A Deep Dive into Alternative Investment Funds (AIFs) in GIFT City

Sophisticated, retail investors with high risk appetite and High Net Worth Individuals (HNIs) look beyond the traditional asset classes to diversify their wealth. The Alternative Investment Funds (AIFs) provide an avenue for these sophisticated investors to invest in new and emerging sectors. These investments carry high risk and high returns for the investors.

India’s Alternative Investment Funds (AIFs) industry is booming, with the market now at ~$400 billion and projected to quintuple to $2 trillion by 2034. GIFT City with its liberal structure under the Foreign Exchange Management Act (FEMA) has been conceptualised to attract HNIs, NRIs and resident Indians to invest in the fund ecosystem.

In this blog, we will look into GIFT City based AIFs, their categorisation and its advantages for NRI investors.

What Are Alternative Investment Funds (AIFs)?

Alternative Investment Funds (AIFs) are privately managed investment vehicles that pool capital from sophisticated or accredited investors (HNIs, institutions, etc.) into specific strategies. AIFs are typically of two types: open-ended and closed-ended.

The open-ended AIFs offer investors the flexibility to enter or quit the fund with specified lock-in periods. On the other hand, in close-ended AIFs, the fund does not allow the investors to withdraw their money before the fund matures.

AIFs are classified into three categories based on the nature of their investment strategy:

1. Category I AIFs

Category I AIFs focus on socially or economically desirable sectors (e.g. startups, infrastructure, SMEs). This includes venture capital funds (VCFs), angel funds, infrastructure funds and social venture funds.

2. Category II AIFs

Category II AIFs include private equity, debt, real estate, special situation funds and fund-of-funds that don’t fall under Category I or III.

3. Category III AIFs

Category III AIFs include hedge funds and aggressive strategies like long-short equity, market-neutral and derivatives-based investing. They aim to earn returns using tools like short-selling and leverage.

Other than this classification, there are two kinds of funds in GIFT City based on the destination of investment. These are the inbound funds and outbound funds. The inbound funds invest in the Indian markets and the outbound equities invest in international markets.

Why GIFT City Is a Game-Changer for AIFs

GIFT City’s IFSC offers a globally accepted framework that is reshaping fund management in India. Key benefits include:

1. Tax Benefits in GIFT City

There are no taxes at the investor level for GIFT City based AIFs. All categories (Category-1, Category-2 and Category-3) of the GIFT City funds are taxed at the fund level. The fund house pays taxes on the capital gains at their end based on the investment outcome and the NAV for the investor is net of the taxes paid by the fund. No further tax is payable by the investor at their end when they redeem their investments and transfer the gains to their account.

Category-3 AIFs that invest in Indian equity mutual funds (and not stocks directly) are given exemption from capital gains tax at the fund level too.

2. Seamless Global Onboarding and KYC

Investing through GIFT City-based AIFs comes with simplified onboarding and investor-friendly compliance. The KYC process is easy, streamlined under international standards, and does not require a PAN card for NRIs or foreign investors. Funds can be transferred directly from international bank accounts, and full repatriation of capital and returns is allowed, making cross-border investing hassle-free.

3. Easy Repatriation

Returns can be remitted globally in foreign currency. NRIs need not convert to INR or deal with domestic exchange controls. In contrast, onshore funds pay out in INR. In addition to this, denomination in international currencies protects the investors from INR depreciation.

4. Diversification and Scale

Investors can participate in schemes not available domestically (e.g. offshore hedge funds, exclusive VC deals or India-concentrated PE on an offshore footing). The big-ticket size and accreditation requirement ensure a highly professional investor base.

Who Can Invest in AIFs in GIFT City?

Resident Indians can invest in GIFT City AIFs under the Liberalised Remittance Scheme (LRS), with an annual limit of US$250,000, but only into funds investing abroad (outbound AIFs). Non-residents, including NRIs, OCIs, and foreign investors, face no such limits and can invest freely in foreign currency, making GIFT City AIFs highly accessible to global capital.

GIFT City AIF Minimum Investment

The minimum ticket size for investing in GIFT City AIFs is $150,000 but at the same time ticket size relaxation is offered for accredited investors and the minimum ticket size varies from fund to fund.

GIFT City AIFs: Mapping India in Global Investment Landscape

The trajectory is upward for GIFT City AIFs. The Indian government and IFSCA envision GIFT City as a global funds and markets centre.

At present 229 AIFs are registered in GIFT City with total committed capital of $15 billion. These funds have raised $8 billion and have invested $ 6 billion of the fund in India and abroad. 3000+ investors have invested in GIFT City AIFs. (ifsca.gov.in).

