India-UAE DTAA Explained: How UAE NRIs Can Save Tax on Indian Income

You just got your NRO FD interest credited - ₹1.5 lakh annual income from your ₹50 lakh deposit. But then you see the TDS deduction: ₹45,000 (30%).

Your first thought: "I already pay zero tax in Dubai. Why am I paying 30% in India? There must be a way to reduce this."

You're absolutely right. And that's exactly what the India-UAE DTAA (Double Taxation Avoidance Agreement) is designed to solve.

Here's what most UAE NRIs don't realize: With proper DTAA planning, that ₹45,000 tax could have been just ₹18,750 - saving you ₹26,250 annually. On larger amounts, we're talking about savings of ₹1-5 lakh every year.

By the end of this guide, you'll understand exactly how the India-UAE DTAA works, which income gets relief, the step-by-step claiming process, and - most importantly - how to avoid the compliance mistakes that trigger IT department notices.

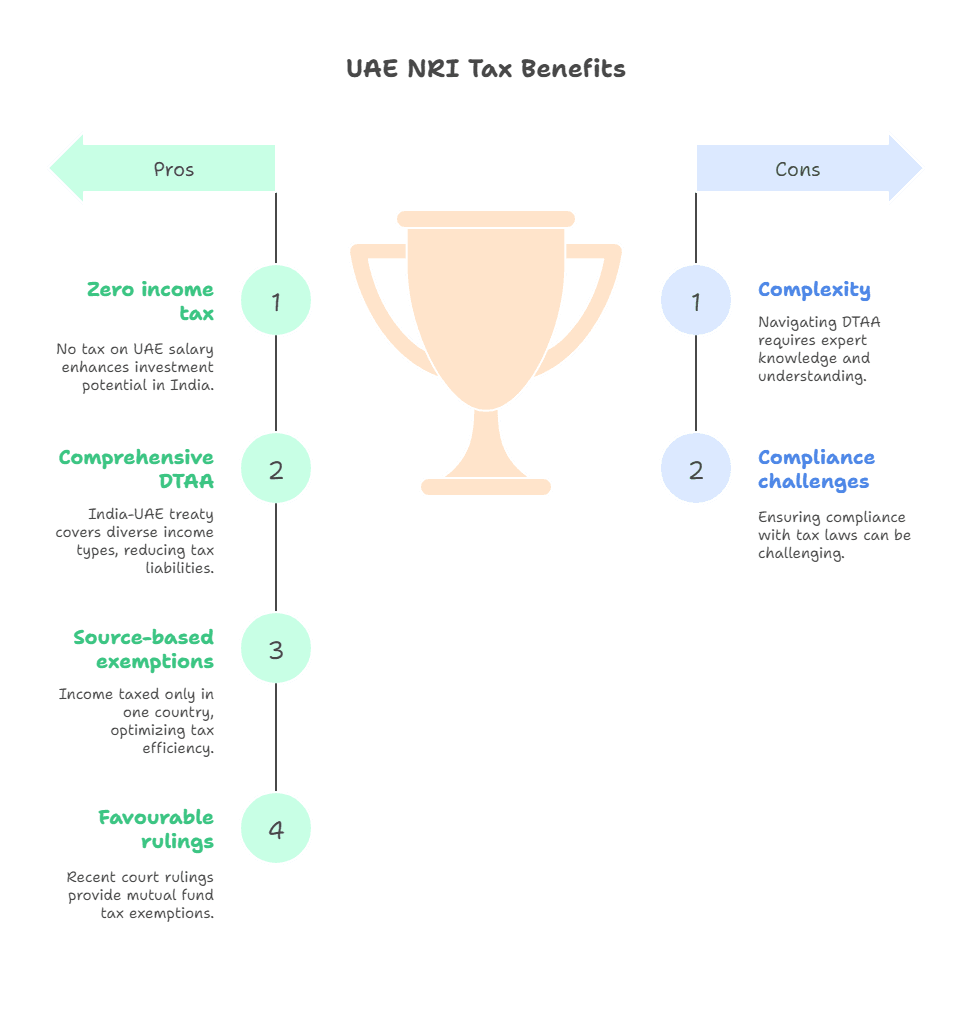

Why UAE NRIs Have a Unique DTAA Advantage

Let me start with something that might surprise you: UAE NRIs have one of the most favorable tax positions globally when it comes to Indian investments.

Here's why:

- Zero personal income tax in UAE - You don't pay tax on your Dubai/Abu Dhabi salary

- Comprehensive DTAA coverage - India-UAE treaty covers virtually all income types

- Source-based exemptions - Many income types are taxed only in one country

- Recent favourable court rulings - Mumbai ITAT decisions on mutual fund exemptions

Real example: Arjun works in Dubai, earns AED 30,000 monthly, and has ₹80 lakh invested across Indian FDs, mutual funds, and rental property.

- Without DTAA knowledge: Pays ₹3.2 lakh annual tax to India

- With DTAA optimization: Pays ₹1.1 lakh annual tax to India

- Annual savings: ₹2.1 lakh

That's a 66% reduction in his Indian tax liability.

The Game-Changing Mumbai ITAT Ruling on Mutual Funds

Before we dive into the mechanics, here's the biggest development for UAE NRIs: In October 2024, the Mumbai Income Tax Appellate Tribunal (ITAT) ruled that capital gains from mutual fund investments by UAE residents are not taxable in India.

Why this matters:

Mutual fund units are structured as trust units (not company shares) under SEBI regulations. Article 13(5) of the India-UAE DTAA states that gains from shares are taxable only in the UAE. Since mutual funds aren't technically "shares," gains are taxed only in UAE - which means zero tax.

The impact:

If you're a UAE resident with ₹50 lakh in Indian mutual funds earning 12% annually (₹6 lakh), you could potentially save:

- Long-term capital gains tax: ₹50,000 annually

- Over 10 years: ₹5+ lakh in tax savings

📍 Important: This is based on recent tribunal rulings. While encouraging, always consult a tax advisor for your specific situation, as interpretations can vary.

Types of income covered under the India–UAE DTAA

The DTAA defines taxation for different types of income generated by individuals and entities who are resident in the UAE (NRIs, OCIs or other foreign nationals or companies) and have income in India (and vice versa).

The taxation rules for key income categories relevant to individuals under this agreement are summarised below:

Tax on Indian income for UAE residents (NRIs, OCIs, foreign nationals) under India-UAE DTAA

Source of Income in India | Tax in India without DTAA | Tax relief available under DTAA | Tax in India under DTAA |

Interest | As per the slab rate TDS @ 30% | Yes | Max rate of 12.5% |

Dividends | As per the slab rate TDS @ 30% | Yes | Max rate of 10% |

Royalties | As per the slab rate. TDS @ 30% | Yes | Max rate of 10% |

Capital gains from equity-based mutual funds | Short-term capital gains @ 20% Long-term capital gains @ 12.5% TDS at 20% & 12.5% respectively | Yes | Tax-free |

Capital gains from debt and non-equity-based mutual funds | Taxed at 30% for both short and long-term TDS @ 30% | Yes | Tax-free |

Capital gains from stocks | Short-term capital gains @ 20% Long-term capital gains @ 12.5% TDS at 20% & 12.5% respectively | No | Same as a resident Indian. |

Capital gains from selling real estate | Short-term capital gains @ 30% Long-term capital gains @ 12.5% TDS at 30% & 12.5% respectively on the sale value | No | Same as a resident Indian. |

Rental income from property | As per the slab rate TDS @30% | No | Same as a resident Indian. |

How to Claim Benefits Under the India-UAE DTAA

NRIs/OCIs resident in UAE can strategically utilise the DTAA agreement to claim the exemptions and reduced tax rate in India. To do this, four prerequisites must be met:

- The individual must be classified as a non-resident under the Income Tax Act of India. You can check your resident status using Belong’s Residential Status Calculator.

- The individual must be a resident of UAE, i.e. must have spent 183 or more days in the UAE in a calendar year.

- They must procure a tax residency certificate from the Federal Tax Authority of UAE.

- Filing Form 10F on the income tax portal is necessary to avail of the DTAA benefits.

What is a Tax Residency Certificate (TRC)?

A Tax Residency Certificate is a legal document issued by a government confirming an individual’s tax residency in that country.

This document is essential for claiming tax benefits under the DTAA.

How can NRIs apply for a TRC in the UAE?

To obtain a Tax Residency Certificate (TRC) in the UAE, you must make an application online via the Federal Tax Authority (FTA) portal.

To obtain a TRC, the individual must have been a resident of the UAE for at least 183 days in the calendar year for which they are requesting the certificate.

