Common Mistakes NRIs Make While Choosing an NRE Banking Account

You've been researching NRE accounts for weeks. You've read bank websites, compared interest rates, maybe even called a few relationship managers.

Yet something feels off.

The information seems incomplete. Too many "terms and conditions apply" disclaimers. Too many conflicting opinions in those UAE NRI WhatsApp groups.

Here's what's really happening: Most NRIs choose their first Indian bank account based on incomplete information, and it costs them dearly.

I've seen UAE-based professionals lose ₹50,000-₹80,000 annually because they made preventable mistakes during account selection.

The problem isn't that you're not smart enough. You're dealing with 47-page fee schedules, changing RBI regulations, and banks that highlight benefits while burying limitations in fine print. Even CAs sometimes give outdated advice.

After helping 1,200+ UAE NRIs optimize their Indian banking over the past 3 years, I've identified 7 critical mistakes that trap even experienced professionals. More importantly, I'll show you how to avoid each one.

By the end of this guide, you'll know exactly which red flags to watch for, which questions to ask your bank, and how to choose an NRE account that actually serves your needs instead of draining your wealth.

The NRI Banking Dilemma: Why Smart People Make Bad Choices

The Information Gap

You're sitting in Dubai, researching Indian banking online. The bank websites look professional. Interest rates seem attractive. But you can't shake the feeling that you're missing something important.

You're right to be cautious.

Here's what most comparison articles don't tell you:

- HDFC advertises "6.8% NRE FD rates" but their currency conversion markup alone costs ₹31,000/year for typical UAE salary transfers

- ICICI promotes "global banking convenience" while charging ₹1,200 per incoming wire transfer

- SBI offers "wide branch network" but their digital banking experience for NRIs is consistently rated 2/5 stars

The Urgency Factor

Mistake amplifier: Many NRIs choose accounts under pressure. Your UAE employer needs Indian bank details for salary transfer. You're buying property and need funds transferred quickly. The sales pressure from bank relationship managers feels overwhelming.

Result: Hasty decisions based on incomplete information that cost thousands annually for years.

The Compliance Fear

The deeper problem: You're worried about getting something wrong. FEMA violations. Tax implications. Regulatory issues that could surface years later.

This fear is justified – but it shouldn't paralyze you into poor decisions.

Why These Mistakes Matter More Now

2025 Regulatory Changes

RBI's updated FEMA guidelines are stricter on compliance violations. Banks are required to report more NRI transactions to authorities.

The cost of mistakes has increased significantly.

New reality:

- Enhanced scrutiny on fund sources and repatriation

- Stricter KYC requirements for NRI accounts

- Higher penalties for non-compliance -The penalty for a FEMA contravention is severe and can be up to three times the sum involved in the violation - Section 13 of FEMA

Technology Evolution

Digital banking gap: UAE-based NRIs need robust online/mobile banking since physical branch visits are impossible. Yet many banks offer poor digital experiences for NRI customers.

Current problem: You'll discover the digital limitations only after opening the account and transferring significant funds.

Economic Impact

Hidden cost explosion: Currency conversion charges, SWIFT fees, and penalty structures have become more complex and expensive. What used to cost ₹15,000 annually now costs ₹45,000+ for the same transactions.

