DTAA for Freelancers, Consultants & Remote Workers - The Complete Guide

You're sitting in a café in Berlin, finishing a project for a Mumbai-based startup.

The payment hits your German bank account, but then reality strikes: "Do I pay tax in Germany, India, or both?"

Welcome to the remote worker's tax nightmare.

Last month, I received 47 queries from freelancers, consultants, and remote workers - all confused about the same thing: how DTAA applies to their cross-border income.

Here's what's happening: The remote work revolution created millions of digital nomads and cross-border professionals. But tax systems haven't caught up.

Result? Good people are either paying double tax or accidentally evading it (which is worse).

Why This Matters Now

The numbers are staggering:

- 4.2 million Indians work remotely for foreign companies

- 68% have never heard of DTAA

- Average overpayment: ₹45,000 annually per person

But it gets worse. India's DTAAs with various countries help prevent double taxation. Key provisions include: Tax credit: Indian tax liability can be reduced by the amount of tax paid abroad.

The problem? Most remote workers don't know how to use these provisions.

👉 Tip: DTAA covers "income from employment, business profits, dividends, interest, royalties, capital gains, among others" - this includes your freelancing and remote work income.

Breaking Down DTAA for Remote Workers

The Core Principle

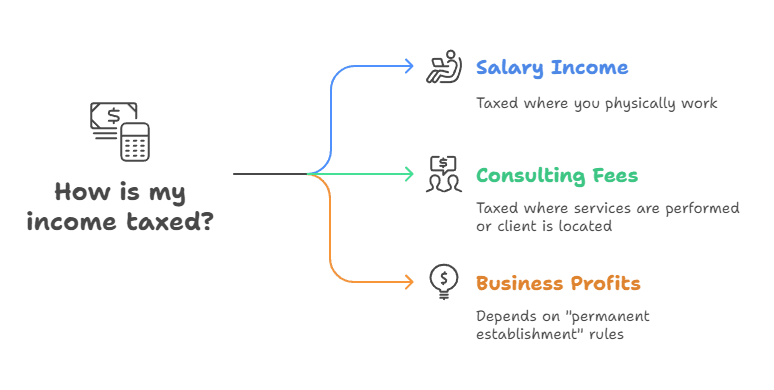

DTAA agreements cover a range of income such as income from employment, business profits, dividends, interest, royalties, capital gains, among others.

These agreements specify guidelines as to which country holds the right to impose taxes on particular types of income.

For remote workers, this means:

- Salary income: Usually taxed where you physically work

- Consulting fees: Taxed where services are performed or client is located

- Business profits: Depends on "permanent establishment" rules

If You Live Abroad and Earn in India

Scenario 1: You're a tax resident of UAE working for Indian clients

Good news: UAE has zero income tax. Under India-UAE DTAA, you'll only pay Indian taxes.

What you pay in India:

- Freelancing income: Taxed at slab rates (up to 30%). As a non-resident, the presumptive taxation scheme under Section 44ADA is not available.

You must calculate your taxable income after deducting actual business expenses.TDS: The default TDS rate is 30% (plus cess) under Section 195.

However, once you provide your UAE Tax Residency Certificate and file Form 10F, your client can apply the lower DTAA rate. What you pay in UAE: Zero

Your action: Get UAE Tax Residency Certificate, file Form 10F in India

Scenario 2: You're a tax resident of Germany working for Indian clients

Germany taxes worldwide income. India taxes income earned in India.

Without DTAA planning:

- Indian tax: 30% on your consulting income

- German tax: Up to 42% on the same income

- Total burden: Could exceed 70%

With proper DTAA planning:

- Pay Indian tax: 30%

- Claim credit in Germany for Indian tax paid

- Net German tax: 12% (42% - 30% credit)

- Total effective rate: 42% (instead of 70%+)

👉 Tip: German residents get full credit for Indian tax paid, making the effective rate much lower than paying separately in both countries.

Scenario 3: You're a tax resident of Canada working for Indian clients

Canada's tax treaty with India is particularly favourable for service income.

The benefit: Canada taxes only 50% of capital gains, and service income gets full foreign tax credit.

How to Structure Payments Properly

Structure 1: Direct Personal Payments

Indian Client → Your Foreign Bank Account

Pros: Simple, direct Cons: Higher TDS (30%), currency conversion costs Best for: Small freelancing projects under ₹5 lakh annually

Structure 2: Indian Intermediary Company

Indian Client → Indian Company → Your Foreign Account

Pros: Lower TDS rates, easier compliance Cons: Setup complexity, ongoing compliance costs Best for: Regular income above ₹10 lakh annually

Structure 3: Foreign Company Setup

Indian Client → Your Foreign Company → Your Salary

Pros: Maximum tax efficiency, business deductions Cons: Highest setup cost, requires permanent establishment compliance Best for: High-value consulting (₹25 lakh+ annually)

👉 Tip: Foreign clients might not be aware of GST provision in India, and hence, it's better to communicate to them the applicable GST rules.

Payment Timing Strategies

Strategy 1: Year-end bunching Receive payments in one financial year to optimize slab rates and deductions.

Strategy 2: Advance vs arrears Time payments to fall in favourable tax years in both countries.

Strategy 3: Currency hedging Invoice in stable currencies to avoid forex losses.

Tax Traps to Avoid

Trap 1: Ignoring TDS Requirements

The Problem: If you are a resident freelancer in India, your client must deduct 10% TDS under Section 194J.

