10 Banks Offering the Highest FCNR Deposit Rates

You're sitting in Dubai, watching your salary hit your UAE bank account every month in dirhams. You know you should be saving for the future-maybe a house back home, your kids' education, or retirement.

But here's the question that keeps coming up: "Should I keep my savings in AED, convert to INR, or is there a smarter way?"

At Belong, we work with thousands of NRIs who ask us this exact question every week. And one option that keeps coming up-especially for those worried about rupee volatility-is the FCNR deposit.

It lets you save in foreign currency (USD, GBP, EUR, etc.), earn guaranteed returns, and stay protected from rupee depreciation. All while keeping your money in an Indian bank.

This guide covers everything: what FCNR deposits are, how they compare to NRE and NRO fixed deposits, which banks offer the best rates in 2025, tax rules, repatriation, risks, and whether FCNR is right for you.

By the end, you'll know exactly where to park your foreign currency savings.

What is an FCNR Deposit? (And Why NRIs Should Care)

FCNR stands for Foreign Currency Non-Resident. It's a fixed deposit account where you deposit foreign currency (like USD, EUR, GBP, AUD, CAD, or JPY) into an Indian bank.

The bank holds your money in that same foreign currency for a fixed tenure (1-5 years) and pays you interest in that currency.

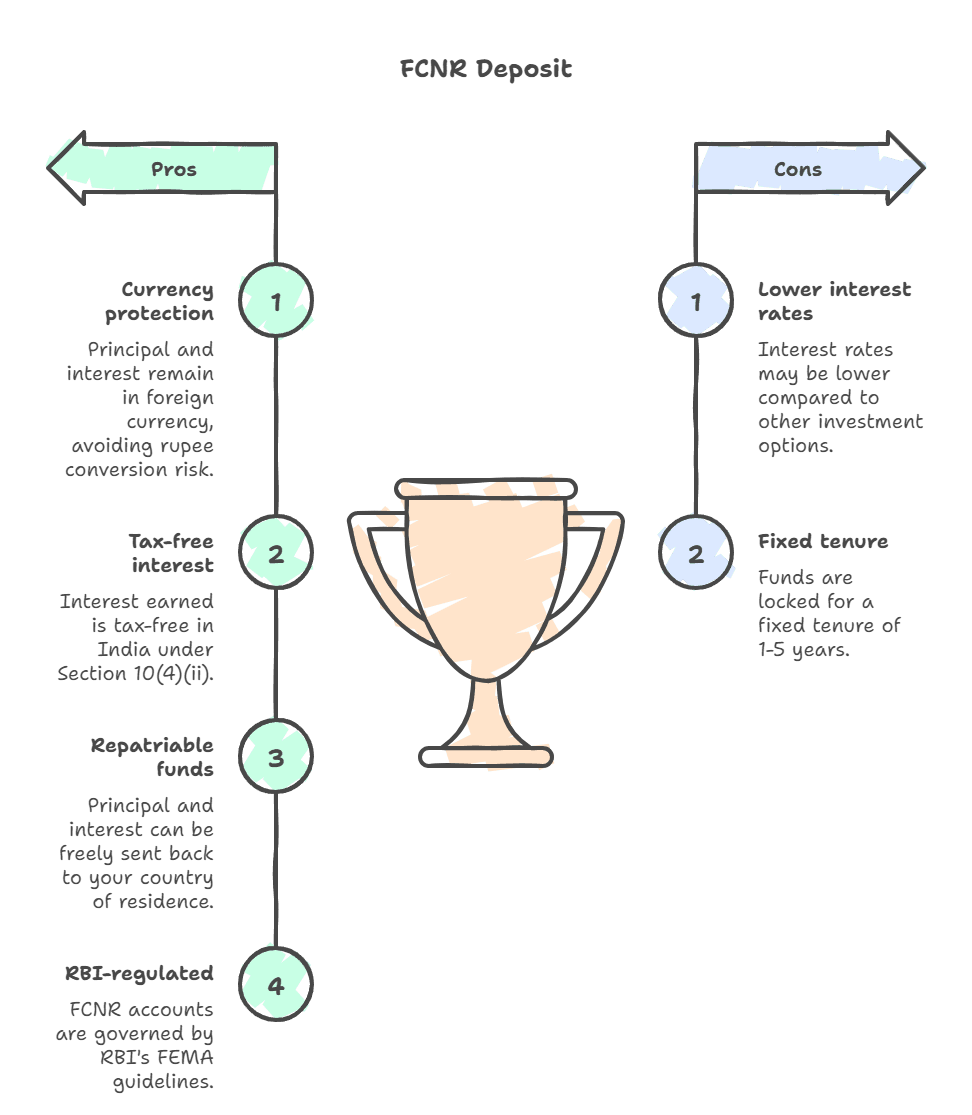

Key features:

- Currency protection: Your principal and interest remain in foreign currency. No rupee conversion risk.

- Tax-free: Interest earned is completely tax-free in India under Section 10(4)(ii) of the Income Tax Act (source).

- Repatriable: Both principal and interest can be freely sent back to your country of residence.

- RBI-regulated: All FCNR accounts are governed by the Reserve Bank of India's FEMA guidelines (source).

Who can open an FCNR account?

Only Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs). Resident Indians and OCIs cannot open FCNR accounts.

Why it matters: If you're living in the UAE and earning in AED/USD, you can deposit USD into an FCNR account and avoid the risk that tomorrow the rupee crashes from ₹83 to ₹95 per dollar. Your savings stay in dollars.

