The Complete NRI Status Guide for UAE Residents

As someone who's spent years helping Indians navigate their financial journey abroad, I understand the complexity and confusion surrounding NRI status.

Whether you're a software engineer in Dubai, a business owner in Abu Dhabi, or planning your return to India, understanding your residential status isn't just about compliance - it's about optimizing your financial future.

The most important thing to know upfront: Your residential status affects every aspect of your Indian finances, from taxation to investment options to property purchases.

With recent regulatory changes creating new opportunities and challenges, getting this right has never been more critical.

Recent tribunal rulings have created uncertainty between different regulatory interpretations, making professional guidance essential for complex situations.

This comprehensive guide will answer every question you have about NRI status, from basic definitions to advanced tax planning strategies.

By the end, you'll have the clarity and confidence to manage your Indian financial affairs effectively while living in the UAE.

If you want to find out if you qualify as an NRI, use the NRI Status Checker tool here.

What exactly qualifies you as an NRI?

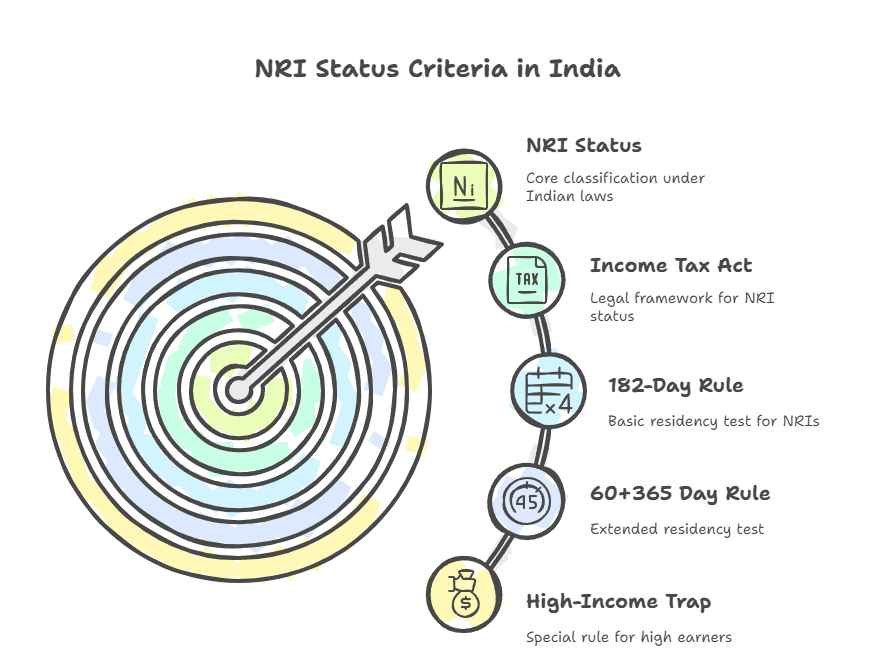

Understanding NRI status begins with recognizing that different laws have different definitions. The Income Tax Act and FEMA regulations don't always align, creating practical challenges that many UAE residents face.

The legal framework

Under the Income Tax Act, Section 6, you're classified as a Non-Resident Indian if you fail to meet the resident criteria. The primary tests are:

The 182-day rule: If you stay in India for 182 days or more during any financial year, you're typically considered a resident. This is the most straightforward test that applies to most UAE-based Indians.

The 60+365 day rule: You're also considered resident if you stay in India for 60+ days in the current year AND 365+ days in the preceding four years combined.

However, for Indian citizens working abroad (which includes most UAE residents), this 60-day period extends to 182 days, providing significant protection for your NRI status.

The high-income trap: If you're an Indian citizen earning more than ₹15 lakh from Indian sources, the 60-day threshold becomes 120 days instead.

This provision, introduced in 2020, particularly affects successful business owners and investors with substantial Indian income.

