Common Mistakes NRIs Make When Investing in Indian Mutual Funds (And How to Avoid Them)

Rajesh, an NRI in New York, invested ₹25 lakh in Indian mutual funds but couldn’t redeem them due to outdated KYC. Worse, he faced an IRS notice for unreported PFIC investments-mutual funds with harsh US tax rules he didn’t know applied.

He’s not alone. In our 4,000+ NRI community at Belong, we see these errors monthly: picking regular plans and losing 1% to commissions or US NRIs facing 40-50% tax on gains due to PFIC missteps.

Indian mutual funds offer strong returns (10-15% historically), but NRIs face unique regulatory traps. Get it wrong, and your investments may get locked, over-taxed, or non-compliant.

This guide highlights common mistakes NRIs make-before investing, during selection, while holding, and at exit-plus how to avoid or fix them for smarter, compliant investing.

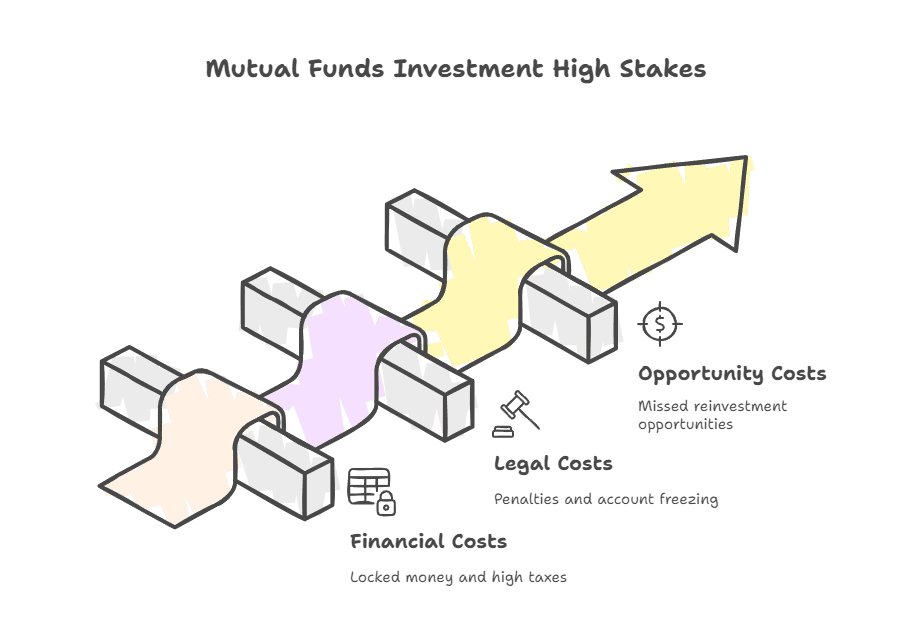

The Real Cost of Getting It Wrong

Before we dive into specific mistakes, let's understand what's at stake.

Financial costs: Wrong account type can lock your money for years. Wrong tax planning can cost you 30-40% in avoidable taxes. Choosing regular plans instead of direct can reduce returns by 1-1.5% annually-that's ₹15 lakh less on a ₹50 lakh investment over 20 years.

Legal costs:FEMA violations for not updating KYC can result in account freezing and penalties. US NRIs who don't report PFIC investments face IRS penalties starting at $10,000 per violation.

Opportunity costs: If your investments are blocked due to compliance issues, you miss out on the ability to rebalance, exit at peaks, or reinvest elsewhere.

Every mistake in this guide has a solution. Whether you've already made one of these errors or you're just starting your NRI investment journey, we'll show you how to fix it or avoid it entirely.

Mistake Category 1: Before You Invest (Setup Errors)

These are the foundational mistakes that happen before you invest a single rupee. They're the most common-and often the most expensive to fix later.

Mistake 1: Using Your Old Resident Bank Account

When you move abroad and become an NRI, FEMA (Foreign Exchange Management Act) prohibits you from continuing to use regular resident savings accounts for investments.

