GIFT City Funds - Investment Opportunities for NRIs

The regulatory framework of GIFT City as a Special Economic Zone (SEZ) supports the set-up of various entities offering financial services. Among the financial entities available in GIFT City are Alternative Investment Funds (AIFs), mutual funds, venture capital funds and portfolio management services, etc. These funds provide access to alternative investment opportunities that are not available through stocks, bonds or mutual funds.

What are GIFT City Funds?

GIFT City funds are funds such as AIFs, mutual funds and venture capital funds operating out of GIFT City.

At the time of writing this, all the GIFT City funds are under an AIF structure with a minimum investment of USD 150,000. These funds are designed to attract foreign and domestic investors to India. They give investors access to global markets and investment options in international currencies while leveraging the benefits of regulatory frameworks and tax advantages.

Learn why GIFT City in India stands out as a world-class financial and tech destination.

Features of GIFT City Funds

The following are the features of GIFT City funds:

Global Regulations

A regulatory body called the International Financial Services Centre Authority (IFSCA) under the government of India has been formulated to oversee all the financial activities in GIFT City. IFSCA combines the regulatory powers of the RBI, SEBI, PFRDA and IRDA. IFSCA's rules are designed to meet international standards, making it easier and more flexible for global investors to participate.

Global Market Exposure

The regulatory guidelines for GIFT City funds permit investments in global and Indian securities and assets without any limitations. This lets the investors engage in offshore fund management.

Currency Flexibility

Most of the GIFT City funds are USD-denominated, which makes it easy for international investors to invest in the funds.

Tax Incentives

These investment funds come under the jurisdiction of GIFT City SEZ and benefit both fund management entities and investors. Cat-3 AIFs (funds) investing in India-based mutual funds (not equities) are exempt from income tax.

| Also Read:

Types of GIFT City Funds

GIFT City mainly offers investment funds in two categories:

Alternative Investment Funds (AIFs)

AIFs offer greater flexibility to individual and institutional investors in investment strategies in comparison to mutual funds. AIFs enable them to invest in real estate, private equity, start-ups, hedge funds and other alternative assets with the potential for significant returns. Here are the various types of AIFs available in GIFT City:

Category I: Funds in this category invest in start-ups, early-stage ventures, social ventures, SME funds, and infrastructure funds.

Category II: Funds in this category invest in private equity and debt funds.

Category III: Funds in this category invest in hedge funds (funds that trade to make short-term gains), open-ended funds and funds that do not have any special incentives or discounts.

Other than this classification, there is a classification based on the destination of investment:

- India-focused equity funds: They are also referred to as inbound funds, which invest in Indian equities.

- Global focused equity funds: Also referred to as outbound funds that invest in global equities. The limit for investment here for resident Indians comes under the Liberalised Remittance Scheme.

GIFT City Funds List:

GIFT City hosts a growing number of registered fund management entities offering AIF and PMS services to global investors. Here is the list of registered fund management entities with IFSCA.

Portfolio Management Services (PMS)

PMS in GIFT City offers professional management of investment portfolios to high-net-worth individuals and institutions. A dedicated fund manager actively manages these portfolios across various asset classes, aiming to achieve specific investment objectives. Several types of PMS are available:

- Discretionary PMS: In this type, the fund manager has full authority to make investment decisions on behalf of the client based on the agreed-upon investment mandate. The client gives the portfolio manager full control over investment decisions.

- Non-Discretionary PMS: Here, the portfolio manager provides investment recommendations to the client, who retains the final decision-making power. The manager executes trades only after receiving explicit approval from the client.

- Focused/Concentrated PMS: This strategy involves investing in a limited number of carefully selected stocks or assets based on strong conviction and thorough research. This approach maximises returns but may also carry higher risk due to less diversification.

- Advisory PMS: In an advisory PMS, the portfolio manager provides personalised investment advice and creates a tailored investment strategy and asset allocation plan for the client. The client is then responsible for implementing the recommendations and making the actual investment decisions. This is similar to non-discretionary, but the level of ongoing support and customisation might differ.

Benefits of GIFT City Funds

The following are the key benefits of GIFT City funds:

Diversified Global Portfolio

AIFs and PMS in the ecosystem can leverage the benefits of SEZ GIFT City and explore a wide array of investment avenues and opportunities to invest in various real estate, infrastructure projects and more. This helps investors create diverse global portfolios.

Compare GIFT City FD vs FCNR Deposit vs NRO FD vs NRE FD to choose the best option for your savings.

Tax Benefits

GIFT City funds get the array of tax benefits offered in the special economic zone. This includes a 10-year tax holiday for fund managers. Investors enjoy the benefits of capital gain tax exemption in specified funds (such as Category III AIFs investing in Indian equity mutual funds), interest income exemption, and more. The income earned by non-resident investors from offshore investments made through GIFT City AIFs is not subject to taxation in India.

Regulatory Advantages

The rules and regulations set by IFSCA are designed to be similar to those used in other major financial centres around the world. It offers transparency, security and ease of entry for both the global investors and the fund managers.