FEMA's different approach

Under FEMA regulations, NRI status depends on both physical presence and intention.

You qualify if you're residing outside India for more than 182 days OR if you demonstrate clear intent to reside abroad for an uncertain period with supporting documentation.

Recent tribunal ruling impact: A 2024 Appellate Tribunal decision has emphasized strict 182-day physical presence requirements under FEMA, potentially overriding RBI's previously flexible intent-based approach.

This creates practical challenges, particularly for returning NRIs who must now wait longer before converting bank accounts or purchasing agricultural property.

Practical scenarios for UAE residents

Dubai IT professional: Rahul works in Dubai, visits India for 45 days during Diwali and 60 days during summer. Total: 105 days.

Status: Clear NRI under all provisions.

Abu Dhabi businessman: Priya runs businesses in both countries, earning ₹20 lakh from Indian operations, stays 140 days in India.

Status: Resident but Not Ordinarily Resident (RNOR) due to high income and 120+ day presence.

Frequent traveler: Ahmed makes multiple short trips totaling 190 days in India.

Status: Resident for tax purposes, requiring careful planning for the following year.

How do you determine if you qualify as NRI?

Determining your status requires systematic calculation and documentation.

Day counting is critical - every single day matters, including both arrival and departure days.

Step-by-step determination process

Step 1: Calculate physical presence Track every day you're physically present in India during the financial year (April 1 to March 31). Include partial days - if you arrive on July 15th at 11 PM, that counts as one full day.

Step 2: Apply the appropriate rules

- If you're an Indian citizen employed abroad: Only the 182-day rule applies

- If you have Indian income exceeding ₹15 lakh: The 120-day rule may apply instead of 60 days

- Multiple visits are cumulative

Step 3: Consider your intention For FEMA purposes, document your intention to reside abroad through employment contracts, UAE residence visas, and property rentals or ownership in the UAE.

Common calculation mistakes

Airport transit counting: Time spent in Indian airports during international connections doesn't count toward the 182 days unless you formally clear immigration and enter India.

Medical emergency extensions: No automatic exemptions exist for emergency situations that extend your stay. You must apply for specific relief citing exceptional circumstances.

Family visit miscalculation: Many UAE residents undercount their total annual presence by focusing only on major trips rather than cumulative days across multiple visits.

What are the tax implications and residential status differences?

Your residential status fundamentally determines your tax obligations in India. Understanding these differences helps you plan your finances and potentially save significant amounts in taxes.

Tax implications by status

Non-Resident Indians face the most limited tax scope. You're taxed only on income that's earned in India or received in India.

Your Dubai salary remains completely tax-free in India, even if it's substantial. However, any Indian rental income, capital gains from selling Indian property, or interest from NRO accounts faces taxation.

Resident but Not Ordinarily Resident (RNOR) status provides an excellent bridge when transitioning back to India. You qualify for RNOR status if you've been a non-resident for 9 out of 10 preceding years, or if you've stayed in India for 729 days or less during the preceding 7 years.

RNOR status gives you NRI-like tax benefits for up to three years, meaning your foreign income remains non-taxable while you establish yourself back in India.

Full Residents must pay tax on global income, including your UAE salary, investments, and any foreign assets above specified thresholds.

Current tax slabs for NRIs (FY 2024-25)

The government has made the new tax regime default from FY 2024-25, though you can opt out to the old regime if beneficial. For most NRIs with straightforward income structures, the new regime offers better rates:

New Tax Regime (Default):

- Up to ₹3 lakh: Nil

- ₹3-7 lakh: 5%

- ₹7-10 lakh: 10%

- ₹10-12 lakh: 15%

- ₹12-15 lakh: 20%

- Above ₹15 lakh: 30%

Key difference for NRIs: Unlike residents, NRIs cannot claim the Section 87A rebate, meaning your effective tax starts from the first rupee above ₹3 lakh.

