How to Open an NRI Account Online from the UAE & USA

You're sitting in your Dubai apartment or Manhattan office, scrolling through bank websites that promise "online NRI account opening."

But after three different bank sites, two contradictory blog posts, and one confusing customer service call, you're more confused than when you started.

Here's the question that brought you here: Can I actually open an NRI account online from UAE/USA without traveling to India?

The short answer is yes, but it's not as "online" as banks make it sound.

By the end of this guide, you'll have a clear step-by-step roadmap, know which banks actually work smoothly from your location, and understand the document attestation process that trips up 60% of first-time applicants.

The Big Question: Can You Really Open an NRI Account "Online"?

Let me be straight with you: No NRI account opening is truly 100% online.

What banks call "online opening" is really "online application submission" followed by physical document courier. You'll fill forms digitally, but you must still mail attested hard copies to India.

Here's why: RBI regulations require physical KYC verification for NRI accounts. Banks can't just rely on digital scans - they need original documents or properly attested copies in their hands.

The reality: It's a hybrid process that saves you the India trip but not the paperwork hassle.

Also read: Documents required for online account opening

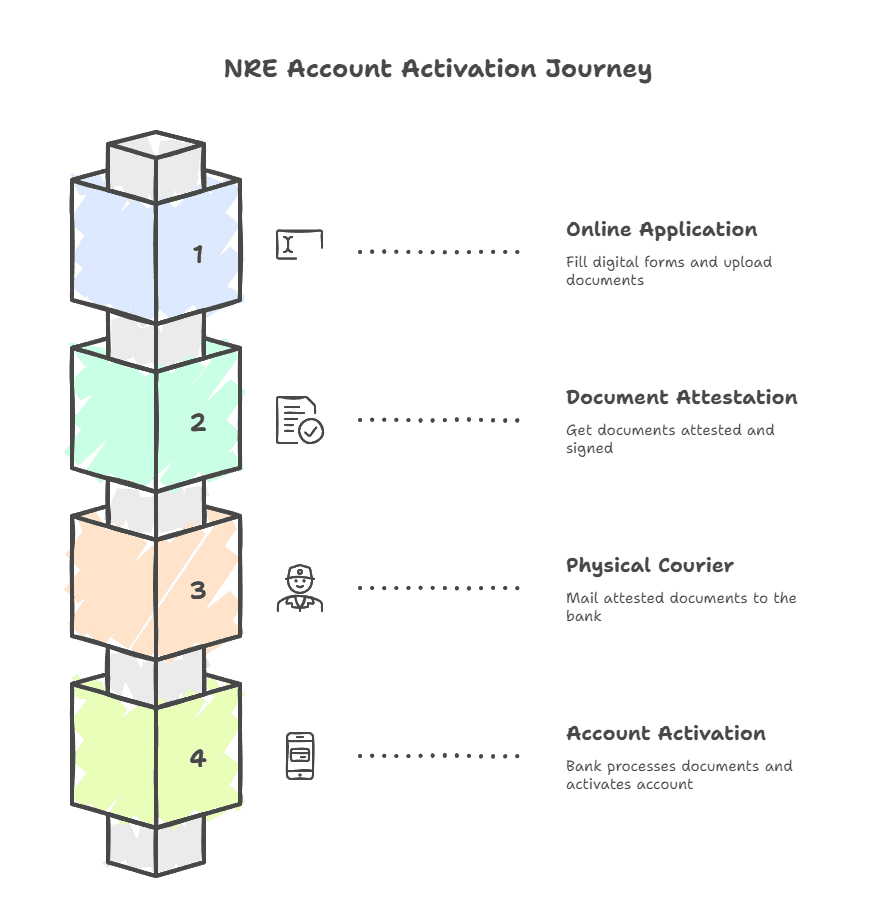

Quick Answer: Here's What Actually Happens

Phase 1: Online Application (30 minutes)

- Fill digital forms on bank website

- Upload document scans for preliminary verification

- Receive application reference number

Phase 2: Document Attestation (1-3 days)

- Get documents attested by authorized persons

- Print and sign physical forms

Phase 3: Physical Courier (5-15 days)

- Mail attested documents to bank's India office

- Wait for bank verification

Phase 4: Account Activation (7-21 days)

- Bank processes your documents

- Account gets activated

- Debit card and internet banking credentials sent

Total timeline: 2-6 weeks depending on your bank and location.