Many NRIs ignore this. They keep using their old ICICI or HDFC savings account because it's easier. They don't update their status with the bank or mutual fund houses.

Why this is a problem:

- It's a FEMA violation that can result in account freezing

- Tax authorities may question your residential status

- You can't legally repatriate funds using a resident account

- Banks can block transactions if they discover the mismatch

Also Read -FEMA Guidelines Every NRI Should Know

What you should do instead: Convert your resident savings account to an NRO (Non-Resident Ordinary) account or open an NRE (Non-Resident External) account. Which one depends on your investment goals:

- NRE account: Use this for investments funded by foreign earnings. Fully repatriable, tax-free interest, but only rupee-denominated.

- NRO account: Use this for managing Indian income (rental, interest, dividends). Repatriable up to $1 million per year, but interest is taxable.

Submit a formal application to your bank within 3-6 months of becoming an NRI. Most banks allow online conversion now.

👉 Tip: Open both NRE and NRO accounts. Link your NRE account for foreign-funded mutual fund investments and NRO for Indian income. This gives maximum flexibility.

Mistake 2: Not Updating KYC to NRI Status

Your KYC (Know Your Customer) details are centralized across all mutual fund houses in India. When your residential status changes to NRI, you must update your KYC with the KRA (KYC Registration Agency) within a reasonable period.

Many NRIs delay this for years. They assume their investments will continue running as before. They don't.

Why this is a problem:

- AMCs may block redemptions until KYC is updated

- You can't start new SIPs or make additional investments

- Incorrect TDS rates may be applied (higher NRI rates vs resident rates)

- You remain non-compliant with FEMA

What you should do instead: Update your KYC immediately after becoming an NRI. The process:

- Log in to CAMS KRA portal or KFintech portal

- Submit updated documents: passport, visa, foreign address proof, PAN, NRE/NRO account details

- File FATCA/CRS declaration (mandatory for all NRIs)

- Complete in-person verification (at Indian Embassy in your country, or by notarized documents)

Once updated with one AMC, it reflects across all your mutual fund holdings. Processing takes 2-4 weeks.

Mistake 3: Choosing the Wrong Account Type for Your Goals

Even NRIs who correctly open NRE/NRO accounts often choose the wrong type for their investment strategy.

Common scenario: You're in Dubai, saving AED 10,000 monthly to build a corpus for your child's education in India 10 years from now. You invest in mutual funds through an NRO account because someone told you "NRO is for investments."

Also Read -NRE vs NRO vs FCNR

Why this is a problem: NRO accounts are non-repatriable beyond $1 million per year. If your mutual fund corpus grows to ₹5 crore (about $600,000), you can repatriate it. But if it grows to ₹15 crore, you'll need 2 years to repatriate the full amount at $1 million/year-assuming you have no other NRO income to repatriate.

Also Read - Types of Mutual Funds

What you should do instead: Match account type to investment goal:

Goal | Recommended Account | Why |

|---|---|---|

Long-term wealth building with foreign savings | NRE | Fully repatriable, no limits, tax-free interest on deposits |

Managing rental income or Indian earnings | NRO | For income sourced in India, easier to manage |

Unsure if you'll return to India | NRE | Maximum flexibility for future repatriation |

Planning to reinvest in India (property, business) | NRO | Lower repatriation needs |

If you've already invested through the wrong account type, you can switch. Transfer mutual fund units to a new folio linked to the correct account, but consult your AMC first-some don't allow this without redemption and repurchase.

Mistake 4: Skipping the FATCA/CRS Declaration

FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard) declarations are mandatory for all NRIs investing in India. They're part of your KYC process.

Many NRIs skip these forms or fill them incorrectly, thinking "I'm not American, so FATCA doesn't apply to me" or "I don't have enough money for this to matter."

