INR Depreciation Explained - Financial Tips for NRIs

The Indian Rupee has been on a rollercoaster journey against the US Dollar, and if you're an NRI watching your hard-earned dollars convert to fewer rupees each month, you're not alone. Let’s understand why the INR is weakening and what it means for your financial planning.

The Trend in INR Depreciation:

Back in 1947, $1 was equal to Rs. 4.16. In the 60’s, $1 grew to Rs. 7.5. The steepest rise was during the 1980s when $1 was equal to Rs. 17.

The 90s saw a steady rise in the US dollar when it reached Rs. 43 at the end of the decade. In the 2000s, the rupee kept hovering around the Rs.43-48 range against $1. The steepest rise in the dollar was in the 2010s decade where it grew 67% against the rupee over a decade.

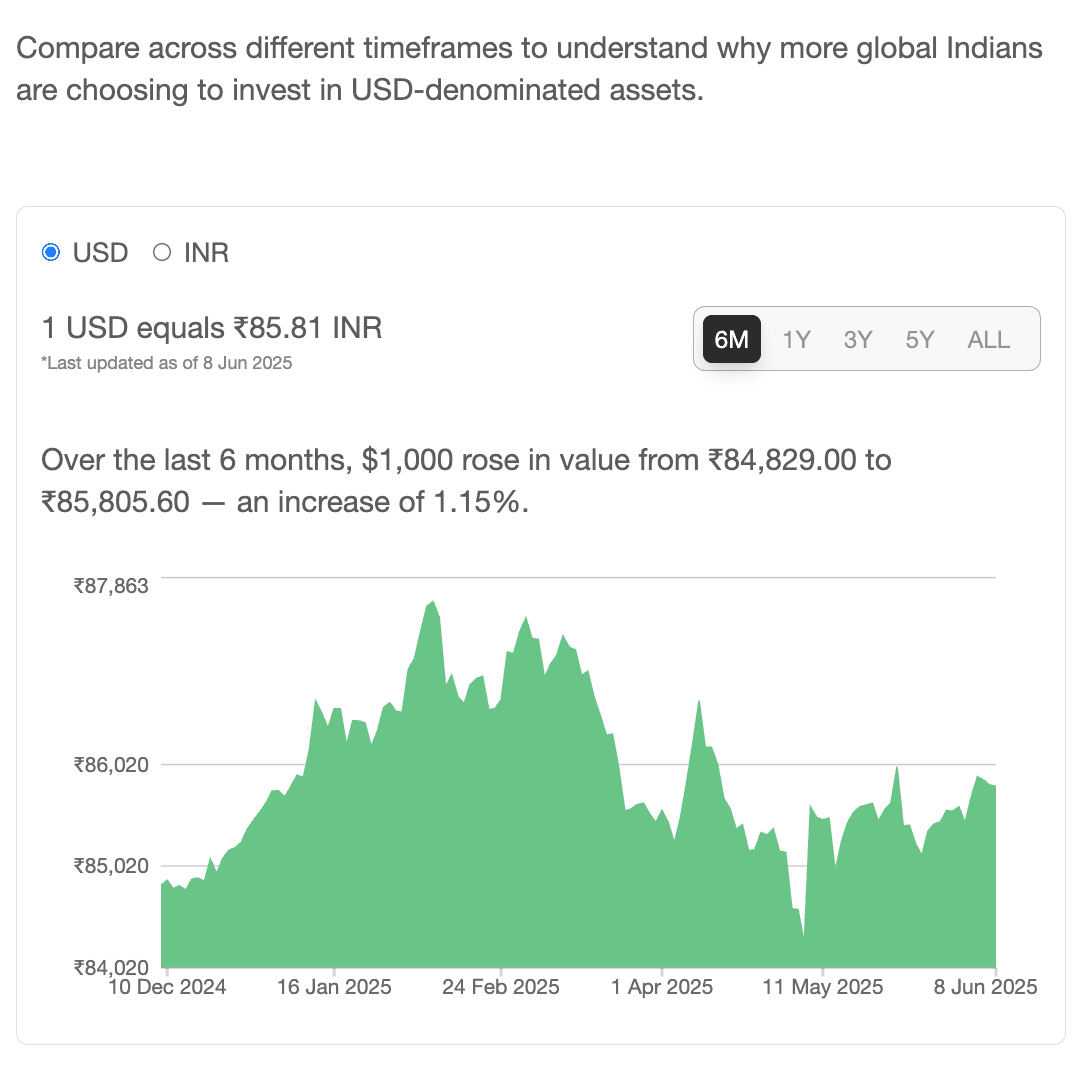

In 2025, one USD will stand at the Rs. 85-87 range. But it has not been a constant downward trend in rupee depreciation. In March 2025, there was a brief period when the dollar appreciated against the rupee.

Find out how INR is performing against USD track historical trends with daily-updated exchange rates with Belong's Rupee vs Dollar Tracker

Reasons Behind Indian Rupee's Depreciation

1. Trade Deficit Pressures:

India imports more than it exports, creating a constant demand for foreign currency. From crude oil to electronics, India's import bill puts continuous pressure on the rupee. When global commodity prices rise, this pressure intensifies, pushing the INR lower.

2. Capital Flow Dynamics:

Foreign institutional investors often move money in and out of emerging markets based on global economic conditions. When the US Federal Reserve raises interest rates or global uncertainty increases, capital flows out of India, weakening the rupee.

3. Economic Fundamentals, Like Inflation and Fiscal Deficits:

India's economy continues to grow, but factors like inflation differentials between India and the US, fiscal deficits and current account imbalances all play a role in currency valuation.

4. Global Dollar Strength:

The US Dollar's status as the world's reserve currency means it often strengthens during times of global uncertainty, making other currencies appear weaker by comparison.

What This Means (for NRIs)

- Remittance Reality: Your dollar remittances now buy more rupees, which might seem like good news for supporting family back home or investing in Indian assets. However, this advantage comes with long-term implications for your wealth preservation.

