Best SIP Options for NRIs - Complete Step-by-Step Guide

So, you are looking for ways to investment, preferably in SIPs. Good call!

But, let me share some details and numbers before diving in.

₹6,57,000 – Additional wealth generated by a ₹10,000 monthly SIP in equity funds versus bank fixed deposits over 10 years. (assuming 12% equity returns and 6.5% FD rates).

26.5% – Three-year returns delivered by top-performing NRI SIP funds like Motilal Oswal Midcap Growth in 2025.

₹50 lakhs – Final corpus from investing ₹10,000 monthly for 15 years at 12% annual returns (total investment: ₹18 lakhs).

₹500 – Minimum monthly amount needed to start most SIP investments as an NRI.

75% – Percentage of NRIs who remain invested in SIPs for more than 5 years, according to recent surveys.

These aren't just numbers. They represent the financial transformation thousands of NRIs experience through systematic investment planning.

While your friends debate timing the market perfectly, successful NRI investors are building wealth methodically through SIPs – month after month, regardless of market volatility.

Sources: Business TodayMoneycontrolICICI Bank

Why NRIs Are Choosing SIPs Over Lump Sum Investing

The India Growth Story

India's economy continues its robust growth trajectory, offering NRIs unique opportunities to participate in this expansion. GDP growth averaging 6-7% annually translates into attractive mutual fund returns for disciplined investors.

Currency Advantage: When you earn in dollars, pounds, or dirhams and invest in rupees, you often start with a mathematical advantage due to favorable exchange rates.

Rupee Cost Averaging Magic

Here's how SIPs protect NRIs from currency and market volatility:

Month 1: ₹10,000 buys 100 units at ₹100 per unit

Month 2: ₹10,000 buys 125 units at ₹80 per unit

Month 3: ₹10,000 buys 91 units at ₹110 per unit

Average cost per unit: ₹94.34 (despite prices fluctuating between ₹80-₹110)

This automatic averaging works especially well for NRIs dealing with dual currency volatility – both INR fluctuations and your home country market cycles.

Digital Convenience

Unlike the old days of depending on family members or periodic India visits, modern SIP platforms allow complete online management. Set up once, and your investments run automatically from anywhere in the world.

👉 Tip:Most successful NRI SIP investors start conservatively with ₹5,000-₹10,000 monthly and gradually increase amounts as they gain confidence and income grows.

How SIPs Work for NRIs

The Investment Mechanics

Every month on your chosen date, a predetermined amount gets debited from your NRE or NRO account and invested in your selected mutual fund scheme.

You purchase units at the current Net Asset Value (NAV). When markets are high, you buy fewer units. When markets are low, you buy more units. Over time, this averages out your purchase cost and reduces timing risk.

Account Requirements

NRE Account Benefits:

- Fully repatriable investments and returns

- Tax-free interest on account balance

- Better for NRIs prioritizing repatriation flexibility

NRO Account Benefits:

- Can handle Indian income sources

- Suitable for mixed investment strategies

- Repatriation limited to $1 million per year

FCNR Account:

- Maintain investments in foreign currency

- Natural hedge against currency fluctuations

- Higher minimum balance requirements

Compliance Framework

All NRI SIP investments must comply with:

- FEMA regulations for foreign exchange management

- KYC requirements with overseas address verification

- FATCA/CRS declarations based on your country of residence

- Tax obligations in both India and your country of residence

Best SIP Categories for Different Goals

Conservative Growth (Low to Moderate Risk)

Large-Cap Equity Funds:

- ICICI Prudential Bluechip Fund: 25%+ three-year returns, diversified across 50+ large companies

- HDFC Top 100 Fund: Consistent performer focusing on market leaders

- SBI Blue Chip Fund: Government backing with professional management

Target Allocation: 40-60% of total SIP amount

Minimum SIP: ₹1,000-₹5,000 monthly

Ideal For: First-time NRI investors, retirement planning, conservative wealth building

Balanced Growth (Moderate Risk)

Multi-Cap and Flexi-Cap Funds:

- Motilal Oswal Large and Midcap Fund: 26.5% three-year returns, balanced exposure (source)