The required documents to obtain a TRC for individuals are:

Passport

Valid residence permit, i.e. UAE visa

Emirates ID

Proof of permanent place of residence

Proof of source of income

A bank statement for the last six months issued by a local bank

Filing the Form 10F in the IT portal

Form 10F is a self-declaration used by NRIs to claim the benefits of DTAA while filing their ITR. This form needs to be filled out, and the TRC needs to be attached with it to claim the benefit of DTAA.

Documents needed to file Form 10F

Proof of residential address in the country of residence, i.e. UAE, in this case

Duration of residential status as stated in the TRC

Proof of nationality, eg passport

TIN or any other unique tax identification number in the country of residence

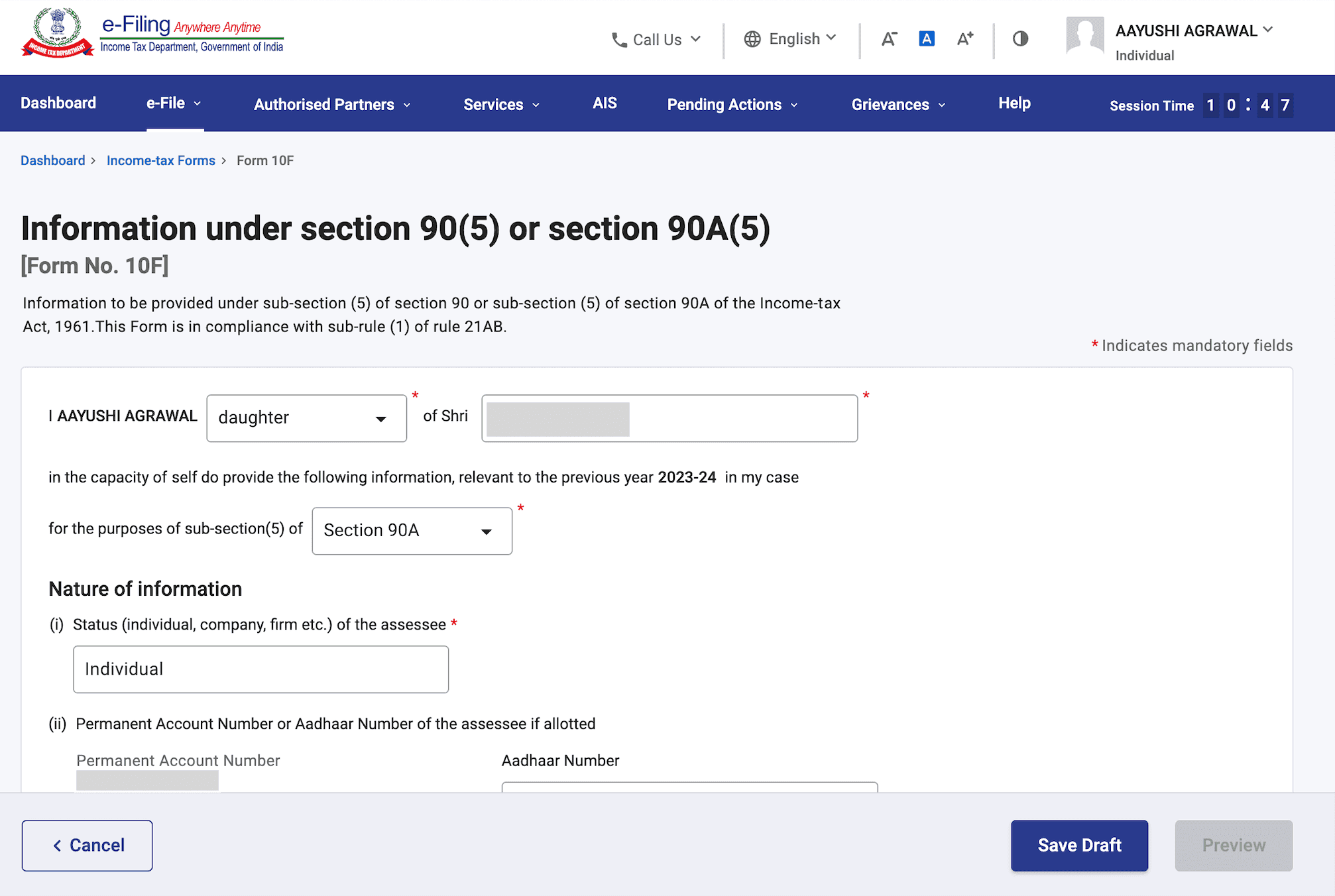

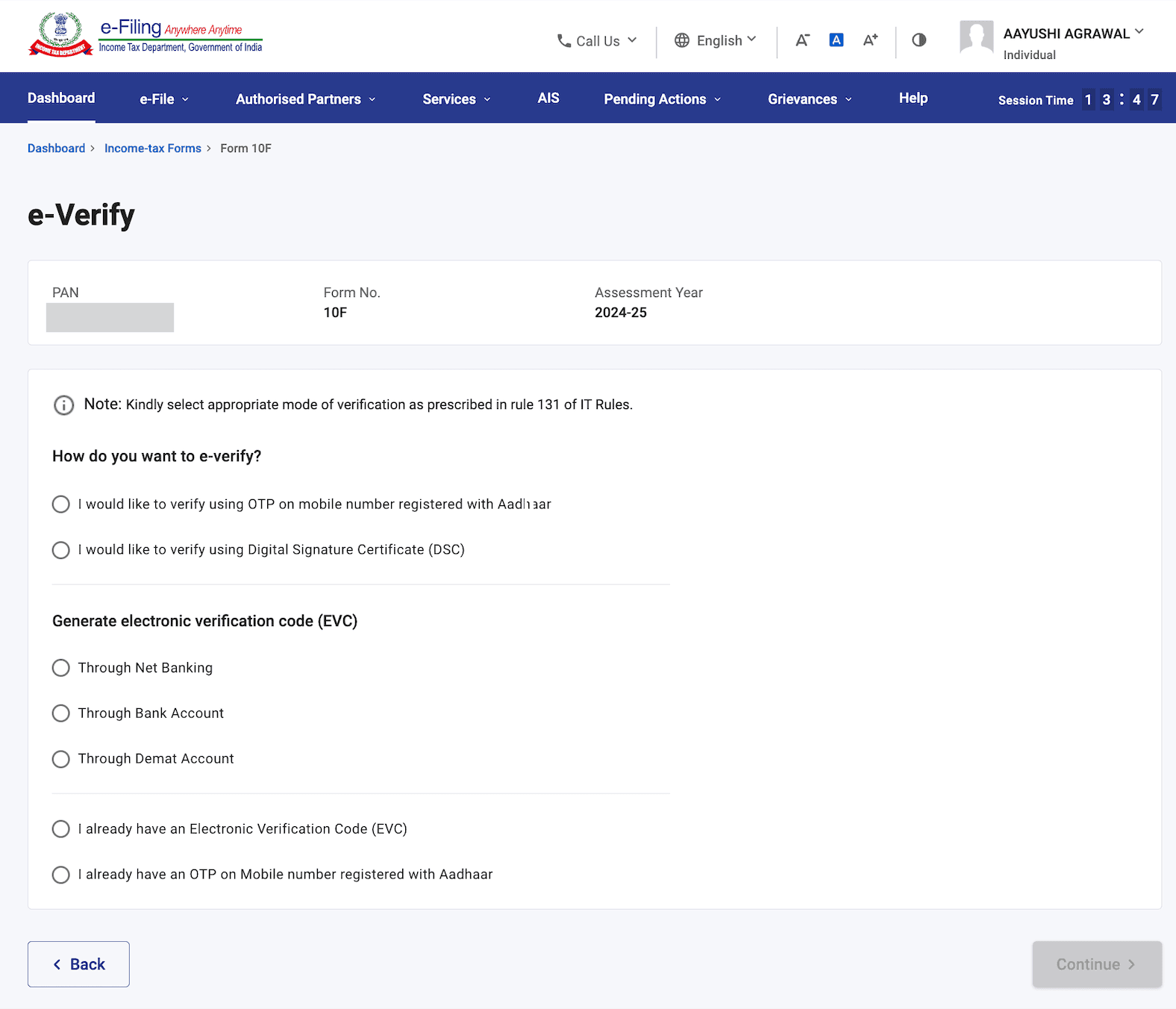

Steps to File Form 10F Online

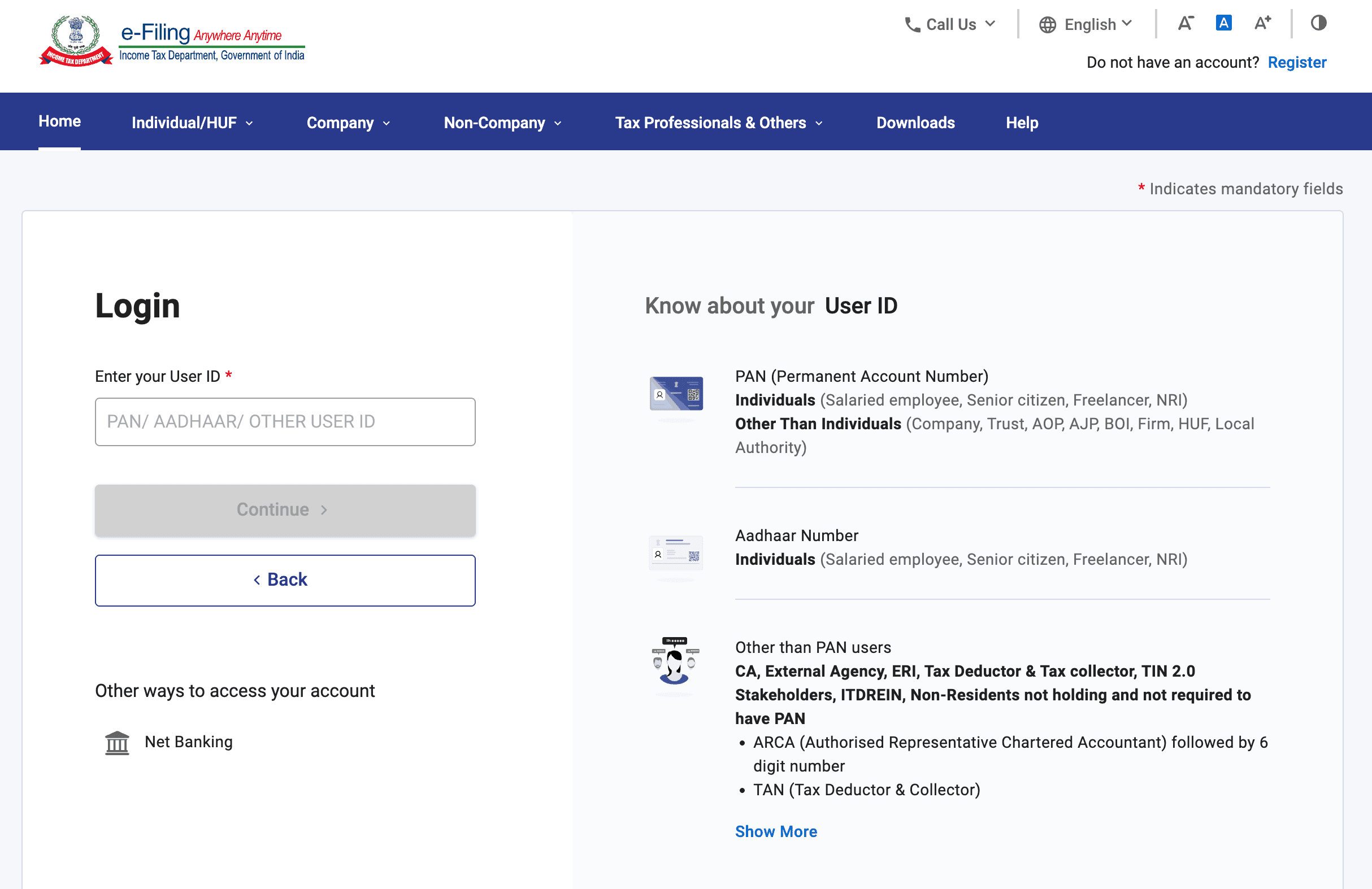

Step 1: Log in to the official e-filing portal with your PAN or the user ID.

