How to Settle in Dubai: Smart Financial Planning for NRIs

Last month, I got a message on our NRI WhatsApp Group from Priya, an IT manager who'd just landed a job in Dubai.

Her question? "Ankur, everyone says Dubai Marina is the place to be, but the rent is ₹2.8 lakhs per month. That's more than my entire salary back in Bangalore! How do I choose where to live without destroying my financial goals?"

Sound familiar?

Here's what most Dubai housing guides won't tell you: Your choice of neighbourhood doesn't just impact your lifestyle - it determines whether you'll build wealth or just survive paycheck to paycheck.

After helping plenty of NRIs plan their Dubai finances over the past five years, through Beyond, we've learned that the "best" place to live isn't the one with the fanciest amenities.

It's the one that fits your financial strategy while you build your long-term wealth in India.

By the end of this guide, you'll know exactly how much you should spend on housing in Dubai, which neighbourhoods offer the best value for different life stages, and - most importantly - how to structure your living costs so you can still invest ₹50,000+ monthly back in India.

Meet Rohit: How Housing Choice Made Him ₹15 Lakhs Richer

Before we dive into neighbourhoods, let me tell you about Rohit, a marketing director who moved to Dubai in 2019.

Initially, Rohit was tempted by a fancy 2-bedroom in Downtown Dubai for AED 120,000 annually (about ₹27 lakhs). The Instagram-worthy Burj Khalifa views were calling his name.

Instead, we did the math together. That extra AED 40,000 per year (compared to a similar flat in JLT) meant ₹9 lakhs less available for investments. Over 5 years, by choosing JLT and investing the difference in Indian mutual funds averaging 12% returns, Rohit accumulated an extra ₹15 lakhs.

Today, he owns a ₹1.2 crore portfolio in India and is planning his return with a corpus that supports his lifestyle. The Downtown flat owner? Still paying rent and starting investment planning.

👉 Tip: The general rule I follow with clients: your Dubai housing should never exceed 25% of your gross income if you want to build serious wealth back home.

The Financial Reality Most Dubai Guides Skip

Dubai housing articles love to showcase glamorous neighbourhoods, but they rarely mention the hidden costs that can derail your financial goals.

Here's what your total "housing cost" really includes:

Rental Components:

Base rent (the advertised amount)

Security deposit (5-10% of annual rent, refundable)

Real estate agent commission (usually 5% of annual rent)

DEWA connection (AED 2,000 activation + monthly bills)

Hidden Monthly Costs:

DEWA utilities: AED 200-800/month depending on AC usage

Internet: AED 300-400/month for good plans

Municipality tax: 5% of annual rent (usually added to DEWA bill)

Chiller fees: AED 15-25 per sq ft annually in newer buildings

Parking: AED 1,000-3,000 annually (if not included)

Let's say you're looking at a 1-bedroom in Dubai Marina for AED 85,000.

Your real annual cost is:

Rent: AED 85,000

Commission: AED 4,250

DEWA setup: AED 2,000 (first year)

Monthly utilities: AED 4,800

Municipality tax: AED 4,250

Total Year 1: AED 100,300 (₹22.4 lakhs)

Total Year 2+: AED 94,050 (₹21 lakhs)

That's 24% higher than the advertised rent. Most people budget for AED 85,000 and wonder why they're always short on money.

