As an investment advisor working with NRIs for over 12 years, I've noticed a recurring pattern.

Most non-resident Indians face the same fundamental challenge: finding safe, tax-efficient investment options that offer better returns than what's available in their country of residence.

Consider the mathematics. If you're an NRI in the UAE earning 2-3% on bank deposits, or in the US getting 4-5% on savings accounts, you're essentially losing money to inflation.

Meanwhile, Indian government bonds currently offer 8.05% annual returns with sovereign guarantee – a compelling proposition for risk-averse investors.

Yet, despite this obvious opportunity, many NRIs avoid bond investments due to perceived complexity around taxation, FEMA regulations, and the investment process itself.

The result?

Millions of dollars sitting in low-yield foreign accounts when they could be generating substantially higher returns in India.

This comprehensive guide addresses every aspect of bond investing for NRIs – from understanding different bond types and regulatory requirements to managing taxation and optimizing returns.

Whether you're a first-time bond investor or looking to expand your fixed-income portfolio, you'll find actionable strategies tailored specifically for non-resident Indians.

By the end of this article, you'll have a clear roadmap to start building a bond portfolio that balances safety, returns, and tax efficiency while staying fully compliant with Indian regulations.

What Are Bonds and Why Should NRIs Care?

Think of a bond as an IOU. When you buy a government bond, you're essentially lending money to the Indian government.

In return, they promise to pay you interest regularly and return your principal after a fixed period.

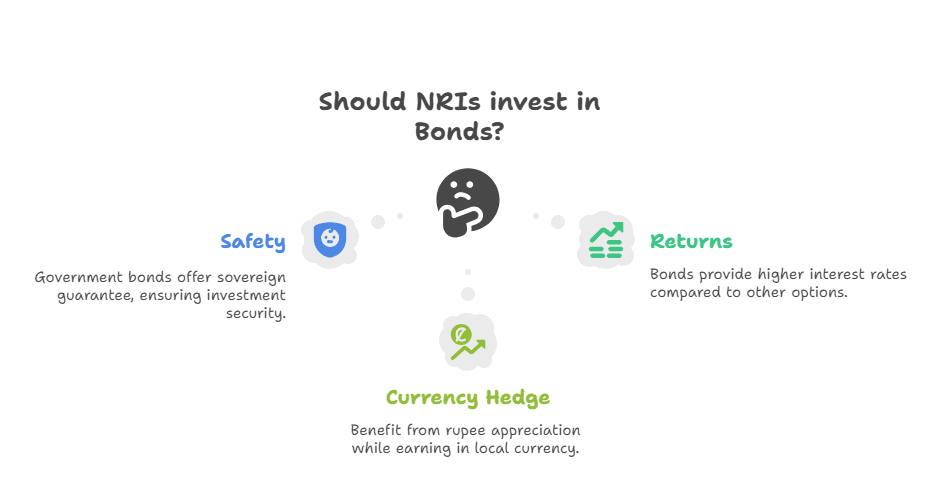

For NRIs, bonds offer three key advantages:

Safety First: Government bonds carry sovereign guarantee. Unlike fixed deposits that depend on bank stability, government bonds are backed by the full faith of the Indian government.

Predictable Returns: Current RBI Floating Rate Bonds offer 8.05% annual interest, paid every six months. Compare this to UAE banks giving 2-3% or US savings accounts barely touching 4%.

Currency Hedge: When you invest from abroad, you benefit from rupee appreciation potential while earning in local currency.

👉 Tip: If you're earning in USD, EUR, or AED, converting during favourable exchange rates can boost your effective returns significantly.

Types of Bonds NRIs Can Invest In

Not all bonds are available to NRIs, but you still have solid options. Here's what you can actually invest in:

Government Bonds (G-Secs)

These are issued by the central government and carry zero default risk. You can access them through RBI's Retail Direct platform.

Examples:

Treasury Bills (91, 182, 364 days)

Government Securities (5-40 year tenure)

RBI Floating Rate Savings Bonds (8.05% current rate)

PSU Bonds

Public Sector Undertaking bonds are issued by government companies where the state holds at least 51% stake. Think NTPC, IRFC, or NHAI bonds.