DTAA benefits for UAE residents

The India-UAE Double Taxation Avoidance Agreement provides significant benefits, but you must document your UAE tax residency properly. Key reduced rates include:

- Dividends: 10% instead of 20%

- Interest: 5% for bank deposits, 12.5% for other sources instead of 20%

- Capital gains: Potential complete exemption for UAE residents

Critical requirement: You must obtain a Tax Residency Certificate from UAE authorities and file Form 10F with your Indian income tax return to claim these benefits.

Upcoming changes for FY 2025-26

Significant tax relief is coming for the next financial year:

- Income up to ₹4 lakh will be tax-free

- Standard deduction of ₹75,000 for salaried income

- Effective tax-free income up to ₹12.75 lakh with rebates

What documentation do you need and how do you ensure compliance?

Proper documentation isn't just about meeting legal requirements - it's about protecting yourself from penalties and ensuring smooth financial transactions.

Non-compliance can result in penalties up to three times your account balance or ₹2 lakh, whichever is higher.

Essential documents for establishing NRI status

Identity and citizenship proof:

- Valid Indian passport (mandatory)

- OCI or PIO card if applicable

- UAE Emirates ID and residence visa

Address and residence proof in UAE:

- DEWA, ADDC, or other utility bills

- Emirates NBD, ADCB, or other UAE bank statements

- Tenancy contract (Ejari) or property ownership documents

- Employment visa showing UAE residence

Income and employment verification:

- Employment contract or offer letter from UAE employer

- Recent salary certificates and pay slips (minimum 6 months)

- UAE income tax exemption certificate if available

- Previous years' Indian tax returns

Banking compliance requirements

Immediate conversion obligations: When you become an NRI, you must immediately convert all your resident bank accounts to NRO accounts. This isn't optional - it's a legal requirement under FEMA regulations.

Required bank documentation:

- Fresh KYC forms with NRI status declaration

- Resident to NRO account conversion forms

- Updated address proof in UAE

- FATCA and CRS compliance declarations

- Recent passport-sized photographs

Investment account changes: Your Demat accounts must be converted to NRI status, and you need a Portfolio Investment Scheme (PIS) account for equity investments on a repatriable basis.

Common compliance mistakes that cost money

Delayed account conversion is the most expensive mistake UAE residents make. Banks impose heavy penalties - up to ₹5,000 per day for every day you delay conversion after becoming an NRI.

Incorrect Re-KYC completion can freeze your accounts without notice. With enhanced RBI guidelines in 2024, banks are conducting more frequent KYC updates.

Proactive Re-KYC completion when banks request it prevents account freezing.

Mixed funding in NRE accounts violates FEMA regulations. Your NRE account can only receive foreign currency remittances or transfers from other NRE/FCNR accounts - never local Indian income.

How do you change from resident to NRI status and vice versa?

Status changes require careful planning and precise execution. Timing matters significantly because it affects your tax obligations and available financial products.

Converting from resident to NRI status

Step 1: Establish your timeline Calculate when you'll meet the NRI criteria based on your planned stay in the UAE. Many residents become NRIs partway through a financial year, creating pro-rata tax calculations.

Step 2: Banking conversions Visit your bank branches with complete documentation to convert accounts. Don't wait until you're already an NRI - start the process as soon as you know you'll qualify. Banks can take 2-4 weeks to complete conversions.

Step 3: Investment portfolio updates

- Convert Demat accounts to NRI status

- Open PIS account with your designated bank

- Update mutual fund folios to NRI status

- Review and restructure investments if needed

Step 4: Tax planning adjustments Consider selling assets that might become tax-inefficient as an NRI, such as domestic equity mutual funds that lose indexation benefits, or restructuring your investment portfolio for tax efficiency.

Returning to India: NRI to resident conversion

Understanding RNOR benefits: When returning to India, you may qualify for RNOR status, which provides NRI-like tax benefits for up to three years. This gives you time to restructure your finances without immediate full resident tax obligations.

