Why India Is Still a Top Investment Choice for NRIs?

India continues to attract Non-Resident Indians (NRIs) seeking to diversify their portfolios and participate in India’s growth story. This economic momentum is further bolstered by ongoing regulatory reforms aimed at enhancing the ease of doing business, a growing middle class driving domestic consumption, and a stable macroeconomic environment. Collectively, these factors solidify India's position as an attractive destination for investment in 2025.

For NRIs, investing in India not only offers the potential for attractive returns but also provides an opportunity to contribute to India's growth story. However, navigating the investment landscape requires a clear understanding of the legal frameworks, account types, and tax implications involved.

Why India Remains an Attractive Investment Destination in 2025

India continues to be a compelling destination for Non-Resident Indians (NRIs) and global investors in 2025, owing to several key factors:

1. Robust Economic Growth

India's economy is projected to grow at a rate of 6.5% during the fiscal year 2025–26, according to the Reserve Bank of India. This steady growth reflects effective monetary policies and a stable macroeconomic environment.

2. Digital Transformation

India has embraced digitalisation, leading to significant advancements in sectors like fintech, e-commerce, and digital infrastructure. Initiatives like 'Digital India' and Unified Payment Interface (UPI) have created a conducive environment for technological innovation, attracting investments in startups and established tech firms.

3. Policy Reforms and Ease of Doing Business

The Indian government has implemented several reforms to enhance the ease of doing business, including simplifying regulations, reducing bureaucratic hurdles, and offering incentives for foreign investors. These measures have improved India's ranking in global ease of doing business indices and have made the investment process more transparent and efficient.

4. Strategic Global Positioning

India's proactive engagement in international trade agreements and its strategic positioning in global supply chains have enhanced its attractiveness to global investors. The country's stable political environment and commitment to democratic principles provide a reliable backdrop for long-term investments.

5. Sectoral Growth Opportunities

India offers diverse investment opportunities across various sectors:

Infrastructure: Government initiatives are driving significant investments in transportation, urban development, and smart cities.

Renewable Energy: India is making substantial strides in green energy like solar, wind and hydropower etc. aiming to become a global leader in renewable energy production.

Healthcare and Pharmaceuticals: The country's pharmaceutical industry is expanding rapidly, with a focus on innovation and global exports.

Information Technology: India's IT sector continues to grow, offering services and solutions to global clients.

- Strong Capital Markets: India's capital markets have shown resilience and growth, with increased participation from domestic and foreign investors. The retail investors having brokerage accounts have touched the 22 crore mark, with 11 crore unique retail investors in March 2025.

Can NRIs Invest in India? What You Need to Know First

Legal Framework: FEMA and RBI Regulations

The Foreign Exchange Management Act (FEMA) governs all foreign investments in India, including those by NRIs. The Reserve Bank of India (RBI) plays a pivotal role in regulating and managing foreign exchange transactions under FEMA. NRIs must ensure compliance with FEMA provisions, which cover various aspects of financial transactions, including the purchase of immovable property, investments in stocks and mutual funds, and the remittance of funds.

Importance of NRE/NRO Accounts

To facilitate investments, NRIs need to open specific bank accounts in India:

NRE (Non-Resident External) Account: Allows NRIs to deposit foreign earnings in India. Funds are fully repatriable, and interest earned is tax-free in India.

NRO (Non-Resident Ordinary) Account: Used to manage income earned in India, such as rent or dividends. Funds are repatriable up to $1 million in a year, and interest earned on interest income is subject to Indian taxes.

These accounts are essential for routing investments and managing income in compliance with Indian regulations.

Best NRI Investment Options in India with Taxation Benefits

Here’s a consolidated view of the most tax-efficient and return-generating investment options available to NRIs in India as of 2025:

1. Fixed Deposits (NRE / NRO / FCNR / GIFT City)

NRE Fixed Deposits are ideal for parking your foreign earnings. The interest earned is completely tax-free in India under Section 10(4)(ii) of the Income Tax Act. Plus, both principal and interest are fully repatriable, making it one of the most NRI-friendly options.

NRO Fixed Deposits are suitable for income earned within India. However, there is a TDS deducted at 30% on interest income. The tax can be claimed back while filing the IT returns.

FCNR Fixed Deposits let you deposit in foreign currency, which eliminates exchange rate risk. The interest is tax-free, and funds are fully repatriable, offering both safety and simplicity.