- Invesco India Flexi Cap Fund: Dynamic allocation across market caps

- Parag Parikh Flexi Cap Fund: International diversification included

Target Allocation: 30-50% of total SIP amount

Minimum SIP: ₹2,000-₹7,500 monthly

Ideal For: Medium-term goals (5-10 years), balanced growth approach

Aggressive Growth (High Risk)

Mid-Cap and Small-Cap Funds:

- Motilal Oswal Midcap Growth: 26.5% three-year returns, highest NRI SIP performer 2025

- Bandhan Small Cap Fund: 31.19% three-year returns, small company focus

- ICICI Prudential Infrastructure Fund: 29.63% three-year returns, infrastructure theme

Target Allocation: 20-40% of total SIP amount

Minimum SIP: ₹1,500-₹5,000 monthly

Ideal For: Long-term goals (10+ years), young NRIs with high risk tolerance

Tax-Efficient Growth (Dual Benefit)

ELSS (Equity Linked Savings Scheme) Funds:

- Mirae Asset ELSS Tax Saver: Strong performance with tax benefits

- Axis Long Term Equity: Consistent returns with 3-year lock-in

- DSP ELSS Tax Saver: High returns with tax deduction benefits

Tax Benefit: Up to ₹1.5 lakh deduction under Section 80C

Lock-in Period: 3 years (shortest among 80C investments)

Minimum SIP: ₹500-₹1,000 monthly

Ideal For: NRIs with Indian taxable income

Stable Income (Low Risk)

Debt and Hybrid Funds:

- ICICI Prudential All Seasons Bond Fund: 8-10% steady returns

- Aditya Birla Sun Life Medium Term Plan: 9% returns with lower volatility (source)

- Kotak Debt Hybrid Fund: Mix of debt and equity for balanced returns

Target Allocation: 10-30% of total SIP amount

Minimum SIP: ₹1,000-₹3,000 monthly

Ideal For: Emergency fund building, short-term goals, conservative investors

👉 Tip:Successful NRI SIP portfolios typically combine 2-4 fund categories rather than concentrating in a single fund type.

Step-by-Step SIP Setup Process

Phase 1: Foundation (Week 1-2)

Step 1: Account Verification

- Ensure your NRI bank account is active and funded

- Verify online banking and mobile app access

- Confirm international transaction capabilities

Step 2: KYC Compliance

- Complete fresh KYC with NRI status if not already done

- Update overseas address and contact information

- Submit FATCA/CRS declarations as required

Step 3: Goal Setting

- Define specific financial goals (retirement, child education, property purchase)

- Determine investment timeline for each goal

- Calculate required monthly investments using SIP calculators

Phase 2: Fund Selection (Week 2-3)

Step 4: Risk Assessment

- Evaluate your comfort level with market volatility

- Consider age, income stability, and existing investments

- Decide allocation between aggressive and conservative funds

Step 5: Fund Research

- Compare 3-year and 5-year returns of shortlisted funds

- Check expense ratios (lower is better for long-term wealth)

- Review fund manager experience and consistency

- Analyze top holdings and sector allocation

Step 6: Platform Selection Choose between:

- Direct AMC Platforms: Lower costs, more research needed

- Bank Platforms: Convenience, higher fees, integrated banking

- NRI-Specialized Platforms: Tailored services, moderate costs

Phase 3: Investment Execution (Week 3-4)

Step 7: Application Submission

- Fill online application forms for chosen funds

- Specify monthly SIP amount and debit date

- Select auto-increase options if available (10-15% annual escalation)

- Choose repatriable/non-repatriable basis

Step 8: Documentation

- Attach KYC acknowledgment numbers

- Submit bank mandate for automatic debits

- Provide FATCA/CRS certificates

- Upload identity and address proofs

Step 9: SIP Activation

- Receive confirmation emails with SIP details

- Set up online portfolio tracking

- Download mobile apps for monitoring

- Schedule first quarterly review date

Also Read - Documents Required for NRI Account Opening

Phase 4: Optimization (Monthly)

Step 10: Performance Monitoring

- Track monthly statements and returns

- Compare performance against benchmarks

- Monitor expense ratios and fund manager changes

- Review asset allocation drift

Step 11: Regular Adjustments

- Increase SIP amounts annually with income growth

- Rebalance allocation based on goal proximity

- Add new funds as portfolio grows

- Consider switching underperforming funds

👉 Tip:Set up automatic SIP increases of 10-15% annually to keep pace with income growth and inflation.