Safety Level: High (government backing) Typical Returns: 7-9% annually Tenure: Usually 10-15 years

Tax-Free Bonds

These bonds offer tax-free interest income, making them attractive for high-income NRIs. However, the government hasn't issued new tax-free bonds since 2016, so you can only buy existing ones in secondary markets.

Infrastructure Bonds

Issued by entities like NHAI or Rural Electrification Corporation for infrastructure projects.

Special Benefit: Under Section 54EC, if you invest up to ₹50 lakh in infrastructure bonds within 6 months of selling property, you can claim exemption on long-term capital gains tax.

Comparison Table: Bond Types for NRIs

Bond Type | Risk Level | Typical Returns | Min Investment | Tenure |

Government Bonds | Lowest | 6-8.5% | ₹10,000 | 91 days - 40 years |

PSU Bonds | Very Low | 7-9% | ₹10,000 | 10-15 years |

Tax-Free Bonds | Low | 4-6% (tax-free) | ₹10,000 | 10-20 years |

Infrastructure Bonds | Low | 7-8.5% | ₹10,000 | 10-15 years |

👉 Tip: Start with government bonds if you're new to bond investing. They offer the perfect balance of safety and returns.

Rules and Regulations for NRIs

Before you invest, understand what FEMA and RBI allow:

What You CAN Invest In

NRIs can invest in government securities, PSU bonds, NCDs, and infrastructure bonds. You can invest on both repatriable (through NRE account) and non-repatriable basis (through NRO account).

What You CANNOT Invest In

NRIs cannot invest in bonds issued by private sector companies. You're also not eligible for RBI's Floating Rate Savings Bonds (the 8.05% ones) - these are only for resident Indians.

Account Requirements

You'll need either:

NRE Account: For repatriable investments (can take money back abroad)

NRO Account: For non-repatriable investments (limited repatriation)

FEMA Compliance

Under the Fully Accessible Route introduced by RBI, NRIs can invest in specified government bonds without any investment ceiling limit.

How to Actually Invest: Step-by-Step Process

Here's exactly how Rajesh invested from Dubai, and how you can do it too:

Step 1: Open Required Accounts

For Government Bonds:

Open an NRE or NRO account with any Indian bank

Register on RBI Retail Direct

Complete your KYC online using Aadhaar OTP

For PSU/Corporate Bonds:

Open a Demat account with brokers like Zerodha, ICICI Direct, or HDFC Securities

Link it to your NRE/NRO bank account

Complete additional KYC for trading

Step 2: Choose Your Investment Platform

Option A: RBI Retail Direct (For Government Bonds)

No charges for account opening or maintenance

Direct access to government securities

Primary and secondary market trading

Option B: Online Brokers (For All Bond Types)

Platforms like Zerodha, GoldenPi, or WintWealth

Access to PSU bonds, NCDs, and secondary market

May charge brokerage fees

Step 3: Fund Your Investment

Transfer money from your overseas account to your Indian NRE/NRO account. NRE accounts allow you to deposit foreign currency, while NRO accounts are for rupee deposits from Indian income sources.

Step 4: Select and Purchase Bonds

For Primary Issues:

Watch for new bond announcements

Apply during the issue period

Bonds are allotted and credited to your account

For Secondary Market:

Browse available bonds on your platform

Check credit ratings (look for AAA-rated bonds)

Place buy orders like you would for stocks

Step 5: Track Your Investment

Monitor interest payments (usually semi-annual) and keep records for tax filing.

👉 Tip: Set up automatic sweep from your NRE/NRO account to reinvest interest payments for compound growth.

Taxation for NRIs on Bonds

This is where it gets technical, but stay with me – understanding taxation can save you thousands.

