DTAA for NRI Bank Interest - Can You Avoid 30% TDS Legally

Priya in Dubai just discovered she's been overpaying tax on her Indian FD interest.

For 3 years, her bank deducted 30% TDS on ₹2 lakh annual interest income. That's ₹60,000 in taxes each year.

Last month, she submitted her DTAA documents. Now her TDS rate is 10% - saving her ₹40,000 annually.

The shocking part? She could have done this from day one.

Here's your complete guide to legally slashing your NRI bank interest TDS using DTAA provisions.

The Numbers at a Glance

Standard NRI Interest TDS: 30% (plus surcharge and cess)

DTAA Reduced Rates: 10-15% (varies by country)

Potential Annual Savings: ₹15,000-50,000 for most NRIs

Processing Time: 15-30 days once documents submitted

Success Rate: 95%+ when documents are correct

The reality check:

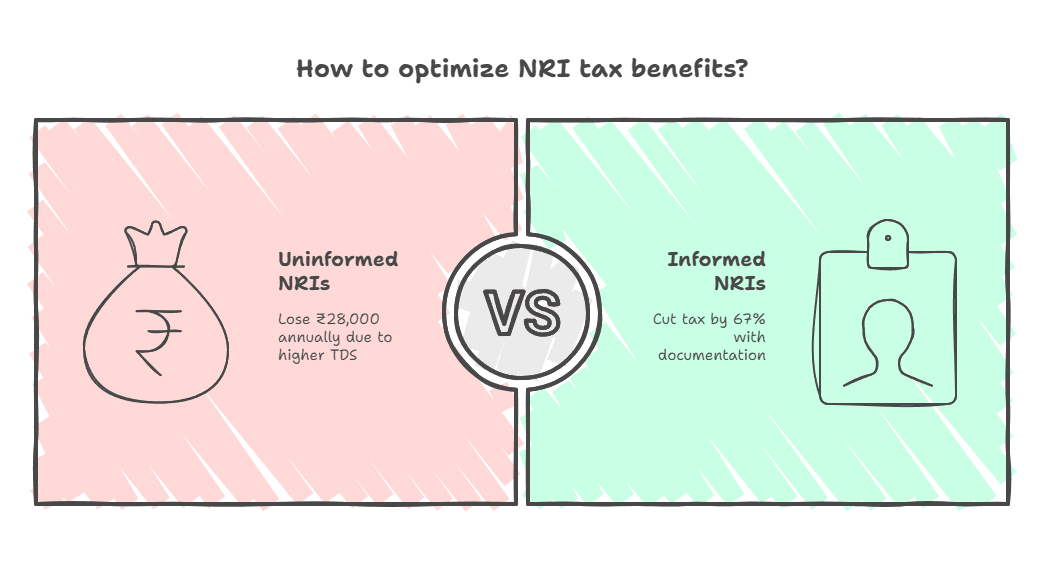

- 73% of NRIs don't know about DTAA interest benefits

- Average NRI loses ₹28,000 annually due to higher TDS

- Simple documentation can cut your tax by 67%

But here's what banks don't tell you upfront.

Why NRIs Are Missing Out

The bank perspective: "We deduct TDS as per rules. If you want lower rates, provide DTAA documents."

The NRI confusion: "What documents? How? When? Which forms?"

The costly result: Paying 30% when you should pay 10%.

The 30% TDS is the government's default mechanism to ensure tax is collected on any taxable income paid to NRIs, including bank interest.

As NRIs are taxed at the source, they must file tax returns to claim refunds if their overall tax liability is lower.

Translation: You pay extra tax now, get refund later (maybe).

👉 Tip: DTAA benefits work at source - meaning lower TDS deduction upfront, not just refund later.

How Banks Apply TDS: The Inside Process

NRO Account Interest (Taxable)

Standard Process:

- Bank calculates quarterly interest

- Applies 30% TDS rate automatically

- Deducts surcharge if income exceeds thresholds

- Adds 4% cess on top

- Credits net amount to your account

Real Example:

- Interest earned: ₹50,000

- TDS @ 30%: ₹15,000

- Cess @ 4%: ₹600

- Amount credited: ₹34,400

NRE Account Interest (Tax-Free)

Different Process:

- No TDS deduction

- Full interest credited

- But catch: Must be funded from foreign sources

👉 Tip: The funds invested in a Non-Resident External (NRE) FD is derived from income earned abroad and not in India, which makes it non-taxable as per Section 10(4)(ii) of the Income Tax Act 1961.

