What Happens to Your NRI Account When You Return to India

Last month, Priya from our NRI WhatsApp group, called me from Dubai airport, panic in her voice. After 7 years of working there, she was finally returning to India permanently.

"Ankur," she said, "my colleague just told me I might face huge penalties if I don't handle my NRI accounts correctly.

I have an NRE account, NRO FDs, and some mutual fund investments. What exactly am I supposed to do?"

This conversation happens more often than you'd think. One day you're an NRI with tax-free NRE accounts and specific investment rules. The next day, you're back home in India, and suddenly the entire regulatory framework around your money changes.

Here's what most returning NRIs don't realize: you don't just "keep things as they are" when you come back. RBI has specific rules about what happens to each type of account, and yes, there can be penalties if you don't comply.

But there's also good news - becoming a resident again opens up investment opportunities that were completely blocked when you were an NRI.

I'm Ankur Choudhary, and over the past 12 years, I've helped hundreds of families transition from NRI to resident status.

The process isn't complicated once you know the rules, but the stakes are real. Get it wrong, and you could face compliance issues. Get it right, and you'll unlock a whole new world of investment options while staying perfectly compliant.

By the end of this guide, you'll know exactly which accounts must be converted, the timeline you're working with, what documentation you need, and how to make the most of your new resident status financially.

Understanding Your New Residential Status: The 182-Day Rule Explained

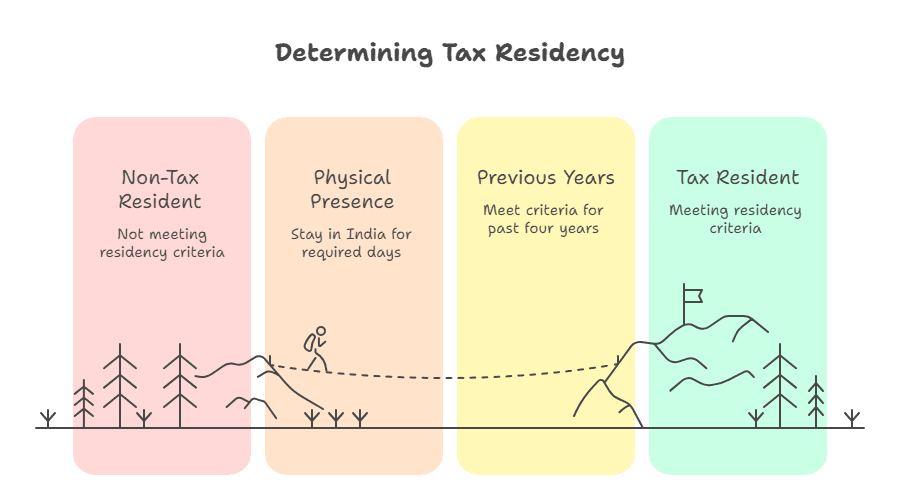

The moment you decide to return to India permanently, two different government departments start evaluating your status - and they don't always reach the same conclusion at the same time.

Under FEMA (Foreign Exchange Management Act), you become a resident the moment you have "intention to stay in India for more than 182 days." Notice the word "intention" - you don't need to complete 182 days first. If you've returned with the plan to stay permanently, RBI considers you a resident immediately.

Under the Income Tax Act, it's more mechanical. You become a resident when you either stay 182+ days in a financial year, or stay 60+ days in the current year AND 365+ days in the preceding 4 years.

Let me give you a real example from my client Rajesh in Abu Dhabi. He returned to India in February 2024 with a permanent job offer.

Under FEMA, he became resident immediately because of his intention to stay. For income tax purposes, he became resident only in April 2024 when the new financial year started (since he hadn't completed 182 days in FY 2023-24).

This difference creates important implications:

- Your NRI account compliance requirements kick in immediately (FEMA rules)

- Your tax treatment changes from the financial year when you meet Income Tax Act criteria

- Interest on NRE accounts becomes taxable once you're a tax resident, even if the account hasn't been converted yet

👉 Tip: Don't wait for day 183. If you've returned to India with intention to stay, start the account conversion process within 30 days.