Why this is a problem:

- AMCs won't accept your investment without proper FATCA/CRS declaration

- If you're a US person (citizen, green card holder, or tax resident) and don't declare it, the AMC can freeze your account

- Incorrect declarations can lead to reporting to wrong tax authorities

What you should do instead: File FATCA/CRS declaration honestly:

- Declare your country of tax residence

- Provide Tax Identification Number (TIN) from your resident country (SSN for US, NI number for UK, TFN for Australia, etc.)

- If you're a US person, declare it-only 8-10 AMCs in India accept US NRI investments, so you're limited anyway

Update this declaration every time your tax residency changes (e.g., you move from UAE to Singapore).

👉 Tip:If you're a US green card holder, you're a "US person" for FATCA even if you live in India. Declare correctly to avoid future issues.

Mistake Category 2: While Choosing Funds (Selection Errors)

Once your accounts are set up, the next set of mistakes happens when selecting which mutual funds to invest in.

Mistake 5: Assuming All AMCs Accept NRIs from Your Country

Not all Asset Management Companies (AMCs) accept investments from all countries. US and Canada-based NRIs face the most restrictions due to FATCA compliance requirements.

Current status (as of September 2025):

- US/Canada NRIs:Only 8-10 AMCs accept investments, and most require offline transactions with physical presence or notarized Power of Attorney

- UAE/UK/Singapore NRIs: Most AMCs accept investments, minimal restrictions

- Other countries: Varies by AMC, check individual policies

Why this is a problem: If you invest in a fund through an AMC that doesn't accept NRIs from your country, they may:

- Reject your application after weeks of processing

- Block future transactions

- Force redemption if they discover your residency later

What you should do instead: Check AMC policy before investing:

- Visit the AMC website and look for "NRI Investment Policy" or "International Investor Guidelines"

- Call customer service and confirm your country is accepted

- If you're from US/Canada, stick to these AMCs that accept investments (offline or online): ICICI Prudential, SBI Mutual Fund, Axis Mutual Fund, Kotak Mahindra, UTI Mutual Fund

If you're a US NRI and the AMC list feels too restrictive, consider GIFT City AIFs or direct equity investments instead-they're not subject to the same FATCA restrictions.

Mistake 6: Not Understanding PFIC Implications (US NRIs Only)

If you're a US tax resident (citizen, green card holder, or resident for tax purposes), Indian mutual funds are classified as PFICs (Passive Foreign Investment Companies) under US tax law.

This is the single biggest mistake US NRIs make-and it can cost you 40-50% of your gains.

Why this is a problem:PFIC taxation is punitive:

- You pay tax on unrealized gains every year (mark-to-market), even if you don't sell

- Gains are taxed at ordinary income rates (up to 37%) plus penalty interest, not favorable capital gains rates (15-20%)

- You must file Form 8621 annually for each PFIC holding-complex and expensive (CPA fees alone cost $500-2000)

- India also taxes gains (12.5% LTCG or 20% STCG). Even with DTAA credits, combined tax can exceed 40%

Also Read -DTAA Between India and USA: Benefits & How to Claim Them

What you should do instead: If you're a US NRI, avoid Indian mutual funds entirely. Invest in:

- GIFT City fixed deposits (not classified as PFICs, tax-free in India, simple reporting in US)

- Direct Indian stocks (not PFICs, though you still pay tax in both countries, it's at capital gains rates)

- US-domiciled mutual funds and ETFs (no PFIC issues, easier tax treatment)

If you already hold Indian mutual funds:

- File Form 8621 for every PFIC holding to avoid penalties

- Consider redeeming them before moving to the US if possible

- Consult a US-India cross-border tax advisor immediately

Canada-based NRIs don't face PFIC rules, but must report holdings over CAD 100,000 on Form T1135. Much simpler than US rules.

👉 Tip: If you're planning to move to the US in the future and currently hold Indian mutual funds, redeem them before obtaining US tax residency (green card or 183+ days). Once you're a US tax resident, the PFIC nightmare begins.

Also Read - Residential Status Under Section 6 Of Income Tax Act

Mistake 7: Chasing Last Year's Top Performers

Every January, financial websites publish "Top 10 Mutual Funds of [Last Year]." NRIs see these lists and think, "I'll invest in these winners."