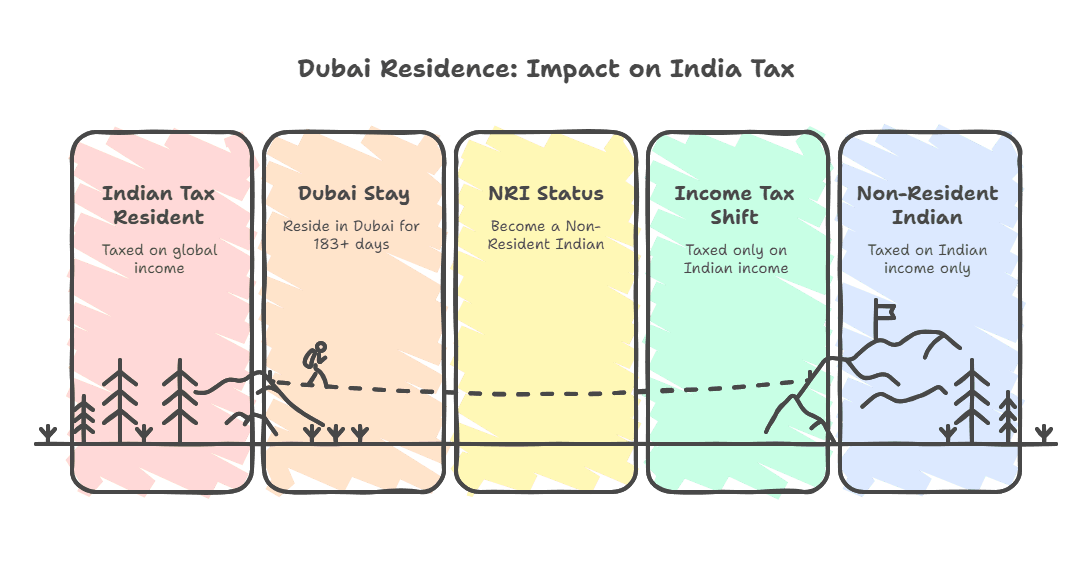

How Dubai Residence Affects Your India Tax Planning

This is where my financial advisory background becomes crucial. Your Dubai address impacts your India tax status in ways most housing guides never mention.

Residential Status Rules: If you're in Dubai for 183+ days annually, you're an NRI for Indian tax purposes. This affects:

Income Tax: Only Indian-sourced income is taxable in India

Investment Options: Some instruments like PPF have restrictions for NRIs

Capital Gains: Different rates apply for NRI property sales

DTAA Benefits: UAE-India tax treaty protects you from double taxation

DTAA Certificate Planning: Living in Dubai gives you access to the UAE-India Double Taxation Avoidance Agreement. Apply for Form 10F through UAE tax authorities to claim treaty benefits on your Indian investments.

👉 Tip: File for DTAA benefits even if you're not paying UAE income tax. It reduces TDS on your Indian mutual fund dividends from 20% to 10%.

Smart Financial Framework for Choosing Dubai Neighbourhoods

Before looking at specific areas, let's establish the financial framework I use with all my clients.

The 50-30-20 Dubai Rule:

50% on essentials (housing, food, transport)

30% on lifestyle (dining, travel, entertainment)

20% on India investments and savings

If your monthly Dubai income is AED 15,000 (₹3.35 lakhs):

Maximum housing budget: AED 6,250/month (₹1.4 lakhs)

India investment target: AED 3,000/month (₹67,000)

Neighborhood Selection Criteria:

Commute Cost: Factor in taxi/car costs to work

Utility Efficiency: Newer buildings = higher chiller fees but lower DEWA

Appreciation Potential: If buying, consider 5-year value trends

Exit Strategy: How easy is it to break lease if you return to India?

| Also Read - How to Choose the Best Bank for an NRI Account?

The Complete Neighbourhood Breakdown (With Financial Analysis)

Now let's analyse Dubai's top expat areas from a wealth-building perspective.

Dubai Marina: The Young Professional's Paradise

Financial Profile: High cost, high convenience Best For: Singles and couples earning AED 20,000+ monthly

Housing Costs:

1-bedroom: AED 75,000-95,000 annually

2-bedroom: AED 110,000-140,000 annually

Total monthly cost (including utilities): AED 8,000-12,000

Financial Pros:

Metro connectivity reduces transport costs

Walking distance to restaurants saves on delivery fees

Strong rental yield if you buy (6-8% annually)

Financial Cons:

Premium pricing cuts into investment budget

Tourist area = higher daily living costs

Limited family school options increase education costs later

Real Client Example: Sachin, a consultant earning AED 18,000 monthly, spends AED 8,500 total monthly in Marina.