👉 Tip: Start the process during Indian banking hours (9 AM - 5 PM IST). Customer service responses are 3x faster.

The Full Picture: Step-by-Step Process That Actually Works

Step 1: Choose the Right Bank for Your Location

Not all banks handle UAE/USA applications equally. Here's what I've learned from client experiences:

Best for UAE Residents:

- ICICI Bank - Has UAE branches, smoother process

- HDFC Bank - Good digital platform, accepts Emirates NBD attestation

- SBI - Dubai representative office offers instant account facility

Best for USA Residents:

- SBI - Established USA processes, multiple PO boxes

- ICICI Bank - Money2India integration works well

- Bank of Baroda - Strong USA presence

Avoid for online opening: Smaller banks or those without international presence. Their online systems are often glitchy.

Step 2: Prepare Your Documents (Before Starting Online)

This is where 40% of applications fail. Get these ready first:

Mandatory Documents (All Applicants):

- Valid passport (first, last, and visa pages)

- Current visa/residence permit

- Overseas address proof (utility bill/bank statement, max 3 months old)

- Indian address proof (for communication)

- Passport-size photographs (with white background)

- PAN card copy

UAE-Specific Requirements:

- Emirates ID (if available)

- UAE salary certificate or employment contract

- Bank statement from UAE bank (last 3 months)

USA-Specific Requirements:

- Social Security Number (some banks request this)

- US address proof (utility bills, lease agreement)

- Employment authorization document (if applicable)

Document quality matters: Use a good scanner, 300 DPI minimum. Blurry documents cause automatic rejections.

Also Read - Documents Required for NRI Account Opening in India - Full Guide

Step 3: Fill the Online Application Correctly

Common mistakes I see:

- Using nicknames instead of passport names

- Wrong Indian address formats

- Inconsistent signatures across forms

- Missing mandatory fields

Pro tips for form filling:

- Use exactly the same name as on your passport

- Indian address should match your address proof document

- Keep your overseas contact number handy (with country code)

- Choose "either or survivor" for joint accounts (most flexible)

Step 4: Navigate Document Attestation (The Tricky Part)

This is where UAE and USA processes differ significantly:

From UAE: You can get documents attested by:

- Indian Consulate General (Dubai/Abu Dhabi)

- Notary public authorized by UAE government

- Manager of Emirates NBD, ADCB, or other major UAE banks

- ICICI/HDFC UAE branch managers

From USA: Authorized attestation sources:

- Indian Embassy/Consulate (Washington DC, New York, San Francisco, etc.)

- Notary public registered in your state

- Manager of Indian bank branches in USA (SBI, Bank of Baroda)

- US bank manager (if bank has relationship with Indian banks)

What attestation means: The authorized person must sign, stamp, and write "Verified with original" on each document copy.

My recommendation: Indian consulates are most reliable but take longer. Local bank managers are faster if you have good relationships.

Step 5: Mail Documents the Right Way

Courier options by location:

From UAE:

- Emirates Post (3-5 days to India, ₹2,000-3,000)

- DHL/FedEx (2-3 days, more expensive but trackable)

- Use bank's PO Box if available (ICICI has UAE PO Boxes)

From USA:

- USPS Priority Mail International (7-10 days, $50-80)

- FedEx/UPS (3-5 days, $150-200)

- Bank PO Boxes available for major cities

What to include:

- All attested documents

- Signed physical application form

- Covering letter with your reference number

- Self-addressed envelope for return courier (optional)

Pro tip: Always use tracking. 15% of applications get delayed due to lost mail.