Entities operating out of GIFT City can use a basket of 15 different currencies to accept investments. This enhances global connectivity and promotes cross-border investments. GIFT City funds for NRIs offer various benefits. NRIs and OCIs can directly invest in GIFT City funds from their foreign bank accounts without needing to open one at GIFT City.

They can invest in GIFT City funds after converting their resident country’s currency to USD. in the currency of their resident country. They can invest directly through asset management companies or through banks and financial advisors.

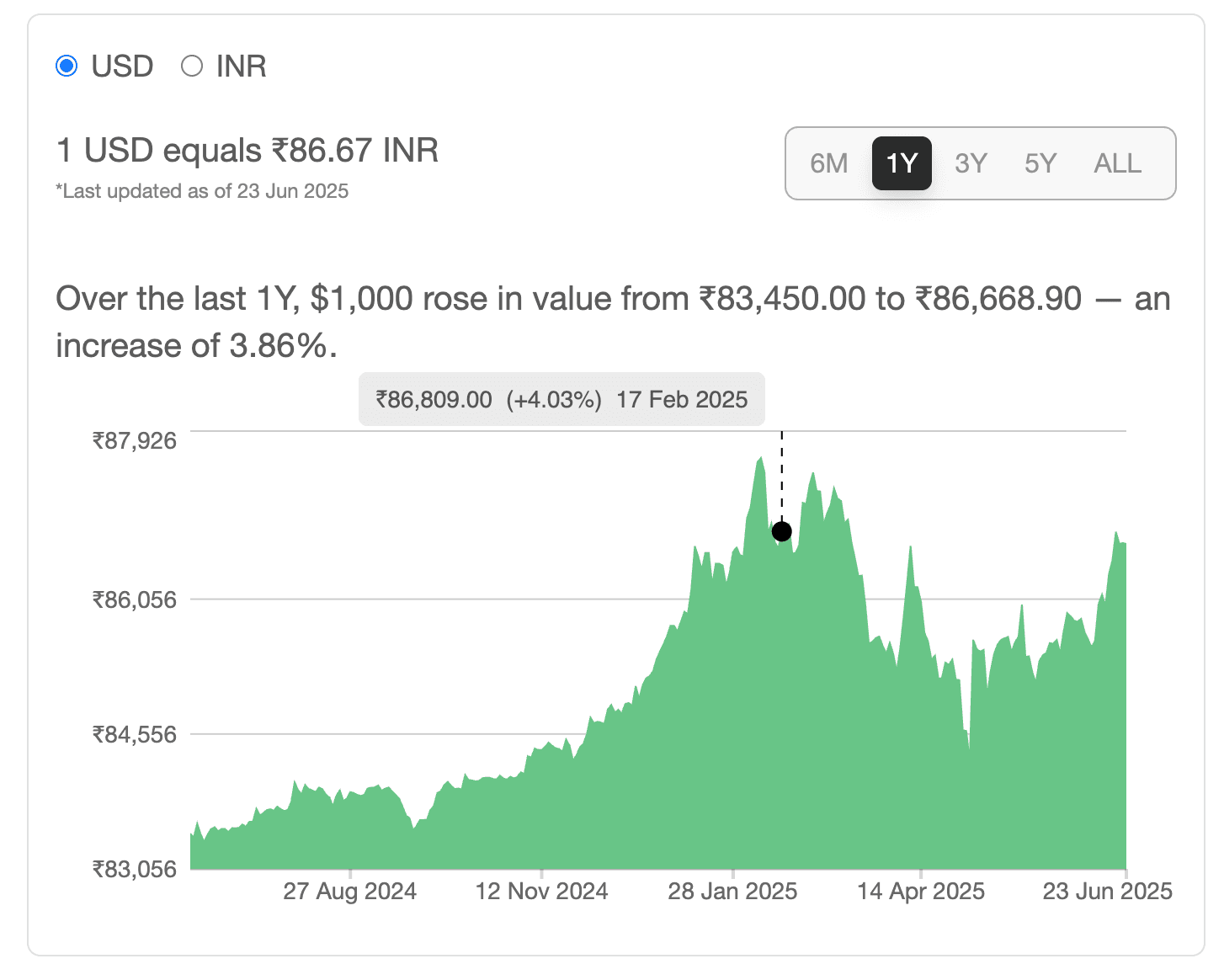

INR has been depreciating against USD by 13% in the last five years. Find out how INR is performing against USD using Belong's USD vs INR Tracker

AIFs in GIFT City: An Avenue for NRI Investors

To conclude, GIFT City funds offer diverse investment opportunities through PMS and AIFs to global investors, including NRIs, foreign investors and institutional investors. Investments can benefit from a tax incentive, a favourable regulatory environment, currency flexibility and global market exposure. GIFT City’s world-class infrastructure, cost efficiency, and operational ease for fund managers make it an attractive option for global investors to invest in India’s growing economy.

Other GIFT City Related Blogs

- How to invest in GIFT City

- GIFT City IT Companies

- GIFT City Club Membership

- GIFT City SEZ

- GIFT City Banks

Comments

Your comment has been submitted