NIFTY Bharat Bond Index Futures in GIFT City

The NIFTY Bharat Bond Index Futures in GIFT City marks a significant development in India's financial markets. Launched on December 30, 2024, this innovative product offers investors a mechanism to access and manage fixed-income securities.

NIFTY Bharat Bond Index Futures combines stability with flexibility. It opens up a new way for non-resident Indians (NRIs) and global participants to engage with India's fixed-income market. These contracts combine AAA-rated bonds from public sector enterprises with a futures product.

In this blog we will look into the NIFTY Bharat Bond Index Futures.

Key Features of NIFTY Bharat Bond Index Futures

Underlying Asset: Currently there are five maturity dates for NIFTY Bharat Bond Indices (April 2025 and April 2033). Each index has a basket of AAA-rated bond maturities on specific dates.

Exchange: They are traded in NSE IX.

Currency: US Dollars

Daily Price Limit: ±3%, expandable in extreme conditions

Settlement: Cash-settled

Lot Size: US$10 multiplied by Index Points

Tick Size: US$0.0025

Expiry:

Monthly Contracts: Last Thursday of each month

Half-Yearly Contracts: Last Thursday of June and December

Trading hours: 9:00 AM to 5:00 PM IST

Why NIFTY Bharat Bond Index Futures?

The Bharat Bond Index was launched on December 4, 2019, by the National Stock Exchange (NSE). It was introduced to address the need for efficient, predictable and accessible fixed-income investment opportunities.

The introduction of these futures in GIFT City underscores a commitment to providing global investors with structured, liquid and efficient tools for:

Credit quality: Bonds in NIFTY Bharat Bond Index Futures are rated AAA, the highest rating given by credit rating agencies. There's a very low likelihood of default providing safety net for investors.

Hedging interest rate risks: Investors can hedge their bond portfolios against rising or falling interest rates.

Speculative trading: Professional traders seeking to profit from short-term interest rate moves can use these futures within a regulated, transparent environment.

Diversification: High-quality Indian bonds (AAA-rated) provide a stable source of returns. For NRIs with a global portfolio, adding Indian fixed-income increases diversification and reduce overall portfolio volatility.

Cash settlement: As these contracts are cash-settled in USD, there’s no complex delivery of bonds. This feature is appealing to investors who want exposure to Indian bonds without dealing with domestic custody or dematerialisation processes.

Bharat Bond Index Futures vs Bharat Bond ETFs

Bharat Bond ETFs and NIFTY Bharat Bond Index Futures track the same underlying Bharat Bond Indices while serving complementary purposes in different geographies.

Feature | Bharat Bond ETFs | NIFTY Bharat Bond Index Futures |

Nature | Direct investment in AAA-rated bonds | Derivative contracts on NIFTY Bharat Bond Indices |

Investor base | Resident Indians | NRIs, foreign investors and institutional participants |

Currency | Indian Rupees | US Dollars |

Trading venue | Indian Exchanges | NSE IX in GIFT City |

Risk profile | Risk Profile Low-risk, steady returns | Higher risk, leveraged exposure with potential for both gains and losses |

Use case | Long-term conservative investing | Hedging, speculative trading |

How the NIFTY Bharat Bond Index Futures benefit the market

The launch of index futures has been associated with improved market efficiency in India. Since the launch of index futures in 2000, these instruments have allowed for quicker price adjustments to new information. Through these index futures, market has responded more effectively to economic changes resulting in more dynamic trading environment. The NIFTY Bharat Bond Index Futures continues this trend by providing a structured platform for price discovery in the fixed-income space.

RBI's research has shown that index futures has reduced the spot market volatility. The NIFTY Bharat Bond Index Futures through their tracking of AAA-rated bonds from public sector enterprises enhance this stability. These bonds are less susceptible to market shocks compared to lower-rated securities.

NIFTY Bharat Bond Index Futures: A Gateway to India's Debt Market

Introduction of NIFTY Bharat Bond Index Futures is a landmark step in India’s drive to expand its fixed-income derivative offerings. By listing these AAA bond-based futures on NSE IX in GIFT City, regulators offer a vehicle for NRIs and global investors seeking stable yields, interest rate hedging and exposure to high-grade Indian public sector bonds all in US dollars.