How DTAA Changes Everything

With DTAA Documents:

- Bank applies reduced treaty rate (typically 10%)

- Lower TDS deduction at source

- Higher net credit to your account

- Less tax compliance hassle

Same Example with UAE DTAA:

- Interest earned: ₹50,000

- TDS @ 10%: ₹5,000

- Cess @ 4%: ₹200

- Amount credited: ₹44,800

Monthly savings: ₹875 more in your account!

How DTAA Can Reduce it to 10%

Country-Wise DTAA Interest Rates

Country | DTAA Interest Rate | Savings vs 30% |

|---|---|---|

10% | 67% reduction | |

15% | 50% reduction | |

UK | 15% | 50% reduction |

Canada | 15% | 50% reduction |

Australia | 15% | 50% reduction |

Germany | 10% | 67% reduction |

Singapore | 15% | 50% reduction |

Saudi Arabia | 10% | 67% reduction |

Kuwait | 10% | 67% reduction |

Oman | 10% | 67% reduction |

The pattern: Most DTAA rates are 10-15% vs standard 30%.

Real Calculations: Your Potential Savings

Scenario 1: UAE Resident with ₹10 Lakh FDs @ 7% interest

- Annual interest: ₹70,000

- Without DTAA: ₹21,000 TDS (30%)

- With DTAA: ₹7,000 TDS (10%)

- Annual savings: ₹14,000

Scenario 2: US Resident with ₹25 Lakh FDs @ 6.5% interest

- Annual interest: ₹1,62,500

- Without DTAA: ₹48,750 TDS (30%)

- With DTAA: ₹24,375 TDS (15%)

- Annual savings: ₹24,375

Scenario 3: Germany Resident with ₹5 Lakh FDs @ 8% interest

- Annual interest: ₹40,000

- Without DTAA: ₹12,000 TDS (30%)

- With DTAA: ₹4,000 TDS (10%)

- Annual savings: ₹8,000

For example, if you are a US citizen, the applicable tax rate under the DTAA is 15%. Note that under Section 90(4) of the Income Tax Act, 1961, you have to provide a Tax Residency Certificate (TRC) containing prescribed details issued by the government authority of the country in which you reside, to avail of benefits under DTAA.

👉 Tip: The earlier you submit DTAA documents, the more you save. Benefits apply from the date of submission.

Required Documents and Practical Tips

Core Documents Needed

1. Tax Residency Certificate (TRC)

- Issued by your resident country's tax authority

- Must be in English (or translated)

- Valid for specific financial year

- Contains your tax residency status

2. Form 10F

- Self-declaration form filed electronically

- Supplements TRC information

- Mandatory since July 2022

- Must be filed before claiming benefits

3. PAN Card

- Essential for all Indian tax matters

- Must be linked to Aadhaar

- Higher TDS if not provided

4. Bank Account Documents

- NRO account opening documents

- Know Your Customer (KYC) compliance

- Address proof in resident country

👉 Tip: Obtaining a TRC is a necessary step for NRIs who wish to avail benefits under DTAA on their NRO account's interest income. The process involves expensive paperwork, so it can only be financially advantageous for those with significant interest earnings.

Step-by-Step Documentation Process

Phase 1: Getting TRC (2-8 weeks)

Step 1: Contact your resident country's tax authority

- USA: IRS (Form 8802)

- UK: HMRC

- UAE: Federal Tax Authority

- Canada: Canada Revenue Agency

Step 2: Submit application with required documents

- Tax residency proof

- Income statements

- Application fee (varies by country)

Step 3: Receive TRC (usually 4-6 weeks)

Phase 2: Form 10F Filing (Same day)

Step 4: Log into Income Tax e-filing portal

Step 5: Navigate to "Services" > "Submit Form 10F"

Step 6: Fill form with TRC details

Step 7: Upload TRC document

Step 8: Submit electronically with digital signature

Phase 3: Bank Submission (7-15 days)

Step 9: Submit documents to your bank

- Original TRC + photocopy

- Form 10F acknowledgment

- Written request for DTAA rate application

Step 10: Bank verifies and updates their system

Step 11: Lower TDS applies from next interest payout

Common Documentation Mistakes

Mistake 1: Expired TRC

TRCs have a limited validity and apply to specific tax years, which vary across countries. Some countries follow a calendar year (January-December), while others follow a financial year (e.g., India: April-March).

