GIFT City Tax Benefits For NRIs - Complete Guide for 2025

GIFT City (Gujarat International Finance Tec-City), located between Ahmedabad and Gandhinagar in Gujarat, is India's first international financial services centre (IFSC).

GIFT City has been conceptualised with the primary objective of attracting foreign capital into India, especially from NRIs, and to become a global financial centre like Singapore or Dubai.

As of 2025, over 750+ entities operate here, including major banks, insurance providers, stock exchanges, and fintech startups.

GIFT City provides a comprehensive suite of financial products and services specifically designed to cater to the needs of NRIs. These financial products offer significant advantages in terms of currency protection, tax efficiency, and global accessibility.

In this blog, we will look into the tax benefits available through different financial products in GIFT City.

Regulatory Structure in GIFT City

FEMA and Offshore Treatment

The Foreign Exchange Management Act (FEMA) governs the banking and financial transactions for NRIs in India. FEMA treats GIFT City entities (banks, fund houses, etc.) as “non-resident”. This means that the financial transactions taking place in GIFT City are considered to be offshore in nature, even though they’re happening within India’s borders.

This design is especially useful for NRIs and global investors who want to access India's economy via an offshore structure that is completely regulated. This makes GIFT City a simplified and liberal investment channel.

GIFT City has certain advantages which are not available when the NRI invests directly in Indian financial products. NRIs can invest in GIFT City’s financial products in 15 different international currencies, without any NRE/NRO account, PAN Card, and with tax benefits across products.

Regulatory Oversight by IFSCA

All the activities in GIFT City are regulated by the International Financial Services Centres Authority (IFSCA) that combines the regulatory powers of the RBI, SEBI, PFRDA, and IRDA under one roof.

Tax Incentives for NRIs & Foreign Investors

GIFT City offers various financial products for NRIs and foreign investors to invest in India. They include fixed deposits, Alternative Investment Funds (AIFs), international stock exchanges, insurance products and bonds. Gains/income from many of these products are exempt from any taxation in GIFT City and India and are only taxable in the investor’s country of residence, thereby reducing the burden of double taxation on investors. Additionally, all DTAAs signed by India with other countries also apply to income from GIFT City products.

Fixed Deposits in GIFT City

The banking ecosystem in GIFT City is built on International Banking Units (IBUs). They are branches of Indian and foreign banks in GIFT City, regulated by IFSCA. As of 2025, there are 30 operational IBUs, including prominent Indian banks (State Bank of India, ICICI, HDFC, RBL Bank) and international institutions (Citibank, HSBC, Bank of America).

The IBUs offer fixed deposits in USD and multiple other foreign currencies. The interest earned from these deposits are tax-free in India, and there is no tax deducted at source (TDS) as well. The interest is taxable only in the investor's country of residence.