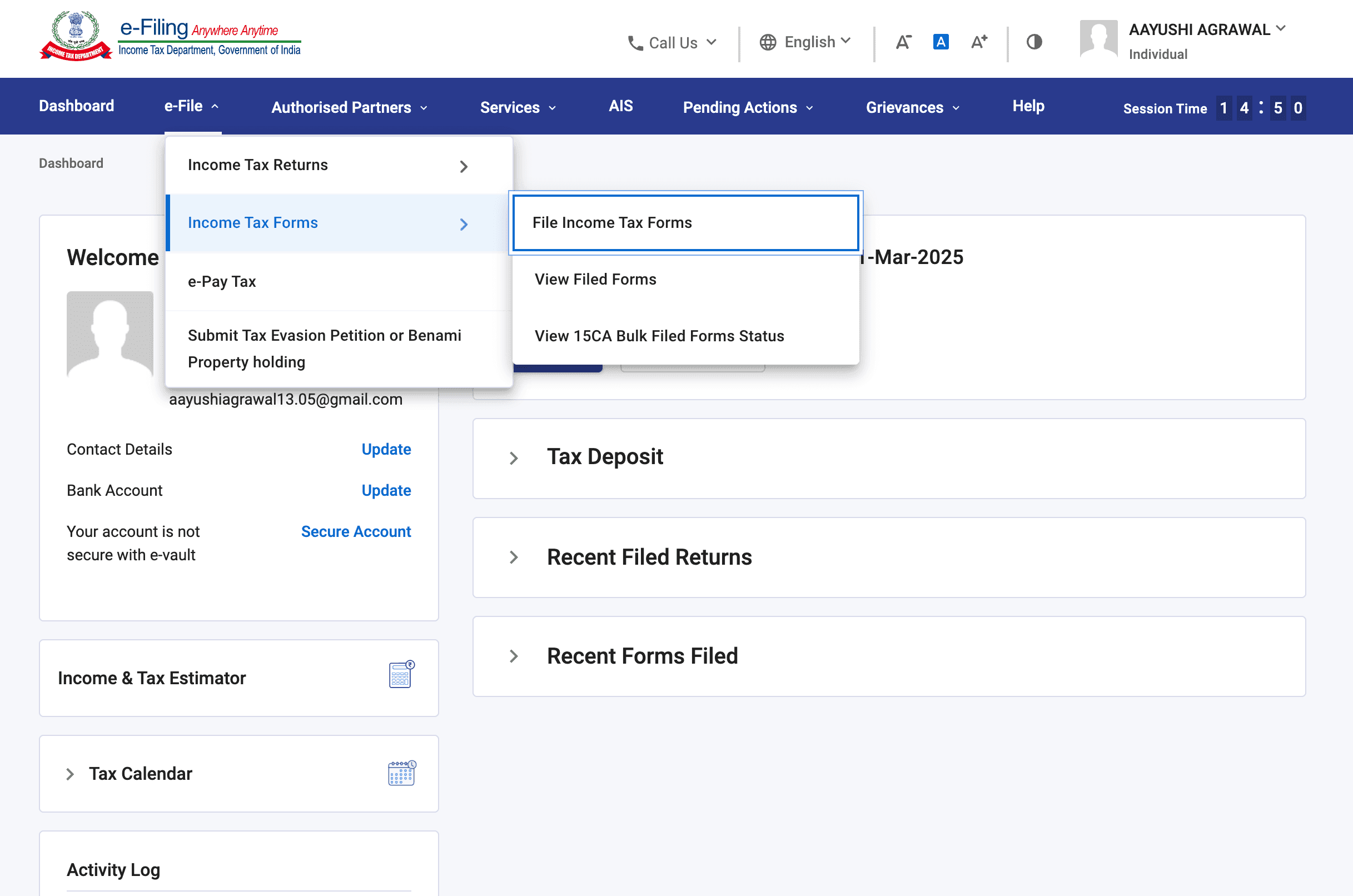

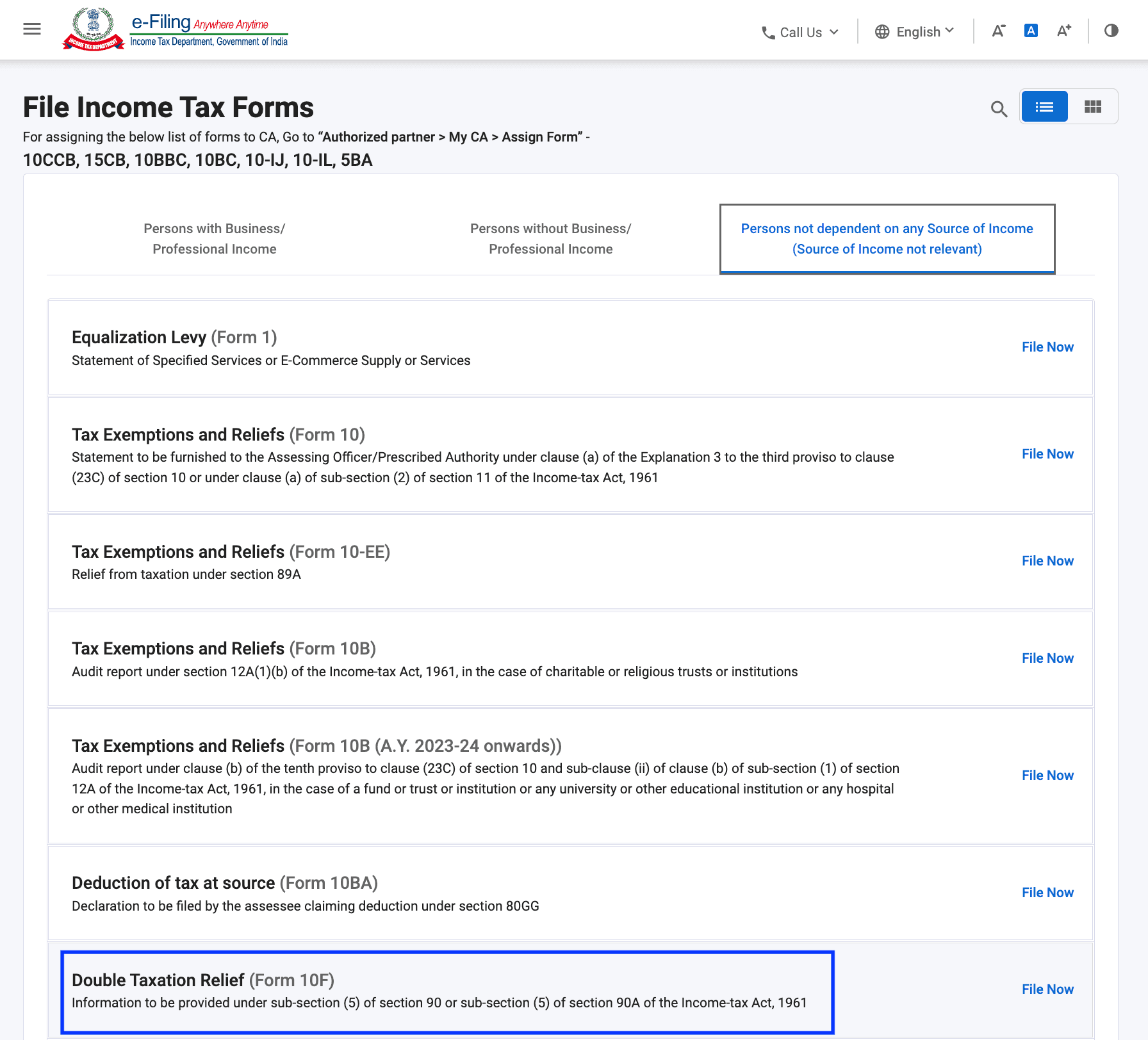

Step 2: On the dashboard, navigate to the ‘e-File’ menu and select ‘Income Tax Forms’. Click on ‘File Income Tax Forms’.

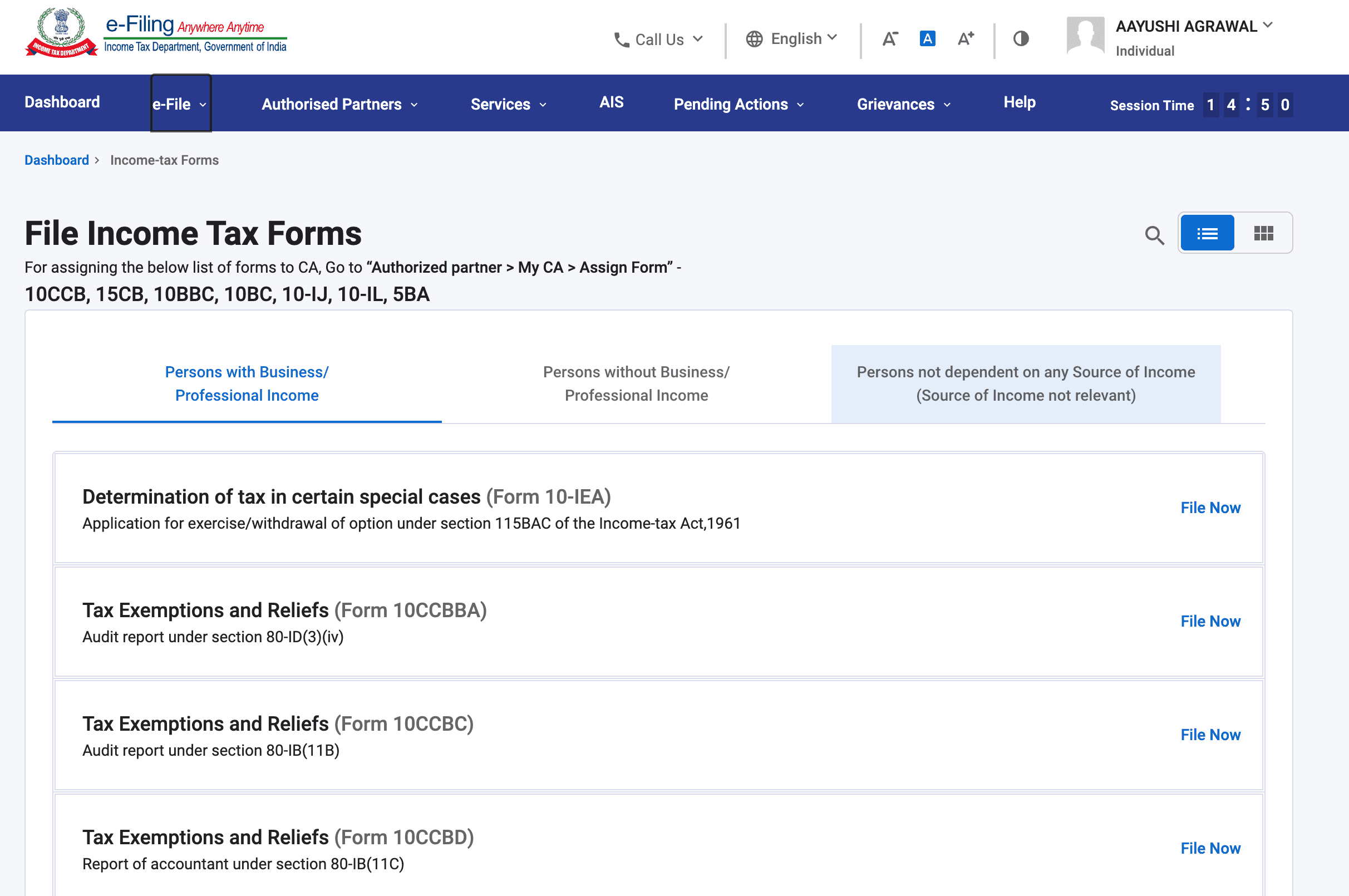

Step 3: On the next page, select the 3rd tab ‘Person not Dependent on any Source of Income’.

Step 4: You will find the option to file Form 10F in the last column on this page. Click on ‘File Now’.