Interest Income Taxation

Interest from bonds is taxable in India for NRIs, with TDS deducted at source. Here's how it works:

Standard TDS Rates:

Regular Bonds: 30% TDS on interest income

Tax-Free Bonds: Interest is tax-free, but TDS may still apply for NRIs

DTAA Benefits

If your country has a Double Taxation Avoidance Agreement with India, you can benefit from reduced TDS rates:

Example for UAE NRIs:

Standard TDS: 30%

Under India-UAE DTAA: Potentially reduced to 12.5% for certain types of interest

You need to submit Form 10F for treaty benefits

Example for US NRIs: Under India-US DTAA, interest income may be taxed at reduced rates, and you can claim credit for taxes paid in India when filing US returns.

Capital Gains on Bond Sales

If you sell bonds before maturity in secondary market:

Short-term gains (held < 36 months): Taxed at slab rates (up to 30%)

Long-term gains (held > 36 months): 12.5% without indexation (new rates from July 2024)

Tax-Saving Strategy Table

Income Type | Standard Rate | DTAA Rate (varies by country) | Tax-Saving Tip |

Bond Interest | 30% TDS | 10-25% (depending on treaty) | Submit Form 10F |

Capital Gains (LTCG) | 12.5% | Same | Hold for >36 months |

Tax-Free Bond Interest | 0% (but TDS may apply) | 0% | Best for high-income NRIs |

👉 Tip: Always check your country's DTAA with India. Countries like Singapore and Mauritius have particularly favourable tax treaties.

Risks and Things to Watch Out For

Bonds aren't completely risk-free. Here's what to consider:

Interest Rate Risk

When interest rates rise, bond prices fall. If you need to sell before maturity, you might get less than what you paid.

Example: You bought a 10-year bond at 7% interest. If new bonds are issued at 9%, your bond's market value will drop.

Credit Risk

While PSU bonds have government backing and rarely default, corporate bonds carry higher risk. Always check credit ratings:

AAA: Highest safety

AA: High safety

Below A: Higher risk, avoid unless you understand implications

Liquidity Risk

Some bonds might be hard to sell quickly in secondary markets, especially during volatile periods.

Currency Risk

If you're planning to repatriate funds, rupee depreciation can impact your returns when converted back to foreign currency.

Final Tips for NRI Bond Investors

After helping dozens of NRIs like Rajesh build their bond portfolios, here are my top recommendations:

Start Small and Diversify

Don't put all your money in one bond type. Mix government securities with PSU bonds for optimal risk-return balance.

Match Investment Horizon with Bond Tenure

Short-term goals (1-3 years): Treasury Bills or short-term government bonds Medium-term goals (5-10 years): PSU bonds or government securities Long-term goals (10+ years): Infrastructure bonds or longer-tenure government securities

Consider Tax Efficiency

For high-income NRIs, tax-free bonds in secondary markets might offer better post-tax returns despite lower gross yields.

Keep Documentation Ready

Maintain records for:

TDS certificates

Investment confirmations

DTAA claims

Annual interest statements

Review Regularly

Bond portfolios need annual review to:

Reinvest matured bonds

Rebalance based on interest rate changes

Optimize for tax efficiency

👉 Tip: Set calendar reminders for bond maturity dates. Planning 3-6 months ahead helps you decide whether to reinvest or diversify into other instruments.

Your Next Steps

Bond investing doesn't have to be complicated. Start with these actions:

This Week: Open an NRE account if you don't have one

Next Week: Register on RBI Retail Direct or choose a broker platform

This Month: Make your first government bond investment with ₹50,000-1 lakh

Remember, every month you delay is money not earning those 7-8% returns while sitting in low-interest foreign accounts.

If you found this guide helpful, download our NRI Investment Calculator to compare returns across different bond types and plan your portfolio allocation.

Ready to start your bond investment journey? Join our WhatsApp community of 2,000+ NRIs sharing investment experiences and get expert advice on your specific situation.

Disclaimer: This article is for educational purposes only and should not be considered as personalized investment advice. Please consult with a qualified financial advisor before making investment decisions. Bond investments are subject to market risks including interest rate and credit risk.

