7 DTAA Claim Mistakes That Cost NRIs Thousands in Tax Refunds

"I paid 30% tax on my FD interest instead of 10%. Now I'm wondering if I can get my money back?"

This WhatsApp message landed in my inbox last week from Priya, an NRI in Dubai. She lost ₹45,000 in excess tax because of one simple DTAA mistake.

Here's the painful truth: Most NRIs leave money on the table every year due to DTAA claim errors.

The Big Question

Why do smart, educated NRIs keep making the same DTAA mistakes year after year?

It's not because they don't understand tax laws. It's because the DTAA claiming process is riddled with traps that even experienced CAs sometimes miss.

The frustrating part? These aren't complex legal loopholes. They're straightforward documentation and process errors that cost you real money.

Quick Answer (Summary Verdict)

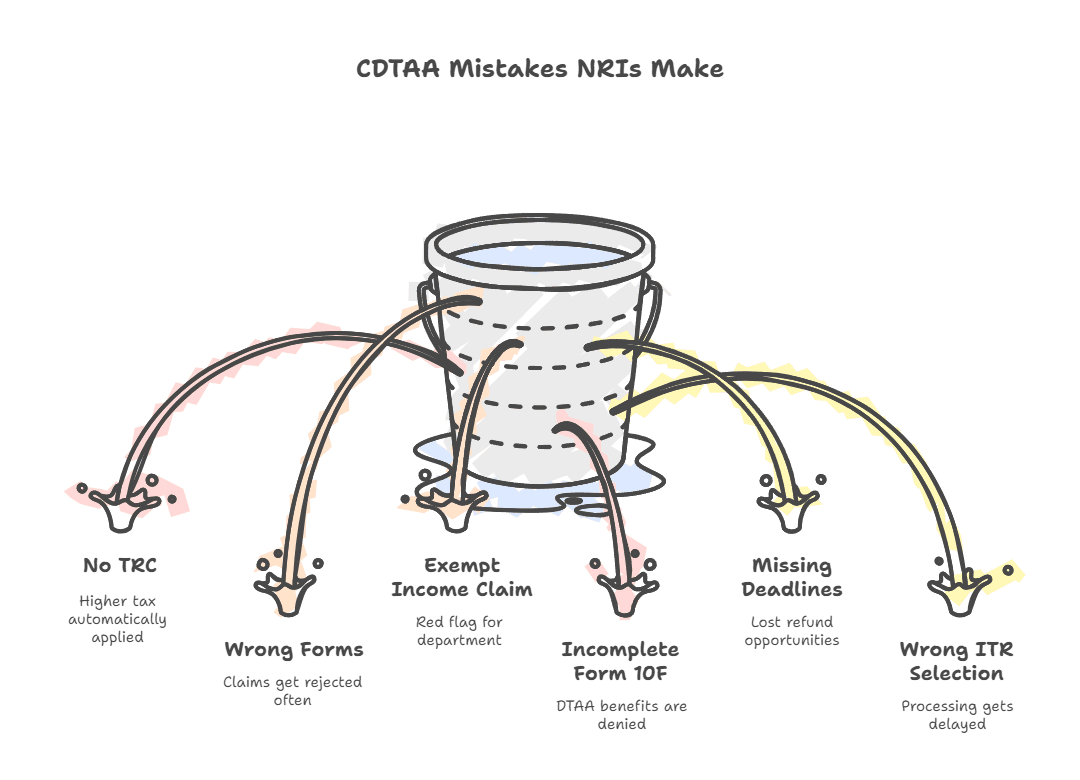

The 7 costliest DTAA mistakes NRIs make:

- Not getting TRC - Automatic 20-30% higher tax

- Submitting wrong forms - Claims get rejected

- Claiming exempt income - Red flag for tax department

- Incomplete Form 10F - DTAA benefits denied

- Missing deadlines - Lost refund opportunities

- Wrong ITR selection - Processing delays

- Poor documentation - Audit troubles

Bottom line: These mistakes cost the average NRI ₹15,000-50,000 annually in excess tax payments.

👉 Tip: 80% of DTAA claim rejections happen due to just three mistakes - incomplete TRC, wrong Form 10F, and claiming exempt income.

The Full Picture

Let me walk you through each mistake with real examples:

Mistake 1: Not Getting Tax Residency Certificate (TRC)

The Problem: If NRIs fail to submit Form 10F and the Tax Residency Certificate (TRC), they may lose the DTAA benefits and face higher tax rates in India.

For instance, an NRI earning dividends in India may be taxed at 20% instead of the reduced 15% under the DTAA with the USA.

Real Example: Ramesh in Canada earned ₹2 lakh interest from Indian FDs. Without TRC, he paid 30% tax (₹60,000). With TRC under India-Canada DTAA, he should have paid only 15% (₹30,000).

Why it happens: Getting TRC feels complicated. NRIs think "I'll do it next year." Meanwhile, the tax keeps getting deducted at full rates.

Mistake 2: Submitting Incorrect Forms

The Problem: Filing Form 10F might seem simple, but many Indian NRIs make errors that can lead to DTAA benefit denial.

Common errors:

- Filing Form 67 instead of Form 10F to claim DTAA benefits in India

- Using old ITR-1 when ITR-2 is required

- Submitting forms manually instead of electronic filing

Real Example: Suresh, an NRI in the US, mistakenly filed Form 67-a form meant for Indian residents-instead of the required Form 10F for his DTAA claim.

His DTAA claim was rejected, and he paid double tax on the same income.