This is one of the most common behavioral mistakes investors make-and it's costly.

Why this is a problem:

- Funds that performed exceptionally well in one year often underperform the next (mean reversion)

- Top performers are usually concentrated in hot sectors (e.g., tech in 2020, pharma in 2021). When that sector corrects, the fund tanks

- You're buying at peak valuations after the growth has already happened

What you should do instead: Focus on consistency over 3-5 years, not single-year performance:

- Look for funds that delivered top-quartile returns in at least 3 of the last 5 years

- Check rolling returns (3-year, 5-year, 10-year) rather than point-to-point returns

- Compare funds within the same category (large-cap vs large-cap, not large-cap vs small-cap)

Better yet, use index funds. They track the market (Nifty 50, Sensex) and avoid the temptation to chase performance. Read our guide on best investment platforms for NRIs for more options.

Also Read -How to Invest in Bonds - Beginner's Guide for NRIs

Mistake 8: Choosing Regular Plans Over Direct Plans

Most NRIs invest through "regular plans" because that's what their bank or distributor recommends. Regular plans have higher expense ratios (1.5-2.5%) because they pay commissions to distributors.

Direct plans of the same fund have lower expense ratios (0.5-1.5%). The difference seems small-but it compounds massively over time.

Example:

- Investment: ₹10 lakh

- Time: 20 years

- Expected return: 12% pre-expenses

Plan Type | Expense Ratio | Final Corpus | Difference |

|---|---|---|---|

Regular Plan | 2.0% | ₹67 lakh | - |

Direct Plan | 0.8% | ₹82 lakh | ₹15 lakh more |

You lose ₹15 lakh over 20 years just because you chose the wrong plan.

What you should do instead: Always choose direct plans:

- Invest directly through the AMC website

- Use platforms like Kuvera, Zerodha Coin, or Groww (they only offer direct plans)

- If you want advice, pay a SEBI-registered investment advisor a one-time fee instead of paying 1-2% annually forever

Already invested in regular plans? Switch to direct plans. You can switch units from regular to direct without tax implications, though you'll trigger exit load if you haven't held for 1 year (typically 1% for equity funds).

Mistake 9: Ignoring Currency Risk Entirely

NRIs earn in foreign currency (USD, AED, GBP) but invest in Indian mutual funds denominated in rupees. The rupee-to-foreign-currency exchange rate matters enormously.

Many NRIs forget this. They see "Fund gave 15% return" and assume they made 15% in their home currency. They didn't.

Example:

- You invest $10,000 when USD/INR = 75 (₹7.5 lakh)

- After 3 years, mutual fund grows to ₹9 lakh (20% return in INR terms)

- But now USD/INR = 83

- When converted back: ₹9 lakh ÷ 83 = $10,843

- Actual return in USD: 8.4%, not 20%

The rupee depreciated 10% over 3 years, eating half your returns.

What you should do instead: You can't eliminate currency risk, but you can manage it:

- Accept it as part of investing in India. Over decades, rupee depreciation is offset by higher Indian GDP growth and mutual fund returns

- Diversify across currencies. Don't put 100% of your wealth in INR-denominated assets

- Hedge with GIFT City investments.GIFT City fixed deposits are in USD, EUR, or GBP, giving you currency-hedged exposure to Indian interest rates

Never try to time currency movements. You'll lose more often than you win.

👉 Tip: Think in terms of purchasing power in India (if you're planning to return) rather than home currency. If you'll eventually spend money in India, rupee depreciation matters less.

Mistake Category 3: During Investment (Behavioral Errors)

Once you've invested correctly, the next set of mistakes happens while holding the investments.

Mistake 10: Trying to Time the Market

Market crashes scare NRIs. They're far from home, reading alarming headlines, and they panic.

During the 2020 COVID crash, many NRIs sold mutual funds at 30-40% losses. The market recovered within 6 months. Those who held earned 15-20% returns the next year.