Account conversion process: Converting NRE accounts to resident accounts is straightforward - the process is typically automatic. NRO accounts require fresh documentation and declarations about your residential status.

Investment implications: As a returning resident, you gain access to products like PPF accounts, small savings schemes, and domestic mutual funds with potentially better tax treatment.

Special considerations for UAE residents

UAE employment visa implications: Your UAE residence visa status affects your Indian residential determination. Maintaining valid UAE residence and employment helps preserve NRI status during extended India visits.

Family in India considerations: If your family resides in India while you work in the UAE, maintain clear documentation about your primary residence and economic ties to establish your genuine NRI status.

What are the latest RBI and tax department updates affecting you?

Staying current with regulatory changes isn't just about compliance - it's about identifying new opportunities and avoiding unexpected obligations. 2024-25 has brought significant changes that directly impact UAE residents.

Recent RBI updates and their implications

New KYC streamlining (November 2024): RBI has introduced Unique Customer Identification Code (UCIC) that allows KYC-compliant customers to open accounts across different financial institutions without repeating the entire process. This particularly benefits NRIs who often maintain relationships with multiple banks.

Enhanced compliance monitoring: Banks now conduct more frequent risk-based KYC updates. UAE residents should proactively respond to bank communications about Re-KYC to avoid account restrictions.

Simplified account management: The elimination of separate NRO PINS account requirements reduces complexity for NRI investment portfolios.

Tax department changes affecting NRIs

Extended filing deadlines: ITR filing deadline for FY 2024-25 has been extended to September 15, 2025, providing more time for complex NRI returns requiring DTAA documentation.

Capital gains impact: The removal of indexation benefits for property sales (effective July 23, 2024) significantly increases tax liability for NRIs selling Indian real estate. Properties bought years ago no longer benefit from inflation adjustments, resulting in higher taxable capital gains.

Liberalized Remittance Scheme expansion: The annual limit has increased from ₹7 lakh to ₹10 lakh, providing more flexibility for your family members in India to send money abroad for education, medical treatment, or travel.

Practical impact on UAE residents

Property sale planning: If you're considering selling Indian property, the timing now matters more than ever. Properties sold before July 23, 2024, could claim indexation benefits, while later sales face higher tax burdens.

Family remittance benefits: Your spouse or children in India can now send up to ₹10 lakh annually abroad under LRS, with zero TCS on education-related remittances to specified financial institutions.

Investment flexibility: Enhanced digital compliance frameworks make it easier to manage investments remotely, though documentation requirements remain stringent.

What is RNOR status and how does it benefit you?

RNOR (Resident but Not Ordinarily Resident) status is one of the most valuable provisions for UAE residents planning to return to India or those with high Indian income. Understanding and leveraging RNOR status can save hundreds of thousands of rupees in taxes.

Qualifying for RNOR status

You qualify for RNOR status if you meet the basic residency criteria but satisfy either of these conditions:

- Nine-year rule: You've been a non-resident for 9 out of the 10 preceding financial years

- Seven-year rule: Your total stay in India was 729 days or less during the 7 preceding years

Special provision for high-income NRIs: If you're an Indian citizen earning more than ₹15 lakh from Indian sources and staying 120-182 days in India, you're automatically classified as RNOR rather than a full resident.

Tax benefits of RNOR status

Foreign income exemption: Your UAE salary, foreign investments, and overseas business income remain completely exempt from Indian taxation - just like when you were an NRI.

Indian income taxation: You're taxed on Indian income at resident rates, but without the complexity of global income reporting and taxation.

Duration of benefits: RNOR status can last up to three financial years, providing substantial transition time to reorganize your finances.

Strategic planning with RNOR status

Return timing optimization: Plan your return to India to maximize RNOR benefits. Returning early in a financial year gives you more time to benefit from this status.

Income structuring: During RNOR years, consider accelerating foreign income realization while deferring Indian income where possible to optimize your overall tax burden.