👉 Tip:Not sure of your residential status? Use Belong's Residential Status Calculator to confirm if you qualify as an NRI.

How FCNR is Different from NRE and NRO Fixed Deposits

NRIs often confuse FCNR with NRE and NRO accounts. Here's the breakdown:

Feature | FCNR FD | NRE FD | NRO FD |

|---|---|---|---|

Currency | Foreign (USD, GBP, EUR, etc.) | INR (converted from foreign currency) | INR (from India income or foreign) |

Tax on Interest | Tax-free | Tax-free | Taxable at slab rates; 30% TDS |

Repatriation | Fully repatriable (principal + interest) | Fully repatriable | Principal repatriable up to USD 1M/year; interest after tax |

Exchange Rate Risk | None (stays in foreign currency) | Yes (rupee fluctuation affects value) | Yes |

Tenure | 1-5 years | 7 days-10 years | 7 days-10 years |

Best For | NRIs wanting currency hedge | NRIs wanting INR returns without tax | NRIs with India-sourced income |

Example:

You deposit $10,000 into an FCNR account at 3.5% for 3 years. After maturity, you get $11,088 (approx.) back in USD. Even if the rupee falls from ₹83 to ₹90, your dollars are safe.

If you had put the same $10,000 into an NRE FD (converted to ₹8,30,000), and the rupee fell to ₹90, your maturity value in dollars would drop to $9,222-a loss of $778.

Source:RBI FEMA Guidelines, Income Tax Act Section 10(4)(ii).

Also Read -NRE vs NRO vs FCNR

Why Are FCNR Rates Lower Than NRE/NRO Rates?

FCNR deposit rates are typically 2-4%, while NRE/NRO FD rates can go up to 7-8%. Why?

- Global interest rate benchmarks: FCNR rates are linked to international rates like LIBOR, SOFR (for USD), and EURIBOR (for EUR). These are much lower than Indian domestic rates.

- Currency risk for banks: Indian banks take on the exchange rate risk when they accept foreign currency. They hedge this risk, which reduces the rate they can offer you.

- RBI caps: The RBI sets limits on how much banks can offer on FCNR deposits to manage the country's foreign exchange reserves.

Trade-off: You accept a lower return in exchange for zero currency risk and tax-free income.

Source: RBI notifications on FCNR deposit regulations (rbi.org.in).

Also Read -Which Fixed Deposit Should You Choose as an NRI in 2025?

Top 10 Banks Offering the Highest FCNR Deposit Rates in 2025

We researched rates from 25+ Indian banks as of April 2025. Here are the top 10 for USD FCNR deposits (most popular currency among UAE-based NRIs):

1. State Bank of India (SBI)

Tenure | SBI USD FCNR Rate (as of 15.10.2025) |

|---|---|

1 year | 4.80% |

Above 1 to \<2 years | 4.80% |

2 to \<3 years | 3.95% |

3 to \<4 years | 3.75% |

4 to \<5 years | 3.35% |

5 years | 3.45% |

Why we like it: SBI is India's largest bank, with a global network and strong credibility. They offer dedicated NRI branches in Dubai, Abu Dhabi, and other GCC cities. Online account opening is smooth if you already have an SBI NRE/NRO account.

Watch out for: Customer service can be slow. Processing times for account opening and maturity proceeds can take 7-10 days.

How to open: Visit SBI's NRI portal or walk into an SBI branch in the UAE. You'll need your passport, visa copy, address proof, and PAN card.

Source:SBI NRI FCNR Deposit Rates.

For more details on SBI NRI services, see our guide on opening an SBI NRI account.

2. ICICI Bank

Interest rates (percent per annum) till Oct 14th, 2025

Tenure | USD \< 1,000,000 | USD ≥ 1,000,000 to \< 2,500,000 | USD ≥ 2,500,000 |

|---|---|---|---|

12m to \< 24m | 4.00 | 4.05 | 4.00 |

≥ 24m to \< 36m | 3.50 | 3.50 | 3.50 |

≥ 36m to \< 48m | 3.25 | 3.25 | 3.25 |

≥ 48m to \< 60m | 3.25 | 3.25 | 3.25 |

60m | 3.25 | 3.25 | 3.25 |

Why we like it: ICICI offers the highest standard rates among major private banks. Their digital banking platform is excellent-you can open FCNR FDs entirely online through iMobile or Internet Banking. They also have a strong UAE presence with branches in Dubai and Abu Dhabi.

Watch out for: ICICI's premature withdrawal penalty is steep (up to 1% of interest earned). If you might need liquidity before maturity, consider shorter tenures.

How to open: Use ICICI's online NRI account opening (icicibank.com/nri) or visit a branch in the UAE.

Source:ICICI NRI FCNR Deposit Rates.

Read more about ICICI NRI banking in our ICICI Bank UAE guide.

3. HDFC Bank

USD FCNR Rates (October 2025):

Period | USD |

|---|---|

1 year | 3.55% |

2 years | 3.30% |

3 years | 3.20% |

4 years | 2.95% |

5 years | 2.75% |

Why we like it: HDFC has a reputation for excellent customer service and a seamless digital experience. Their mobile app allows you to open and manage FCNR FDs without visiting a branch. They also offer relationship managers for NRI customers with deposits above $50,000.

Watch out for: HDFC's rates are slightly lower than ICICI. However, the service quality often makes up for it.

How to open: Apply online via HDFC NRI Banking or visit their UAE branches.

Source:HDFC NRI FCNR Deposit Rates.

Learn more in our article on HDFC NRI account in UAE.

4. Axis Bank

USD FCNR Rates (October 2025):

Maturity Period | USD (\<1M) | USD (≥1M) |

|---|---|---|

1 year \< 2 years | 4.00% | 4.00% |

2 years \< 3 years | 3.50% | 3.50% |

3 years \< 4 years | 3.25% | 3.25% |

4 years \< 5 years | 3.25% | 3.25% |

Why we like it: Axis offers competitive rates and flexible tenure options. They also allow partial withdrawals in some FCNR schemes (rare among banks). Their UAE presence is growing, with branches in Dubai and Sharjah.

Watch out for: Account opening can take longer than ICICI or HDFC (10-15 days for first-time NRI customers).

How to open: Visit Axis NRI Banking or a UAE branch.

Source:Axis Bank NRI FCNR Rates.

More on Axis NRI services: Axis NRI Bank in UAE.

