India Has DTAA With How Many Countries? 2025 Complete List + Tax Benefits for NRIs

You're living in Dubai, earning well, but still have investments back home in India. Every year during tax filing, you wonder: "Am I paying tax twice on the same income?"

Here's a WhatsApp forward that landed in my inbox last week: "India only has DTAA with 15-20 rich countries. Most NRIs will pay double tax forever."

That's completely wrong. Let me show you the real picture.

The Common Myths

Myth 1: India has DTAA with only a handful of countries.

Myth 2: DTAA automatically means zero tax in India.

Myth 3: You need a CA to claim DTAA benefits.

These myths cost NRIs thousands of rupees every year. I've seen engineers in Canada paying 30% tax in India when they should pay 15% under DTAA.

The truth? India has one of the world's largest DTAA networks.

👉 Tip: Never assume your country doesn't have DTAA with India. Always check the official list first.

What the Rules Actually Say

India has signed comprehensive DTAAs with more than 94 countries as of 2025. To put this number in perspective, India's network is globally competitive, comparable to other major Asian economies like China (which has over 110 agreements) and Vietnam (with around 80).

The Income Tax Department maintains the official list. These treaties provide for the income that would be taxable in either of the contracting states, depending on the understanding of the nations.

Here's what this means practically: If you're living in the UAE and earning from Indian fixed deposits, you won't pay full Indian tax rates.

How DTAA Really Works

DTAA doesn't eliminate tax - it prevents double taxation. Think of it as a referee between two tax systems.

Under these agreements, your income and remittances are subject to tax and benefits as per the DTAA with your resident country.

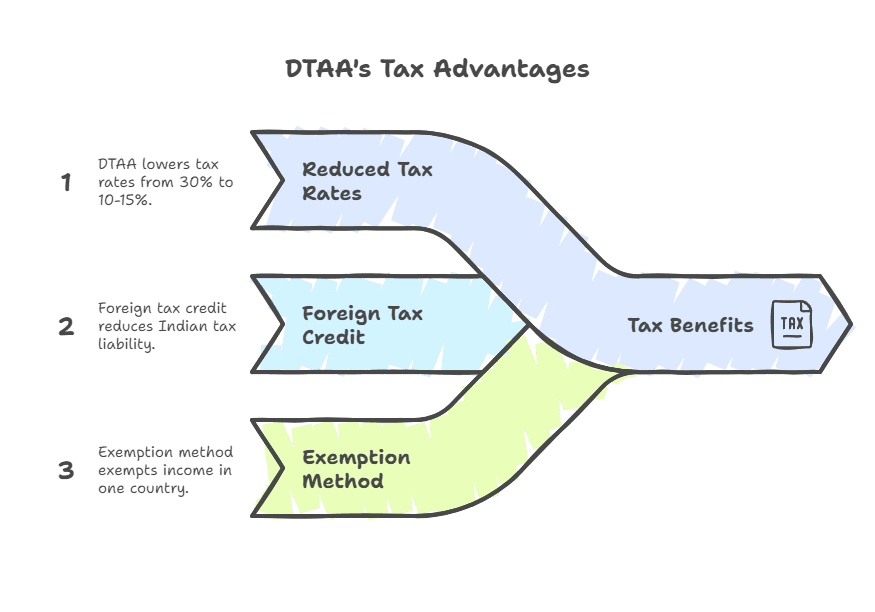

You get three main benefits:

- Reduced tax rates - Instead of 30%, you might pay 10-15%

- Foreign tax credit - Tax paid abroad reduces your Indian tax

- Exemption method - Some income is exempt in one country

👉 Tip: The UAE-India DTAA is particularly favourable. Interest income from Indian FDs is taxed at just 10% instead of 30%.