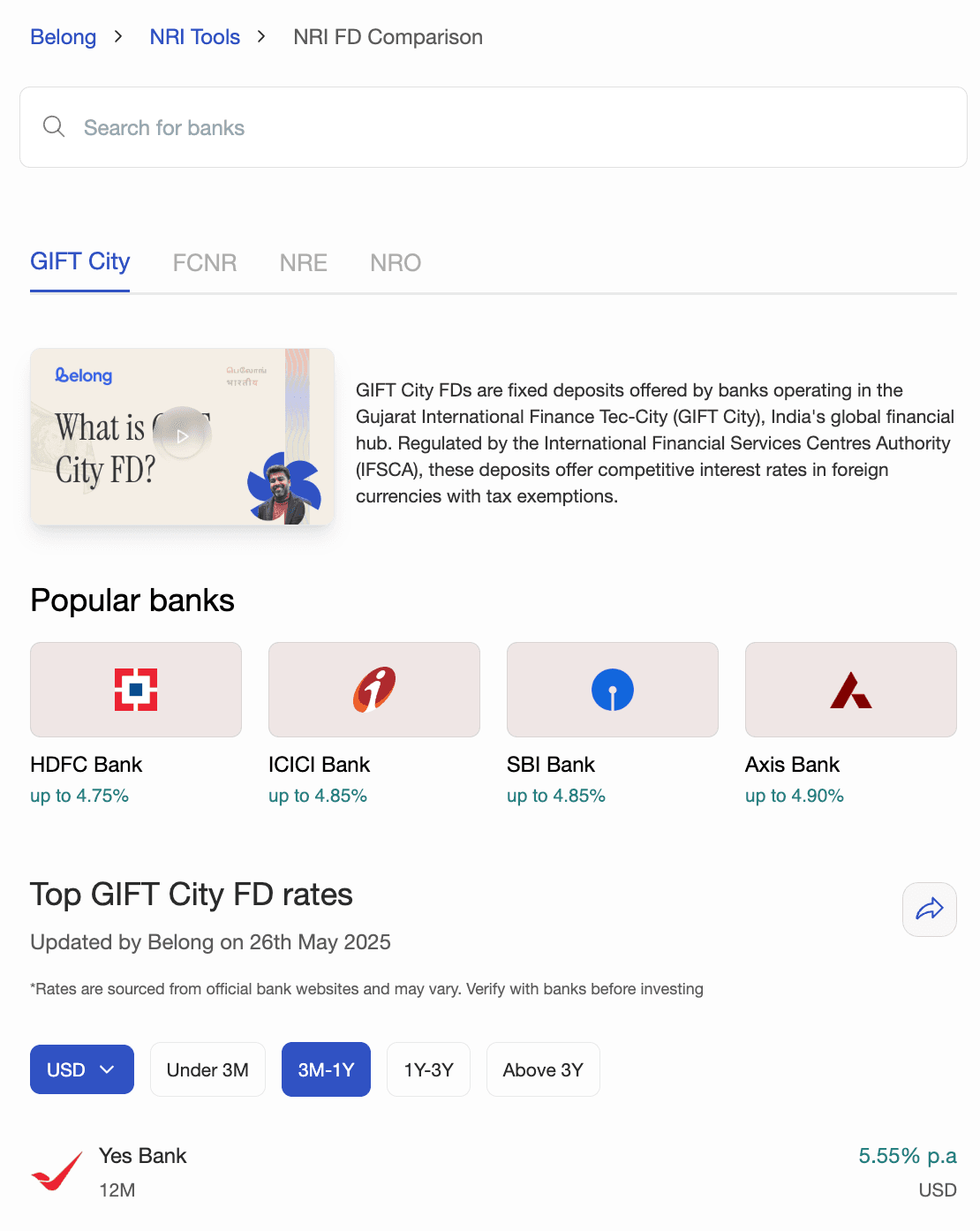

GIFT City Deposits are similar to FCNR deposits. These deposits are offered by banks located in GIFT City, India’s offshore investment destination. They also offer shorter tenures and no penalty on premature withdrawal.

Explore the best NRI FDs with Belong's FD Comparison Tool

2. Mutual Funds

Mutual funds offer a good way for NRIs to participate in the Indian equity markets and diversify their portfolio through debt and equity-based funds. The onboarding process in mutual funds is a bit complex for NRIs. They have to undergo a physical KYC when in India or have an agency to do it on their behalf. NRIs living in the US and Canada have to fill out the FATCA compliance for investing in mutual funds. US and Canada based NRIs can only invest in selected mutual funds.

Debt mutual funds are taxed according to the slab rate of the individual investor. Equity mutual funds held for more than 12 months qualify as long-term investments and are taxed at 12.5% (LTCG) if gains exceed ₹1.25 lakhs in a financial year. Short-term gains (less than 12 months) are taxed at 20%.

One thing to note here is that the fund house deducts TDS at 30% when the NRI redeems their mutual funds. If they fall in the lower tax slab, they can get a refund for the rest of the deduction after filing their IT returns.