Step 6: Follow Up and Avoid Common Rejections

Typical bank processing timeline:

Bank | Document Receipt | Verification | Account Opening | Total Time |

|---|---|---|---|---|

SBI | 2-3 days | 7-10 days | 3-5 days | 2-3 weeks |

ICICI | 1-2 days | 5-7 days | 2-3 days | 1-2 weeks |

HDFC | 2-4 days | 7-14 days | 3-5 days | 2-4 weeks |

Top rejection reasons and how to avoid them:

- Incomplete documentation (35% of rejections)

Solution: Use bank's document checklist, tick off each item - Poor attestation (25% of rejections)

Solution: Ensure attesting person signs with date and designation - Address proof older than 3 months (20% of rejections)

Solution: Get fresh utility bills before starting process - Signature mismatch (15% of rejections)

Solution: Practice your passport signature, use same pen type - Insufficient initial deposit (5% of rejections)

Solution: Fund account within 30 days of opening with minimum balance

Also Read - Best NRI Fixed Deposit Accounts India Complete Tax & Rate Guide

UAE vs USA: Key Differences in the Process

UAE Advantages:

- Stronger banking relationships: UAE-India banking ties mean smoother processes

- Faster courier: 2-3 days to India vs 7-10 days from USA

- Local bank branches: ICICI, HDFC have UAE offices for support

- Currency advantage: AED-INR stability makes initial funding easier

USA Advantages:

- Established processes: Banks have 20+ years of USA NRI experience

- Multiple PO Boxes: SBI, ICICI have USA collection points

- Better tracking: USPS integration with Indian postal system

- Time zone overlap: East Coast has some overlap with Indian business hours

USA Specific Challenges:

- Longer courier times: West Coast adds 2-3 extra days

- State regulations: Some notary requirements vary by state

- Tax implications: Need to consider US reporting requirements

UAE Specific Benefits:

- Instant account facility: SBI Dubai office can activate accounts immediately

- Zero tax advantage: UAE has no income tax, simplifies planning

- Banking partnerships: Emirates NBD-ICICI, ADCB-multiple bank relationships

Digital vs Physical: What's Actually Digital in 2025?

What's digital now:

- Application form filling

- Document upload for preliminary verification

- Application status tracking

- Customer service chat support

What's still physical:

- Document attestation

- Original signature requirements

- Initial funding (wire transfer/demand draft)

- Debit card delivery

Coming soon (2025-2026):

- Video KYC for some banks

- Digital attestation through DigiLocker (for specific documents)

- Blockchain-based document verification (speculative but possible)

My prediction: Full digital NRI account opening is still 2-3 years away due to RBI regulations.

Bank-by-Bank Breakdown: Which Process Works Best

SBI (State Bank of India)

UAE Process:

- Dubai representative office offers instant facility

- Account number provided same day

- Activation within 2-3 working days

- Best for UAE residents

USA Process:

- Multiple PO Boxes (New York, California, etc.)

- 45-day deadline for document submission

- Global NRI Centre handles all USA applications

- Good for West Coast residents

Minimum initial deposit: ₹50,000-1,00,000

ICICI Bank

UAE Process:

- UAE PO Box available for document courier

- Money2India facility integration

- Online application works smoothly

- Good customer service in UAE time zone

USA Process:

- Multiple USA PO Boxes

- 2-day processing at Regional Processing Centre

- Strong digital platform

- Best overall USA experience

Minimum initial deposit: ₹25,000

HDFC Bank

UAE Process:

- Digital-first approach

- UAE bank attestation accepted

- 11-step process clearly defined

- Good for tech-savvy users

USA Process:

- Standard online process

- No specific USA advantages

- Takes longer than ICICI/SBI

Minimum initial deposit: ₹25,000

👉 Tip: If you're in UAE, start with SBI Dubai office visit. If in USA, ICICI has the smoothest online process.

Also Read - Top Indian Banks for Online NRI Account Opening

Costs Involved: The Real Financial Picture

Direct Costs:

- Document attestation: $50-200 (varies by consulate/notary)

- Courier charges: $50-200 depending on speed and location

- Initial deposit: $300-1,200 (₹25,000-1,00,000)

- Account opening fees: Usually waived for NRI accounts

Hidden/Opportunity Costs:

- Time spent on documentation: 10-15 hours

- Multiple courier attempts (if documents rejected): $100-300

- Currency conversion spreads: 0.5-2% on initial funding

Total budget: $400-800 for smooth account opening process.