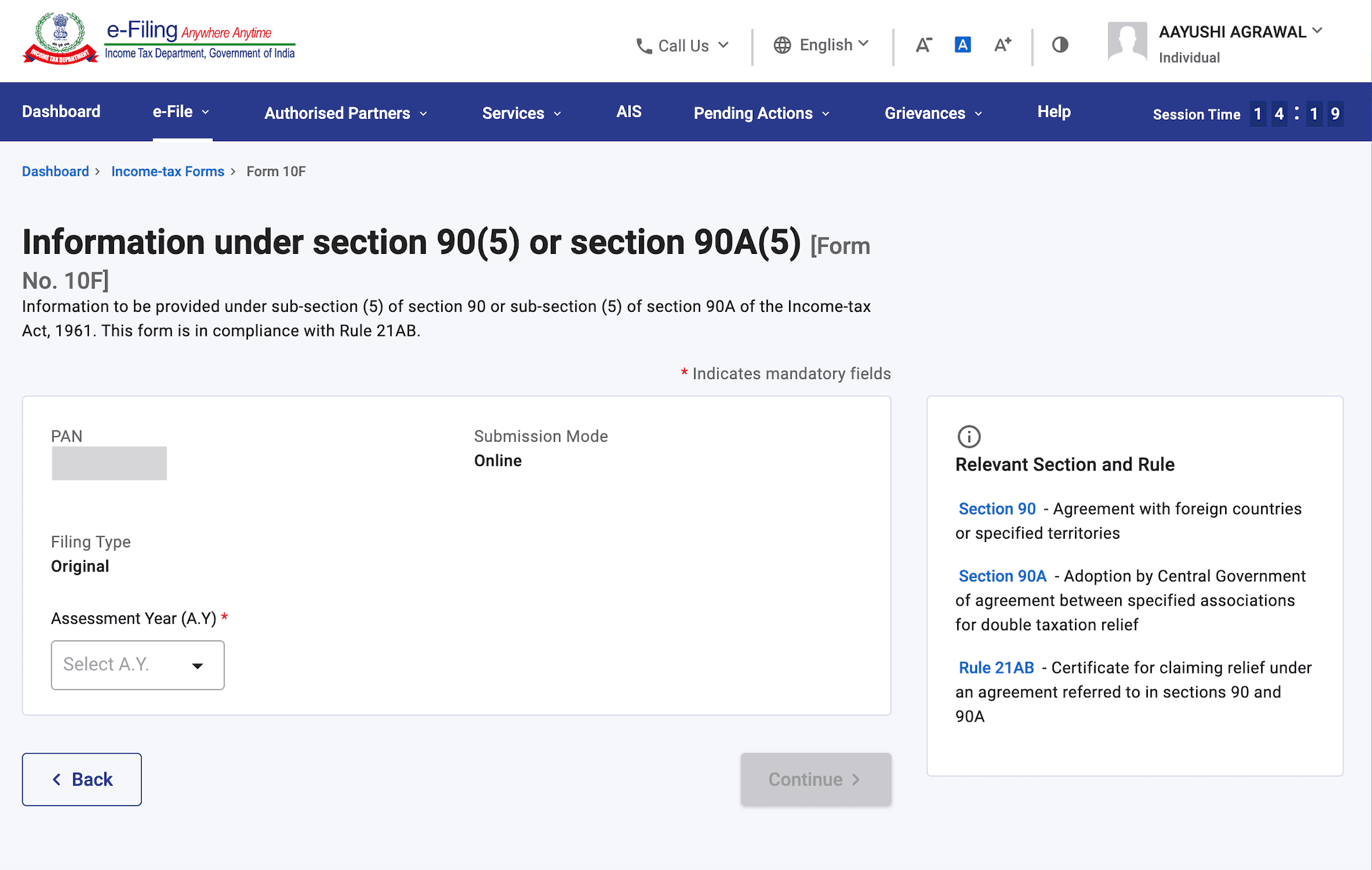

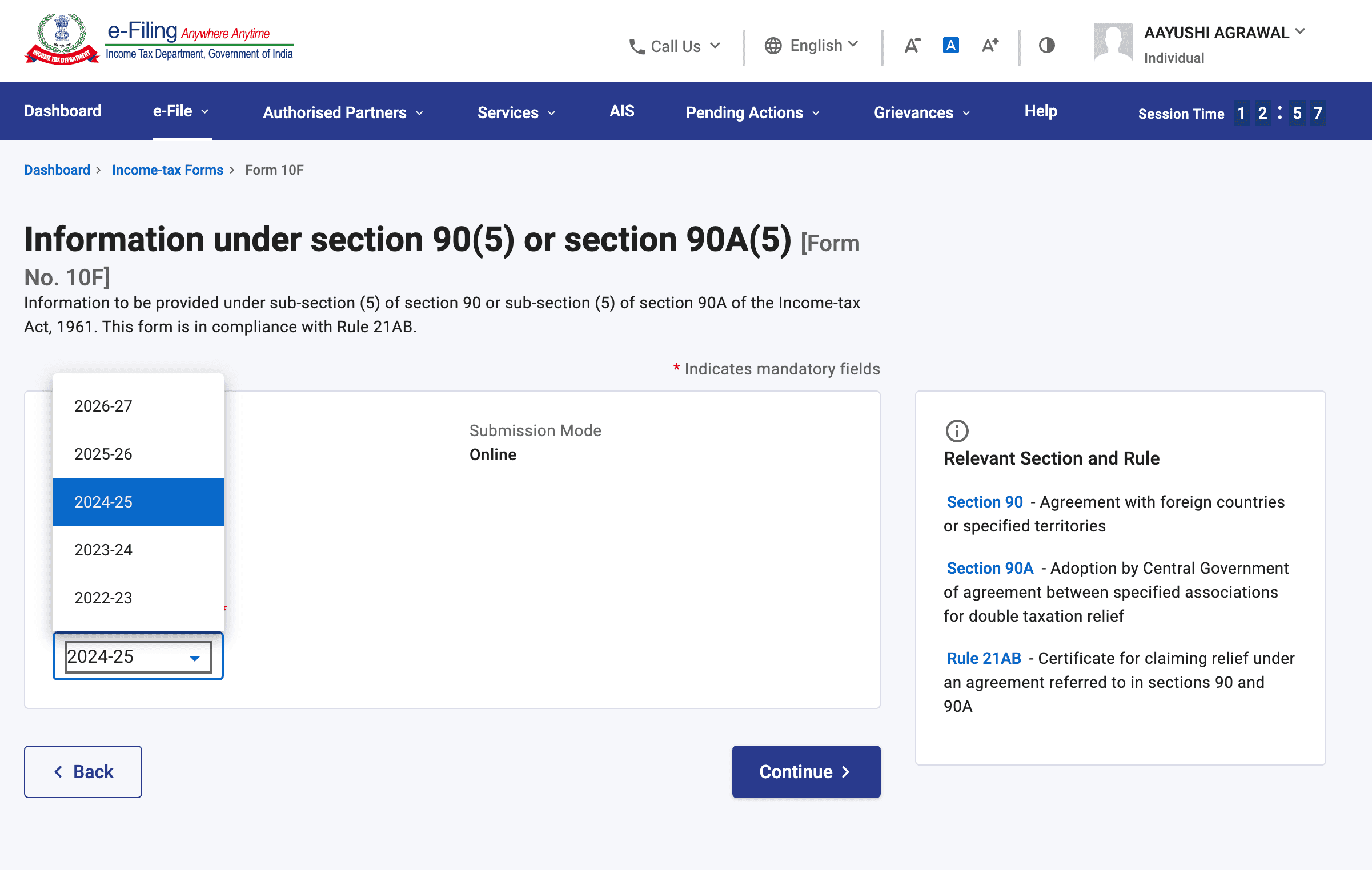

Step 5: Your PAN is pre-filled in the next page. Select the assessment year from a dropdown menu. Click on ‘Continue’.

