Which mutual fund types should you choose as an NRI?

You've saved diligently in Dubai, worked hard in the US, or built a career in London. Now you want your money to grow back home in India.

But mutual funds feel overwhelming. Equity funds, debt funds, ELSS, hybrid funds, index funds – what do these even mean? Which ones suit your goals?

Quick Summary

NRIs can invest in five main mutual fund categories in India: equity funds (for growth), debt funds (for stability), hybrid funds (balanced approach), ELSS (tax-saving), and index funds (passive investing). Each serves different purposes based on your risk appetite and financial goals.

Your choice depends on three factors: how much risk you can handle, when you need the money, and whether you want tax benefits.

The Full Picture

What Are Mutual Funds for NRIs?

Think of mutual funds as a basket where you pool money with thousands of other investors. Professional fund managers use this pooled money to buy stocks, bonds, or other securities.

NRIs are legally allowed to invest in mutual funds in India under Foreign Exchange Management Act (FEMA) regulations. However, the investment must be done in Indian currency, and routed through NRE or NRO accounts.

The beauty lies in diversification. Instead of putting all eggs in one company's stock, you spread risk across dozens or hundreds of companies.

👉 Tip: You must have an NRE account or NRO account before investing in Indian mutual funds. These accounts determine your repatriation flexibility.

1. Equity Funds: Growth-Focused Investments

Equity funds invest primarily in company stocks. These funds aim for capital appreciation over the long term.

Types of Equity Funds:

- Large-cap funds: Invest in top 100 companies by market value

- Mid-cap funds: Focus on companies ranked 101-250

- Small-cap funds: Target smaller, high-growth potential companies

- Multi-cap funds: Mix of all company sizes

- Sectoral funds: Concentrate on specific industries

Risk and Returns: Equity funds that invest more than 65% in equities are taxed at 20% for short-term capital gains and 12.5% for long-term capital gains above ₹1.25 lakh (holding >12 months). These rates apply to gains realized on or after July 23, 2024.

These funds historically deliver 12-15% annual returns over long periods. But they're volatile – your investment value can swing significantly in short term.

Best For: NRIs with 5+ year investment horizon who can tolerate market fluctuations for higher growth potential.

Also Read - How NRIs Can Invest in Indian Stock Market from Abroad

2. Debt Funds: Stability-Oriented Investments

Debt funds invest in bonds, government securities, and corporate debentures. They're like lending money to companies or government in exchange for regular interest.

Types of Debt Funds (per SEBI Duration Categories):

- Overnight funds: For ultra-short parking (≤1 day maturity)

- Liquid funds: Park money for a few days to <91 days

- Ultra-short duration: <3 months average maturity

- Low duration: 3-6 months Macaulay duration

- Money market: <1 year maturity

- Short duration: 1-3 years Macaulay duration

- Medium duration: 3-4 years Macaulay duration

- Long duration: >3 years average, targeting ≥7 years Macaulay

- Credit risk funds: ≥65% in

For taxation:

Funds with ≤35% equity (post-April 1, 2023) have gains taxed at slab rates regardless of holding.

Pre-April 1, 2023:

STCG (<24 months) at slabs; LTCG (>24 months) at 12.5% without indexation if sold on/after July 23, 2024 (or 20% with indexation if beneficial).

👉 Tip: Debt funds typically deliver 6-9% annual returns. They're perfect for repatriating funds back to your home country in 2-3 years.

Best For: Conservative NRIs who prioritize capital safety over high returns, or those nearing retirement.

(Source : SEBI - Categorization and Rationalization of Mutual Fund Schemes)

3. Hybrid Funds: Balanced Investment Approach

Hybrid mutual funds invest in a mixture of underlying assets such as equity, debt, and gold instruments. The combination of the investment depends on the investment objective of the particular fund.

Types of Hybrid Funds:

- Conservative hybrid: 10-25% equity, rest in debt

- Balanced hybrid: 40-60% equity allocation

- Aggressive hybrid: 65-80% equity exposure

- Dynamic asset allocation: Fund manager adjusts equity-debt ratio based on market conditions

These funds offer moderate growth with lower volatility than pure equity funds. Professional fund managers balance risk and return by adjusting asset allocation.