Ensure your TRC covers the period for which you seek tax benefits.

Mistake 2: Submitting DTAA documents after interest pay-out

To get the benefit of a lower TDS at source, Form 10F and the TRC must be submitted to the bank before the interest is credited.

The bank needs your DTAA documents in its system before it pays out the interest. This is a hard, internal cut-off date, usually a few weeks before the end of each quarter.

Also don't be confused, the Income Tax Return due date (typically July 31st) is for claiming a refund if higher tax has already been deducted.

Mistake 3: Incomplete TRC information

If the TRC is issued in the local language of the resident country, it is advisable to have an English-translated version of the TRC to claim the benefits.

Mistake 4: Wrong bank branch submission

Submit documents to the branch where your account is held, not just any branch.

Mistake 5: Missing annual renewals

TRC and Form 10F must be renewed annually.

Bank-Specific Procedures

ICICI Bank:

- Submit documents 15 days before interest pay-out

- Processing time: 7-10 working days

- Online DTAA form available

HDFC Bank:

- Dedicated NRI relationship manager assistance

- Document verification: 5-7 days

- SMS confirmation when DTAA rate applied

SBI:

- Submit to home branch only

- Processing time: 10-15 working days

- Email confirmation required

Axis Bank:

- Online document upload facility

- Faster processing: 3-5 days

- Real-time rate update in mobile app

👉 Tip: Call your bank's NRI helpline before submitting documents to understand their specific process and timelines.

Practical Implementation Tips

Timing Your Submissions

Best Practice Timeline:

- April-May: Renew TRC for new financial year

- June: File fresh Form 10F

- July: Submit to bank before Q1 interest pay-out

- Result: Full year of lower TDS

What NOT to do:

- Submit documents after interest has been credited

- Wait until tax filing season (March)

- Assume last year's documents still work

Multiple Bank Accounts

If you have FDs with multiple banks:

- Submit DTAA documents to each bank separately

- Maintain copies of all submissions

- Track which banks have applied reduced rates

- Follow up on delayed processing

Monitoring and Follow-up

Monthly checks:

- Verify TDS rate applied on interest credits

- Compare with previous period rates

- Raise queries immediately if higher rate applied

Annual review:

- Calculate total tax savings achieved

- Plan TRC renewal in advance

- Update any changed residential details

What If Your Bank Doesn't Cooperate?

Escalation process:

- Speak to NRI relationship manager

- Submit written complaint to branch manager

- Contact bank's customer care toll-free number

- File complaint with Banking Ombudsman

- Claim refund through ITR filing

Final Takeaway

DTAA can legally cut your NRI bank interest TDS from 30% to 10-15% - but only if you take action.

The process is straightforward:

- Get TRC from your resident country

- File Form 10F electronically

- Submit documents to your bank

- Enjoy 67% lower TDS

Most NRIs lose ₹20,000-50,000 annually simply because they don't know about this process.

But here's the bigger picture: Even with DTAA benefits, you're still paying 10-15% tax on interest income.

Smart alternative: Our GIFT City USD FDs offer completely tax-free returns. No TDS, no DTAA paperwork, no annual renewals.

Your action plan:

- Check if your country has DTAA with India

- Start TRC application process immediately

- Consider tax-free alternatives for future investments

Sometimes the best tax strategy is avoiding taxable investments altogether.

Download Belong App to explore tax-free USD FDs with 5.0% returns - no DTAA complications needed.

Disclaimer: DTAA benefits depend on specific treaty provisions and proper documentation. Tax laws change regularly. Always consult qualified tax professionals and verify current rates with your bank.

Comments

Your comment has been submitted