Everything You Need to Know About Banking in GIFT City IFSC

GIFT City (Gujarat International Finance Tech-City) is India’s first and one of its kind international financial services centres (IFSCs). This global technology and financial services hub located in Gandhinagar, Gujarat, is conceptualised with an aim to support India’s economy, promote sustainable development and attract global businesses to place the country at the top of the global map.

Several Indian and foreign banks are already operating in GIFT City under the regulatory framework of the International Financial Services Centres Authority (IFSCA). IFSCA has unified authority for the development and regulation of financial products, services and institutions in GIFT City in Gujarat, combining the powers of regulators like RBI, SEBI, PFRDA, and IRDAI.

What are IFSC Banks or IBUs?

IFSC banks or IBUs (International Banking Units) are specialised banking units of Indian and foreign banks that operate under the regulatory framework of IFSCA, GIFT City in Gujarat. These banking units offer offshore banking services to global customers like foreign currency accounts, foreign currency loans, corporate banking, trade finance and more.

GIFT City’s Special Economic Zone (SEZ) regulations provide a supportive business environment for the banks. These banks provide frictionless international financial services while having global regulatory standards.

Key Features of GIFT City Banks

The following are the key features of GIFT City banks:

1. Global banking products and services

IBUs or banks in GIFT City provide international banking services such as foreign currency accounts and deposits, ECB (external commercial borrowings) loans, trade finance, corporate banking, wealth management and more to global customers, including institutional investors, NRIs (non-resident Indians) and corporations.

2. Tax Incentives

GIFT City in Gujarat includes a special economic zone (GIFT City SEZ) that provides tax incentives to businesses and customers. The significant tax benefits offered to GIFT City banks include tax exemption on interest income, capital gains and goods and services tax exemption on IFSC exchange transactions. Also, transactions within the IBU are primarily in foreign currencies, minimising the need for frequent conversions of currencies.

3. International Regulatory Standards

International regulatory standards by IFSCA combine the regulatory powers of banking, capital markets, insurance, and other financial services operating within GIFT City. The combined regulatory powers of IFSCA ensure compliance, competitiveness and transparency. This makes it a favourable environment for businesses to operate with ease and efficiency.

Products and Services Offered by IBUs or GIFT City Banks?

GIFT City Banks offer a range of products and services catering to the needs of NRIs, Indian nationals (within the LRS limits), and non-NRIs.

1. Foreign Currency Accounts: GIFT City IBUs offer foreign currency-denominated accounts primarily in US Dollars. Some of the banks offer accounts in other international currencies like the Euro, Pound, Dirham, etc.

