Step-by-Step Process to Close an NRI Account in India

"I want to close my NRI account in India, but I'm confused about the process.

Will I lose money to taxes? What documents do I need? Can I do this from abroad?"

If you're asking these questions, you're not alone. Every month, thousands of NRIs face this exact dilemma. Some are returning to India permanently.

Others want to consolidate their finances. Many simply want to avoid maintenance charges on dormant accounts.

The confusion is real. One bank asks for Form A, another wants Form 15CA. Your friend says you can do everything online, but your bank insists on a branch visit.

Quick Answer (Summary Verdict)

Yes, you can close your NRI account from anywhere in the world. The process typically takes 7-15 days and requires specific documents based on your account type. Here's what matters most:

- NRE accounts: Full repatriation allowed, minimal documentation

- NRO accounts: USD 1 million annual repatriation limit, tax compliance required

- FCNR accounts: Complete repatriation possible, no tax implications

👉 Key insight: Closing isn't always the best option. Sometimes converting to a different account type saves money and keeps your options open.

The Full Picture

Let me share what happened to Raj from Dubai last year. He wanted to close his ICICI NRO account because he wasn't using it. The bank charged him ₹5,000 in penalties and he lost ₹45,000 to unnecessary TDS.

Why? He didn't know the rules.

When NRIs typically close accounts:

Scenario 1: Returning to India permanently

You need to convert your NRE and NRO accounts to resident accounts or close them entirely. Under FEMA regulations, you cannot hold NRI accounts as a resident Indian.

Scenario 2: Simplifying finances

Managing multiple accounts across banks becomes expensive. Many NRIs consolidate their banking with one trusted institution.

Scenario 3: Switching to better options

Traditional NRE FDs give 6-7% returns. Meanwhile, GIFT City investments offer tax-free USD returns without currency risk.

Current regulations (2025):

FEMA mandates that you must either close your resident accounts or convert them to NRO accounts when you become an NRI. Failure to comply can result in penalties up to three times your account balance.

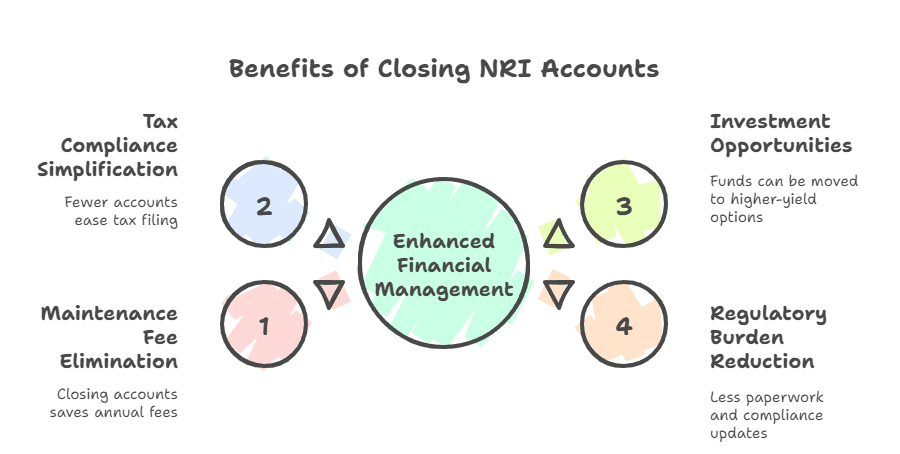

Benefits of closing an NRI Account

1. Eliminates maintenance fees

Most banks charge ₹2,000-5,000 annually for dormant NRI accounts. Closing saves these charges.

2. Simplifies tax compliance

Fewer accounts mean simpler ITR filing. You avoid unnecessary TDS complications on minimal balances.

3. Access to better investment options

The money can be moved to higher-yield investments like GIFT City funds or alternative investment funds.

4. Reduces regulatory burden

Fewer KYC updates, fewer compliance requirements, less paperwork.

👉 Tip: Before closing, check if your bank offers NRI fixed deposit laddering strategies to maximize returns on your existing balance.

What to Watch Out For

1. Tax implications vary by account type

Interest on NRO accounts is taxable at 30% TDS, while NRE and FCNR account interest is tax-free in India. Closing an NRO account triggers immediate tax calculations on accrued interest.

