A Guide To NRI Finance Terms: Fixed Deposit, TDS & More

Sometimes, terms from the finance space can be confusing. We have compiled this glossary of the most common ones, with their definitions, to help you navigate decisions and discussions involving them much better. Use this as your point of reference whenever any of these terms need simplifying.

Resident Status Related Terms

1. NRI (Non-Resident Indian)

An Indian citizen who resides outside India for work, business, education or other reasons without giving up their Indian citizenship. For tax purposes, it is defined through the time one stays in India over a financial year or multiple financial years.

2. PIO (Person of Indian Origin)

A person who was or whose ancestors were Indian nationals but who is now a citizen of another country.

3. OCI (Overseas Citizen of India)

A permanent visa status for PIOs, offering most rights of Indian citizens except voting rights and certain property purchase restrictions.

4. RNOR (Resident but Not Ordinarily Resident)

RNOR is a transitional tax status for returning NRIs. It offers certain tax benefits for foreign income for up to two years after returning to India.

Banking Terms

1. NRE Account (Non-Resident External Account)

A bank account in India opened by NRIs to deposit foreign earnings. Funds are maintained in Indian Rupees, with the principal and interest fully repatriable outside India. Interest earned via this account is tax-free.

2. NRO Account (Non-Resident Ordinary Account)

A bank account in India for NRIs to manage income earned in India, such as rent, pension or dividends. Has restrictions on repatriation, and interest earned via this account is taxable.

3. FCNR (Foreign Currency Non-Resident) Fixed Deposit

FCNR is a type of term deposit account that allows NRIs and PIOs to maintain deposits in foreign currencies such as US Dollars, British Pounds, Euros, Australian Dollars, Canadian Dollars, etc. FCNR FD is protected from INR depreciation and is tax-free in India.

4. NRE Fixed Deposit

A term deposit that allows Non-Resident Indians to invest foreign earnings in Indian Rupees for a fixed period at pre-determined interest rates. Both the principal and interest earned are fully repatriable (can be converted to foreign currency and transferred abroad). The interest earned is exempt from tax in India.

5. NRO Fixed Deposit

A term deposit account for NRIs to invest their funds earned in India (such as rental income, pension or dividends). It offers fixed interest rates for pre-determined periods. While interest earned is taxable in India, limited repatriation of funds is permitted under FEMA regulations (currently up to USD 1 million per financial year).

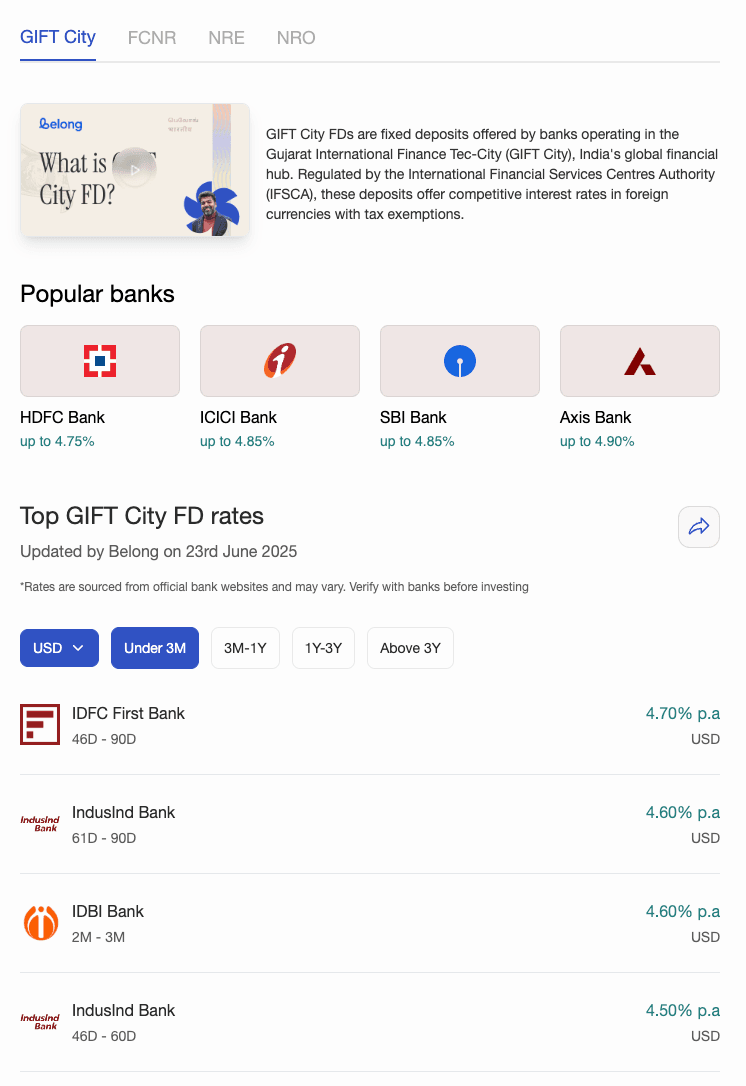

6. GIFT City Fixed Deposit

A fixed deposit account offered by banks in Gujarat International Finance Tec-City (GIFT City), India's first International Financial Services Centre. These deposits are maintained in foreign currency, operate under special regulatory frameworks with potential tax benefits and allow NRIs to invest in foreign currency deposits while keeping funds within the Indian banking system but outside domestic regulations.

You can check out the best interest rates on NRI FDs using Belong's NRI FD Comparison Tool.

5. RFC Account (Resident Foreign Currency Account)

An account that returning NRIs can open to maintain their foreign currency holdings after becoming residents of India again.

6. Repatriation

The process of converting Indian Rupees into foreign currency and transferring it abroad.

7. Remittance

The process of transferring money from an NRI's foreign country of residence to India or vice versa. For NRIs, this typically involves sending money to family members in India, investing in Indian assets or repatriating funds from Indian accounts to their country of residence. Remittances can be made through various channels including bank transfers, money transfer operators or digital payment platforms. They are subject to regulatory limits and documentation requirements.

8. Forex Markup

The additional fee charged by banks and money transfer services above the exchange rate when converting one currency to another during international transactions. For NRIs sending money to India or repatriating funds, this markup is an often-hidden cost that increases the overall expense of currency conversion. The markup typically ranges from 0.5% to 3% of the transaction amount, varying by service provider, transaction size and currencies involved.

9. SWIFT Code

A standard format identifier (also known as BIC - Bank Identifier Code) that is used to specify a particular bank or branch during international money transfers. For NRIs sending or receiving international remittances, the SWIFT code is a mandatory element that ensures funds are routed to the correct financial institution. It consists of 8-11 characters: a 4-letter bank code, a 2-letter country code, a 2-character location code and an optional 3-character branch code.

Investment Terms

1. PIS (Portfolio Investment Scheme)

Scheme under the RBI guidelines through which NRIs can buy and sell shares of Indian companies on stock exchanges.

2. PINS (Portfolio Investment Non-Repatriable Scheme)

Scheme allowing NRIs to invest in Indian capital markets with the condition that the principal amount cannot be repatriated.

3. TEPs (Tax Exemption Plans)

Investment schemes that offer tax benefits to NRIs under various sections of the Income Tax Act.

Taxation Terms

1. TDS (Tax Deducted at Source)

Tax withheld at the source of income. For NRIs, TDS rates are often higher than for residents.

2. DTAA (Double Taxation Avoidance Agreement)

DTAA is a treaty between countries to prevent the same income from being taxed twice. It's important for NRIs who may be taxed in both their country of residence and India.

3. PAN (Permanent Account Number)

PAN is a unique identification number assigned to taxpayers in India, mandatory for financial transactions above certain limits.

4. FATCA (Foreign Account Tax Compliance Act)

FATCA is a US law requiring foreign financial institutions to report on financial accounts held by US taxpayers, affecting NRIs with US citizenship. For NRIs with US citizenship or green cards, FATCA compliance is mandatory regardless of where they live. Non-compliance can result in significant penalties, including a 30% withholding tax on US-source payments and potential closure of financial accounts.

5. Form 15CA/15CB

These are forms required when making overseas remittances from India; 15CB is a chartered accountant's certificate and 15CA is an undertaking by the remitter.

6. TRC (Tax Residency Certificate)

An official document issued by tax authorities certifying an individual's tax residency status in a particular country. For NRIs, a TRC is crucial for claiming benefits under Double Taxation Avoidance Agreements (DTAAs) between India and their country of residence. This certificate helps prevent the same income from being taxed in both countries and get benefits of DTAA.

Regulations & Compliance Terms

1. LRS (Liberalised Remittance Scheme)

LRS is an RBI scheme that allows residents to remit up to $250,000 per financial year for permitted current and capital account transactions, such as sending money to children studying abroad or investing abroad.

2. RBI (Reserve Bank of India)

RBI is India's central banking institution, responsible for regulating all foreign exchange transactions and NRI banking activities.

3. FEMA (Foreign Exchange Management Act)

Indian legislation that regulates foreign exchange transactions and investments by NRIs and foreigners.

| Also Read:

Comments

Your comment has been submitted