Platform and Amount Strategies

Optimal SIP Amounts by Income Level

Entry Level (Monthly Income $2,000-$4,000):

- Total SIP: ₹5,000-₹15,000 monthly

- Large-cap fund: ₹3,000-₹8,000

- Mid-cap fund: ₹2,000-₹5,000

- ELSS fund: ₹1,000-₹2,000

Mid Level (Monthly Income $4,000-$8,000):

- Total SIP: ₹15,000-₹40,000 monthly

- Large-cap fund: ₹8,000-₹20,000

- Multi-cap fund: ₹5,000-₹15,000

- Mid-cap fund: ₹3,000-₹10,000

- Debt fund: ₹2,000-₹5,000

Senior Level (Monthly Income $8,000+):

- Total SIP: ₹40,000+ monthly

- Diversified across 4-6 fund categories

- Include international funds and sectoral themes

- Consider GIFT City investments for tax efficiency

Platform Comparison for NRIs

Best for Beginners: iNRI

- Pros: End-to-end NRI services, simplified processes, expert guidance

- Cons: Limited to partner funds, moderate fees

- Best For: First-time investors, those wanting full-service experience

Best for Cost-Conscious: Direct AMC Platforms

- Pros: Lowest expense ratios, direct fund house relationship

- Cons: Need multiple accounts, more research required

- Best For: Experienced investors, cost optimization focus

Best for Convenience: ICICI Direct/HDFC Securities

- Pros: Integrated banking, comprehensive research, mobile apps

- Cons: Higher fees, may push proprietary products

- Best For: Existing bank customers, those wanting one-stop-shop

Best for Community: SBNRI

- Pros: 25,000+ NRI community, mobile-first, educational content

- Cons: Newer platform, limited track record

- Best For: NRIs wanting peer learning and networking

Also Read - NRI Account Charges Compared Across Major Indian Banks

SIP Date Optimization

Best SIP Dates for NRIs:

- 5th-10th: Aligns with salary credit cycles

- 15th: Mid-month liquidity after initial expenses

- 25th: Month-end planning and budget assessment

Avoid:

- 1st-3rd: Bank processing delays

- 30th/31st: Month-end volatility and operational issues

👉 Tip:Spread multiple SIPs across different dates (e.g., 7th, 15th, 25th) to further average market timing.

SIP Management and Optimization

Portfolio Rebalancing Strategy

Quarterly Review Checklist:

- Compare actual vs. target allocation percentages

- Identify significantly over/underperforming funds

- Check for expense ratio changes or fund manager movements

- Assess goal timeline and adjust risk accordingly

Annual Optimization Actions:

- Increase SIP amounts by 10-15% to match income growth

- Consider tax-loss harvesting opportunities

- Review and update nomination details

- Evaluate new fund launches and category additions

Performance Tracking Metrics

Key Performance Indicators:

- XIRR (Annualized Returns): Compare against category benchmarks

- Sharpe Ratio: Risk-adjusted returns measurement

- Standard Deviation: Volatility compared to similar funds

- Expense Ratio: Ensure competitive cost structure

Red Flags to Watch:

- Consistent underperformance for 2+ years

- Expense ratio increases without performance justification

- Frequent fund manager changes

- Asset size becoming too large (₹20,000+ crores) affecting agility

Tax-Smart SIP Strategies

For NRIs in UAE:

- Maximize equity funds for potential DTAA benefits

- Consider ELSS for Indian tax optimization

- Plan redemptions during UAE residency for tax efficiency

For NRIs in US:

- Balance PFIC implications with growth potential

- Maintain detailed records for IRS reporting

- Consider timing redemptions for optimal tax treatment

For NRIs in UK:

- Post-Brexit DTAA benefits still applicable

- Monitor capital gains annual exemption limits

- Consider ISA/pension contributions in parallel

👉 Tip:Maintain separate SIPs for different goals – this makes tax planning and goal tracking much simpler.