5. IDFC FIRST Bank

USD FCNR Rates (October2025):

Period | Up to $1 million USD | Above $1 million USD |

|---|---|---|

1 Yr \< 15 Months | 4.50% | 4.25% |

15 Months \< 2 Yrs | 4.50% | 4.25% |

2 Yrs to \< 3 Yrs | 4.25% | 4.00% |

3 Yrs to \< 4 Yrs | 4.25% | 4.00% |

4 Yrs to \< 5 Yrs | 4.25% | 4.00% |

5 Yrs only | 4.25% | 4.00% |

Why we like it: IDFC FIRST often leads with the highest rates among private banks. They're also willing to negotiate rates for deposits above $100,000. Customer service is responsive, and digital onboarding is smooth.

Watch out for: IDFC has a smaller UAE footprint-no physical branches. You'll rely on phone/email support and online banking.

How to open: Apply online at IDFC FIRST NRI Banking.

Source:IDFC FIRST FCNR Deposit Rates.

6. IndusInd Bank

USD FCNR Rates (October 2025):

Period | USD \< 1 M | USD 1-10 M | USD 10-25 M |

|---|---|---|---|

1 Yr \< 2 Yrs | 4.75% | 4.75% | 4.75% |

2 Yrs \< 3 Yrs | 4.30% | 4.30% | 4.30% |

3 Yrs \< 4 Yrs | 4.00% | 4.00% | 4.00% |

4 Yrs \< 5 Yrs | 4.00% | 4.00% | 4.00% |

5 Yrs | 4.00% | 4.00% | 4.00% |

Why we like it: IndusInd offers personalized service and flexible deposit options. They also provide instant debit cards linked to your FCNR account for emergency access.

Watch out for: Processing times can be slower than larger banks like ICICI or HDFC.

How to open: Visit IndusInd NRI Banking.

Source:IndusInd Bank NRI FCNR Rates.

7. Yes Bank

USD FCNR Rates (OctoberApril 2025):

Period | USD (\<1M) |

|---|---|

1 Yr to \<2 Yrs | 5.00% |

2 Yrs to \<3 Yrs | 4.25% |

3 Yrs to \<5 Yrs | 4.25% |

5 Yrs & above | 4.20% |

Why we like it: Yes Bank offers quick online account opening and competitive rates for 3-year deposits. They also have tie-ups with UAE exchange houses for easy fund transfers.

Watch out for: Yes Bank faced financial stress in 2020 (though it has since recovered under RBI supervision). Some NRIs remain cautious.

How to open: Apply at Yes Bank NRI Services.

Source:Yes Bank FCNR Deposit Rates.

8. Kotak Mahindra Bank

USD FCNR Rates (October 2025):

Period | USD (\<0.5M) | USD (≥0.5M) |

|---|---|---|

>1 Year - Less than 2 Year | 4.20% | 4.20% |

>1 Year - Less than 3 Year | 4.20% | 4.25% |

2 Year - Less than 3 Year | 3.75% | 3.75% |

3 Year - Less than 4 Year | 3.50% | 3.50% |

4 Year - Less than 5 Year | 3.45% | 3.45% |

5 Year Only | 3.45% | 3.45% |

Why we like it: Kotak's mobile app and net banking are among the best in India. They also offer automatic renewal options with rate locks.

Watch out for: Rates are slightly lower than IDFC or Axis. However, the digital experience is top-notch.

How to open: Apply online at Kotak NRI Banking.

Source:Kotak NRI FCNR Deposit Rates.

9. Federal Bank

USD FCNR Rates (October 2025):

Period | USD (\<5L) | USD (≥5L) |

|---|---|---|

1 year to less than 2 years | 4.75% | 4.50% |

2 years to less than 3 years | 4.25% | 4.00% |

3 years to less than 4 years | 4.00% | 3.75% |

4 years to less than 5 years | 3.75% | 3.50% |

5 years only | 3.90% | 3.60% |

Why we like it: Federal Bank has a strong NRI focus (over 40% of their deposits come from NRIs). They offer dedicated NRI helplines and faster processing.

Watch out for: Smaller brand recognition compared to SBI or ICICI. However, they're RBI-regulated and safe.

How to open: Visit Federal Bank NRI Services.

Source:Federal Bank FCNR FD Rates.

Read more: Federal Bank Fixed Deposit Rates.