Sources:

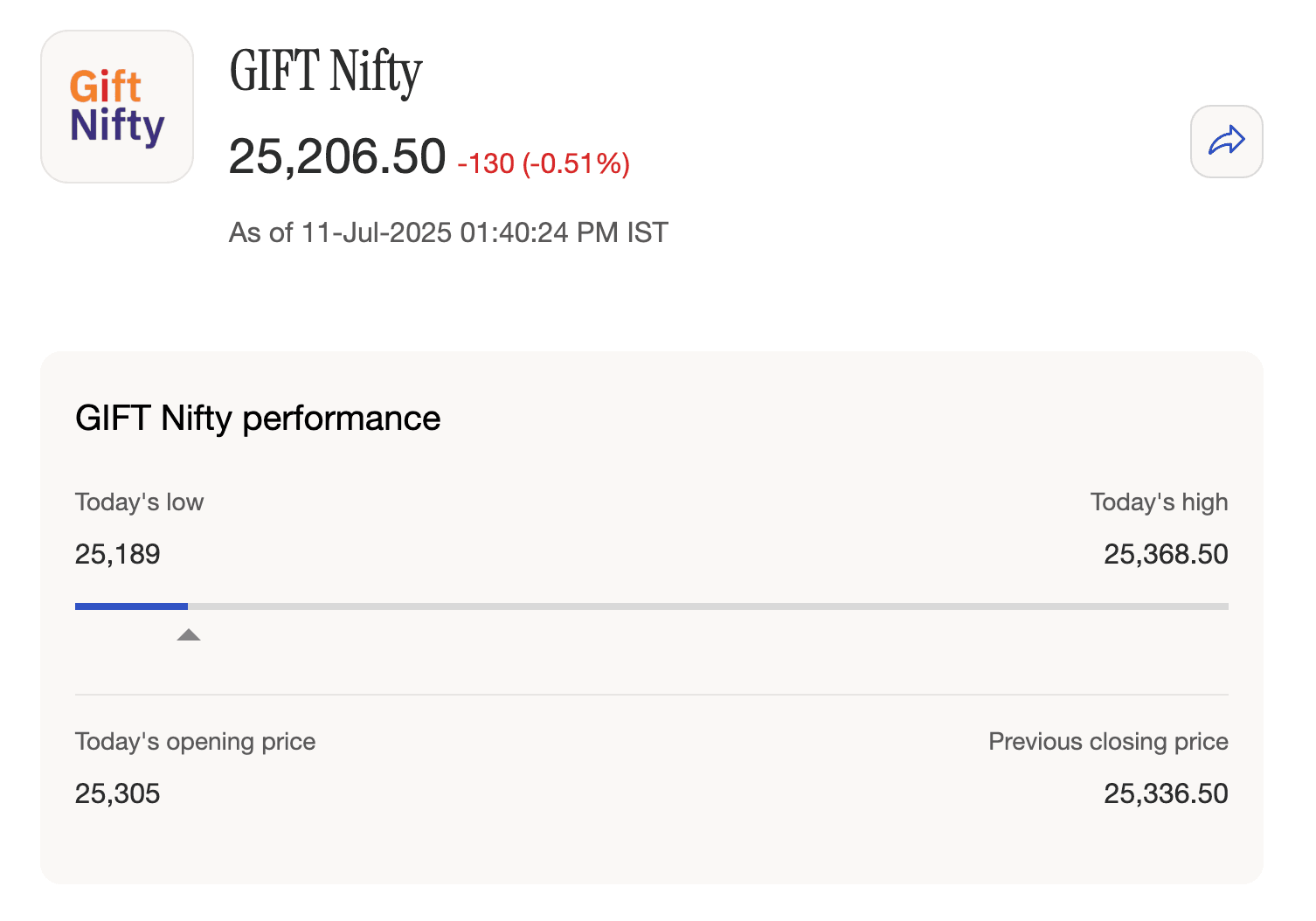

Track GIFT Nifty live (formerly SGX Nifty) price using Belong's GIFT Nifty Live Tracker