Also Read -Difference Between NRI and Resident Tax Filing in India

What Actually Happens to Each Type of NRI Account

Different types of NRI accounts have completely different rules when you return. Here's the breakdown for each:

NRE (Non-Resident External) Accounts: Your Two Choices

Your NRE account cannot continue as an NRI account once you become resident. RBI gives you two options:

Option 1: Convert to Regular Resident Savings Account

- Same account number continues

- Funds automatically transfer over

- Interest becomes taxable at your income slab rate

- Full access to all resident banking services

Option 2: Transfer Funds to RFC (Resident Foreign Currency) Account

- You maintain the foreign currency exposure

- Useful if you might become NRI again or want currency hedging

- Interest may not be taxable if you qualify for RNOR status

- Can transfer to resident rupee account anytime

Here's what most people miss: if you have NRE fixed deposits that mature later, they can continue until maturity date. The interest earned during your NRI period remains tax-free, but interest earned after you become resident gets taxed.

Our customer Suresh from Dubai had a 3-year NRE FD that was supposed to mature in 2025. When he returned in 2023, the bank allowed the FD to continue till maturity.

His interest from 2020-2023 remained tax-free, but interest for 2024-2025 became taxable.

NRO (Non-Resident Ordinary) Accounts: Simpler Conversion

NRO accounts must be redesignated as resident savings accounts. The good news? This is the simplest conversion:

- Same account number continues

- All existing funds remain in the account

- Interest continues to be taxable (no change since NRO interest was always taxed)

- Repatriation rules change (now no annual $1 million limit on capital gains)

Also Read -NRE vs NRO vs FCNRFCNR (Foreign Currency Non-Resident) Accounts: Wait for Maturity

FCNR fixed deposits can continue until their original maturity date. You cannot create fresh FCNR deposits as a resident, but existing ones are grandfathered.

At maturity, you must:

- Transfer proceeds to a resident savings account (converted to INR), OR

- Transfer to an RFC account (kept in foreign currency)

The tax implication: interest becomes taxable from the date you became resident, even though the deposit was created when you were an NRI.

👉 Tip:If you have large FCNR deposits maturing soon after your return, consider opening an RFC account first to maintain foreign currency exposure.

The RNOR Tax Advantage: Why Your Return Date Matters

Here's something most returning NRIs don't know: you might qualify for RNOR (Resident but Not Ordinarily Resident) status, which can save you lakhs in taxes.

RNOR Qualification: You get RNOR status if:

- You were non-resident in at least 9 out of 10 years preceding the current financial year, OR

- You were in India for 729 days or less in the 7 years preceding the current financial year

RNOR Tax Benefits:

- Foreign income not derived from business controlled in India is not taxable in India

- This includes rental income from foreign property, dividends from foreign stocks, interest from foreign bank accounts

- Capital gains from sale of foreign assets are also not taxable

Let me show you how powerful this can be. My client Priya qualified for RNOR status when she returned from London in 2023. She has:

- Rental income from UK property: £8,000 annually (₹8 lakh)

- Dividend from US stocks: $2,000 annually (₹1.6 lakh)

- Interest from Singapore bank FD: $1,500 annually (₹1.2 lakh)

Total foreign income: ₹10.8 lakh annually that's completely tax-free in India because of RNOR status. If she was a regular resident, this would be taxed at 30% slab, costing her over ₹3 lakh in taxes annually.

RFC Account Strategy for RNOR: If you qualify for RNOR, transferring your NRE funds to an RFC account instead of regular resident account can be tax-efficient. Interest on RFC accounts may not be taxable for RNOR residents.

Your "Resident but Not Ordinarily Resident" (RNOR) status typically lasts for 2-3 years after returning to India.

This status is lost if you have been a resident for 2 of the past 10 years, or have stayed in India for 730 days or more in the past 7 years.

Conversion Process Timeline: What Happens When

Here's the practical timeline I guide my clients through:

Week 1: Immediate Notifications

Day 1-7 after return:

- Inform all banks about your return to India and intention to stay

- Request account conversion forms

- Gather required documents (passport, address proof, PAN card)

What banks need to know:

- Date of return to India

- Intention to stay permanently

- Indian address for correspondence

- Contact details

Week 2-3: Form Submission and Processing

For NRE Account Conversion:

- Decide between resident rupee account vs RFC account transfer

- Submit conversion application with required documents

- Choose new debit card delivery address

For NRO Account Conversion:

- Fill redesignation form (simpler process)

- Update address and contact information

- Confirm account number remains same

For Investment Accounts:

- Update status with mutual fund companies

- Open new resident demat account

- Initiate transfer of securities from NRI demat

Week 4-6: Account Activation and Testing

What to verify:

- New account reflects resident status

- Debit cards work for domestic transactions

- Internet banking access with updated features

- Checkbook reflects new account type

Investment updates:

- Existing mutual fund SIPs continue without disruption

- Fresh investments now follow resident tax treatment

- Access to previously restricted investment categories

👉 Tip: Test a small transaction first before assuming everything is working perfectly. I've seen cases where the conversion was processed but certain features remained blocked.

Required Documents: Your Complete Checklist

Getting documentation right upfront saves weeks of back-and-forth with banks.

Essential Documents for All Conversions

Identity Proof:

- Passport with India entry stamps (crucial for establishing return date)

- PAN card (mandatory)

- Aadhaar card (if you have one)

- Voter ID or driving license as backup

Address Proof (Indian Address):

- Electricity, gas, or water bill in your name

- Bank statement with Indian address

- Rent agreement (if renting)

- Property documents (if own property)

Bank-Specific Forms:

- Residential status change declaration

- Account conversion application

- Fresh KYC form with updated detail

- Nomination form (good time to update beneficiaries)

Also Read - Documents Required for NRI Account Opening in India - Full Guide

Additional Documents for Specific Situations

For Large Account Balances (₹50+ lakh):

- Income source documentation

- Tax residency certificate from previous country (if available)

- Form 15CA/15CB for future repatriations

For Investment Account Updates:

- Recent investment statements

- Power of attorney forms for new demat account

- Risk profiling questionnaire

- Trading limit application forms

For Joint Accounts:

- If joint holder is still NRI: Special undertaking forms

- If joint holder is also returning: Both persons' documentation required

- Mandate forms if adding new signatories

👉 Tip:Keep both originals and self-attested copies. Some banks want to see originals for verification but keep the copies.

Investment Portfolio Changes: What Opens Up

Returning to India doesn't just mean account compliance - it unlocks a completely different investment universe.

Previously Restricted Investments Now Available

Tax-Advantaged Options:

- PPF (Public Provident Fund): 15-year tax-free growth, currently ~7.1% returns

- ELSS Mutual Funds: 3-year lock-in with tax benefits under Section 80C

- NSC (National Savings Certificate): Government-backed tax-saving bonds

- NPS Tier II: Additional voluntary retirement savings with tax benefits

Trading and Market Access:

- Intraday Trading: No longer restricted to delivery-based trades only

- Currency Derivatives: Trade USD-INR, EUR-INR futures for hedging

- Commodity Trading: Gold, silver, crude oil futures access

- Options Trading: Full derivatives access without NRI restrictions

Sectoral Investments:

- Defense Stocks: Previously restricted sectors now open

- Atomic Energy Companies: Can invest in NPCIL and related entities

- Government Securities: Direct access via RBI Retail Direct portal

Enhanced Real Estate Rights

As NRI, you couldn't buy agricultural land. As resident:

- Agricultural land purchase allowed

- Farm house investments permitted

- Easier home loan access with better rates

- Access to all government housing schemes

Better Credit Access

Credit Cards:

- Higher limits than NRI cards

- Access to premium cards with better rewards

- Domestic transaction convenience without forex charges

Loans:

- Personal loans at resident rates (typically 2-3% lower than NRI rates)

- Education loans for children with government subsidies

- Business loans without additional NRI documentation

Let me share a success story: My client Ramesh returned from Singapore in 2022. Within 6 months, he:

- Opened PPF account with ₹1.5 lakh investment (₹46,000 tax saved)

- Started ELSS SIP of ₹25,000/month (additional ₹78,000 tax saved)

- Got approved for ₹50 lakh home loan at 8.5% (vs 9.2% NRI rate he was quoted earlier)

- Started intraday trading with ₹10 lakh limit

Total annual tax savings: ₹1.24 lakh plus ₹35,000 saved on loan interest annually.

Also Read - Best NRI Debit Cards in India - Complete Guide

Penalties and Compliance: What Actually Happens If You Delay

Let's address the fear factor around penalties. Here's what RBI rules actually say and what happens in practice:

Official Penalty Structure

FEMA violations can result in:

- Fine up to 3 times the amount involved in the account

- Or ₹2 lakh if the amount is not quantifiable

- Daily penalty of ₹5,000 from the date of violation

The Reality Check

In 12 years of practice, I've seen penalties imposed in less than 5% of delayed conversion cases. Here's when penalties typically get triggered:

High-Risk Scenarios:

- During income tax scrutiny assessments

- When applying for high-value loans

- If flagged during RBI bank audits

- Large-scale repatriation attempts from non-converted accounts

Low-Risk Scenarios:

- Routine account operations

- Small-value transactions

- Voluntary compliance within 6-12 months of return

Practical Timeline Guidance

Safe zone (minimal risk): Conversion within 90 days of return Caution zone (low risk): Conversion within 180 days of return

Risk zone (penalties possible): Beyond 180 days without action

Most banks will process conversions without questions if done within 6 months of return. Beyond that, you might need additional documentation explaining the delay.

👉 Tip: Even if you're uncertain about staying permanently, inform your banks about your presence in India. This creates a paper trail showing you're taking appropriate steps.

Special Situations: Complex Scenarios Explained

Situation 1: Returning with Non-Resident Spouse

Challenge: You're returning to India but your spouse continues working in Dubai.

Solution:

- You cannot continue as primary holder in joint NRI accounts

- Spouse can become primary holder if they remain NRI

- You can be added as joint holder in their NRI accounts (resident + NRI joint accounts are allowed)

- Alternative: Convert to resident accounts with NRI spouse as joint holder

Situation 2: Children's NRI Accounts

Challenge: Your minor children have NRI accounts but will return with you.

Solution:

- Minor's residential status follows the guardian (you)

- All children's accounts must be converted to resident accounts

- Guardian signature required for all conversion processes

- Existing education-purpose FDs can continue till maturity

Situation 3: Uncertain Return Plans

Challenge: You've returned to India but might go back abroad if you get a good opportunity.

Solution Under FEMA:

- Residential status is based on "intention to stay," not certainty about future

- If you've returned with intention to stay (even if uncertain), you must convert accounts

- RFC accounts provide flexibility if plans change

- Maintain detailed records of days spent in India

Income Tax Implications:

- Physical presence determines tax residency

- Track your days carefully using passport stamps

- Consider maintaining some foreign currency exposure through RFC accounts

Situation 4: Power of Attorney Complications

Challenge: You hold POA for elderly parents' NRI accounts, but you're now resident.

Solution:

- Your residential status change doesn't affect your POA authority

- Parents' accounts remain NRI accounts if they're still non-resident

- Inform banks about your status change for transparency

- POA can be operated by residents for NRI accounts

Common Costly Mistakes Returning NRIs Make

Mistake 1: Ignoring the RFC Account Option

What people do: Automatically convert NRE accounts to resident rupee accounts.