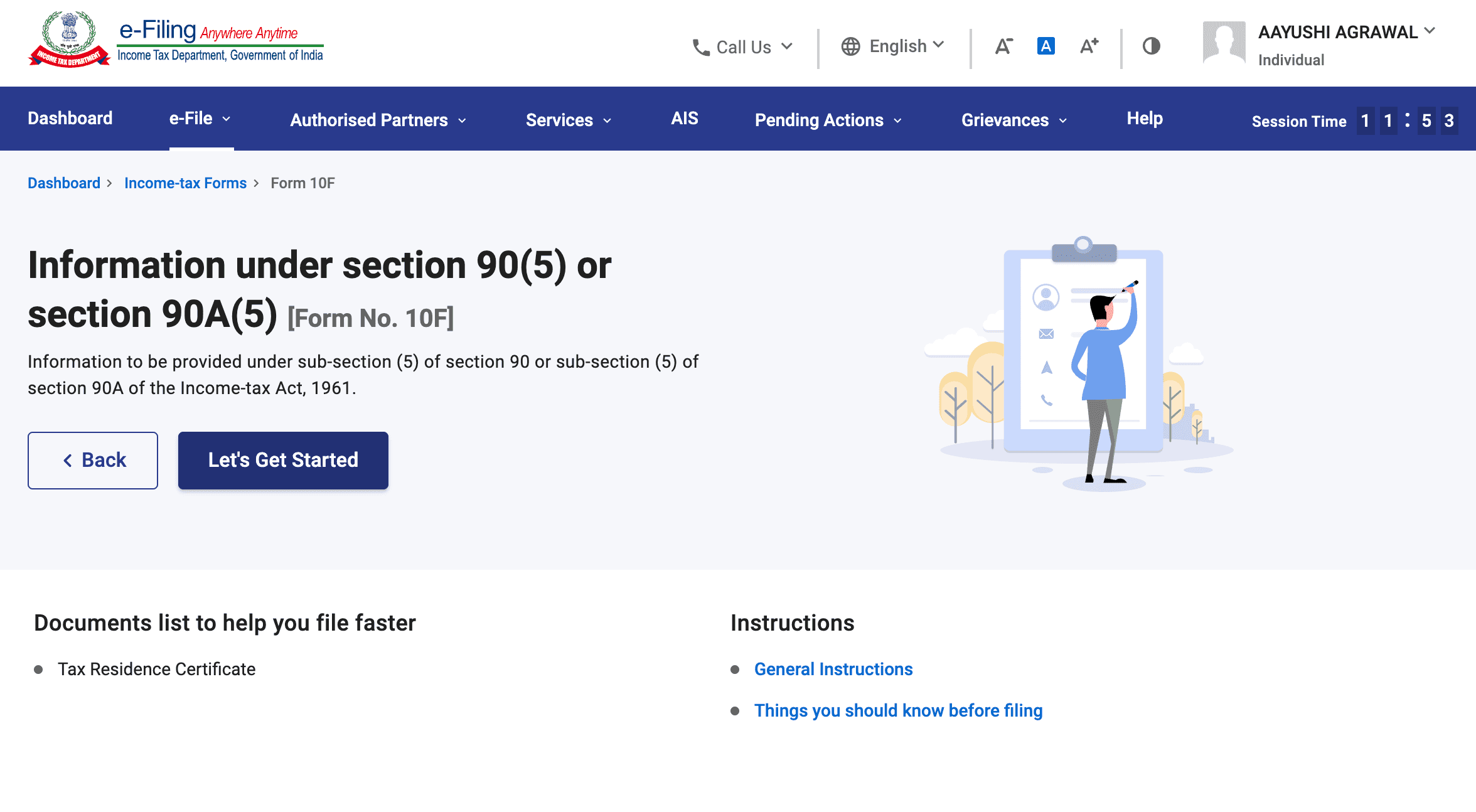

Step 6: Select ‘Let’s Get Started’ button under Information under section 90(5) or section 90A(5).

Step 7: Enter the required details, including your name, father’s name, Section 90/90A, country of registration/residence, TIN, etc.

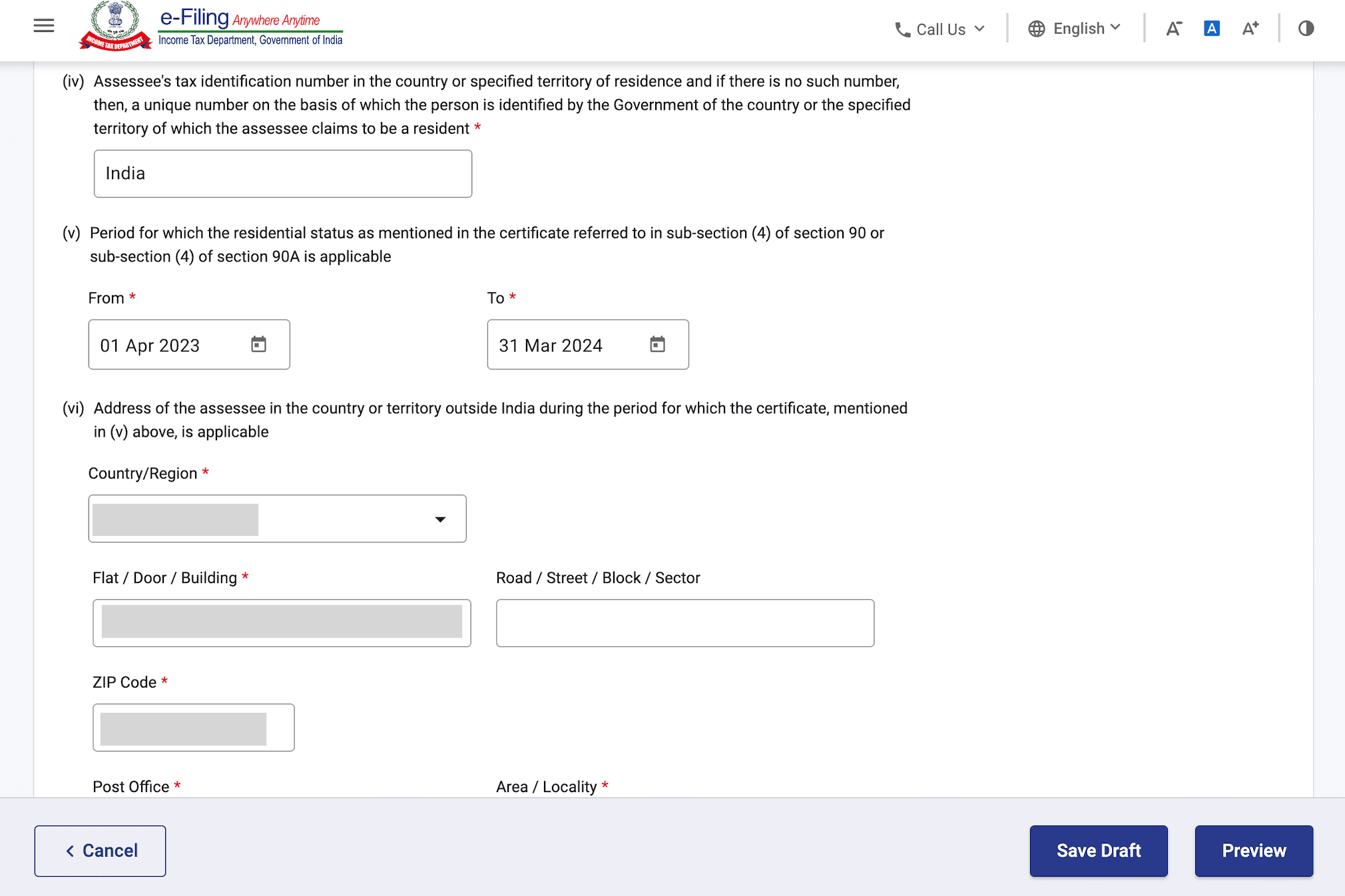

Step 8: Next, select the period for which you obtained the TRC and your address outside India.

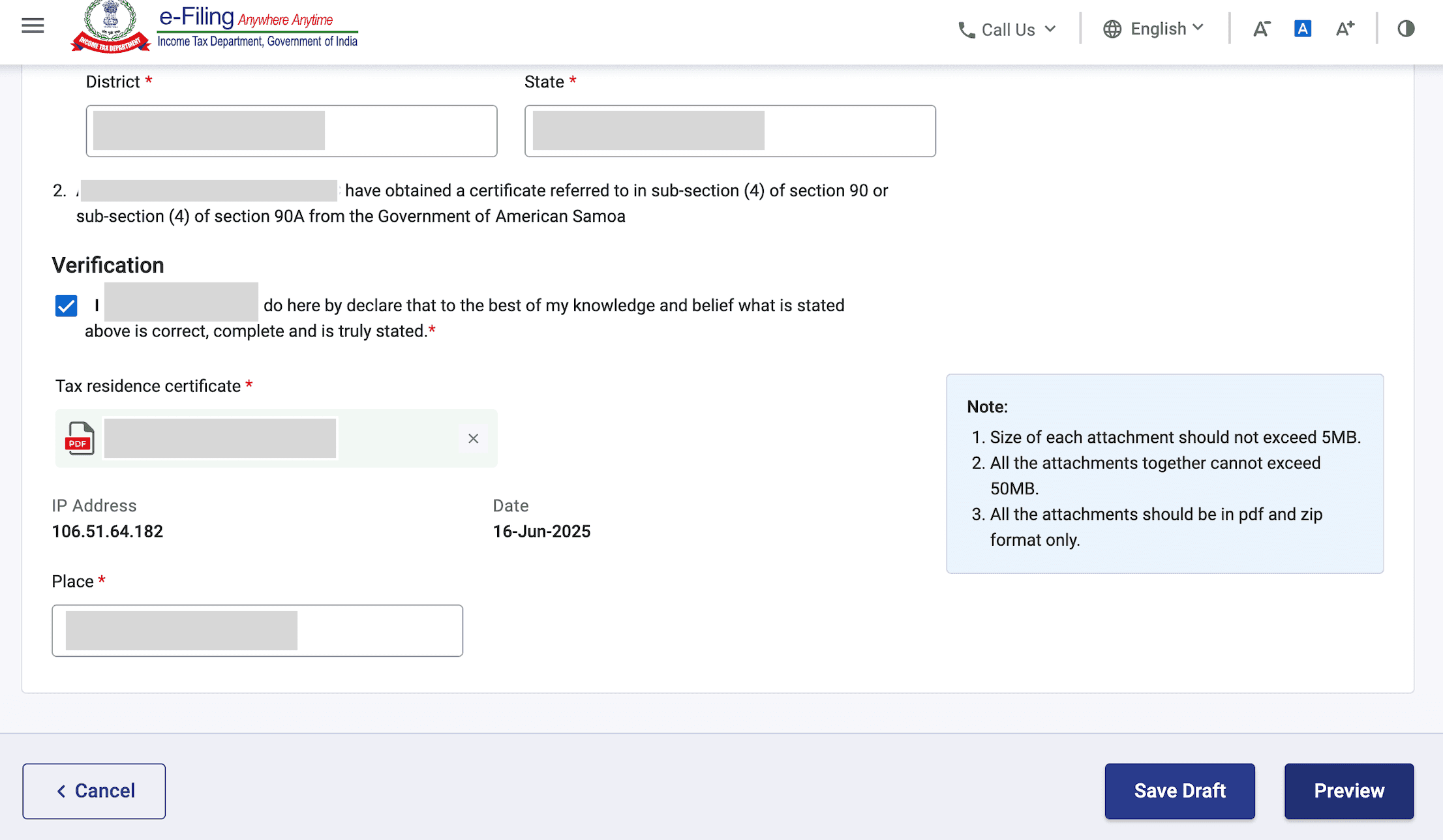

Step 9: After filing the other details, you need to attach a copy of your tax residency certificate.

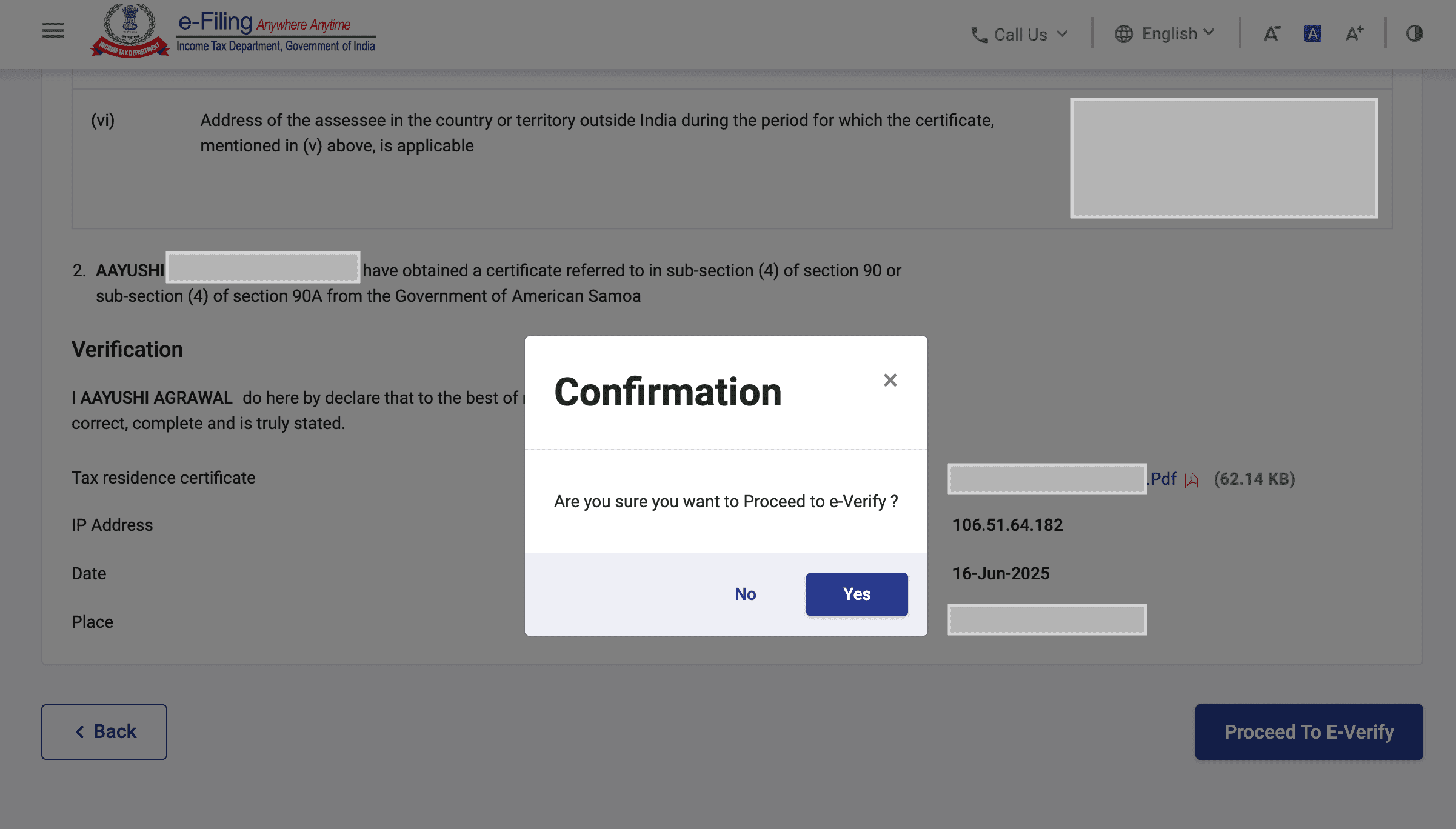

Step 10: Click on ‘Preview’ to review the details and e-verify the form.

Step 11: Signing of the form can be done via Aadhar e-signature or with Digital Signature Certificate (DSC). There’s also an option to generate electronic verification code (EVC) through Net Banking, Bank or Demat Account.

Form 10F needs to be submitted while filing the IT returns.

How India-UAE DTAA Reduces Your Tax: The Complete Breakdown

The India-UAE DTAA, signed in 1993 and effective since September 22, 1993, creates specific rules about which country gets to tax what income. Here's how it works for different income types:

Interest Income: From 30% to 12.5% (or 5%)

Standard NRI rate: 30% TDS

DTAA rate: 12.5% for most interest, 5% for bank loans

Article 11 of the DTAA states:

- Interest arising in India and paid to a UAE resident may be taxed in both countries

- But if you're the beneficial owner, India can't charge more than:

5% if interest is from a bank loan or similar financial institution

12.5% for all other interest (FDs, bonds, company deposits)

Real calculation:

₹10 lakh FD earning 7.5% = ₹75,000 annual interest

- Without DTAA: ₹22,500 tax (30%)

- With DTAA: ₹9,375 tax (12.5%)

- Annual saving: ₹13,125

Dividend Income: Reduced to 10%

Standard NRI rate: 20% TDS

DTAA rate: 10%

Article 10 covers dividends:

Dividends paid by an Indian company to a UAE resident are taxable in both countries, but India's rate cannot exceed 10%.

Capital Gains: Where It Gets Interesting

Property gains: Still taxed in India (20% for long-term)

Share gains: Taxed only in UAE (Article 13) = Zero tax

Mutual fund gains: Recent rulings suggest zero tax for UAE residents

Salary Income: Complete Exemption

Article 15 is clear: Salary earned in UAE by a UAE resident is taxable only in UAE.

Since UAE has zero personal income tax, your Dubai/Abu Dhabi salary is completely tax-free globally.

Step-by-Step: How to Claim DTAA Benefits

Step 1: Confirm Your UAE Tax Residency

You must be a genuine UAE tax resident. The criteria:

Primary test: Physical presence in UAE for 183+ days in a 12-month period

OR

Secondary test: Physical presence for 90-182 days + meeting additional conditions:

- Primary place of residence in UAE

- Center of financial and personal interests in UAE

- Permanent source of income in UAE

👉 Pro tip: Keep detailed records of your UAE entry/exit dates. The Federal Authority for Identity and Citizenship can provide official reports.

Step 2: Apply for UAE Tax Residency Certificate (TRC)

This is your key document. Here's the updated 2025 process:

Where to apply:EmaraTax portal

Processing time: 5-10 business days

Validity: 1 year

Cost (as of 2025):

- Individuals (registered taxpayers): AED 500

- Individuals (non-registered): AED 1,000

- Companies (non-registered): AED 1,750

Required documents:

- Emirates ID and UAE residence visa

- Entry/exit report showing 183+ days presence

- Salary certificate or proof of UAE income

- Proof of UAE residence (EJARI/tenancy contract)

📋 Note: Bank statements are no longer required as of 2025, per FTA updates.

Step 3: File Form 10F in India

This is mandatory and must be done online before claiming DTAA benefits.

Login to: incometax.gov.in

Navigate to: e-File > Prepare and Submit Online > Form 10F

Key details to include:

- Your UAE TRC details

- Income types you want DTAA benefits for

- Bank account information

- Period for which benefits are claimed

Step 4: Submit Documents to Your Bank/Payer

For ongoing income (like FD interest), submit these to your Indian bank:

- Original UAE TRC (or certified copy)

- Form 10F acknowledgment

- Self-declaration of beneficial ownership

- Lower TDS request letter specifying DTAA rate

Bank-specific procedures:

- ICICI: Submit at any branch, takes 7-10 days to update records

- HDFC: Online submission possible through NetBanking for existing customers

- SBI: Branch submission required, keep receipt for follow-up

- Axis: Can email documents to designated NRI email IDs

Step 5: File ITR and Claim Credit

Even with reduced TDS, you must file ITR to validate your DTAA claims.

Key schedules:

- Schedule FSI: Report foreign source income (your UAE salary)

- Schedule TR: Claim tax relief under DTAA

- Schedule FA: Declare foreign assets if applicable

The Hidden Gotchas: What Banks Won't Tell You

You might think that the banks will tell you everything you need to know. Nope!

Timing Is Everything

Mistake: Submitting TRC after interest payment

Result: 30% TDS deducted, you have to claim refund through ITR

Solution: Submit documents at least 15 days before interest payment date

Form 10F Validity

Mistake: Using old Form 10F for new financial year

Result: Bank may reject reduced TDS request

Solution: File fresh Form 10F for each financial year

The "Beneficial Owner" Trap

Mistake: Investing through complex structures (POA, joint accounts with non-UAE residents)

Result: DTAA benefits may be denied

Solution: Invest directly in your name as UAE resident

Branch-Level Confusion

Reality check: Many bank branches aren't familiar with DTAA procedures.

What happened to Priya in Dubai: Her ICICI branch rejected her TRC, saying "only original accepted." She escalated to NRI customer care, got approved in 2 days.

👉 Always escalate: If branch staff seem confused, ask to speak with the NRI relationship manager or customer care.

How UAE Compares to Other Countries

Country | Interest Rate | Dividend Rate | Mutual Fund Gains | Salary (earned locally) |

|---|---|---|---|---|

UAE | 12.5% | 10% | Potentially 0% | 0% |

USA | 15% | 15%/25% | Taxed in India | Taxed in USA |

Singapore | 15% | 5% | Potentially 0% | Taxed in Singapore |

UK | 15% | 15% | Taxed in India | Taxed in UK |

Clear winner: UAE NRIs have the most favourable overall tax treatment.

Smart Tax Planning Strategies for UAE NRIs

Strategy 1: Optimize Your Investment Mix

Instead of: ₹50 lakh in NRO FDs (30% tax)

Consider:

- ₹20 lakh in NRE FDs (0% tax)

- ₹20 lakh in GIFT City USD FDs (0% tax)

- ₹10 lakh in Indian mutual funds (potentially 0% tax under DTAA)

Tax saved annually: ₹2-3 lakh

Strategy 2: Time Your Repatriations

UAE has no exit tax, so you can time fund transfers to India during:

- Lower interest rate cycles

- Favorable exchange rates

- End of financial year for tax planning

Strategy 3: Consider GIFT City for Maximum Benefits

Why GIFT City beats regular FDs for UAE NRIs:

- Returns in USD (no rupee depreciation risk)

- Zero Indian tax (vs 12.5% under DTAA)

- Easy repatriation to UAE accounts

- Professional fund management

Learn more about GIFT City opportunities →

Real Case Study: Rajesh's ₹2.5 Lakh Annual Savings

Profile: Rajesh, Dubai-based IT manager

Indian investments: ₹1.2 crore across FDs, mutual funds, and rental property

Before DTAA optimization:

- FD interest: ₹8 lakh/year → ₹2.4 lakh tax (30%)

- Rental income: ₹6 lakh/year → ₹1.8 lakh tax (30%)

- Mutual fund gains: ₹3 lakh/year → ₹30,000 tax (10%)

- Total annual tax: ₹4.23 lakh

After DTAA optimization:

- FD interest: ₹8 lakh/year → ₹1 lakh tax (12.5%)

- Rental income: ₹6 lakh/year → ₹1.8 lakh tax (still 30%, no DTAA benefit)

- Mutual fund gains: ₹3 lakh/year → ₹0 tax (UAE resident exemption)

- Total annual tax: ₹2.8 lakh

Annual savings: ₹1.43 lakh

Over 10 years: ₹14.3 lakh saved

Additional optimization: Rajesh shifted ₹40 lakh from NRO FDs to GIFT City USD FDs, saving another ₹1 lakh annually in taxes.

The Compliance Calendar: When to Do What

January-March

- Apply for UAE TRC renewal (if expiring)

- Review previous year's DTAA claims

- Plan current year's investment strategy

April-June

- File Form 10F for new financial year

- Submit updated TRC to banks

- File previous year's ITR with DTAA claims

July-September

- Monitor TDS deductions on quarterly interest

- Update bank records if TRC details change

- Plan mid-year repatriations

October-December

- Calculate year-end tax projections

- Consider additional investments for optimization

- Prepare documents for next year's TRC application

Red Flags That Trigger IT Department Scrutiny

Avoid these mistakes:

❌ Claiming DTAA benefits without proper residency proof

❌ Not filing ITR after claiming reduced TDS

❌ Using expired TRC for current year benefits

❌ Claiming exemptions on income types not covered by DTAA

❌ Inconsistent residential status claims across years

Green flags that show proper compliance:

✅ Valid TRC for the relevant financial year

✅ Form 10F filed before claiming benefits

✅ ITR filed with correct DTAA schedules

✅ Consistent UAE residential proof

✅ Proper documentation for all claims

Your Next Steps: The DTAA Action Plan

Immediate (This Week):

- Calculate your current Indian tax liability

- Check if your UAE residency qualifies for TRC

- Gather documents for TRC application

Short-term (Next Month):

- Apply for UAE TRC if eligible

- File Form 10F for current financial year

- Submit DTAA documents to your bank

Medium-term (Next 3 Months):

- Monitor TDS reductions on your income

- Plan investment rebalancing for tax optimization

- File ITR with proper DTAA claims

Ongoing:

- Renew TRC annually

- Track regulatory changes affecting DTAA

- Optimize portfolio based on latest rulings

Beyond DTAA: Building a Tax-Efficient Portfolio

While DTAA helps reduce taxes on traditional investments, consider these alternatives for maximum efficiency:

GIFT City USD Fixed Deposits

- Tax treatment: Completely tax-free returns

- Currency advantage: No rupee depreciation risk

- Repatriation: Direct to your UAE account

- Minimum investment: $10,000

Compare this: ₹50 lakh NRO FD vs GIFT City USD FD

- NRO FD: 7% return = ₹3.5 lakh gross, ₹3.06 lakh after DTAA tax (12.5%)

- GIFT City USD FD: 5% return = $3,000 (≈₹2.5 lakh), completely tax-free

- Plus: Protection from rupee depreciation

NRE Account Optimization

- Interest: Completely exempt from Indian taxes

- Repatriation: No documentation needed

- DTAA formalities: Not required

The Bottom Line: Your Money, Your Choice

The India-UAE DTAA isn't just about saving taxes - it's about maximizing your financial potential across two countries.

If you're a UAE resident earning income in India, you're likely overpaying taxes. With proper DTAA planning, most UAE NRIs can reduce their Indian tax burden by 40-60%.

The key is starting now. Every month you delay is money left on the table.

Disclaimer: This information is for educational purposes only and should not substitute for personalized tax advice. The examples used are for illustration, and actual tax implications may vary based on individual circumstances and latest regulatory changes.

NRIs living abroad may have a source of income back in India. This income may come from various sources like interest income on bank deposits, rent from Indian property, capital gains or dividends from holding Indian stocks and mutual funds.

The income from these sources is liable to be taxed in both countries: the country where the income is earned (i.e. India) and the country where the NRI is a resident. This increases the tax burden on the NRI.

To prevent or alleviate such a situation, countries typically sign bilateral treaties called Double Taxation Avoidance Agreements (DTAA). India has such DTAA agreements with 80+ countries. These treaties reduce the tax burden on NRI/OCIs living and working abroad but having some income in India.

| Also Read - Step-by-step procedure for NRIs to file their Income Tax Return (ITR) in India.

Want to track GIFT Nifty?

Follow real-time movements with Belong's GIFT Nifty Live Tracker.

Comments

Your comment has been submitted