After expenses, he invests AED 3,500 monthly in Indian equity funds. His Dubai lifestyle is great, but wealth building is slow.

Jumeirah Lake Towers (JLT): The Sweet Spot

Financial Profile: Best value for money in prime location Best For: Anyone serious about balancing lifestyle and wealth building

Housing Costs:

1-bedroom: AED 65,000-80,000 annually

2-bedroom: AED 95,000-120,000 annually

Total monthly cost: AED 6,500-9,500

Financial Pros:

15% cheaper than Marina with similar amenities

Excellent metro access

Strong expat community reduces social spending

Financial Cons:

Some buildings have high chiller fees

Construction noise in certain clusters

Why I Recommend JLT: The cost difference vs Marina allows an extra AED 1,500-2,000 monthly for India investments. Over 5 years, that's AED 90,000-120,000 (₹20-27 lakhs) more in your investment corpus.

Downtown Dubai: The Prestige Choice

Financial Profile: Maximum cost, maximum prestige Best For: Senior executives earning AED 25,000+ monthly

Housing Costs:

1-bedroom: AED 90,000-130,000 annually

2-bedroom: AED 140,000-200,000+ annually

Total monthly cost: AED 9,000-16,000

Financial Analysis: Downtown's rent premium is 25-30% higher than JLT for similar quality. Unless your job requires Downtown presence or you're in the AED 30,000+ income bracket, this choice significantly hurts your wealth-building capacity.

👉 Tip: If you love Downtown's lifestyle, consider Al Barsha or Business Bay. You get 80% of the convenience at 60% of the cost.

Business Bay: The Emerging Value Pick

Financial Profile: Mid-range pricing, strong appreciation potential Best For: Professionals planning 3-5 year Dubai stays

Housing Costs:

1-bedroom: AED 70,000-90,000 annually

2-bedroom: AED 100,000-130,000 annually

Total monthly cost: AED 7,000-10,000

Investment Angle: Business Bay property prices increased 18% in 2024. If you're considering buying, this area offers better capital appreciation potential than established locations.

Arabian Ranches: The Family Financial Strategy

Financial Profile: High upfront cost, long-term family value Best For: Families planning 5+ year stays with children under 10

Housing Costs:

3-bedroom villa: AED 180,000-250,000 annually

4-bedroom villa: AED 220,000-300,000 annually

Total monthly cost (including maintenance): AED 18,000-28,000

Family Financial Considerations:

Excellent schools reduce private education premiums

Villa space supports working from home (saves office costs)

Community amenities reduce external entertainment expenses

Higher transport costs to city center

Math for Families: Despite higher rent, total family costs can be lower due to included amenities and school proximity.

Cost Comparison: The Real Numbers That Matter

Here's the financial comparison most Dubai guides won't show you:

Area | 1-BR Annual Rent | Total Annual Cost | Monthly Investment Capacity* |

JLT | AED 70,000 | AED 85,000 | AED 4,200 |

Marina | AED 85,000 | AED 102,000 | AED 2,800 |

Downtown | AED 110,000 | AED 130,000 | AED 1,500 |

Business Bay | AED 75,000 | AED 90,000 | AED 3,800 |

Al Barsha | AED 65,000 | AED 80,000 | AED 4,600 |

*Based on AED 15,000 monthly income using 50-30-20 rule

The Winner for Wealth Building: Al Barsha offers the highest monthly investment capacity while maintaining good connectivity and amenities.

Currency Impact on Your Housing Decision

This is something only a financial advisor would tell you: your housing choice affects currency risk.

The Hidden Currency Cost: Dubai rent is in AED, but your India investments are in INR. When AED weakens against INR (like it did in early 2024), your purchasing power for Indian investments increases.

Smart Currency Strategy:

Lock in annual rent contracts when AED is strong

Use rent savings during favorable exchange periods for lump sum India investments

Consider UAE property purchase to hedge if you're staying 5+ years

👉 Tip: I track AED-INR rates weekly for my clients. Currently trading around 22.4, down from 23.1 in 2023. Good time to increase India investment allocation.