Why this is a problem:

- You lock in losses by selling during crashes

- You miss the recovery (best days are often right after worst days)

- Transaction costs and taxes eat into returns

What you should do instead: Follow a disciplined approach:

- Invest via SIPs (Systematic Investment Plans). This averages your purchase price across market highs and lows

- Rebalance annually, don't react to headlines. Review portfolio once a year, not once a week

- Hold for at least 5 years. Short-term volatility smooths out over long periods

If you're tempted to sell during a crash, remember: the Indian stock market has delivered 12-15% CAGR over 20+ years despite multiple crashes. Long-term trends > short-term noise.

Better yet, use a step-up SIP strategy where you increase SIP amounts by 10% annually. This automates investing discipline.

Also Read - Best SIP Options for NRIs – Step by Step Guide

Mistake 11: Setting Up SIPs and Forgetting They Exist

Many NRIs set up SIPs when they're feeling optimistic, then forget about them for years. No reviews, no rebalancing, no updates.

Why this is a problem:

- Your financial situation changes (income, goals, risk tolerance), but your portfolio doesn't

- Fund managers change-a great fund in 2020 might be mediocre in 2025 under a new manager

- Sector concentrations build up without you realizing (e.g., 50% in IT because tech funds performed well)

What you should do instead: Review your mutual fund portfolio annually:

- Check performance: Are funds beating their benchmark and category average?

- Review asset allocation: Is your equity-debt split still aligned with your risk tolerance?

- Look for changes: Has the fund manager changed? Has the fund's investment style drifted?

- Rebalance: Trim winners, add to losers to maintain target allocation

Set a calendar reminder every January. Spend 2-3 hours reviewing statements, comparing performance, and making adjustments.

If you don't have time or expertise, use a robo-advisor or hire a SEBI-registered investment advisor for an annual review (₹10,000-25,000 fee is worth it for a ₹50 lakh+ portfolio).

Mistake 12: Not Nominating Beneficiaries

Indian mutual funds require nomination. If you pass away without a nominee, your legal heirs face a lengthy legal process to claim the funds-sometimes taking years.

SEBI made nomination mandatory for all mutual fund and demat accounts from June 1, 2025. Yet many NRIs skip this step.

Why this is a problem:

- Without nomination, your mutual fund units are stuck until legal heirs provide succession certificates or court orders

- This process can take 1-3 years in India, during which the funds remain locked

- Your family can't access the money even in emergencies

What you should do instead: Add nominees to all mutual fund folios:

- Log in to your AMC account or CAMS/KFintech portal

- Add up to 3 nominees with percentage allocation (e.g., spouse 50%, child 1 25%, child 2 25%)

- Provide nominee details: name, relationship, date of birth, address

Update nominations whenever life circumstances change (marriage, birth of child, divorce).

If you're an OCI or foreign citizen, check if your AMC allows foreign nationals as nominees. Some AMCs only allow Indian citizens/residents as nominees, which can complicate estate planning.

Mistake Category 4: Tax & Compliance (Regulatory Errors)

These mistakes relate to filing taxes and maintaining compliance with Indian and foreign tax authorities.

Mistake 13: Not Filing ITR in India

Many NRIs assume "I'm an NRI, so I don't need to file taxes in India." Wrong.

NRIs must file Income Tax Returns (ITR) in India if they have taxable income in India, including:

- Capital gains from mutual fund redemptions

- Dividend income from mutual funds

- Interest from NRO accounts (taxable)

Why this is a problem:

- Failure to file ITR can result in penalties (₹5,000-10,000) and interest (1% per month on unpaid tax)

- You can't claim TDS refunds if excess tax was deducted

- You can't carry forward capital losses to offset future gains

- Non-compliance can create issues when applying for loans, visas, or returning to India

What you should do instead: File ITR by July 31 every year (or extended deadline) if:

- You redeemed mutual funds with capital gains exceeding the basic exemption

- You have taxable interest income from NRO accounts

- You have rental income from Indian property

- You had any taxable income in India, even if TDS was fully deducted

Use ITR-2 form for capital gains from mutual funds. Declare capital gains, claim DTAA benefits if applicable, and attach relevant documents (TDS certificates, bank statements, capital gains statements from AMC).