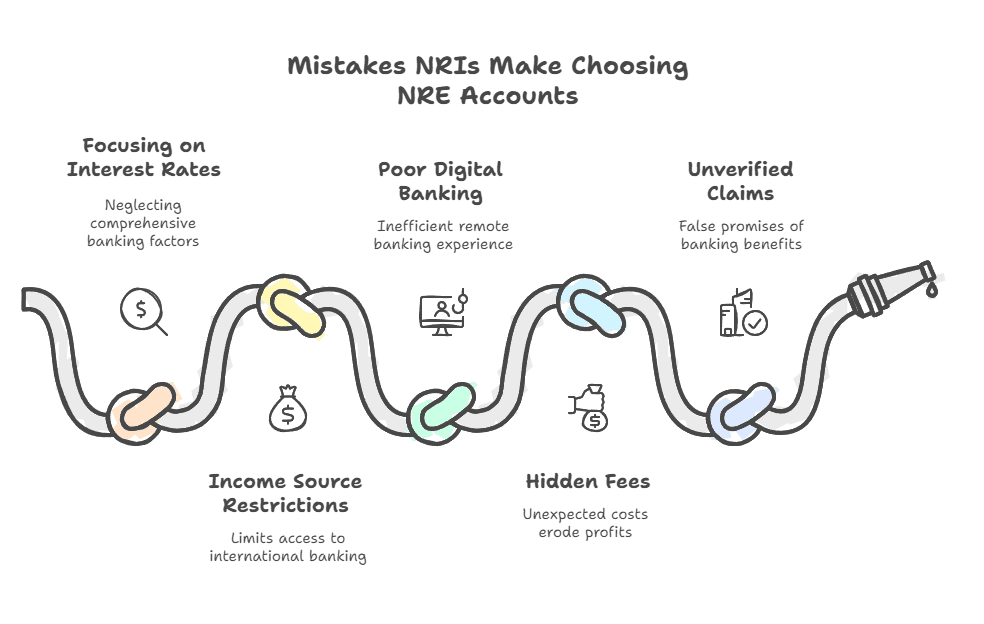

Breaking Down the 7 Critical Mistakes

Mistake #1: Choosing Based Only on Interest Rates

What NRIs do: Compare 6.8% vs 7.1% FD rates and pick the higher number.

Why this backfires: A 0.3% rate advantage gets wiped out by higher conversion charges, SWIFT fees, or poor digital banking that forces expensive workarounds.

Real example: Sahil chose Bank X for 7.1% NRE FD rate vs Bank Y's 6.8%. But Bank X's 3.2% currency conversion markup cost him ₹48,000 annually on salary transfers.

Net result: ₹42,000 annual loss despite "higher" interest rate.

👉 Tip: Calculate total cost of ownership, not just deposit returns. Include conversion charges, SWIFT fees, and maintenance costs.

Mistake #2: Not Understanding Income Source Restrictions

The confusion: Thinking any money can go into NRE accounts since they're "for NRIs."

FEMA reality: Only foreign-sourced income can be deposited in NRE accounts. Indian rental income, dividends from Indian companies, or proceeds from Indian asset sales CANNOT go into NRE accounts.

Violation consequences:

- Account freezing by bank

- Can lead to account freezing and a FEMA penalty of up to three times the amount you wrongly deposited.

- Tax complications requiring expensive CA resolution

- Difficulty in future repatriations

Real case: Priya (Abu Dhabi) deposited her Mumbai apartment rent into her NRE account for 8 months.

An RBI notice resulted in a significant penalty and complicated paperwork to regularize the violation

For a ₹1.2 lakh wrongful deposit, the penalty could theoretically be up to ₹3.6 lakh..

Mistake #3: Ignoring Digital Banking Quality

Common assumption: "All bank apps work the same way."

Ground reality for UAE NRIs:

- Need to transfer money at odd hours (time zone differences)

- Can't visit branches for problem resolution

- Require robust customer support for international users

Digital banking scorecard (based on 400+ UAE NRI user reviews):

Bank | Mobile App Rating | UAE Customer Support | International Features |

|---|---|---|---|

ICICI Bank | 4.1/5 | 24/7 UAE toll-free | Excellent |

HDFC Bank | 3.8/5 | Business hours only | Good |

Axis Bank | 3.6/5 | Limited UAE support | Average |

SBI | 2.9/5 | Poor international support | Below average |

Hidden costs of poor digital banking:

- Need to call customer service: ₹200-₹500 per international call

- SWIFT charges for bank-to-bank transfers when app fails: ₹1,500 per transaction

- Delayed transfers causing FX losses: ₹5,000-₹15,000 annually

Mistake #4: Underestimating Hidden Fees

Marketing vs. Reality:

What banks advertise:

- "Competitive exchange rates"

- "Free international banking"

- "Low minimum balance requirements"

What they don't prominently disclose:

- 2-4% currency conversion markup hidden in "today's rate"