👉 Tip: Since July 16, 2022, e-filing Form 10F has been mandatory for claiming tax treaty benefits.

Mistake 3: Claiming DTAA on Exempt Income

The Problem: NRIs try to claim DTAA benefits on income that's already exempt under Indian law.

Real Example: Anil claimed DTAA benefits on agricultural income from his Kerala farm. Agricultural income is already exempt in India - there's no tax to reduce!

Other exempt incomes where DTAA doesn't apply:

- GIFT City USD FD interest (already tax-free)

- Tax-free bonds interest

- PPF withdrawals

- Insurance maturity proceeds

Why it's dangerous: In Schedule Exempt Income (EI), you need to provide your details of exempt income i.e., income not to be included in total income or not chargeable to tax. Claiming DTAA on exempt income creates red flags.

Mistake 4: Incomplete Form 10F Details

The Problem: Your name and details on Form 10F must exactly match those on your Tax Residency Certificate. Your PAN details must also be accurate.

Common Form 10F errors:

- Name spelling doesn't match TRC

- Wrong TIN number

- Incorrect resident country details

- Missing digital signature

Mistake 5: Missing Critical Deadlines

The Problem: NRIs miss filing deadlines or submit documents after tax has been deducted.

Timeline mistakes:

- Getting TRC after financial year ends

- Submit your TRC and Form 10F to your bank before they pay the interest.

- Not informing bank about DTAA status before interest payment

Mistake 6: Wrong ITR Form Selection

The Problem: Choosing the wrong ITR form is another common mistake NRIs make. It's essential to select the appropriate ITR form based on your income sources and residential status.

Correct forms for NRIs:

- ITR-2: For capital gains, foreign income, multiple sources

- ITR-3: For business income

Never use ITR-1 as an NRI - it's only for residents.

Mistake 7: Poor Documentation

The Problem: Maintaining comprehensive documentation is essential for NRIs during tax filing. Failure to keep records of income, expenses, investments, and other financial transactions can create challenges during the filing process.

Missing documents:

- Original TRC

- Foreign tax payment proof

- Bank statements showing tax deduction

- DTAA treaty provisions copy

👉 Tip: Keep digital copies in cloud storage. Physical documents get lost during international moves.

Advantages for NRIs (When Done Right)

When you avoid these mistakes, DTAA benefits are substantial:

Reduced tax rates: Interest income tax drops from 30% to 10-15% in most countries.

Foreign tax credit: Individuals who qualify as Indian residents, can claim credit in India for foreign taxes paid in the source country by filing Form 67 with the income tax department.

Double protection: No double taxation on the same income source.

Automatic TDS reduction: Once you submit correct documents, future payments come with reduced TDS.

Real savings example: An NRI with ₹10 lakh Indian income annually can save ₹50,000-1.5 lakh through proper DTAA planning.

Downsides You Must Consider

Documentation burden: DTAA claims require extensive paperwork and annual renewals.

Processing delays: Even correct claims can take 6-12 months for refunds.

Audit risk: Incorrect claims trigger tax department scrutiny.

Professional fees: CA charges for complex DTAA claims can be ₹15,000-50,000.

Currency conversion complexity: Tax claims use official rates, not market rates. For tax credit purposes in India, Rule 128 of the Income Tax Rules mandates using the SBI's specific 'telegraphic transfer buying rate' on the last day of the month.

👉 Tip: For simple FD interest under ₹2 lakh, consider tax-free alternatives like GIFT City USD FDs instead of complex DTAA claims.

Step-by-Step How-To (Avoid All Mistakes)

Phase 1: Planning (Before Financial Year)

Step 1: Determine your tax residency status in both countries

Step 2: Apply for TRC from your resident country's tax authority

Step 3: Check which DTAA articles apply to your income sources

Phase 2: During the Year

Step 4: Submit TRC and Form 10F to your bank/deductor before payment

Step 5: Monitor TDS rates - they should be DTAA rates, not domestic rates

Step 6: Keep records of all tax documents and payments

Phase 3: Filing (ITR Season)

Step 7: Select correct ITR form (ITR-2 for most NRIs)

Step 8: Report all income sources accurately

Step 9: File Form 10F electronically if not done earlier

Step 10: Submit ITR with all supporting documents

Phase 4: Follow-up

Step 11: Track refund status online

Step 12: Respond to any tax department queries promptly

Step 13: Renew TRC for next year

👉 Tip: Start the TRC application process 3 months before you need it. Government processing times vary by country.

Final Recommendation

For simple cases (FD interest under ₹5 lakh annually): Learn the process yourself. The savings justify the effort.

For complex cases (multiple income sources, business income): Hire a CA specializing in NRI taxation. The cost is worth avoiding mistakes.

For everyone: Consider tax-efficient alternatives. Our GIFT City USD FDs offer tax-free returns without any DTAA complications.

The biggest DTAA mistake? Doing nothing at all. Even a basic understanding can save you thousands annually.

Your action plan:

- Check if you missed claiming DTAA in previous years

- Start your TRC application for next year

- Consider tax-free investment alternatives for future planning

DTAA claims don't have to be complicated. But they do need to be done right.

Download Belong App to explore tax-free USD FDs that eliminate DTAA complications entirely.

Join our NRI Tax WhatsApp Group for live discussions on DTAA strategies and mistake-proofing your claims.

Disclaimer: This article is for informational purposes only. Tax laws are complex and change frequently. Always consult a qualified CA for personalized advice.

Comments

Your comment has been submitted