Filing ITR online takes 1-2 hours. Use ClearTax, QuickBooks, or hire a CA (₹2,000-5,000 for simple returns). It's a small price for peace of mind and compliance.

Mistake 14: Missing DTAA Benefits

India has Double Taxation Avoidance Agreements (DTAA) with 90+ countries. These treaties prevent you from paying tax twice on the same income.

But DTAA benefits aren't automatic. You must claim them explicitly.

Why this is a problem: Without claiming DTAA:

- You pay full tax in India (12.5% LTCG or 20% STCG)

- You also pay tax in your resident country (10-30% depending on country)

- Total tax: 25-50% of your gains-unnecessarily high

What you should do instead: Claim DTAA benefits in two steps:

Step 1: In India

- Obtain Tax Residency Certificate (TRC) from your resident country

- File Form 10F on India's income tax portal

- Declare capital gains in ITR and claim exemption or reduced rate under relevant DTAA article

Step 2: In your resident country

- Report Indian income in your home country tax return

- Claim Foreign Tax Credit for taxes already paid in India

- Attach TDS certificates from India (Form 16A or 26AS)

Different countries have different DTAA provisions:

- UAE NRIs may pay zero tax on mutual funds (depending on recent ITAT ruling)

- US NRIs pay tax in both countries but can claim Foreign Tax Credit

- UK NRIs can claim credit for Indian tax paid

Confused by DTAA? Join our WhatsApp community where we discuss country-specific strategies, or read our detailed guide on how to avoid double taxation on mutual fund gains.

Mistake 15: Poor Documentation and Record-Keeping

NRIs often lose track of:

- Which mutual funds they hold

- Purchase dates and NAVs (needed to calculate capital gains)

- TDS certificates

- Redemption statements

When tax time arrives, they scramble to gather documents-and often file incorrect returns because data is missing.

Why this is a problem:

- You can't calculate capital gains accurately without purchase dates/NAVs

- You can't claim TDS refunds without certificates

- In case of IT department scrutiny, you have no proof of your investments

- Errors in ITR can trigger penalties and notices

What you should do instead: Maintain a digital folder for each financial year with:

- Mutual fund statements: Download quarterly (or after every transaction)

- Capital gains statements: Download at redemption from AMC website

- TDS certificates: Form 26AS (download from income tax portal annually)

- Bank statements: NRE/NRO accounts showing fund transfers

- ITR acknowledgments: After filing each year

Use cloud storage (Google Drive, Dropbox) so you can access documents from anywhere. Organize by year and investment type.

Set calendar reminders:

- March 31: Download all mutual fund statements for the financial year

- June 1: Download Form 26AS

- July 15: Gather all documents for ITR filing

👉 Tip:Most AMCs now allow you to consolidate all your investments across AMCs on one platform (CAMS or KFintech). Use this to get a single unified statement instead of tracking each fund separately.

Mistake Category 5: Exit Planning (Repatriation & Return Errors)

The final set of mistakes happens when you want to exit investments or return to India.

Mistake 16: Not Planning for Repatriation Limits

If you invested in mutual funds through an NRO account, you can repatriate only up to $1 million per financial year.

Many NRIs don't realize this until they want to move money abroad.

Example: You invested ₹10 lakh through NRO over 10 years. It grew to ₹50 lakh. Now you want to send it to your US bank account.

₹50 lakh = ~$600,000 (at USD/INR = 83). You can repatriate it in one year.

But if your corpus is ₹2 crore ($2.4 million), you'll need 2-3 years to repatriate the full amount-assuming you have no other NRO income.