10. Canara Bank

USD FCNR Rates (October 2025):

Tenure | USD (\<$100,000) | USD (≥$100,000) |

|---|---|---|

1 year to less than 2 years | 5.30% | 5.40% |

2 years to less than 3 years | 4.00% | 4.00% |

3 years to less than 4 years | 3.70% | 3.70% |

4 years to less than 5 years | 3.50% | 3.50% |

5 years only | 3.50% | 3.50% |

Why we like it: Canara is a public sector bank with a solid reputation. They have a UAE branch in Dubai and offer competitive rates.

Watch out for: Digital banking is improving but still lags behind private banks.

How to open: Visit Canara Bank NRI Services or their Dubai branch.

Source:Canara Bank FCNR Deposit Rates.

More details: Canara Bank Fixed Deposit Rates.

Comparison Table: Top 10 FCNR USD Deposit Rates (3-Year Tenure)

Bank | 3-Year USD Rate | Bank Type | Digital Banking | UAE Presence |

|---|---|---|---|---|

IDFC FIRST Bank | 4.25% | Private | Excellent | Online only |

Axis Bank | 3.25% | Private | Very Good | Dubai, Sharjah |

Federal Bank | 4.00% | Private | Good | NRI-focused |

ICICI Bank | 3.25% | Private | Excellent | Dubai, Abu Dhabi |

IndusInd Bank | 4.00% | Private | Very Good | Limited |

HDFC Bank | 3.20% | Private | Excellent | Dubai, Abu Dhabi |

Yes Bank | 4.25% | Private | Good | Online mainly |

SBI | 3.75% | Public | Good | Dubai, Abu Dhabi, GCC |

Kotak Mahindra | 3.50% | Private | Excellent | Dubai |

Canara Bank | 3.70% | Public | Average | Dubai |

Source: Bank websites, verified 2025.

👉 Tip: Rates change monthly. Use Belong's NRI FD Rate Comparison Tool to check live rates before opening an account.

Which Currencies Are Accepted in FCNR Deposits?

Most banks accept six major currencies:

- US Dollar (USD) - Most popular, highest rates

- British Pound (GBP)

- Euro (EUR)

- Canadian Dollar (CAD)

- Australian Dollar (AUD)

- Japanese Yen (JPY)

UAE-based NRIs: USD is your best option. Rates are higher, and it's easier to convert AED to USD than to GBP or EUR.

UK-based NRIs: GBP FCNR rates are slightly lower (2.5-3.0%) but eliminate GBP/INR conversion risk.

Source: RBI FEMA regulations (rbi.org.in).

How to Open an FCNR Fixed Deposit from the UAE

Step 1: Check Eligibility

You must be an NRI or PIO. Use Belong's Residential Status Calculator if unsure.

Step 2: Choose a Bank

Compare rates using our table above or Belong's FD tool. Consider digital experience, UAE branch access, and customer reviews.

Step 3: Open an NRE or NRO Savings Account

Most banks require you to have an NRI savings account before opening an FCNR FD. ICICI, HDFC, and Axis allow online NRE account opening.

See our guide: Best NRE Savings Accounts.

Step 4: Transfer Foreign Currency

Send USD (or other accepted currency) from your UAE bank to your Indian NRE account. Use SWIFT or online remittance services like Wise, Vance, or UAE Exchange.

👉 Tip: Check our article on transferring money from Dubai to India to save on fees.

Step 5: Book the FD Online or at Branch

Log in to net banking, select FCNR FD, choose tenure and amount, and confirm. Some banks (like SBI, Canara) may require a branch visit.

Step 6: Receive Confirmation

You'll get an FD receipt with maturity date, rate, and maturity amount. Save this for tax filing and repatriation.

Documents needed:

- Passport copy

- Valid visa/residence permit

- PAN card (mandatory)

- Address proof (UAE utility bill or tenancy contract)

- Proof of NRI status (employer letter or salary slip)

Source: Standard KYC requirements, RBI guidelines.

Tax Rules on FCNR Deposits

In India:

Interest: Completely tax-free under Section 10(4)(ii) of the Income Tax Act. No TDS is deducted.