Looking ahead, GIFT City is rolling out more capabilities. Planned enhancements include broader digital infrastructure (e.g. faster onboarding/KYC), a dedicated fund services ecosystem, and extended tax treaties.

Foreign asset managers are increasingly launching branches in GIFT City, drawn by the regulatory clarity and India’s growth story. With continued policy support, IFSC AIFs are set to become India’s global fund vehicles, fuelling cross-border capital flows and strengthening India’s place in international finance.

| Also Read:

- GIFT City India

- Insurance in GIFT City - Understanding IIOs

- How Belong Helps NRIs Invest in GIFT City

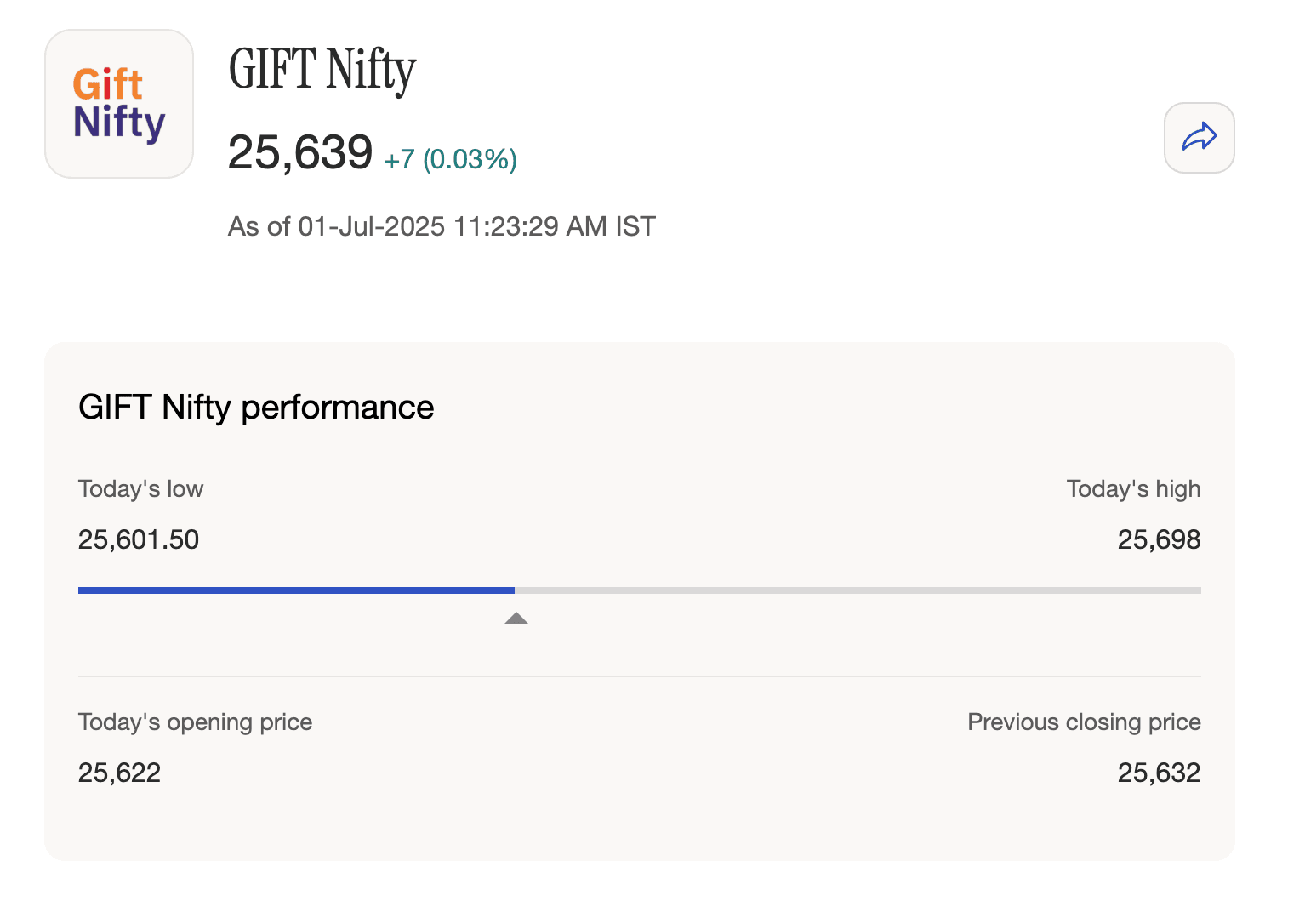

Check GIFT Nifty live (formerly SGX Nifty) with Belong's GIFT Nifty Tracker.

Comments

Your comment has been submitted