What you should do instead: Plan ahead:

- If you know you'll need to repatriate, invest through NRE account (fully repatriable, no limits)

- If already invested in NRO, start repatriation early (don't wait until the last minute)

- Diversify: Some funds in NRE, some in NRO, to spread repatriation risk

When repatriating from NRO:

- Repatriation from an NRO account - Form 15CA must be filed. (For payments exceeding ₹5 lakh in a financial year)

- Note: A Chartered Accountant's certificate in Form 15CB is required before filing Form 15CA.

- Bank will deduct TDS if applicable

The process takes 7-15 days. Plan accordingly if you have time-sensitive payments abroad (down payment on house, tuition fees, etc.).

Mistake 17: Not Planning for Return to India

If you're planning to return to India permanently, your mutual fund strategy should change 2-3 years before return.

Many NRIs don't think about this. They return, then realize their mutual funds are still linked to NRE/NRO accounts that need conversion.

What you should do instead: 2-3 years before returning:

- Understand your residential status:You'll likely become RNOR (Resident but Not Ordinarily Resident) for 2-3 years before becoming full resident

- Leverage RNOR benefits: Foreign income is tax-free during RNOR years. If you hold foreign stocks/mutual funds, redeem them during RNOR years to avoid Indian tax

- Convert accounts: Once you're back in India, convert NRE/NRO accounts to resident savings accounts within 6 months

- Update KYC: Change status from NRI to Resident with all AMCs

- Review portfolio: As a resident, you can now invest in PPF, ELSS with Section 80C benefits, and other instruments previously restricted to NRIs

If you convert accounts correctly, your mutual funds continue without disruption. If you don't, you face the same compliance issues we discussed at the start.

Also Read -What Happens to Your NRI Account When You Return to India

How to Recover from These Mistakes

Already made one (or more) of these mistakes? Here's how to fix them:

If you haven't updated KYC:

- Do it today. It takes 2-4 weeks to process

- Until then, you can't make new investments or redemptions

- After updating, all future transactions will be smooth

If you invested in wrong account type (NRO instead of NRE):

- Check if AMC allows folio transfer between account types

- If not, you may need to redeem and reinvest (triggers capital gains tax-evaluate if it's worth it)

- Going forward, use correct account type for new investments

If you're a US NRI with Indian mutual funds:

- File all pending Form 8621s immediately (hire a US-India tax CPA)

- Consider redeeming funds and switching to PFIC-free options (GIFT City FDs, direct stocks, US mutual funds)

- Yes, you'll pay capital gains tax in India-but ongoing PFIC taxes + compliance costs are worse

Also Read - Taxation on Mutual Funds

If you missed filing ITR:

- File belated returns under Section 139(4): Allowed for current AY (e.g., AY 2025-26), up to Dec 31, 2025.

- Note - Cannot file for past 2 years: If deadlines for earlier AYs (e.g., AY 2024-25) have passed.

- Pay penalty + interest

- Note - For prior years: Use Updated Return (ITR-U) under Section 139(8A), up to 4 years from end of relevant AY, but only to report additional income (no refunds/reduced liability).

(Source)

Also Read - How to File Income Tax Return in India as an NRI

If you're in regular plans:

- Switch to direct plans of the same fund (no capital gains tax, but exit load may apply if held \< 1 year)

- Going forward, invest only in direct plans

If you didn't nominate:

- Add nominees today-takes 5 minutes online

- Update across all folios

Most mistakes are fixable. The key is acting quickly once you realize the error.

The Smarter Alternative: GIFT City Investments

If you're tired of the complexity-KYC updates, FATCA declarations, PFIC worries, currency risk, repatriation limits-there's a simpler option: GIFT City investments.