If you are a non-resident (e.g., living in Germany), your Indian client must deduct TDS under Section 195 at a default rate of 30% (plus cess). You can reduce this rate only by submitting your DTAA documents (TRC and Form 10F).

Real Example: Suresh earned ₹12 lakh from a Delhi client. Client didn't deduct TDS. Suresh got a tax notice for ₹1.2 lakh penalty plus interest.

The Solution: Know your residential status and clearly communicate the correct TDS section and rate to your clients.

Trap 2: Wrong Residential Status

The Problem: Many remote workers think they're NRIs when they're actually residents for tax purposes.

The Test: If you stay in India for 182+ days, you're a resident (with some exceptions).

The Consequence: Residents pay tax on global income, NRIs only on Indian income.

Trap 3: Missing Advance Tax Payments

The Problem: Indian workers employed by foreign companies must navigate a complex web of tax rules, FEMA compliance, advance tax obligations, and DTAA provisions.

Unlike salaried employees, freelancers don't have TDS deducted. If your tax liability exceeds ₹10,000, you must pay advance tax.

Payment schedule:

- 15th June: 15% of estimated tax

- 15th September: 45% of estimated tax

- 15th December: 75% of estimated tax

- 15th March: 100% of estimated tax

Trap 4: GST Compliance Confusion

The Problem: Freelancers must register for GST if annual income exceeds ₹20 lakh (₹10 lakh for special category states).

Foreign Client Confusion: Foreign clients don't understand Indian GST. They expect invoices inclusive of GST but don't know how to claim input credits.

The Solution:

- Clearly communicate GST implications upfront

- Provide GST-compliant invoices

- Consider export of services (0% GST rate)

Trap 5: Presumptive Taxation Misuse

The Scheme: Under Section 44ADA, certain resident freelancers can declare 50% of their gross receipts as taxable income, simplifying their accounting.

The Trap: This powerful scheme is only available to freelancers who are tax residents of India.

Many think this is mandatory. It's optional.

When to avoid: If your actual profit margin is less than 50%, maintain books and claim actual expenses.

👉 Tip: Under the presumptive scheme (Section 44ADA), freelancers cannot claim additional expenses beyond the 50% deduction but may still use tax saving deductions like 80C, 80D, 80E etc.

Benefits for Remote Workers

Reduced double taxation: DTAA ensures you don't pay full tax rates in both countries.

Foreign tax credit:

An Indian resident earning foreign income (e.g., from a German client) files Form 67 in India to claim credit for the tax they paid in Germany.

A foreign resident earning Indian income (e.g., the German freelancer) needs a TRC and Form 10F to claim the lower DTAA tax rate here in India.

Social security relief: Avoiding double social security contributions (SSA Agreement with India): Workers contributing to India's Employees' Provident Fund (EPF) are exempt from contributing to foreign social security schemes if a Social Security Agreement (SSA) exists between India and the foreign country.

Simplified compliance: Clear rules on which country has taxing rights.

Planning opportunities: Structure income to minimize overall tax burden.

Business deduction: Claim expenses like internet, equipment, coworking space costs.

Work from anywhere: Tax certainty enables true location independence.

Risks You Should Know

Permanent establishment triggers: Working for the same Indian client for 6+ months might create PE, changing tax implications.

Currency volatility: Rupee depreciation can affect effective tax rates.

Changing treaties: DTAA provisions can change; what worked last year might not work this year.

Audit complexity: Cross-border transactions invite more scrutiny.

Professional costs: DTAA compliance requires CA assistance, adding ₹25,000-50,000 annually.

Documentation burden: TRC, Form 10F, detailed records - lots of paperwork.

👉 Tip: Keep detailed records of work location, client meetings, and service delivery points. This determines which country has primary taxing rights.

Step-by-Step Process

Phase 1: Planning (Before Starting Work)

Step 1: Determine your tax residency status in both countries

Step 2: Understand the DTAA between your resident country and India

Step 3: Choose optimal payment structure

Step 4: Set up proper documentation systems

Phase 2: During Work (Ongoing)

Step 5: Obtain Tax Residency Certificate from your resident country

Step 6: File Form 10F with Indian authorities

Step 7: Ensure clients deduct correct TDS rates

Step 8: Make advance tax payments if required

Step 9: Maintain detailed records of income and expenses

Phase 3: Tax Filing (Annual)

Step 10: File income tax returns in India (ITR-3 or ITR-4)

Step 11: File returns in your resident country

Step 12: Claim foreign tax credit for Indian taxes paid

Step 13: Submit DTAA documentation

Phase 4: Follow-up

Step 14: Track refund status in both countries

Step 15: Respond to any queries from tax authorities

Step 16: Plan for next year based on learnings

Final Takeaway

Remote work tax planning isn't just about DTAA - it's about creating a sustainable, compliant structure that grows with your career.

The biggest mistake? Treating it as a one-time setup. Tax laws change, DTAAs get revised, and your circumstances evolve.

Your action plan:

- Assess your current tax structure for compliance gaps

- Consider relocating to tax-efficient jurisdictions like UAE

- Explore tax-free investment alternatives for your savings

For your investment portfolio, consider our GIFT City USD FDs - tax-free returns eliminate the need for complex DTAA planning on investment income.

Download Belong App to explore tax-free USD FDs that simplify your cross-border financial planning.

Disclaimer: Cross-border taxation is complex and varies by individual circumstances and countries involved. Always consult qualified tax professionals in both your resident country and India before making decisions.

Comments

Your comment has been submitted