3. Real Estate Investments

India’s real estate sector has been booming and has become an attractive investment destination for NRIs due to regulations around RERA, which make the property transactions more transparent. NRIs can purchase any kind of property except agricultural land.

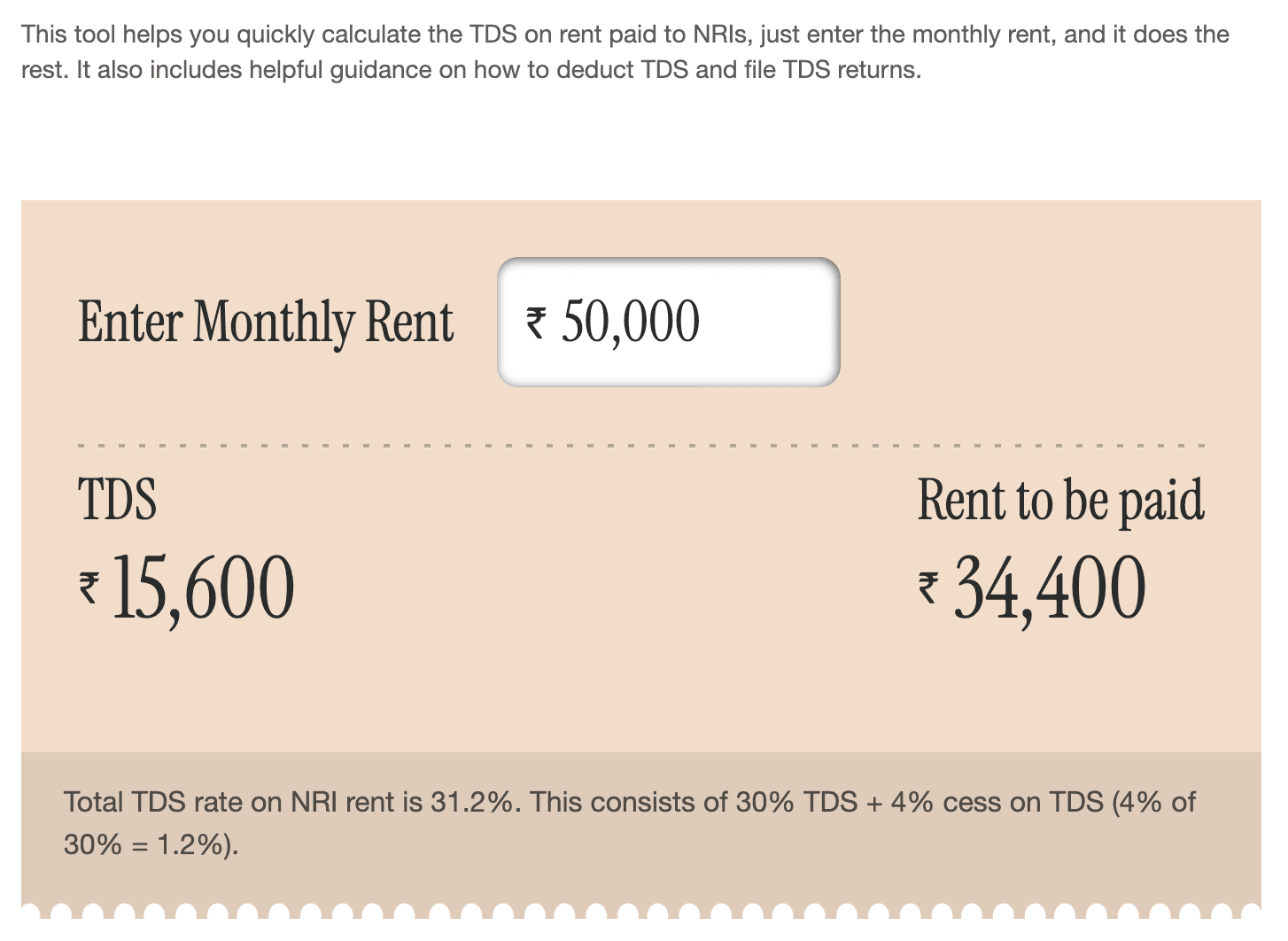

Rental income from property is taxed at slab rates. But the tenants to the NRI landlord will have to deduct TDS at 31.2% of the rent, despite the amount.

Calculate TDS on Rent Paid to NRIs with Belong's NRI Rent TDS Calculator.

Capitalgains on property are taxed based on the holding period. If the property is sold within 2 years, then it is considered short-term gains as per their slab. If one holds it beyond that, then it is taxed as long-term capital gains (LTCG) at 12.5% without indexation.