- ₹750-₹1,500 per incoming wire transfer

- ₹600-₹1,000 monthly penalty for minimum balance violations

Fee structure breakdown for typical UAE NRI (₹40 lakh annual transfers):

Bank | Annual Hidden Costs | Conversion Markup | SWIFT Charges | AMB Penalties |

|---|---|---|---|---|

HDFC Bank | ₹52,000 | 3.2% | ₹18,000 | ₹9,000 |

ICICI Bank | ₹45,000 | 2.8% | ₹14,400 | ₹6,000 |

SBI | ₹48,000 | 3.5% | ₹12,000 | ₹8,400 |

Axis Bank | ₹50,000 | 3.1% | ₹16,800 | ₹7,200 |

*Note: These figures are rough estimates and subject to change. They should be considered as illustrative examples or ranges.

Mistake #5: Not Verifying International Banking Claims

The marketing trap: Banks promote "global banking network" and "international services" without specifics.

Due diligence questions you should ask:

- UAE-specific support:

- Do you have UAE toll-free numbers?

- What are customer service hours for UAE time zone?

- Can I get account statements delivered to UAE address?

- Transaction processing:

- How long for UAE salary transfers to reflect?

- What's the maximum single transfer limit?

- Do you offer same-day processing for urgent transfers?

- Documentation support:

- Can I submit documents electronically from UAE?

- What's the process for account closure from abroad?

- How do you handle signature verification for UAE residents?

Red flags I've observed:

- Banks that can't answer UAE-specific questions clearly

- Relationship managers who've never handled UAE NRI accounts

- No mention of international digital banking features on their website

Mistake #6: Overlooking Compliance Requirements

The assumption: "Banks will handle all compliance automatically."

Reality check: You're responsible for providing accurate information and ensuring your transactions comply with both Indian and UAE regulations.

Critical compliance areas:

Income Source Documentation:

- Salary certificates from UAE employer

- Tax residency certificates

- Proof of funds' foreign origin for large transfers

Repatriation Planning:

- DTAA benefits claiming process

*Note: The Liberalised Remittance Scheme (LRS) is available for RESIDENT Indians sending money out of India.

Not applicable to NRI depositing foreign income in NRE account. The funds in an NRE account are already considered freely repatriable.

TCS does not apply to an NRI sending foreign salary to NRE account in India

Status Updates:

- Informing bank when you visit India (affects NRI status)

- Converting account when you permanently return to India

- Updating beneficiary nominations regularly

Compliance violation costs:

- FEMA penalty: ₹50,000-₹2 lakh

- Tax scrutiny and additional assessments

- Legal complications affecting future banking

Mistake #7: Not Planning for Account Closure

Why this matters: 30% of UAE NRIs change banks within 18 months due to poor service experience or better offers elsewhere.

Account closure complications:

- Some banks charge ₹2,000-₹5,000 for premature closure

- Pending transactions can take 30-60 days to resolve

- Fixed deposits may attract early withdrawal penalties

- Documentation requirements for fund repatriation

Smart planning approach:

- Understand closure fees upfront

- Don't lock large amounts in long-term FDs initially

- Test the banking experience with smaller amounts first

- Keep backup account options ready

How These Mistakes Actually Cost You Money

Case Study: Rajesh's Expensive Learning

Profile: Software engineer in Dubai, AED 25,000 monthly salary

Goal: Transfer salary to India, maintain FDs, send money to parents

Mistakes made:

- Chose bank based on 0.2% higher FD rate

- Ignored poor mobile app reviews

- Didn't negotiate SWIFT fee waivers

- Mixed rental income with salary in NRE account

Annual financial impact:

- Extra conversion charges: ₹31,200

- SWIFT fees (could have been waived): ₹18,000

- FEMA violation penalty: ₹75,000

- Time lost resolving issues: 40 hours (₹50,000 opportunity cost)

Total first-year cost: ₹1,74,200

Could have been avoided: Complete due diligence and proper account selection would have cost ₹5,000 in advisory fees but saved ₹1,69,200.