Why it's wrong: You lose currency hedging and might lose RNOR tax benefits.

The fix: Evaluate RFC accounts if you qualify for RNOR status or might become NRI again within 3-5 years.

Also Read - Best NRE Savings Accounts for UAE NRIs - Complete Guide

Mistake 2: Not Planning for the Conversion Year

What people do: Don't consider tax implications of interest earned during the conversion year.

Why it's wrong: You might face higher tax bills than expected in the first year back.

The fix: Calculate prorated tax liability for the year of return and plan accordingly.

Mistake 3: Rushing Into New Investment Options

What people do: Immediately max out PPF, start multiple SIPs, and invest in everything previously unavailable.

Why it's wrong: Poor portfolio allocation and lack of strategic planning.

The fix: Take time to create a comprehensive financial plan before investing in new options.

Mistake 4: Forgetting About Mutual Fund Companies

What people do: Focus only on bank accounts, ignore mutual fund folios.

Why it's wrong: Investment platforms might freeze your account for KYC non-compliance.

The fix: Create a list of all financial relationships and update each systematically.

Mistake 5: Poor Documentation of Return Date

What people do: Don't maintain proper records of when they returned and why.

Why it's wrong: Creates problems during tax assessments or RBI queries.

The fix: Maintain a file with passport entries, job offer letters, house rental agreements - anything that proves return date and intention.

👉 Tip: The biggest mistake is doing nothing due to confusion. Start with account conversions even if you haven't figured out the optimal investment strategy yet.

Your New Investment Strategy: Making the Most of Resident Status

Once you've handled compliance, it's time to optimize. Here's how I help returning NRIs restructure their portfolios:

Tax-Efficient Investment Ladder

Year 1 Priority (₹15+ lakh savings):

- Max out PPF: ₹1.5 lakh (saves ₹46,000 in 30% tax bracket)

- Start ELSS SIP: ₹12,500/month (₹78,000 additional tax savings)

- Open NPS account: ₹50,000 (₹15,500 additional tax savings under 80CCD)

Total tax savings in first year: ₹1.39 lakh

Year 2+ Expansion:

- Increase NPS to ₹2 lakh annually if income allows

- Add large-cap and mid-cap mutual fund SIPs

- Consider direct equity for better long-term returns

- Explore GIFT City investment options for tax efficiency

Currency and Repatriation Planning

If you maintained RFC accounts:

- Monitor INR-USD exchange rates for optimal conversion timing

- Use partial conversions instead of lump sum to average rates

- Keep 6-12 months expenses in foreign currency if you travel frequently

Real Estate Strategy

Immediate opportunities:

- Home loan pre-approval (rates 2-3% lower than NRI rates)

- Investment in agricultural land or farmhouse (previously restricted)

- Access to government housing schemes and subsidies

Timing considerations:

- Property prices in major cities have risen significantly since 2021, but high prices have led to a 20-32% drop in sales in Q2 2025, with possible moderation expected in late 2025 amid stable interest rates.

- Interest rates, which were on an upward trend, have shown signs of stabilizing through 2024 and into 2025, making it a more predictable time to consider home loan options.

- Consider real estate as part of diversified portfolio, not core holding

Step-by-Step Action Plan for Your First 90 Days

Days 1-30: Essential Compliance

Week 1:

- List all NRI accounts across different banks

- Gather required documents (passport, address proof, PAN)

- Contact each bank to inform about return

Week 2:

- Collect conversion forms from all banks

- Decide NRE account strategy: resident account vs RFC account

- Calculate potential RNOR tax benefits

Week 3:

- Submit conversion applications

- Open resident demat account

- Update address with mutual fund companies

Week 4:

- Follow up on conversion status

- Test new account functionality

- Update employer/family about new account details

Days 31-60: Investment Planning

Month 2 Focus:

- Meet with chartered accountant to confirm RNOR eligibility

- Create comprehensive financial plan for next 3-5 years

- Research new investment options (PPF, ELSS, NPS)

- Evaluate home loan options if buying property

Days 61-90: Implementation

Month 3 Actions:

- Open tax-saving investment accounts (PPF, NPS)

- Start SIPs in ELSS and other mutual fund categories

- Set up systematic transfers from RFC to resident accounts (if applicable)

- Review and optimize overall portfolio allocation

👉 Tip:Don't try to do everything in month 1. Focus on compliance first, then gradually optimize your investment strategy.