Risk Profile: Medium risk, medium returns. Typically deliver 8-12% annually based on equity allocation.

Best For: NRIs wanting growth with less volatility than equity funds, or first-time mutual fund investors.

4. ELSS Funds: Tax-Saving Powerhouses

Equity Linked Savings Scheme (ELSS) mutual funds are diversified equity mutual funds that offer tax deduction of up to Rs 1.5 lakhs under Section 80C of the Income Tax Act.

Key Features:

- Tax Benefit: Save up to ₹31,200 annually in taxes at 20.8% effective slab rate (higher in old regime) (source)

- Lock-in Period: Mandatory 3-year holding (shortest among 80C options)

- Equity Exposure: Minimum 80% invested in stocks

- Investment Mode: Lump sum or SIP both allowed

As per SEBI guidelines, NRIs can invest in ELSS schemes. This will allow them to avail of tax benefits on their Indian income as per their income tax slab and opted tax regime.

👉 Tip: ELSS funds are perfect for NRIs with Indian income who want to reduce tax liability while building wealth. The 3-year lock-in ensures disciplined investing.

Returns: Being equity-oriented, ELSS funds can deliver 12-15% long-term returns but with market-linked volatility.

Best For: NRIs with Indian taxable income seeking dual benefits of tax savings and wealth creation.

5. Index Funds: Simple, Low-Cost Investing

Passive mutual funds are investment funds that aim to replicate the performance of a specific market index or benchmark, such as the Nifty 50 or Sensex, rather than trying to outperform it.

Index funds follow a "buy and hold" strategy. They simply buy all stocks in an index like Nifty 50 or Sensex in the same proportion.

Advantages:

- Low Costs: Minimal fund management fees (0.1-0.5% annually)

- Broad Diversification: Instant exposure to top 50 or 500 companies

- Transparency: You know exactly what stocks you own

- Consistent Performance: No fund manager risk or style drift

The Navi Nifty 50 Index Fund is an index fund that invests in the Nifty 50 index, which tracks the performance of the 50 largest companies listed on the National Stock Exchange of India.

Returns: Index funds deliver market returns. Nifty 50 has generated ~12% annually over past 15 years.

👉 Tip: Perfect for NRIs who want to invest in Indian growth story without picking specific funds or fund managers. Great for systematic investment through SIP.

Best For: Long-term investors who want market returns at low cost, or those building core portfolio allocation.

Advantages for NRIs

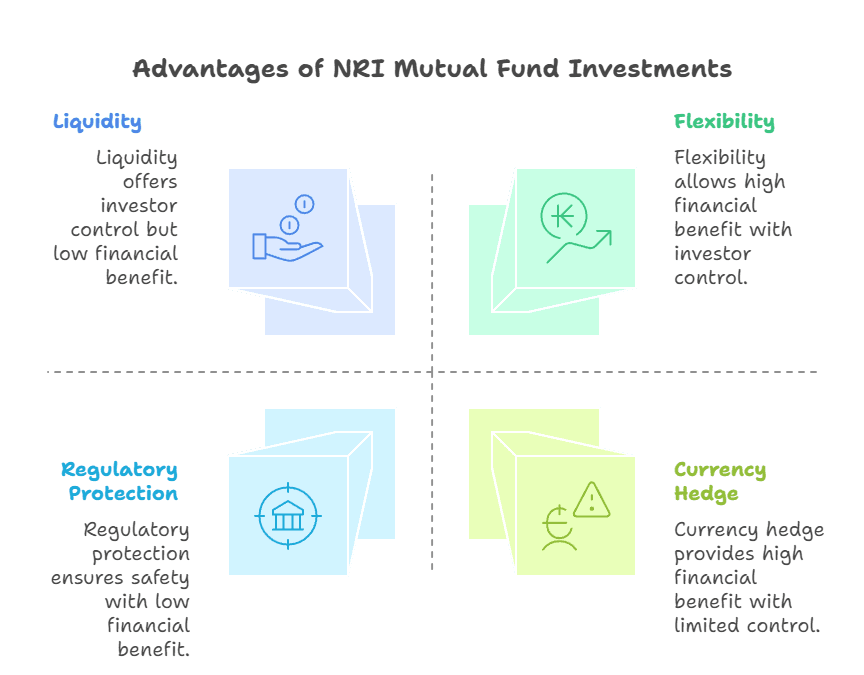

Currency Hedge: Rupee-denominated mutual funds provide natural hedge against dollar/pound/dirham weakness over long term.