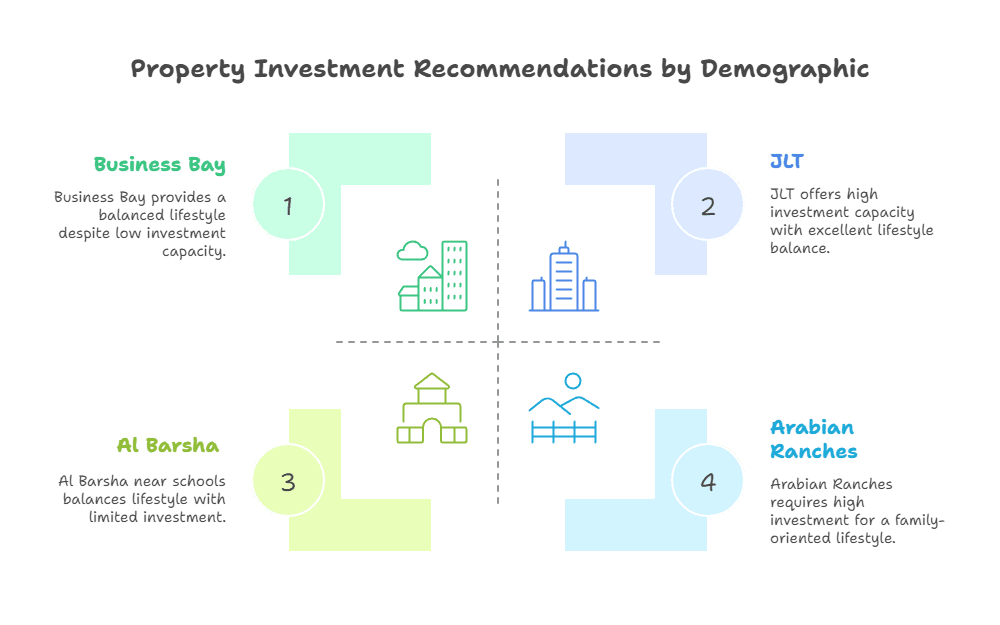

The Family vs Singles Strategic Framework

Your life stage determines not just amenities you need, but the financial strategy that works.

Singles (Age 25-35): Wealth Accumulation Phase

Optimal Strategy:

Target: Save 40-50% of income for India investments

Housing Budget: Maximum 20% of gross income

Best Areas: JLT, Al Barsha, or quality studio in Marina

Focus: Build ₹1+ crore corpus before marriage/family

Sample Budget (AED 18,000 income):

Housing: AED 6,000-7,000

Living expenses: AED 5,000-6,000

India investments: AED 6,000-7,000 (₹1.35-1.6 lakhs monthly)

Young Couples (Age 28-40): Balanced Growth Phase

Optimal Strategy:

Target: Save 30-35% for India investments + Dubai emergency fund

Housing Budget: 25% of combined gross income

Best Areas: 2-bedroom in JLT, Business Bay, or Al Barsha

Focus: Balance lifestyle and wealth building

Families with Kids: Wealth Protection Phase

Optimal Strategy:

Target: Save 20-25% for India investments + education planning

Housing Budget: 30% of gross income (includes schools)

Best Areas: Arabian Ranches, The Springs, Al Barsha

Focus: Asset protection and child education funding

Education Cost Planning:

International school fees: AED 40,000-80,000 annually per child

Budget 15-20% of gross family income for education

Consider schools with Indian curriculum for easier transition back

Advanced Financial Strategies for Dubai Residents

The India Investment Arbitrage

Living in Dubai gives you unique investment advantages:

GIFT City Investments: As a Dubai resident, you can invest in GIFT City products with:

Tax-free returns (like Dubai income)

USD denomination (currency diversification)

Easy repatriation (no FEMA restrictions)

Mutual Fund Timing: Use your Dubai salary cycles to invest during:

Indian market corrections (more units for same money)

Favorable exchange rate periods (more INR per AED)

The Property Investment Decision

Buying vs Renting in Dubai:

Buy When:

Planning 5+ year stay

Can afford 20% down payment without touching India investments

Rental yields exceed 6% annually

Have stable Dubai income source

Rent When:

Planning 2-4 year stay

Want to maximize India investment allocation

Prefer flexibility for job changes

Can invest the down payment for higher returns

Current Market Reality: Dubai property prices increased 15% in 2024, but rental yields are 6-8%. If you can get 12%+ returns in Indian equities, renting + investing the down payment often yields better results.