Investment portfolio adjustments: Use RNOR years to restructure investments, moving from NRI-focused products to resident-beneficial options gradually.

Real-world scenarios: How this applies to your specific situation

Understanding theory is important, but seeing how these rules apply to real situations helps you make better decisions. These scenarios reflect the most common situations UAE residents face.

Scenario 1: The Dubai software engineer

Meet Sarah: Works for a multinational in Dubai, earns AED 400,000 annually, owns an apartment in Mumbai that she rents out for ₹40,000 monthly.

Her challenge: Sarah visits India twice yearly - 60 days during Diwali season and 45 days in summer. She's worried about maintaining NRI status with property income.

The solution: Sarah's total India stay of 105 days keeps her well within NRI limits. Her Dubai salary remains tax-free in India.

The Mumbai rental income of ₹4.8 lakh annually falls in the 5% tax bracket under the new regime. With 30% standard deduction on rental income (after municipal taxes), her taxable rental income reduces to ₹3.36 lakh, keeping her total tax burden minimal.

Action items: Sarah should obtain a UAE Tax Residency Certificate to claim DTAA benefits, potentially reducing TDS on her rental income from 30% to 12.5%.

Scenario 2: The Abu Dhabi businessman

Meet Raj: Runs successful businesses in both UAE and India, earning AED 600,000 in UAE and ₹25 lakh from Indian operations. Spends 150 days in India managing his Indian business.

His challenge: High Indian income combined with substantial India presence creates complex residential status issues.

The solution: Raj qualifies as RNOR (earning more than ₹15 lakh from Indian sources with 120+ day presence). His UAE income remains tax-free, while only his Indian business income faces taxation. Under RNOR status, he gets the best of both worlds - resident tax rates on Indian income but no global income tax obligations.

Action items: Raj should maintain clear documentation of his UAE residency and business operations to support his tax position.

Scenario 3: The planning-to-return family

Meet the Sharmas: After 8 years in Dubai, they're planning to return to India in 2025. They have NRE deposits of ₹50 lakh and own property in both countries.

Their challenge: Timing their return to optimize tax benefits while managing asset transitions.

The solution: The Sharmas qualify for RNOR status upon return (non-resident for 8 out of 10 years). They should plan their return early in the financial year to maximize RNOR benefits. Their NRE deposits can continue earning tax-free interest during RNOR years, while they restructure their investment portfolio for long-term India residence.

Action items: Convert property investments in UAE to Indian assets gradually during RNOR years when foreign income remains tax-free.

Scenario 4: The frequent visitor dilemma

Meet Ahmed: UAE resident who visits India frequently for family and business, often accumulating close to 180 days annually.

His challenge: Managing day counts while maintaining necessary India presence.

The solution: Ahmed should maintain detailed travel records and consider spacing his visits across financial years. If he crosses 182 days in any year, he can potentially benefit from RNOR status rather than full resident taxation.

Action items: Use digital tools to track India presence and plan future visits to optimize residential status.

Step-by-step guidance for determining your status

Taking action on your residential status requires a systematic approach. Following this step-by-step process ensures accuracy and helps you avoid costly mistakes.

Phase 1: Assessment and calculation

Week 1: Gather travel records Collect all passport stamps, boarding passes, and travel records for the current and preceding four financial years. Many UAE residents underestimate their India presence by overlooking short trips or miscounting days.

Week 2: Calculate day counts Use a spreadsheet to track every day spent in India. Include arrival and departure days as full days. Account for multiple trips - they're cumulative across the financial year.

Week 3: Determine preliminary status Apply the 182-day rule first. If you're under this threshold, check the 60+365 day rule (remembering it's 182 days for Indian citizens working abroad). Factor in the high-income rule if your Indian income exceeds ₹15 lakh.