Professional Management: Your relationship managers will help you determine your investment profile, which will be based on your needs, possibilities and expectations. Fund managers have access to research and market intelligence.

Liquidity: Open-ended funds allow redemption anytime (except ELSS 3-year lock-in).

Regulatory Protection: The Mutual Funds sector is regulated to safeguard the investor's interests by SEBI.

Diversification: Single investment gives exposure to dozens of companies across sectors.

Flexibility: Start with ₹500 SIP and increase gradually. Switch between fund categories as goals change.

Also Read - NRI Tax Exemptions and Deductions Under Indian Law - Complete Guide

Downsides You Must Consider

Tax Implications

Any income earned from mutual fund investments by NRIs is subject to taxation in India. AMCs will deduct TDS on redemption/dividend payout.

TDS Rates:

- Equity Funds: 20% TDS on short-term gains, 10% on long-term gains (exemption applies up to ₹1.25 lakh annually).

- Debt Funds: TDS as per applicable slab rates

Currency Risk

Your returns depend on rupee performance versus your home currency. If rupee weakens significantly, your dollar/pound returns may suffer despite good fund performance.

FATCA Compliance Issues

NRIs from the United States and Canada may face restrictions on investing in Indian mutual funds with a few AMCs which may not be FATCA/CRS compliant.

👉 Tip: US and Canada NRIs should verify AMC's FATCA compliance before investing. Some fund houses have additional documentation requirements.

Repatriation Limits

NRO account investments have repatriation limits up to $1 million per financial year. Plan your investment strategy accordingly.

Step-by-Step Investment Process

Step 1: Choose the Right Account

Open NRE account for fully repatriable investments or NRO account if you're okay with repatriation limits.

Step 2: Complete Fresh KYC

Once your residential status changes to an NRI, you will need to do a fresh KYC with relevant documentation.

Required Documents:

- Passport copy

- Overseas address proof (utility bill, bank statement)

- PAN card

- Recent photograph

- FATCA declaration

Step 3: Select Investment Mode

Choose between:

- Direct Investment: Through AMC websites/offices

- Power of Attorney: Authorized person in India manages investments

- Online Platforms: Digital investment apps and websites

Step 4: Pick Fund Category

Based on our discussion:

- Growth-focused: Equity funds (large-cap for stability, multi-cap for diversification)

- Income-focused: Debt funds (liquid for short-term, medium-term for 3-5 years)

- Balanced: Hybrid funds

- Tax-saving: ELSS funds

- Simple diversification: Index funds

Also Read - Best Mutual Funds for NRIs to Invest in India

Step 5: Start Investing

Begin with SIP for rupee-cost averaging. You can always add lump sum investments during market corrections. (Read: How can NRIs start investing in Mutual Funds)

👉 Tip: Start with 1-2 funds rather than over-diversifying initially. You can always add more fund categories as you gain experience.

Action Plan

Here's your next step roadmap:

Immediate (This Month):

- Open NRE or NRO account if you don't have one

- Complete fresh KYC documentation

- Decide your risk appetite and investment timeline

Also Read - Common Mistakes NRIs Make While Choosing an NRE Banking Account

Short-term (Next 3 Months):

- Start with one equity fund (large-cap or index fund) via SIP

- Add one debt fund if you need stability

- Consider ELSS if you have Indian taxable income

Long-term (Next 6-12 Months):

- Review and rebalance portfolio based on performance

- Add more fund categories as you gain confidence

- Increase SIP amounts as income grows

The key is starting simple and building complexity gradually. Pick 1-2 fund types that match your goals and begin your wealth-building journey.

Ready to start building wealth in India?

Join our WhatsApp community where NRIs share investment strategies and get expert guidance.

Download the Belong app to explore GIFT City investment opportunities that offer tax-free USD returns and simplified repatriation.

Your wealth creation journey starts with the first step. Choose your mutual fund type and begin investing today.

Sources: