GIFT City Fixed Deposits for NRIs: Complete Guide

Did you know that NRIs can avail fixed deposits in 15 foreign currencies like the US Dollar (USD), Euro (EUR), British Pound (GBP), UAE Dirham (AED), Australian Dollar (AUD) and Singaporean Dollar (SGD) out of India in GIFT City, Gujarat?

Read the blog post to know more about GIFT City and how you can go about booking a fixed deposit in GIFT City.

Explore Benefits of GIFT City FD for NRIs

What is GIFT City?

GIFT City (Gujarat International Finance Tec-City) located near Gandhinagar in Gujarat is India’s global financial hub on par with other off-shore entities like Dubai, Mauritius, and Singapore. The Foreign Exchange Management Act (FEMA) treats GIFT City as foreign territory for financial purposes where IFSCA (International Financial Services Centres Authority) is the unified regulator.

Indian and foreign banks have been allowed to set up branches under the IFSCA in GIFT City in Gandhinagar, Gujarat. These branches are call IBUs (IFSC Banking Unit) and operate only in foreign currencies.

What is GIFT City FD?

The IBUs in GIFT City offer FDs in foreign currency. These FDs may be in USD, GBP, EUR, AED and AUD. Such FDs allow NRIs to maintain FDs in foreign currencies instead of converting their money into INR and then investing. As an investor, this protects them from the INR depreciation.

These foreign currency IBU FDs are different from FCNR deposits as well as NRE savings/deposit accounts offered by most banks across India. Additionally, the typical minimum tenure of an FCNR Deposit is 1 year, while FDs offered by IBUs can have shorter tenures and generally offer a wider range of tenure options as well. The bank branches in IBU GIFT City may also offer these fixed deposits to foreign nationals, as these branches are treated as overseas branches.

Why Should NRIs Consider Fixed Deposits in GIFT City?

GIFT City FDs have features that make them better than NRE/NRO FDs or FCNR FDs.

The GIFT City FDs are denominated in international currencies like the USD. This reduces the need for currency conversion which is the case of NRE/NRO FDs. The USD denomination of the fixed deposits protects from INR depreciation.

NRE, NRO and FCNR FDs are not available for tenures lower than a year. GIFT City FDs are available for a shorter tenure of 3 months.

The returns you get from your FDs are tax-free in GIFT City. The investor has to pay taxes according to the regulations of their country of residence. Your gains are completely tax-free if you are a resident of a country like the UAE or Singapore, which does not tax capital gains.

GIFT City FDs are easily repatriable to NRI’s country of residence.

All of these factors combined make GIFT City FDs an attractive proposition for NRIs looking to invest in India.

Explore the benefits of an FCNR Deposit Account for risk-free foreign currency savings.

Eligibility Criteria for NRI Fixed Deposits in GIFT City

Resident Indians cannot open GIFT City Fixed Deposits (FD). Foreigners, Indian citizens living outside India for work/business etc., Person of Indian Origin (PIO) and Overseas Citizen of India (OCI) are eligible to open accounts in GIFT City.