Tax Optimization Strategies

UAE Tax Planning

Good News: No personal income tax in UAE means more money for investments.

Corporate Tax (Since 2023): 9% tax on UAE business income above AED 375,000. Plan accordingly if you run a business.

India Tax Optimization

NRI Status Benefits:

Only Indian income is taxable

Access to NRE accounts (tax-free interest)

DTAA benefits on Indian investments

DTAA Certificate Process:

Apply through UAE Federal Tax Authority

Submit to Indian bank/investment providers

Reduces TDS from 20% to 10% on dividends

Claim excess TDS refund through ITR filing

👉 Tip: File ITR in India even if no tax liability. It maintains your financial track record for property loans when you return.

Emergency Fund Strategy

Dubai Emergency Fund:

Target: 6 months of Dubai expenses

Keep in UAE bank FD earning 4-5%

Separate from India investment goals

India Emergency Fund:

Target: 6 months of India lifestyle expenses

Keep in liquid/ultra-short term funds

For family emergencies or return planning

Hidden Costs That Crush Budgets

Beyond rent and utilities, watch for these budget killers:

Transportation Reality

Metro: AED 300-400 monthly (if you live near stations)

Taxi: AED 800-1,500 monthly (depending on distance to work)

Car ownership: AED 1,500-2,500 monthly (payment + insurance + fuel)

The Social Cost Factor

Dubai's social scene can be expensive:

Dinner for two: AED 200-400 at mid-range restaurant

Weekend brunch: AED 150-300 per person

Gym membership: AED 200-500 monthly

Financial Discipline: Budget AED 1,500-2,000 monthly for social activities. The expat lifestyle pressure is real, but don't let it sabotage your wealth building goals.

Healthcare Considerations

Mandatory Health Insurance: Employer-provided or AED 5,000-15,000 annually if self-paid.

Quality vs Cost: Dubai healthcare is excellent but expensive. Good insurance is essential for family financial planning.

Your Neighbourhood Selection Action Plan

Phase 1: Financial Assessment (Week 1)

Calculate True Housing Budget: Use the 25% rule

Define Investment Goals: How much will you send to India monthly?

Timeline Planning: 2 years, 5 years, or permanent move?

Phase 2: Area Research (Week 2)

Shortlist 3 Areas: Based on budget and commute

Visit Different Times: Morning commute, evening, weekends

Calculate Total Costs: Include all hidden fees

Phase 3: Decision Framework (Week 3)

Pro/Con Analysis: Financial and lifestyle factors

Long-term Impact: How does this choice affect 5-year wealth building?

Exit Strategy: How easy is it to change if circumstances shift?

The Bottom Line: Your Dubai Housing Strategy

Here's what I tell every client: Your Dubai housing choice is your first and most important financial decision.

Choose correctly, and you'll build wealth while enjoying an incredible lifestyle. Choose poorly, and you'll live pay check to pay check in the most expensive city in the Middle East.

My Recommendations:

For Singles: JLT or Al Barsha for maximum investment capacity

For Young Couples: Business Bay or Al Barsha for balanced lifestyle and savings

For Families: Arabian Ranches if budget allows, otherwise Al Barsha near good schools

The Investment Test: Whatever area you choose, you should still be able to invest at least AED 3,000 monthly (₹67,000) in India. If not, downsize your housing choice.

Remember: you're not just choosing a place to live. You're choosing your financial future.

Sources:

Use the Belong Residential Status Calculator to know whether you are a resident, NRI, ROR, or RNOR.

Comments

Your comment has been submitted