Money-saving tips:

- Use bank PO Boxes to save courier costs

- Get multiple documents attested in single consulate visit

- Fund account during favorable exchange rates

Common Mistakes That Delay Your Application

Mistake 1: Starting without reading bank-specific requirements

- Each bank has unique document requirements

- Download their specific checklist first

Mistake 2: Using expired address proofs

- Get fresh utility bills within 30 days of application

- Indian address proof can be older, overseas cannot

Mistake 3: Inconsistent signatures

- Your signature must match passport exactly

- Practice before signing final forms

Mistake 4: Poor photo quality

- Use professional passport photos

- White background, recent (within 6 months)

Mistake 5: Wrong initial funding method

- Some banks don't accept all wire transfer types

- Check acceptable funding methods before sending money

What Happens After Your Account Opens?

Immediate actions (first 30 days):

- Fund your account to meet minimum balance requirements

- Activate internet banking and mobile app

- Request debit card delivery to your overseas address

- Set up mobile alerts for transactions

Medium-term setup (next 60 days):

- Link to investment platforms (mutual funds, stocks)

- Set up recurring transfers from your overseas account

- Configure tax-saving investments if applicable

- Explore additional products (FDs, loans)

Long-term optimization (next 6 months):

- Review account performance and fees

- Consider additional account types if needed

- Set up beneficiaries for easy transfers

- Plan tax implications across both countries

UAE/USA Specific Tax and Compliance Considerations

For UAE Residents:

- NRE account interest is tax-free in India and UAE

- No UAE income tax means simpler planning

- Consider DTAA benefits for other investments

- Keep records for UAE residence certificate if needed

For USA Residents:

- NRE interest is tax-free in India but reportable in USA

- Form 1040 Schedule B reporting requirements

- Consider FBAR filing implications if balance >$10,000

- Plan around LRS (Liberalized Remittance Scheme) limits

Smart Strategies for Faster Processing

UAE Residents:

- Visit bank's UAE branch first for guidance

- Use Emirates NBD/ADCB managers for attestation (faster than consulate)

- Apply Monday-Wednesday to avoid weekend delays

- Keep UAE visa validity >12 months when applying

USA Residents:

- Choose East Coast consulates for faster processing

- Use state notary if you have banking relationships

- Apply during Indian financial year (April-March) for better customer service

- Maintain $500+ in existing US account for wire transfer ease

Troubleshooting: When Things Go Wrong

If your application gets rejected:

- Request specific rejection reason in writing

- Fix the exact issue mentioned (don't assume)

- Resubmit within 30 days to avoid starting over

- Consider switching banks if rejection seems unreasonable

If documents get lost in mail:

- File complaint with courier service immediately

- Send duplicate set via different courier

- Inform bank about delayed documents before 45-day deadline

If account opening takes >6 weeks:

- Escalate to branch manager/relationship manager

- File complaint through banking ombudsman portal

- Consider opening with different bank simultaneously

Your Action Plan: What to Do Right Now

Based on everything I've shared, here's your immediate action plan:

This Week:

- Decide on your bank - ICICI for USA, SBI for UAE (if near Dubai), HDFC for digital preference

- Gather all documents - Use the checklists I provided, get fresh utility bills

- Check attestation options - Contact consulate or local banks for attestation services

Next Week:

- Complete online application - Do this in one sitting, keep all documents handy

- Get documents attested - Book appointment with consulate or authorized person

- Prepare courier package - Use tracking services, include covering letter

Following 2-4 Weeks:

- Track document delivery - Follow up with bank within 2 days of delivery

- Monitor application status - Most banks have online tracking systems

- Prepare initial funding - Wire transfer or demand draft as per bank requirements

After Account Opening:

- Set up digital banking - Mobile app, internet banking, alerts

- Plan investment strategy - Link to mutual funds, explore FD rates

- Document for taxes - Keep records for both countries' tax filing

The online NRI account opening process has improved significantly since 2020, but it's still not truly "online."

The key is understanding what's digital vs physical, choosing the right bank for your location, and following the documentation requirements precisely.

Remember: This isn't just about opening an account - it's about building your long-term financial connection with India. Choose a process that works for your lifestyle and location.

Ready to start your NRI account opening journey? Join our NRI community where members share real-time experiences about different banks' processing times and support quality.

Disclaimer: Bank processes and requirements change frequently. Always verify current procedures directly with your chosen bank before starting the application. This guide provides general process information and not personalized banking advice.

Comments

Your comment has been submitted