- Investment Considerations: If you're planning to return to India eventually, the weakening rupee means your overseas savings will have greater purchasing power in India. But if you're investing in Indian assets from abroad, INR depreciation can erode returns when converted back to your earning currency.

- Retirement Planning Challenges: For NRIs planning retirement in India, currency fluctuations add complexity to financial planning. What seems like adequate savings today might not maintain the same lifestyle if the rupee continues to weaken.

| Also Read:

- Comparison of GIFT City FD vs NRE FD vs NRO FD vs FCNR FD for NRIs

- Benefits of Investing in GIFT City FD through Belong

How to Hedge Against Rupee Depreciation?

1. Diversify Currency Exposure

Don't put all your eggs in one currency basket. Consider maintaining assets in multiple currencies to hedge against volatility. The investment basket should ideally have some fixed income assets, like term deposits, and long-term oriented assets like equities.

2. Time Your Transfers

While timing the market perfectly is impossible, staying informed about economic indicators can help you make more strategic decisions about when to transfer money.

3. Focus on Long-term Trends

Short-term fluctuations are normal, but understanding long-term economic trends helps in making better financial decisions.

4. Leverage Technology

Use modern financial platforms that offer competitive exchange rates and lower transfer fees. Every percentage point saved on transfers and fees compounds over time.

Is there any "silver lining" for NRIs when the rupee depreciates?

Yes, a weaker rupee isn't entirely negative. It makes Indian assets, such as real estate or business investments, more affordable for foreign buyers like NRIs. This can present attractive entry points for long-term investments. Additionally, it makes India's exports more competitive globally, which could benefit the broader Indian economy in the long run.

Looking Ahead: Planning in Times of Rupee Fluctuation

Currency movements are influenced by countless factors, making predictions challenging. However, India's strong economic fundamentals, growing digital economy, and young demographic suggest the country remains attractive for long-term investment despite short-term currency volatility.

The key for NRIs is to stay informed and plan strategically rather than react emotionally to currency movements. Consider working with financial advisors who understand both your resident country's and India's financial landscapes.

Comments

Your comment has been submitted