Phase 2: Documentation and compliance

Week 4: Assemble documentation Gather all required documents: passport, UAE residence visa, employment contracts, address proofs, and income documentation. Having complete documentation ready accelerates all subsequent processes.

Week 5: Banking compliance check Review all your Indian bank accounts and investment accounts. Ensure they match your current residential status. If conversions are needed, start the process immediately.

Week 6: Tax planning assessment Calculate your potential tax liability under different scenarios. Consider whether the old or new tax regime benefits you more, and gather DTAA documentation if applicable.

Phase 3: Implementation and monitoring

Week 7: Execute changes Submit account conversion forms, update KYC information, and file any required tax forms. Don't delay - compliance deadlines are strict.

Week 8: Set up monitoring systems Create a system to track future India visits and monitor compliance on an ongoing basis. Many UAE residents benefit from setting phone reminders about their cumulative India presence.

Week 9: Professional consultation For complex situations involving significant assets or income, consult with qualified professionals. The cost of professional advice is minimal compared to potential penalties or missed opportunities.

Common mistakes that could cost you thousands

Learning from others' mistakes is much cheaper than making them yourself. These errors have cost UAE residents significant money and created compliance headaches.

Banking and compliance errors

The delayed conversion disaster: Ramesh became an NRI in July 2023 but didn't convert his accounts until March 2024. His penalty: ₹3.5 lakh on his ₹12 lakh account balance, plus daily penalties for eight months.

The Re-KYC oversight: Priya ignored her bank's Re-KYC notices because she was busy with work. Her accounts were frozen during her daughter's admission season, creating emergency situations and requiring expensive emergency remittances.

Mixed funding violations: Ahmed deposited his Indian consulting income into his NRE account, thinking it would make the money more easily repatriable. The FEMA violation resulted in account closure and regulatory scrutiny.

Tax planning mistakes

The DTAA documentation gap: Sunita had ₹8 lakh in interest income but failed to obtain a UAE Tax Residency Certificate. She paid the full 30% tax rate instead of the 12.5% DTAA rate, losing ₹1.4 lakh unnecessarily.

Incorrect regime selection: Vikram stuck with the old tax regime out of habit, not realizing the new regime would save him ₹45,000 annually on his ₹15 lakh Indian income.

Capital gains timing error: The Aggarwal family sold their Delhi property in August 2024, losing indexation benefits that would have saved them ₹8 lakh in taxes. Selling two months earlier would have provided substantial savings.

Status determination errors

The day counting mistake: Neha counted only "full days" in India, excluding arrival and departure days. Her miscalculation led to incorrect NRI status claims and subsequent tax demands with interest and penalties.

High-income rule oversight: Raj earned ₹18 lakh from Indian sources and stayed 135 days in India. He assumed he remained an NRI, not realizing the 120-day rule for high-income individuals made him RNOR.

Conclusion: Your path forward

Managing NRI status effectively isn't just about compliance - it's about optimizing your financial strategy while living your best life between two countries. The regulatory landscape is evolving, but the fundamentals remain consistent: accurate day counting, proper documentation, and timely compliance protect your interests.

The opportunities are significant for those who plan ahead. DTAA benefits can save thousands annually, RNOR status provides valuable transition flexibility, and proper investment structuring maximizes your wealth building. The key is staying informed and taking action when needed.

Your immediate action items:

- Calculate your current residential status using the systematic approach outlined above

- Ensure all bank accounts and investments match your actual status

- Gather DTAA documentation if you haven't already claimed these benefits

- Plan any major financial decisions (property sales, large investments, India returns) with tax implications in mind

Remember, the cost of professional guidance is minimal compared to the potential benefits of getting this right. Whether you're planning to remain in the UAE long-term or considering a return to India, understanding and optimizing your residential status puts you in control of your financial future.

At Belong, we've seen thousands of UAE residents successfully navigate these complexities. The rules might seem complicated initially, but with proper understanding and planning, you can make them work in your favor. Your financial success depends not just on how much you earn, but on how well you optimize the regulatory framework that governs your cross-border financial life.