Exemptions are available under Sections 54, 54EC, and 54F if you reinvest the gains in specified assets like residential property or certain bonds.

4. Government Securities and Bonds

NRIs can invest in Treasury Bills, Sovereign Gold Bonds (SGBs), and State Government Bonds, which offer relative safety and stable returns.

They can invest in government securities and bonds through the RBI direct portal. To open an RBI retail direct account, NRIs must have an Indian mobile number (linked with Aadhaar if not on the central KYC registry), an NRO (non-resident ordinary) savings bank account with UPI/net banking facility, PAN, a cancelled cheque of the NRO bank account, and a scanned copy of their signature.

Interest income from these bonds is taxed at slab rates and is subject to TDS.

Short-term capital gains (if sold within 2 years) are also taxed at 20%, while long-term capital gains enjoy 12.5% tax without indexation benefits, offering a more favourable structure for long-term investors.

5. National Pension System (NPS)

NRIs aged between 18 and 60 can invest in NPS through their NRE/NRO accounts. It’s a great long-term, low-cost retirement savings tool.

For investing in NPS, the NRI needs to fill out and submit the NRI NPS form and submit it to their respective branch. Once the forms are filled out, they are sent to the NSDL’s Central Record Keeping (CRA). Once verification is done from the CRA’s end, a Permanent Retirement Account Number (PRAN) is generated. The subsequent transactions can be done online.

The NPS has a minimum account opening contribution of Rs 500, a minimum per contribution of Rs 500, and a minimum annual contribution of ₹6,000. NRIs need to keep contributing the minimum amount of Rs. 1000 per year to keep their NPS account active.

The cost of the NPS is a fraction of what active mutual funds charge. The investment fee for NPS ranges between 0.03% and 0.09%, which is the lowest compared to any fund management fee in India.

NPS falls under the EEE (Exempt-Exempt-Exempt) category. This means you get tax benefits at the time of investing (up to Rs 2 lakh per annum allowed as a deduction from income in the old tax regime), the gains or interest accrued are not taxed, and at maturity, the lump sum is also tax-free.

6. GIFT City Investments

GIFT City is India’s financial services Special Economic Zone (SEZ) located in Gandhinagar. It is modelled along the lines of other international financial services centres like Dubai, Singapore, Hong Kong, etc.

It has international banks, funds, insurance and exchanges located in GIFT City. For financial purposes, it is treated as a part outside India. You can read more about GIFT City in this blog.

The banks in the GIFT City offer USD-denominated fixed deposits. They do not require a pre-existing NRE/NRO account to invest in GIFT City FD. The returns earned are tax-free in India and are easily repatriable to the NRIs country of residence.

At present, there are no retail mutual fund options available in GIFT City. There are Alternative Investment Funds (AIFs) investing in Indian (Inbound) and international (Outbound) equities. Category-3 AIFs that invest in Indian equity mutual funds (and not stocks directly) are given exemption from capital gains tax at the fund level too. The minimum investment amount required for GIFT City AIFs is $150,000.

Other than this, there are stock exchanges: India INX (a subsidiary of the Bombay Stock Exchange) and NSE-IX (a subsidiary of the National Stock Exchange). These exchanges offer derivatives trading on Indian based indices. India INX’s Global Access platform allows individuals to access international stock exchanges. NSE-IX offers Unsponsored Depository Receipts (UDRs), which allow investors to invest fractionally in the top 50 US stocks.

Factors to Consider Before Investing as an NRI

Investment Horizon and Goals: Define your financial objectives, whether it's wealth accumulation, retirement planning, or generating regular income.

Risk Appetite and Currency Exposure: Assess your tolerance for risk and consider the impact of currency fluctuations on your investments.

Repatriability of Funds: Understand the rules governing the repatriation of funds to ensure liquidity when needed.

Taxation in India and Host Country: Familiarise yourself with the tax implications in both India and your country of residence. Utilise Double Taxation Avoidance Agreements (DTAAs) to mitigate the risk of being taxed twice on the same income.

India’s Appeal for NRI Investors

India offers a wide spectrum of investment avenues for NRIs, from stable options like NRE fixed deposits and government bonds to growth-driven avenues like equity markets, mutual funds, and real estate. Whether you're looking for capital preservation, regular income, or long-term wealth creation, there’s something for every risk profile.

But here’s the key: compliance and diversification

Investing as an NRI isn’t just about chasing returns. It’s about choosing compliant instruments, understanding tax implications (both in India and your resident country), and ensuring your funds are repatriable if needed. A diversified portfolio not only cushions against market volatility but also gives you better flexibility based on your financial goals.

...............................................................................................................................

Also read:

Comments

Your comment has been submitted