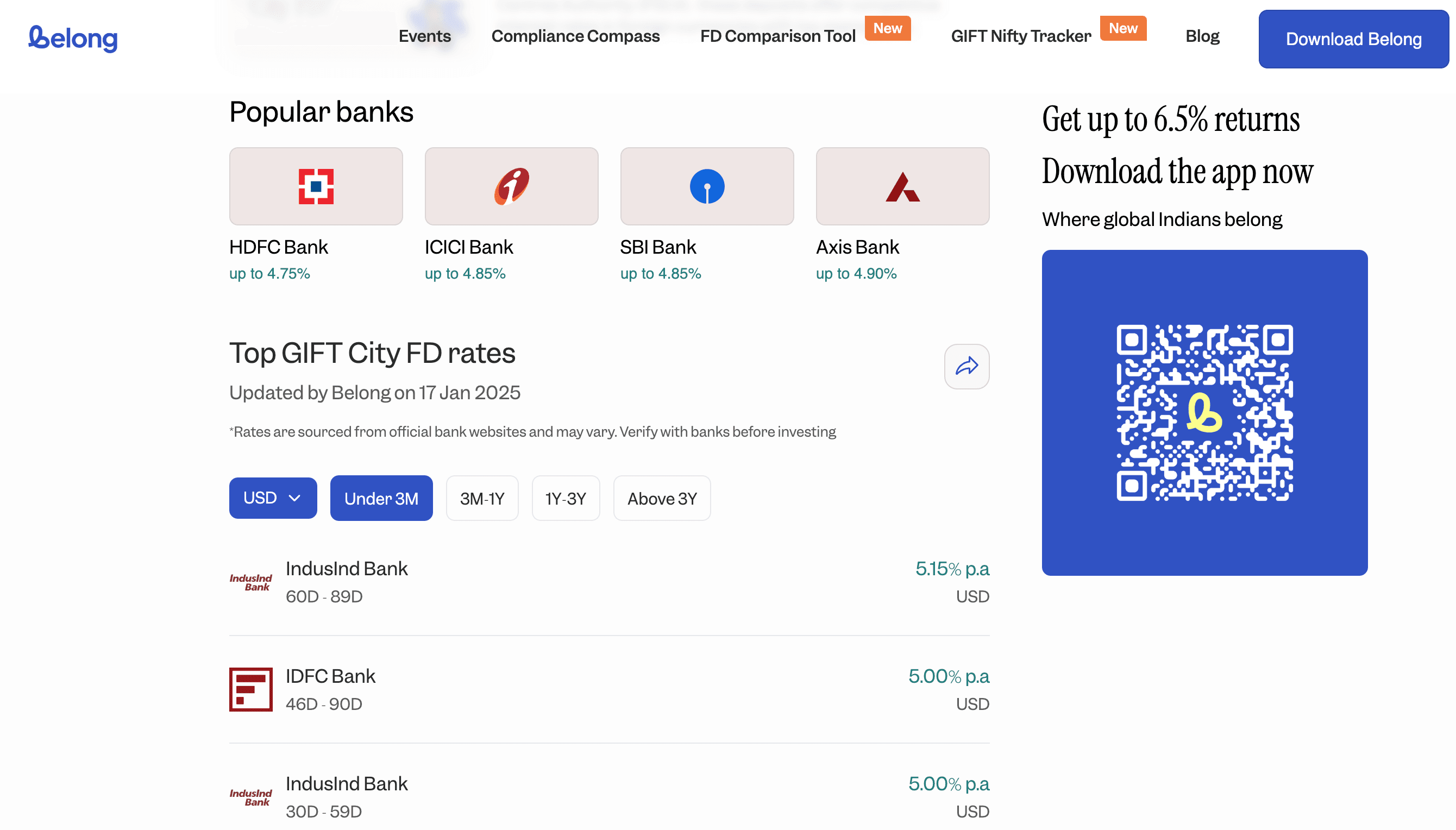

Top Banks Offering Fixed Deposits in GIFT City

Major Indian and International banks have their branches out of GIFT City. Indian banks such as SBI, Bank of Baroda, HDFC Bank, IDFC Bank, etc. have their branches in GIFT City.

Other than this, international banks like HSBC, Standard Chartered Bank, etc. have their branches in GIFT City.

You can now check out the interest rates being offered by GIFT City branches of different banks through the FD comparison tool. This tool consolidates the interest rates offered by different Indian banks with branches in GIFT City. You can compare the interest across banks and across different tenures using this tool.

Tax Benefits & Regulations for NRI FDs in GIFT City

The returns earned from your fixed deposits are completely tax-free in GIFT City. The NRIs pay taxes in their country of residence.

Banking units here are regulated by the International Financial Services Centre Authority (IFSCA), which combines the regulatory powers and authority of the RBI, IRDA, SEBI, and PFRDA.

How To Open a Fixed Deposit in GIFT City as an NRI

To open a Fixed Deposit (FD) in GIFT City as an NRI, you can approach a bank operating within GIFT City. Only NRIs and foreign nationals are eligible for opening bank accounts and booking FDs in GIFT City branches of the bank.

You will have to complete the KYC process for opening a GIFT City bank account and book a FD.

NRIs don’t need an Aadhaar or PAN card to open their GIFT City bank accounts. They just need to provide a copy of their passport, a local ID (e.g. Emirates ID for UAE), and a utility bill or bank statement containing their current address.

Verification can be done over a video call if the customer (NRI) is physically present in India during the KYC process. If not, in-person verification via a visit by an agent is required. Alternatively, the customer can visit a local notary or embassy and get attested copies of the required documents, which can be sent to the financial intermediary for onboarding.

| Also Read:

Risks & Considerations Fixed Deposits in GIFT City

GIFT City investments do not carry much risk due to denomination in foreign currency, no taxation on returns, easy repatriation, and regulation by IFSCA. However, there might be higher minimum investment requirements by the bank.

Comments

Your comment has been submitted