Repatriation: No tax on repatriating principal or interest.

Reporting: If you're a Resident but Not Ordinarily Resident (RNOR) or have returned to India, you may need to report FCNR interest in your ITR (even if tax-free).

Source:Income Tax Act.

In Your Country of Residence (e.g., UAE):

The UAE has no income tax, so FCNR interest is also tax-free there. However, if you live in the US, UK, or another country with income tax, you may need to report FCNR interest under local tax laws.

DTAA Protection: India has Double Taxation Avoidance Agreements (DTAA) with most countries, allowing you to claim tax credits and avoid double taxation.

Read more: DTAA: India-UAE and DTAA Countries List.

👉 Tip:Use Belong's Compliance Compass to check your reporting obligations.

Repatriation Rules: Can You Transfer Your FCNR Maturity Back to UAE?

Yes, fully repatriable. Both principal and interest can be transferred back to your country of residence without any RBI approval.

How:

- Submit a repatriation request through net banking or at the branch.

- Provide your overseas bank account details (IBAN, SWIFT code).

- The bank will credit your foreign account in 3-7 working days.

No limits: Unlike NRO accounts (which have a $1 million annual repatriation cap), FCNR has no limits.

Source: RBI FEMA guidelines (rbi.org.in).

Premature Withdrawal: What Happens If You Need Money Early?

Most banks allow premature withdrawal with no explicit penalty after 1 year, but interest is reduced to the lower of the contracted rate or prevailing rate for the actual period run (per RBI guidelines). No interest if withdrawn before 1 year. (source)

Bank | Penalty (typical) |

|---|---|

SBI | Nil after 1 year (interest at applicable rate for period run; no interest before 1 year) |

ICICI | Nil after 1 year (interest at applicable rate for period run; no interest before 1 year) |

HDFC | Nil (no interest before 1 year; after 1 year- interest at booking-date rate for period run) |

Axis | Before 1 Year: No interest or penalty on premature withdrawal. After 1 Year (Below Threshold): No explicit penalty; interest paid at the lower of the contracted rate or prevailing rate for the period run. |

IDFC FIRST | Nil (interest at applicable rate for period run; no interest before 1 year). |

Better option: Use FD laddering-spread deposits across multiple tenures (1, 2, 3 years) so some mature early if needed.

Read our guide: NRI FD Laddering Strategy.

FCNR vs. GIFT City USD Fixed Deposits: Which is Better?

At Belong, we often recommend GIFT City USD FDs as an alternative to FCNR. Here's why:

Feature | FCNR FD | GIFT City USD FD (via Belong) |

|---|---|---|

Interest Rate | 3.0-4.25-% | 4.5-6%% |

Tax | Tax-free | Tax-free |

Currency | USD, GBP, EUR, etc. | USD |

Tenure | 1-5 years | 1-3 years |

Repatriation | Fully repatriable | Fully repatriable |

KYC | Complex, requires India visit or online | Doorstep KYC in UAE via Belong |

Minimum Deposit | Varies ($1,000-$10,000) | $1,000 |

Why GIFT City FDs offer higher rates:

GIFT City is India's International Financial Services Centre (IFSC), regulated by the IFSCA. Banks there can offer higher USD rates because they operate under different regulatory frameworks and compete with Singapore, Dubai, and Hong Kong.

Source:IFSCA regulations, Belong product data.

Learn more: GIFT City for NRIs and GIFT City vs. NRE/NRO/FCNR.

👉 Tip: Use Belong's app to compare FCNR rates with GIFT City FDs side-by-side. Download here.

Risks to Watch Out For

1. Interest Rate Risk

FCNR rates are fixed. If global USD interest rates rise (e.g., US Fed hikes rates to 5%), you're stuck earning 3.5%. However, if rates fall, you're protected.

2. Bank Credit Risk

Your deposit is only as safe as the bank. Stick to large, well-rated banks like SBI, ICICI, HDFC, or Axis. Avoid small cooperative banks offering unusually high rates (4.5%+)-they may be risky.