Taking Action: Your Next Steps

You now understand exactly what happens to your NRI accounts when you return to India and how to handle the transition properly. Here's your action plan:

This week: Contact all banks where you have NRI accounts and inform them about your return. Request conversion forms and start gathering required documents. Don't delay this - it's the most critical step.

Next 30 days:

Submit conversion applications, decide between resident accounts and RFC accounts based on your tax situation, and update your status with all mutual fund companies and investment platforms.

Next 60 days: Complete the account conversion process, explore new investment opportunities like PPF and ELSS, and create a comprehensive financial plan that takes advantage of your new resident status.

The transition from NRI to resident opens up significant opportunities beyond just compliance. You gain access to tax-efficient investments, better loan rates, and a broader range of financial products. The key is approaching it systematically and making informed decisions that align with your long-term goals.

Frequently Asked Questions

Do I have to convert my accounts immediately after returning to India?

You should start the conversion process within 30 days of return, though RBI doesn't specify exact timelines. The risk of penalties increases significantly if you delay beyond 6 months. Banks are more cooperative and don't ask additional questions if conversions are done within 90 days of return.

Can I keep my FCNR fixed deposit if it matures 2 years after my return?

Yes, existing FCNR deposits can continue until their original maturity date even after you become resident. However, interest earned after you become resident will be taxable in India. At maturity, proceeds must go to either a resident savings account or RFC account - you cannot create a fresh FCNR deposit.

What's the difference between converting to resident account vs RFC account for my NRE funds?

Converting to resident account gives you higher interest rates and full banking services, but you lose foreign currency exposure. RFC accounts let you maintain foreign currency, which can be beneficial if you qualify for RNOR status (interest may not be taxable) or if you might become NRI again. RFC accounts are ideal if you want to time currency conversions or hedge against rupee depreciation.

Will I lose access to my existing mutual fund investments when I become resident?

No, your existing mutual fund investments continue without any impact. Your units, NAV, and portfolio value remain exactly the same. However, you need to update your KYC status from NRI to resident with fund companies. Fresh investments will follow resident tax treatment, and you gain access to investment categories that were previously restricted for NRIs.

How do I know if I qualify for RNOR status and what are the benefits?

You qualify for RNOR if you were non-resident in at least 9 out of 10 years preceding the current financial year. The main benefit: foreign income not derived from business controlled in India is not taxable. This includes rental income from foreign property, dividends from foreign stocks, and capital gains from foreign assets. RNOR status can save lakhs in taxes if you have significant foreign income.

What new investment options become available when I return to India?

You gain access to PPF (15-year tax-free growth), ELSS mutual funds (tax-saving with 3-year lock-in), NPS Tier II, government securities through RBI Direct, intraday trading (previously restricted), currency and commodity derivatives, agricultural land purchase, and all sectoral stocks including defense and atomic energy companies. You also get better rates on loans and credit cards.

Ready to optimize your investment strategy as a returning resident? Explore our complete guide to NRI investment options and see how GIFT City investments can complement your resident portfolio.

Remember, returning to India is a financial opportunity, not just a compliance requirement. Make the most of it by staying informed, acting promptly, and planning strategically.

Join our NRI community WhatsApp group to get advice from other NRIs who have successfully returned to India.

Souces

ICICI Bank

Disclaimer: This article is for educational purposes only. Consult qualified chartered accountants and financial advisors for advice specific to your situation. Tax and regulatory rules change frequently.

Comments

Your comment has been submitted