NRIs with diverse income sources

Singapore NRIs: Emerging Opportunities

Recent developments:

- Potential zero tax on mutual fund gains

- 15% rate on interest income

- 5% rate on dividend income

- No estate duty

Best for: NRIs focused on mutual fund investments

UK NRIs: Traditional Benefits

Key features:

- 15% rate on interest and dividends

- Capital gains generally taxed in India

- Pension treaty benefits

- Relief from double taxation on employment income

Beyond DTAA: Belong's Tax-Optimized Solutions

While DTAA helps reduce tax on traditional investments, consider these alternatives:

GIFT City USD Fixed Deposits

- Tax treatment: Completely tax-free returns

- Currency protection: No rupee depreciation risk

- Repatriation: Seamless transfer to your overseas account

- Documentation: Minimal KYC requirements

Example: ₹50 lakh in GIFT City USD FD earning 5% = ₹2.5 lakh tax-free annual returns vs ₹1.75 lakh after-tax from regular NRE FD.

- NRE Account Benefits

- Interest completely exempt from Indian taxes

- Full repatriation rights

- No DTAA formalities required

What Should You Do Next?

Immediate actions:

Determine your tax residency status using our calculator

Apply for TRC if you haven't already (this takes 4-8 weeks)

Review your current investments for DTAA optimization opportunities

File Form 10F for ongoing income sources

For personalized guidance:

Complex cases: Consult our NRI tax filing service

Stay updated: Join our WhatsApp community for latest DTAA updates and NRI tax tips

Remember: DTAA is not just about paying less tax today. It's about building a sustainable, compliant framework for your long-term wealth creation in India.

The tax you save through proper DTAA planning can be reinvested to grow your wealth faster. Every ₹1 lakh saved in unnecessary taxes, invested at 8% annual returns, becomes ₹2.16 lakh in 10 years.

Ready to optimize your taxes?

Download the Belong app to explore tax-efficient investment options designed specifically for NRIs like you.

Source & References

Government/Regulatory Sources:

- https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-0 (Income Tax Department - Official NRI tax rates)

- https://www.mea.gov.in/images/pdf/OIFCPublication2009GuidebookonTaxationforOI.pdf (Ministry of External Affairs - OCI taxation guide)

Comments

Your comment has been submitted