GIFT City (Gujarat International Finance Tec-City) is India's offshore financial center. Investments made here have unique benefits for NRIs:

Tax benefits:

- Interest on GIFT City fixed deposits is 100% tax-free in India

- No TDS deducted

- Simpler tax reporting in your home country (since no Indian tax was paid, no DTAA complexity)

Currency benefits:

- Denominated in USD, EUR, or GBP (no rupee depreciation risk)

- Rates comparable to foreign banks (4.5-5.5% in USD, tax-free)

Repatriation benefits:

- Fully repatriable, no LRS limits

- No Form 15CA/15CB requirements

- Funds can be transferred abroad within 24 hours

Compliance benefits:

- No KYC updates needed when you change countries

- No PFIC issues for US NRIs

- No complex FATCA declarations

At Belong, we offer GIFT City fixed deposits with:

- Rates up to 5.5% USD (tax-free)

- Digital account opening from anywhere in the world

- Full support for documentation and compliance

Think of GIFT City FDs as the "NRI-friendly" alternative to mutual funds. You get safety, liquidity, tax efficiency, and simplicity-without the 15 mistakes we just discussed.

Compare GIFT City FDs with NRE/NRO fixed deposits to see which works better for your goals.

Your Action Plan: Invest Smarter Going Forward

Here's your checklist to avoid all 15 mistakes:

Before investing:

- [ ] Open NRE and NRO accounts (choose correct type for each goal)

- [ ] Update KYC to NRI status within 6 months of moving abroad

- [ ] File FATCA/CRS declaration correctly

- [ ] Check if your AMC accepts investors from your country

- [ ] If US NRI, avoid mutual funds entirely (invest in GIFT City FDs or direct stocks instead)

While choosing funds:

- [ ] Focus on 3-5 year consistent performance, not last year's winners

- [ ] Always choose direct plans over regular plans

- [ ] Understand currency risk (accept it or diversify across currencies)

- [ ] Check fund manager track record and tenure

During investment:

- [ ] Set up SIPs and automate investments

- [ ] Review portfolio annually (not daily)

- [ ] Don't try to time the market (stay invested through volatility)

- [ ] Add nominees to all folios

Tax & compliance:

- [ ] File ITR in India every year if you have taxable income

- [ ] Obtain TRC and claim DTAA benefits

- [ ] Maintain digital folder with all documents

- [ ] Download Form 26AS and statements annually

Exit planning:

- [ ] If invested in NRO, plan for $1 million/year repatriation limit

- [ ] If returning to India, convert accounts and update KYC within 6 months

- [ ] Leverage RNOR status for 2-3 years to minimize taxes

Following this checklist will save you lakhs in avoidable costs and years of compliance headaches.

Join the Belong Community

Investing from abroad doesn't have to be this complicated. At Belong, we've built tools, resources, and a community to make it easier:

Free tools:

- NRI Fixed Deposit Comparison Tool: Compare rates across NRE, NRO, FCNR, and GIFT City FDs from 15+ banks

- Residential Status Calculator: Determine if you're NRI, RNOR, or ROR for tax purposes

GIFT City investments:

- USD Fixed Deposits with up to 5.5% tax-free returns

- No KYC hassles, no currency risk, full repatriation

- Digital account opening from anywhere in the world

Community support: Join 4,000+ NRIs in our WhatsApp community who discuss real investment questions, share tax strategies, and help each other navigate the complexity: Join Belong's WhatsApp Community

Download the Belong app to explore tax-free USD FDs, compare investment options, and access resources built specifically for NRIs: Download App

Whether you're in Dubai, New York, London, or Singapore-we've helped NRIs from 40+ countries invest smarter in India. You don't have to figure this out alone.

Final Thoughts: Avoiding Mistakes is Easier Than Fixing Them

NRIs don’t err due to carelessness-Indian investment rules like FATCA, PFIC, DTAA, FEMA, TDS, and KYC are complex and ever-changing.

Good news: Set things up right once-correct account, updated KYC, direct plans, FATCA filing-and you’re set for years.

Our team has fixed these mistakes for NRIs, some costing weeks or thousands in penalties. Learn from them. Use this guide as your checklist.

Your goal: Grow wealth in India safely and efficiently to fund your dreams and financial freedom. Avoid these 15 mistakes, and you’re ahead of 90% of NRI investors.

Sources:

Comments

Your comment has been submitted