Here's a comprehensive list of sources used in creating "The Complete NRI Status Guide for UAE Residents in 2025":

Sources

Government & Regulatory Sources

- Income Tax Department - Non-Resident Individual for AY 2025-2026 | https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-0

- Income Tax India - Residential status documentation | https://incometaxindia.gov.in/Documents/residential-status.htm

- Reserve Bank of India (RBI) - Master Circulars | https://www.rbi.org.in/scripts/BS_ViewMasCirculardetails.aspx?id=8137

- Reserve Bank of India (RBI) - Master Directions | https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10198

- Ministry of External Affairs (MEA) - Guidebook on Taxation for Overseas Indians | https://www.mea.gov.in/images/pdf/OIFCPublication2009GuidebookonTaxationforOI.pdf

- TaxSutra - UAE DTAA Documentation | https://www.taxsutra.com/sites/taxsutra.com/files/dtaa/UAE%20DTAA.pdf

Banking & Financial Institution Sources

- HDFC Bank - FEMA Regulations for NRIs | https://www.hdfcbank.com/personal/resources/learning-centre/save/fema-regulations-for-nri

- ICICI Bank - NRI Taxation: Know the income tax rates | https://www.icicibank.com/nri-banking/nriedge/nri-articles/nri-taxation-know-the-income-tax-rates

- ICICI Bank - Budget 2025-26: Key highlights for NRIs | https://www.icicibank.com/nri-banking/nriedge/nri-articles/budget-2025-26-key-highlights-for-nris

- ICICI Bank - Convert your resident savings account to NRO account | https://www.icicibank.com/nri-banking/nriedge/nri-articles/convert-your-savings-account-to-an-nro

- ICICI Bank - Understanding Re-KYC: A comprehensive guide for NRI Accounts | https://www.icicibank.com/nri-banking/nriedge/nri-articles/an-nris-guide-o-re-kyc-process-for-nri-accounts

- Deutsche Bank - FEMA Residential Status FAQ | https://www.deutschebank.co.in/en/nri-banking/non-resident-connect/fema-residential-status.html

- DBS Bank - What Is NRI – Full Form, Meaning, Benefits & Tax Rules (2025) | https://www.dbs.com/in/treasures/articles/nri-hub/live-enriched/what-is-nri

- DBS Bank - NRI Status in India | Explained by DBS Treasures | https://www.dbs.com/in/treasures/articles/nri-hub/live-enriched/nri-status-explained

Tax & Financial Advisory Sources

- ClearTax - NRI Income Tax in India (2025): Slabs, Rules, ITR Forms and Capital Gains | https://cleartax.in/s/income-tax-for-nri

- ClearTax - NRI Taxation and Residency Rules Under the Income Tax Act | https://cleartax.in/s/nri-status-and-taxation

- ClearTax - Double Tax Avoidance Agreement (DTAA) Between India and UAE | https://cleartax.in/s/india-uae-dtaa

- ClearTax - Income Tax Bill 2025: PDF Download, Highlights, Chapters | https://cleartax.in/s/income-tax-bill

- Tax2Win - NRI Income Tax in India: Exemptions, Deductions & Tax Rules in 2025 | https://tax2win.in/guide/income-tax-for-nris

- PwC Tax Summaries - India - Individual - Residence | https://taxsummaries.pwc.com/india/individual/residence

- Ecovis - NRI Tax in India and New Income Tax Bill 2025 | https://global.ecovis.com/nri-tax-in-india-and-new-income-tax-bill-2025/

Insurance & Investment Sources

- PolicyBazaar - NRI Status - NRI Status and NRI Taxation | RNOR | https://www.policybazaar.com/life-insurance/investment-plans/articles/nri-status/