For institutional players the futures offer a structured, liquid and transparent environment to manage interest rate risk or take speculative positions on bond price movements. For NRIs, it opens a gateway to Indian fixed-income markets without navigating all the complexities of domestic bond trading and custody.

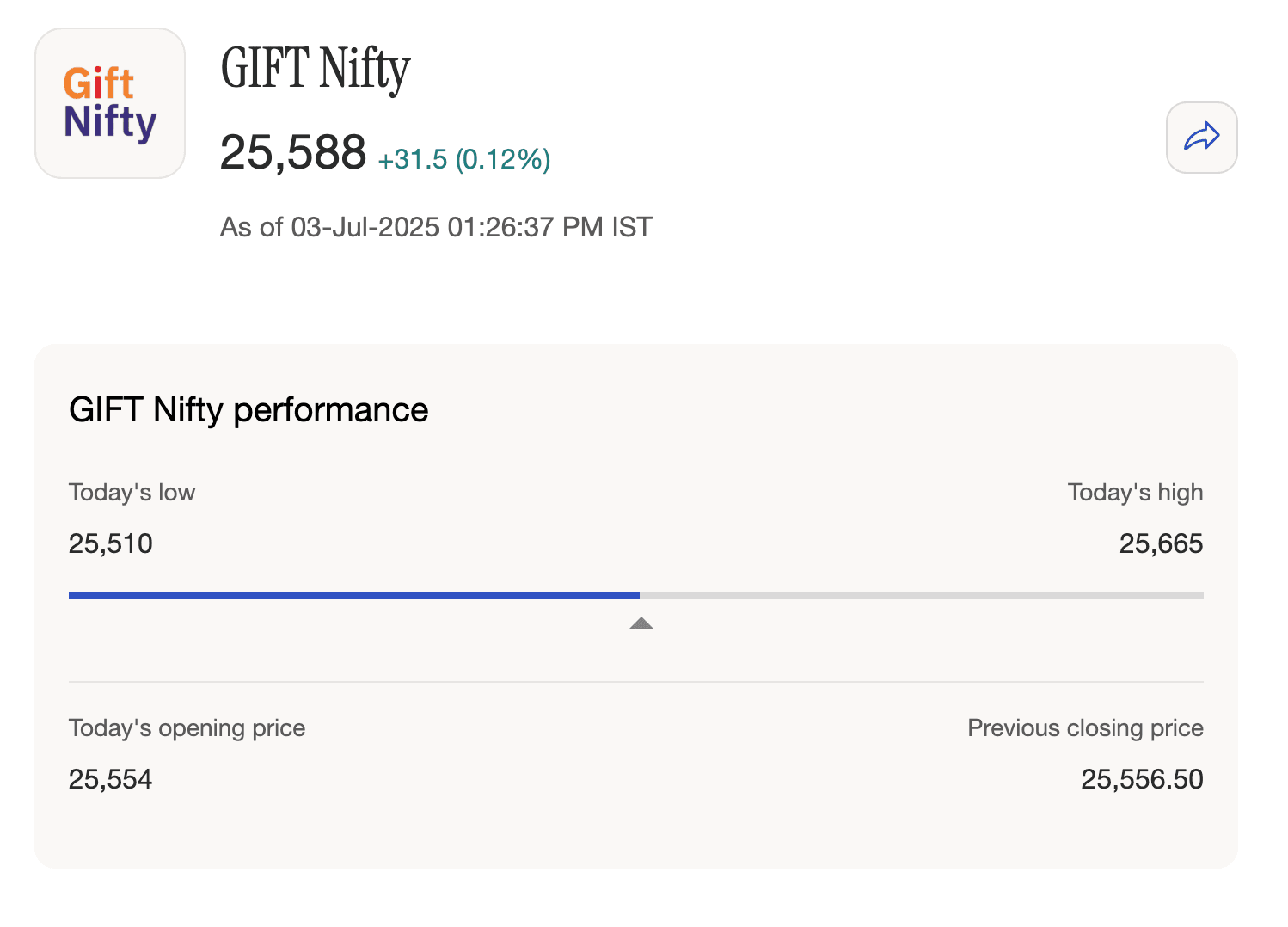

Track GIFT NIFTY Index Share Price Live - Get Real-time prices of GIFT NIFTY with Belong's GIFT Nifty Tracker

Comments

Your comment has been submitted