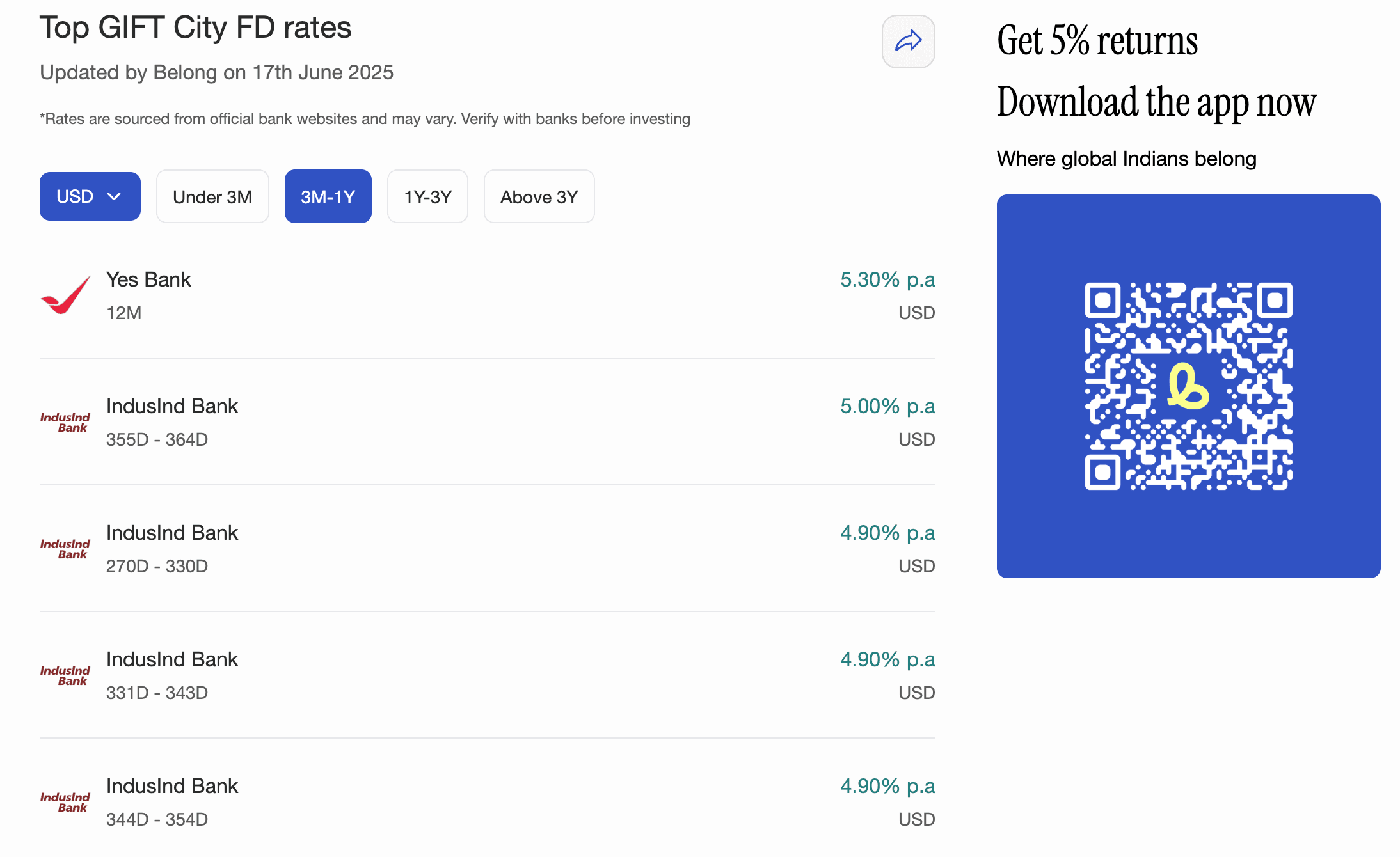

You can also compare GIFT City USD FD rates using Belong's NRI FD Comparison tool

Alternative Investment Funds (AIFs) in GIFT City

Alternative Investment Funds (AIFs) pool money from sophisticated and high-net-worth investors. They invest this money in less liquid assets, like private equity, venture capital, distressed assets or in complex trading strategies. At present, there are about 200 AIFs registered in GIFT City managing billions of dollars worth of funds, including NRIs.

There are two kinds of AIFs in GIFT City: Inbound funds and Outbound funds. The inbound funds invest in Indian equities, and the outbound funds invest in foreign equities.

AIFs (category 1,2 and 3) in GIFT City are taxed at the fund level based on investment outcome and NAV. The investor does not pay any tax on their end when they redeem their investments.

Category-3 AIFs that invest in Indian equity mutual funds (not stocks directly) are fully exempt from capital gains tax in India and are only taxable in the investor’s country of residence.

International Stock Exchanges in GIFT City

GIFT City hosts two international stock exchanges: NSE International Exchange (a subsidiary of the National Stock Exchange) and India INX (a subsidiary of the Bombay Stock Exchange).

NSE IX offers trading in GIFT Nifty derivatives and top 50 US stocks, giving Indian investors access to companies like Apple, Amazon and Tesla for non-US and Canada-based NRIs.

India INX offers derivative trading on the Bombay Stock Exchange’s indices like the Sensex and India 50.

There is no capital gains tax on the profits from derivatives trading on both of these exchanges. There is also no securities transaction tax, no stamp duty or GST on these trades.

Insurance in GIFT City

The insurance sector in GIFT City has been growing over the past few years. Insurance policies are USD-denominated and offer global coverage.

There is a wide range of insurance products available, like term insurance, health insurance, investment products like ULIPs and endowment plans available out of GIFT City.

The maturity amount from ULIPs and endowment plans is tax-free in India if the premium amount is not more than 10% of the sum assured.

Bonds in GIFT City

GIFT City bonds are listed in two of the international exchanges, i.e., NSE IX and India INX. The bonds available in GIFT City exchanges are foreign currency bonds, ESG bonds, and Masala Bonds.

ESG and foreign currency bonds are denominated in international currencies like USD, SGD, JPY etc. Masala bonds are denominated in INR.

Indian entities like ICICI bank, Shriram Finance, Adani Ports etc. have issued their USD and INR denominated bonds in the GIFT City exchanges. ESG bonds allow investors to fund initiatives that finance social and environmental projects.

Interest income on bonds issued after July 1, 2023, is taxed at 9%. Interest income for bonds issued after 1st April 2020 and before 1st July 2023 is taxed at 4%.

There is no tax on capital gains from selling bonds on the exchanges.

GIFT City: An Emerging Financial Hub for NRIs

GIFT City has been conceptualised to compete with international offshore financial centres like Singapore, Dubai, Hong Kong, etc. GIFT City products, with their tax benefits, international currency denomination, and easy repatriation, offer a compelling case for NRIs wanting to be a part of India's growth story.

| Also Read

Comments

Your comment has been submitted