- Tata AIA - RNOR In Income Tax: Navigating Tax Rules & Regulations in India | https://www.tataaia.com/blogs/tax-savings/taxability-of-income-for-rnor-citizens-in-india.html

- HDFC Life - Income Tax for NRI in India 2025: Income Tax Benefits, Rules & Slabs Explained | https://www.hdfclife.com/insurance-knowledge-centre/tax-saving-insurance/income-tax-for-nri-in-india

Professional Services & Legal Sources

- IndiaFilings - Who is an NRI? NRI Tax Status and Residency Rules Under the Income Tax Act | https://www.indiafilings.com/learn/what-is-nri-and-residency-rules-under-the-income-tax-act/

- IndiaFilings - Key Tax Changes for NRIs in 2025: What You Need to Know | https://www.indiafilings.com/learn/key-tax-changes-every-nri-should-know-in-2025/

- IndiaFilings - ITR Filing Due Date FY 2024-25 (AY 2025-26) | https://www.indiafilings.com/learn/income-tax-itr-filing-due-date/

- PravasiTax - Indexation Benefit, Removal of Indexation Benefit, Finance Bill 2024, NRIs | https://pravasitax.com/information-hub/tax/compliance/shift-in-nri-status/removal-of-indexation-benefit-the-impact-on-nri

- IDFC FIRST Bank - Common NRI tax mistakes that lead to penalties and losses | https://www.idfcfirstbank.com/finfirst-blogs/nri/nri-tax-mistakes-to-avoid

News & Media Sources

- Business Today - NRIs must meet 182 day stay requirement to qualify as residents: Tribunal | https://www.businesstoday.in/nri/invest/story/nri-residency-rules-182-day-stay-fema-account-conversion-property-490680-2025-08-22

- India Briefing - Understanding the New Tax Residency Rules for NRIs | https://www.india-briefing.com/news/understanding-the-new-tax-residency-rules-for-nris-36318.html/

- Business Standard - RBI's new KYC rules: Simplified verification and enhanced security | https://www.business-standard.com/finance/personal-finance/rbi-s-new-kyc-rules-simplified-verification-and-enhanced-security-124110701185_1.html

Investment & Wealth Management Sources

- Bajaj Finserv - New Income Tax Slabs and Rates for FY 2025-26 (AY 2026-27) | https://www.bajajfinserv.in/investments/income-tax-slabs

- Bajaj Finserv - ITR Filing Last Date for FY 2024-25: Income Tax Return Extended FY 2024-25 (AY 2025-26) | https://www.bajajfinserv.in/investments/income-tax-return-extended-latest-updates

- PrimeWealth - India-UAE DTAA: The Ultimate Tax Advantage Guide For NRIs In 2025 | https://primewealth.co.in/india-uae-dtaa-the-ultimate-tax-advantage-guide-for-nris/

Reference & Educational Sources

- Return To India - Cracking The 182-Day Code For NRIs: A Guide | https://backtoindia.com/182-days/

- WiseNRI - NRI Legal Challenges in Investing and Managing Wealth in India as an NRI | https://www.wisenri.com/nri-legal-challenges/

- VisaVerge - India's New Income Tax Bill 2025: Slabs, NRI Benefits, Effective 2026 | https://www.visaverge.com/taxes/indias-new-income-tax-bill-2025-slabs-nri-benefits-effective-2026/

- Dinesh Aarjav - Income Tax Bill 2025: Key NRI Tax Updates, Residency Rules & Compliance Changes | https://www.dineshaarjav.com/blog-detail/income-tax-bill-2025-nri-tax-updates

Belong Platform Sources

- GetBelong.com - Old Tax Regime Vs New Tax Regime - What Should NRIs Choose | https://getbelong.com/blog/old-tax-regime-vs-new-tax-regime/

- GetBelong.com - RBI Rules for NRI Accounts You Must Know - Complete Guide | https://getbelong.com/blog/rbi-rules-nri-accounts/

Comments

Your comment has been submitted