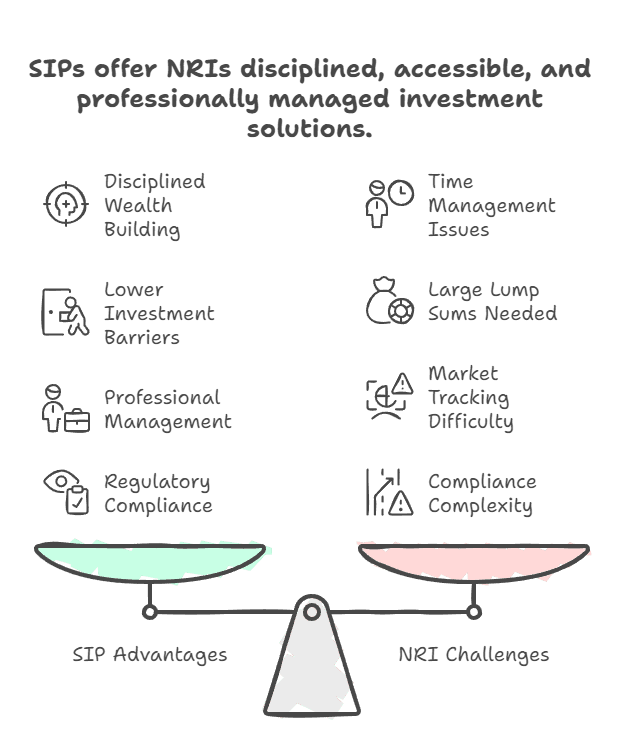

Pros and Limitations

Key Advantages for NRIs

Disciplined Wealth Building: SIPs enforce regular investing habits, preventing the common mistake of trying to time markets. This discipline is especially valuable for busy NRIs managing careers abroad.

Lower Investment Barriers: Start with ₹500 monthly instead of waiting to accumulate large lump sums. This accessibility allows NRIs to begin investing immediately rather than procrastinating.

Professional Management: Fund managers handle research, stock selection, and portfolio rebalancing – crucial for NRIs who can't actively track Indian markets daily.

Regulatory Compliance: Established SIP platforms handle most compliance requirements, making it easier for NRIs to stay within FEMA and tax regulations.

Important Limitations

No Guaranteed Returns: SIP returns depend on market performance. Even the best funds can underperform during extended market downturns.

Currency Double Impact: Poor fund performance combined with rupee depreciation can create significant negative returns in your home currency.

Long-term Commitment Required: SIPs work best over 5+ year periods. Short-term investors may not see the full benefits of rupee cost averaging.

Platform Dependency: Changes in platform policies, FATCA compliance, or fund availability can disrupt established SIP strategies.

Also Read - Minimum Balance Requirements for NRI Accounts in Indian Banks

Action Plan

Transform your NRI investment strategy with systematic SIP implementation:

Week 1-2: Foundation Setup

- Verify your NRE/NRO account status and online banking access

- Complete fresh KYC if your residential status changed to NRI recently

- Research and shortlist 3-5 fund options across different categories

- Calculate target monthly investment amounts using SIP calculators

Week 3-4: Launch Execution

- Choose your preferred platform (direct AMC, bank, or specialized NRI platform)

- Start with conservative amounts: ₹5,000-₹10,000 spread across 2-3 funds

- Set up SIP dates aligned with your salary credit cycle

- Configure online tracking and mobile app access

Month 2-3: Optimization

- Monitor first few investment confirmations and NAV allocations

- Set up automatic annual SIP increases of 10-15%

- Schedule quarterly portfolio review reminders

- Research additional fund categories for future expansion

Ongoing: Scale and Grow

- Increase SIP amounts annually with income growth

- Add new fund categories as portfolio size grows

- Review and rebalance allocation annually

- Consider tax-efficient GIFT City investments as supplement to traditional SIPs

The best time to start your SIP journey was 10 years ago. The second-best time is today.

Ready to optimize your SIP strategy?

Join our WhatsApp community where 15,000+ NRIs share SIP experiences, fund recommendations, and performance tracking strategies. Get expert guidance on portfolio allocation and tax optimization.

Download the Belong app to explore GIFT City USD fixed deposits that complement your SIP portfolio with tax-free returns and currency hedging benefits.

Your systematic investment journey starts with the first SIP installment. Begin building wealth today, one month at a time.

Sources:

Comments

Your comment has been submitted