2. Repatriation limits apply

NRO account holders can repatriate maximum USD 1 million per financial year after tax deductions. NRE and FCNR accounts have no repatriation limits.

3. Currency conversion costs

Banks charge 1-2% on forex conversion. For large amounts, this can mean thousands of dollars in fees.

4. Documentation requirements differ by bank

SBI needs different forms compared to ICICI or HDFC. Some banks accept email submissions, others require physical visits.

5. Closure might not be reversible

Opening a new NRI account later involves fresh KYC, documentation, and potential delays.

👉 Warning: Don't close accounts with pending investments like mutual funds or PPF accounts. Settle these first to avoid complications.

Step-by-Step How-To

Phase 1: Pre-Closure Preparation

Step 1: Determine your account types

Log into net banking and list all accounts. Note the type (NRE/NRO/FCNR) and current balances.

Step 2: Clear all dues

- Cancel recurring deposits and SIPs

- Clear any loan EMIs linked to the account

- Stop all ECS mandates and standing instructions

- Return unused cheque books and debit cards

Step 3: Transfer linked investments

If you have mutual funds or stocks linked to these accounts, update your bank account details with the AMC or broker.

Phase 2: Documentation

For all account types, you'll need:

Document | Purpose | Where to get |

|---|---|---|

Account closure form | Formal request | Bank website or branch |

Copy of passport | Identity proof | Self-attested copy |

Current visa/residence permit | Address proof | Embassy/immigration |

PAN card copy | Tax identification | Income tax department |

Cancelled cheque | Bank verification | Your cheque book |

Additional for NRO accounts:

- Form 15CA (for repatriation > ₹50,000)

- Form 15CB (CA certification for tax compliance)

- Tax residency certificate (for DTAA benefits)

👉 Tip: Download forms from your specific bank's website. ICICI, SBI, and HDFC have different formats.

Phase 3: Submit Closure Request

Option 1: Online submission (recommended)

Most banks now accept closure requests via email. ICICI Bank allows initial requests through their iMobile app, though final verification may require additional steps.

- Fill the closure form completely

- Scan all documents in PDF format

- Email to your bank's NRI services address

- Request email confirmation of receipt

Option 2: Branch visit

If you're in India, visit the branch where you opened the account. Carry original documents for verification.

Option 3: Postal submission

For those abroad, most banks accept closure requests by mail with notarized documents. Use registered mail with tracking.

Phase 4: Fund Transfer Instructions

Specify where your money should go:

For NRE/FCNR accounts:

- Transfer to overseas account (provide SWIFT details)

- Transfer to another NRE account in India

- Convert to demand draft

For NRO accounts:

- Transfer to overseas account (within USD 1 million limit)

- Transfer to NRE account (with proper documentation)

- Keep in India (transfer to resident account)

Phase 5: Follow-up and Confirmation

Timeline expectations:

- Processing: 7-15 business days

- Fund transfer: Additional 3-7 days

- Final confirmation: Email/SMS notification

👉 Important: Keep the closure confirmation letter. You'll need it for tax filing and future reference.

Final Recommendation

Closing your NRI account isn't just about paperwork - it's a financial decision that affects your future options.

When to close:

- You're returning to India permanently

- Account has minimal balance (\< ₹50,000)

- You've found better investment alternatives

When NOT to close:

- You might return to NRI status

- Account balance is substantial

- You have ongoing India income sources

Better alternatives to consider:

- Convert to RFC account: If returning to India, this keeps foreign currency intact

- Switch to GIFT City deposits: Tax-free USD returns without currency risk

- Consolidate with one bank: Keep one account active, close others

Your next steps:

- Evaluate if closure is really necessary

- Compare the best NRI accounts available today

- Consider GIFT City investment options for better returns

Remember, the goal isn't just to close an account - it's to optimize your financial position. Sometimes that means closing, sometimes it means switching to better options.

Ready to explore better NRI investment options? Join thousands of smart NRIs who've discovered tax-free USD investments in GIFT City.

Join our WhatsApp community for personalized guidance on NRI banking and investments.

Download the Belong app to explore GIFT City investments that offer tax-free returns without currency risk.

Sources:

Comments

Your comment has been submitted