Smart NRE Account Selection Process

Step 1: Define Your Banking Needs

Create your requirements checklist:

Transaction Volume:

- Monthly transfer amounts

- Frequency of India remittances

- Family maintenance transfers

- Investment funding needs

Digital Banking Priority:

- Mobile app quality (critical for UAE residents)

- Online customer support availability

- International banking features

- Statement access and transaction tracking

Cost Sensitivity:

- Acceptable annual banking costs

- Willingness to maintain higher balances for fee waivers

- Preference for transparent vs. hidden fee structures

Step 2: Bank Evaluation Matrix

Create comparison spreadsheet with these columns:

Criteria | HDFC | ICICI | Axis | SBI | Weight |

|---|---|---|---|---|---|

Interest Rates | 6.8% | 6.5% | 7.1% | 6.9% | 20% |

Total Annual Costs | ₹52,000 | ₹45,000 | ₹50,000 | ₹48,000 | 40% |

Digital Experience | 3.8/5 | 4.1/5 | 3.6/5 | 2.9/5 | 25% |

UAE Support Quality | Good | Excellent | Average | Poor | 15% |

*Note: These figures are rough estimates and subject to change. They should be considered as illustrative examples or ranges.

Weighted scoring reveals true winners.

Step 3: Test Before Committing

Smart approach: Open accounts with 2 banks, test with small amounts for 3 months.

Testing checklist:

- Transfer ₹50,000 from UAE account

- Test mobile app functionality

- Call customer service with queries

- Check statement accuracy and delivery

- Evaluate overall experience

Decision criteria: Continue with better performer, close the other (factor in closure costs).

Step 4: Negotiate Fee Waivers

Leverage points with banks:

- Monthly salary transfer commitments

- FD placement intentions

- Multiple product relationships (Demat, credit cards)

Specific waivers to request:

- SWIFT charge waivers for salary transfers

- AMB penalty waivers for first 6 months

- Free international debit card

- Priority customer service access

Success rate: 70% of UAE NRIs get partial waivers if they ask professionally.

How do I avoid currency conversion losses?

Strategies:

- Compare real-time rates vs. mid-market rates before transferring

- Consider alternative transfer methods (Wise, Remit2India) for smaller amounts

- Time larger transfers during favorable rate periods

- Use FCNR deposits to eliminate conversion risk entirely

Final Takeaway: Your Action Plan

This Week: Audit Your Current Setup

If you already have NRI accounts:

- Calculate your total annual banking costs using our hidden charges guide

- Evaluate your bank's digital banking quality

- Check compliance of all past transactions

If you're choosing your first NRE account:

- Create requirement checklist based on your specific needs

- Research 3-4 banks using our evaluation criteria

- Contact banks with specific UAE NRI questions

Next Month: Optimize or Migrate

Optimization path:

- Negotiate fee waivers with current bank

- Consolidate accounts to reduce maintenance costs

- Set up monitoring systems for compliance

Migration path:

- Open test account with better bank

- Gradually shift transactions

- Close suboptimal accounts after testing period

Long-term: Stay Updated

Banking landscape changes rapidly:

- RBI regulations evolve every 6-12 months

- Bank fee structures change annually

- Digital banking features improve continuously

Stay informed through:

- Our monthly NRI banking updates

- UAE NRI community forums

- Official RBI notifications

The Bottom Line

Choosing an NRE account isn't about finding the "perfect" bank. It's about finding the bank that best serves your specific needs while minimizing total costs and compliance risks.

The goal: Banking that works seamlessly with your UAE lifestyle while keeping your India financial goals on track.

Your next step: Don't let analysis paralysis delay your decision. Use our evaluation framework, test 1-2 top options, and choose based on real experience rather than marketing promises.

🚀 Consider Modern Alternatives:

Instead of traditional NRE accounts with hidden complexities, explore Belong's USD Fixed Deposits:

- Transparent pricing (no hidden conversion markups)

- Digital-first experience (built for UAE residents)

- 5.0% USD returns (competitive with NRE rates)

- Simplified compliance (GIFT City regulated)

Download Belong App and see how modern banking can eliminate the traditional NRE account pain points.

Comments

Your comment has been submitted