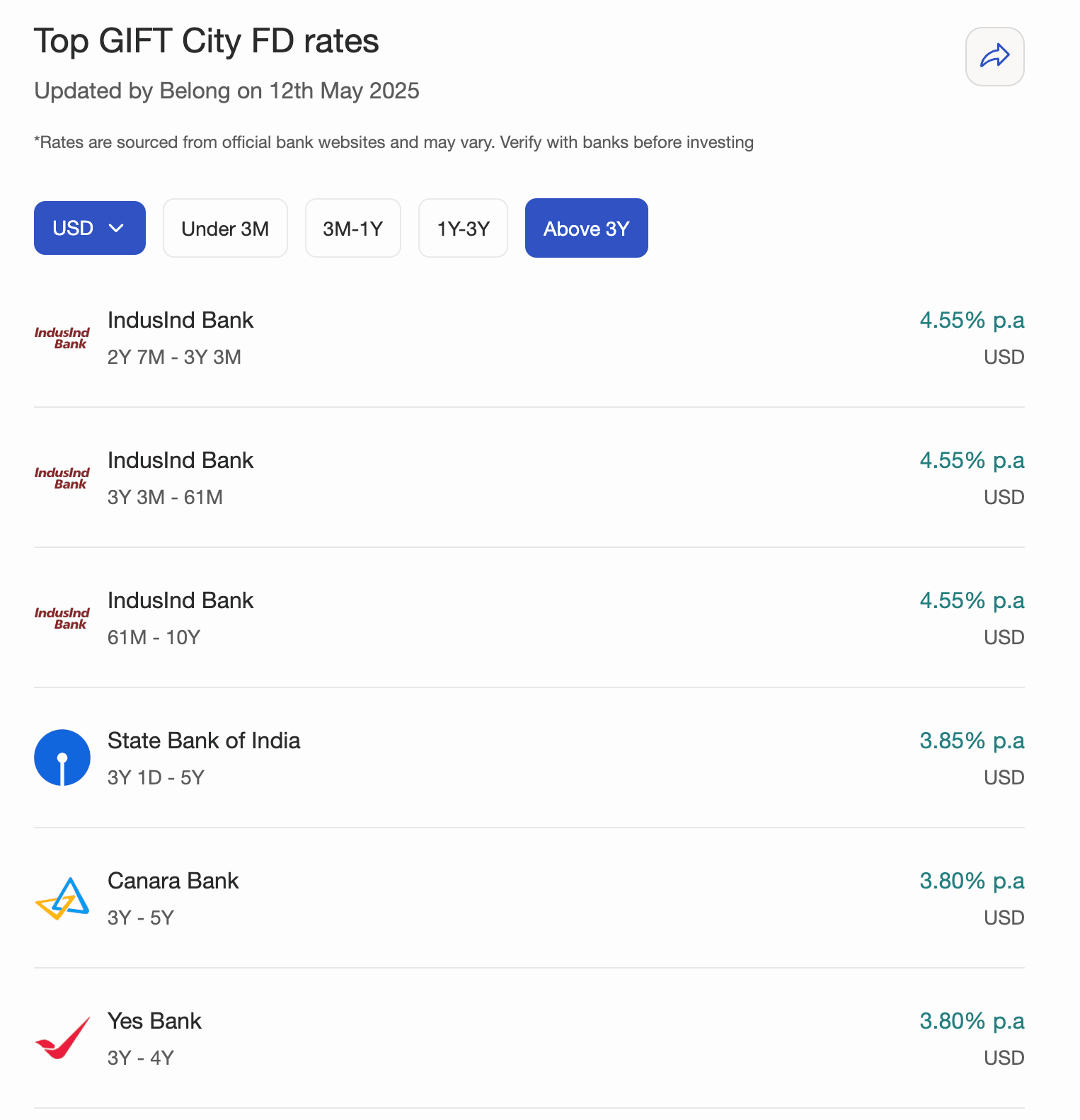

2. Foreign Currency Deposits: Banks in GIFT City offer foreign currency deposits from non-resident Indians, financial institutions and overseas corporations at a competitive interest rate.

3. Lending Products: Banks in GIFT City, Gandhinagar, offer loans such as ECBs, working capital finance, and project finance in foreign currencies.

4. Investment Products: IBUs offer a range of investment services, including advisory and portfolio management, to institutional and high-net-worth investors.

5. Trade and EXIM Services: Banks in GIFT City facilitate import and export transactions with financial instruments like bank guarantees, letters of credit and bill discounting for smooth global trade operations.

Learn why GIFT City is considered the future of India's financial ecosystem.

Advantages of Banking in GIFT City

GIFT City Banks carry some advantages for those banking with them:

Banks in GIFT City can engage in cross-border transactions, which enables global market access, and the strategic location acts as a bridge between Asian and Western financial markets.

Banking units operate under IFSCA and enjoy the benefit of a streamlined regulatory framework comparable to international standards.

Banking units operating out of GIFT City enjoy tax benefits such as a 10-year tax holiday and GST exemptions. This lowers their operation cost, making their services attractive to customers.

Holding assets in foreign currencies through GIFT city protects from the risk against domestic currency depreciation for those whose liabilities are also in foreign currency.

GIFT City Bank Account Opening Process and Features

How to Open an Account in a GIFT City Bank?

Once you identify the bank out of the GIFT City bank list, you need to follow a few simple steps to open an account:

Check on the eligibility criteria: You can visit the respective bank’s website to check on the eligibility criteria to open a GIFT City bank account. This applies to corporations and individuals (foreign citizens, NRIs and resident Indians ).

Get in touch with the bank: Reach out to the bank’s IBU via customer care, or website. You can leave your information on their website for them to get back to you and guide you through the process.

Application and document submission: You are required to submit the application form along with the relevant documents as listed by the respective bank. Individuals may need to submit a copy of their passport and visa along with overseas address proof, proof of income, etc. Corporates are required to submit FATCA annexures, board resolutions, a list of all directors with details, PAN, constitution documents (MOA, AOA, certificate of incorporation), and more.

The application will be scrutinised and processed in the bank’s IBU.

Tax Regulations for GIFT City Banks

Here are the tax benefits available for individuals and corporations

Tax Benefits For Individuals In Gift City |

|

Regulatory Compliance for GIFT City Bank Transactions

IFSCA regulations for banking transactions in GIFT City are aligned with global standards to promote cross-border financial activities. The regulations include:

IBUs can be established with a minimum capital requirement of USD 20 million, along with other prudential norms.

IBUs are restricted to dealing in foreign currencies for deposits, lending and other transactions. INR transactions are not permitted in general.

Periodic reporting of transactions to IFSCA and RBI

Strict adherence to compliance (KYC and Anti-Money Laundering) guidelines to prevent fraud.

Repatriation of Funds from GIFT City Banks

The repatriation process in the IBUs is governed by IFSCA, RBI and FEMA 1999 regulations. Guidelines include:

NRIs and entities operating in GIFT City can repatriate funds, and the transaction has to be conducted in freely convertible foreign currencies.

Earnings from deposits, investments, and profits from business operations in the GIFT City can be the source of repatriation.

The transactions must comply with FEMA and IFSCA regulations. The purpose and source of funds must be clearly disclosed.

Final Thoughts: Why NRIs Should Consider GIFT City Banks

GIFT City propels the vision of creating a financial service centre that provides a competitive environment for international banks and other financial services companies to operate out of India. The international regulatory framework, IFSCA, tax incentives, and other benefits make it a strategic gateway for global investors to be a part of the Indian growth story.

Comments

Your comment has been submitted