DTAA List for India (2025)

Here's the comprehensive table of countries with active DTAA agreements with India:

Region | Countries | Key Benefit (Indicative Rates) |

|---|---|---|

Middle East | Israel, Jordan, Kuwait, Oman, Qatar, Saudi Arabia, Syria, UAE, Bahrain | Interest: 10% - 12.5% Dividends: 5% - 10% |

Americas | USA, Canada, Mexico | Interest: 10% - 15% Dividends: 15% (can be 25%) |

Asia & Oceania | Australia, Bangladesh, Bhutan, China, Fiji, Indonesia, Japan, Kazakhstan, Kyrgyzstan, Malaysia, Mongolia, Myanmar, Nepal, New Zealand, Philippines, Singapore, South Korea, Sri Lanka,Hong Kong, Tajikistan, Thailand, Turkmenistan, Uzbekistan, Vietnam | Interest: 7.5% - 15% Dividends: 5% - 15% |

Europe | Albania, Armenia, Austria, Belarus, Belgium, Bosnia & Herzegovina, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Georgia, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Moldova, Montenegro, Netherlands, North Macedonia, Norway, Poland, Portugal, Romania, Russia, Serbia, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, United Kingdom | Interest: 10% - 15% Dividends: 5% - 15% |

Africa | Botswana, Egypt, Ethiopia, Ghana, Kenya, Libya, Mauritius, Morocco, Mozambique, Namibia, Seychelles, South Africa, Sudan, Tanzania, Uganda, Zambia | Interest: 10% - 15% Dividends: 5% - 10% |

Most Used Treaties by NRIs:

- UAE - 35% of all NRI DTAA claims

- USA - 20% of claims

- UK - 15% of claims

- Canada - 12% of claims

- Australia - 8% of claims

Benefits for NRIs

Reduced withholding tax: For example, if you are a tax resident of the United States (U.S.), under DTAA you can claim a concessional rate of tax, e.g., 15% on the interest earned in India.

Instead of 30% TDS on your FD interest, you pay just 10-15% in most countries.

Foreign tax credit: If you pay tax in your resident country, you can claim credit against Indian tax liability.

Business income relief: Salary, professional fees, and business profits get special treatment under DTAA.

👉 Tip: UAE residents get the best deal - zero tax in UAE plus reduced rates in India means maximum savings.

The Fine Print (Risks)

Tax Residency Certificate is mandatory: For the purpose of claiming a tax treaty benefit, it is necessary for an NR to obtain a TRC of it being resident of the other country.

Without TRC, you can't claim DTAA benefits. Period.

Form 10F filing: You must electronically file Form 10F with specific details about your residency and tax status.

Documentation requirements: Income statements, proof of tax payments, and nationality proof are essential.

Timing matters: Claims must be made when filing returns or before TDS deduction.

👉 Tip: Get your TRC from your resident country's tax authority before the financial year ends. Don't wait for tax season.

Application Process

Step 1: Determine eligibility Check if your resident country has DTAA with India from the table above.

Step 2: Get Tax Residency Certificate Apply to your country's tax authority (IRS in US, HMRC in UK, FTA in UAE).

Step 3: File Form 10F Submit electronically with your Indian tax details.

Step 4: Claim benefits When filing ITR or requesting TDS reduction from the payer.

Step 5: Maintain records Keep TRC, Form 10F, and payment proof for 6 years.

👉 Tip: Process TRC applications 2-3 months before you need them. Government processing takes time.

What This Means for You

India's extensive DTAA network covers 90+ countries where most NRIs live and work. You're likely covered.

But here's the catch: DTAA benefits require paperwork and planning. Many NRIs pay extra tax simply because they don't know about these agreements.

The bigger picture? DTAA makes Indian investments more attractive for NRIs. Combined with products like our GIFT City USD FDs, you can optimize both currency risk and tax efficiency.

Your next steps:

- Check if your country is in our table above

- Start your TRC application process

- Consider tax-efficient products like USD FDs that work alongside DTAA

Want to simplify your NRI investment journey? Our GIFT City USD FDs offer tax-free returns with easy repatriation - no DTAA paperwork needed.

Download Belong App to explore tax-efficient USD FDs starting at 5.0% returns.

Join our UAE NRI WhatsApp Group for live discussions on DTAA strategies and tax optimization tips.

Disclaimer: This article is for informational purposes only. Tax laws change frequently. Consult a qualified CA for personalized advice.

About the Author: Ankur Choudhary is an IIT Kanpur alumnus, SEBI-registered investment advisor, and CEO of Belong. He has over 12 years of experience helping NRIs navigate cross-border financial planning.

Sources: Central Bank of India and Income Tax India

Comments

Your comment has been submitted