👉 Tip:Check bank ratings on CRISIL or ICRA before depositing.

3. Liquidity Risk

FCNR FDs are locked for 1-5 years. Premature withdrawal attracts penalties. Keep emergency funds separate in a savings account or liquid fund.

4. Opportunity Cost

FCNR rates (3-3.7%) are much lower than equity mutual funds (10-12% historical returns) or even GIFT City FDs (5%+). Use FCNR only for the portion of your portfolio where safety and currency hedge matter most.

Who Should Choose FCNR Deposits?

FCNR is ideal if you:

- Earn and save in foreign currency (USD, GBP, etc.)

- Want guaranteed, tax-free returns

- Are worried about rupee depreciation

- Plan to repatriate funds back to your country of residence

- Prefer low-risk, regulated investments

FCNR is NOT ideal if you:

- Want higher returns (consider equity, mutual funds, or GIFT City FDs)

- Need liquidity (FCNR locks funds for 1-5 years)

- Are a resident Indian (you're not eligible)

- Are comfortable with rupee volatility (NRE FDs offer higher rates)

Common Mistakes to Avoid

- Not comparing rates across banks: A 0.2% difference on $50,000 over 3 years = $300 lost.

- Ignoring digital banking quality: If the bank's app is clunky, managing your FD becomes a headache.

- Not using FD laddering: Locking all funds in a 5-year FD limits flexibility.

- Forgetting to update KYC: Expired passports or visas can freeze your account.

- Assuming FCNR is always better than NRE: Sometimes NRE FDs (7-8% in INR) outperform FCNR if the rupee stays stable. Run the math.

How to Maximize Your FCNR Returns

- Negotiate rates for large deposits: Banks often offer 0.25-0.5% extra for deposits above $100,000.

- Use FD laddering: Split deposits across 1, 2, and 3 years so you have liquidity every year.

- Combine with GIFT City FDs: Put half in FCNR (safe, liquid) and half in GIFT City FDs (higher returns).

- Renew at maturity: Don't let funds sit idle. Reinvest immediately or transfer to a better-rate bank.

Bottom Line: Which Bank Should You Choose?

For highest rates: Go with IDFC FIRST Bank (4.25% for 3 years) or IndusInd Bank(4.00%).

For best digital experience: Choose ICICI Bank or HDFC Bank-both offer seamless online FD booking and excellent apps.

For UAE branch access:SBI, ICICI, or Axis have strong UAE presence for in-person support.

For NRI-focused service:Federal Bank specializes in NRI banking and offers faster processing.

For higher returns with similar safety: Consider GIFT City USD FDs via Belong (6%+ tax-free, fully repatriable). Explore options here.

What's Next?

- Compare rates in real-time: Use Belong's NRI FD Rate Comparison Tool to see live FCNR, NRE, NRO, and GIFT City rates side-by-side.

- Join our community: Our WhatsApp group has 2,000+ NRIs discussing FCNR experiences, bank reviews, and tax strategies.

- Download the Belong app: Track the rupee vs. dollar, explore GIFT City investments, and stay updated on the best FD rates. Get it here.

At Belong, we're building more than just tools-we're building a community of informed, confident NRIs who make smarter financial decisions. Whether you choose FCNR, NRE, GIFT City, or a mix, we're here to help you navigate every step.

Questions? Drop them in our WhatsApp community or email us at [email protected].

Sources

- Reserve Bank of India (RBI): www.rbi.org.in

- Income Tax Department, Government of India: www.incometax.gov.in

- SBI NRI FCNR Deposit Rates

- ICICI NRI FCNR Deposit FD Rates

- HDFC NRI FCNR Deposit Rates

- Axis Bank NRI FCNR Rates

- IDFC FIRST FCNR Deposit Rates.

- IndusInd Bank NRI FCNR Rates

- Federal Bank FCNR FD Rates

- Canara Bank FCNR Deposit Rate

- Yes Bank FCNR Deposit Rates

- Kotak NRI FCNR Deposit Rates

- IFSCA (GIFT City regulator)

Comments

Your comment has been submitted