Is NRI Income Taxable in India - NRIs Guide

"Should I be worried about my rental income from Mumbai while I'm working in Dubai?"

This was the first question Prateek asked us when we met at a Belong meetup in Dubai last month. He'd been getting conflicting advice from three different CAs and was genuinely confused about whether his income was taxable in India.

Here's what I told him: Your tax liability as an NRI isn't about your passport or where you live. It's about three things - your residential status for tax purposes, the source of your income, and how you structure your finances.

Get these right, and you'll minimize your tax burden legally while staying fully compliant. Get them wrong, and you could overpay by lakhs or face penalties.

By the end of this guide, you'll know exactly what income gets taxed in India, how to determine your status, which banks to use for tax efficiency, and the practical steps to optimize your tax situation while staying compliant.

The Residential Status Rule That Changes Everything

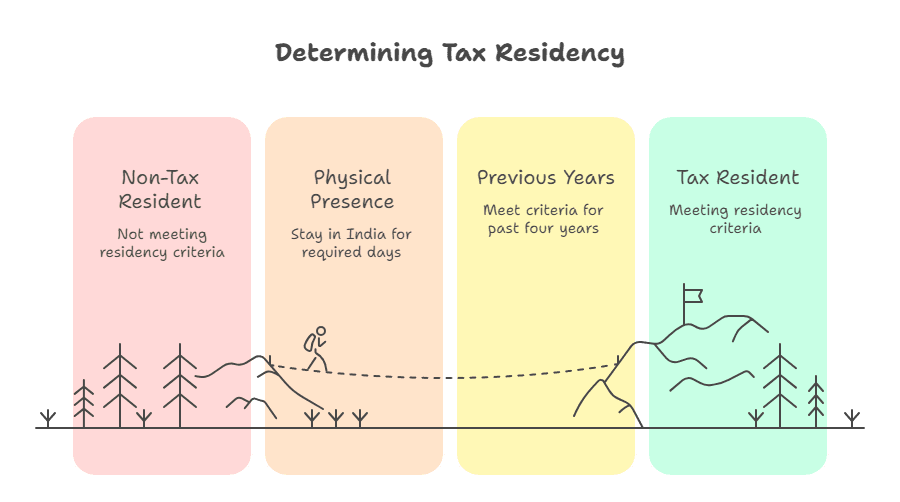

Before we talk about what's taxable, you need to understand this: your residential status determines your entire tax liability in India.

This has nothing to do with your citizenship. I know Indian citizens who are NRIs for tax purposes and foreign nationals who are residents.

You're a Tax Resident if:

- You stay in India for 182 days or more in a financial year, OR

- You stay for 60+ days in the current year AND 365+ days in the past 4 years combined

Special Protection for Expat Workers: If you left India for employment abroad (like most UAE-based professionals), only the first condition matters. You need 182+ days in India to become a resident.

This means you can visit family for 3-4 months without changing your tax status.

The ₹15 Lakh Income Trap

Here's where it gets tricky. If your Indian income exceeds ₹15 lakh and you visit for 60+ days, you become a resident. But there's a buffer - the 60-day limit increases to 120 days for this category.

Real Example: Arjun earns ₹25 lakh rental income from his Gurgaon properties and visits India for 100 days. Under the old rule, he'd be a resident.

The new rule protects him as long as his stay is less than 120 days, not 182. If he stayed for 130 days, he would become a resident (RNOR).

Also Read - Step-by-Step Guide to Converting Resident Account to NRI Account

Deemed Residency: The New Trap for High Earners

Since 2020, there's another category: deemed resident. If you're an Indian citizen earning ₹15+ lakh from Indian sources and not paying tax in any country, you become a resident classified as RNOR.

This targets people exploiting tax havens while earning from India.

👉 Tip:Keep records of your travel dates and any tax paid abroad. UAE doesn't have income tax, but you may have other obligations that count.

Also read: Do NRIs Need to File Income Tax in India if They Have No Income

What Income Actually Gets Taxed: The Source Rule Explained

The key principle is simple: if income has its source in India, it's taxable for NRIs.

But "source" isn't always obvious. Let me break down each type:

Employment Income: Location vs Receipt

Always Taxable:

- Salary for work performed in India

- Salary received in India (even for foreign work)

Not Taxable:

- Your Dubai salary that stays in UAE accounts

- Salary for work done entirely outside India

The Grey Area: If you work remotely for an Indian company while in Dubai, it gets complicated. The work location and payment location both matter.

Property Income: Location Always Wins

Rental Income from Indian Property: Taxable regardless of where you receive the rent. You get:

- 30% standard deduction on gross rent

- Additional deduction for municipal taxes

- Interest on housing loan deduction

Your Tenant's Obligation: If you're an NRI landlord, your tenant must deduct 30% TDS before paying rent. They also need to file Form 15CA for payments above ₹2.5 lakh annually.

Also Read - Taxation on Rental Income in India for NRIs

Investment Income: Account Type Matters

This is where your banking choice becomes crucial:

Tax-Free Investment Income:

- Interest from NRE accounts

- Interest from FCNR accounts

- This can save you thousands annually

Also Read - Best NRI Fixed Deposit Accounts India Complete Tax & Rate Guide

Taxable Investment Income:

- Interest from NRO accounts (30% TDS)

- Dividends from Indian companies (20% tax rate)

- Interest from Indian fixed deposits

Capital Gains: Recent Rule Changes

From July 23, 2024:

- Long-term capital gains (equity): 12.5%

- Short-term capital gains (equity): 20%

- Property gains: 12.5% without indexation benefit

TDS on Property Sales: Buyers deduct TDS at capital gains rates. For properties sold after July 23, 2024, it should be 12.5%, but many still deduct 20%. You can claim refund through ITR filing.

Also Read - Tax Exemption Under Section 54 and Section 54F for NRIs: Your Complete Tax-Saving Guide

Banking Strategy: How Account Type Affects Your Tax Bill

This is where I see NRIs lose the most money unnecessarily.

NRE vs NRO: The Tax Impact

Feature | NRE Account | NRO Account |

|---|---|---|

Interest Taxation | Tax-free | 30% TDS |

Source of Funds | Foreign earnings only | Any income |

Repatriation | Fully repatriable | Limited |

Real Impact Example: ₹50 lakh deposit at 6.5% interest:

- NRE account: ₹3.25 lakh interest (tax-free)

- NRO account: ₹3.25 lakh interest minus ₹97,500 tax

- Annual tax savings with NRE: ₹97,500

Also Read - NRE vs NRO vs FCNR

Best Banking Options for UAE NRIs

Based on my experience with clients, here's what works:

ICICI Bank:

- Strong UAE presence with dedicated NRI branches

- Good mobile app functionality

- Quick online account opening (usually 3-5 days)

- Downside: Premium relationship management costs extra

HDFC Bank:

- Excellent relationship manager support

- Strong NRI fixed deposit offerings

- Good customer service for complex queries

- Downside: Mobile app can be clunky for NRE/NRO switching

Axis Bank:

- Dedicated UAE operations

- Competitive rates on deposits

- Streamlined documentation process

- Downside: Customer service quality varies by branch

👉 Tip: Choose based on your primary banking needs, not just FD rates. If you need frequent customer support, HDFC's relationship manager model works better. For digital-first users, ICICI's app experience is superior.

Also Read -Top Indian Banks for Online NRI Account Opening

DTAA Benefits: Your Legal Shield Against Double Taxation

Double Taxation Avoidance Agreement isn't just a concept - it's your practical tool for tax optimization.

India has DTAAs with 94+ countries including UAE, USA, UK, Canada, Australia.

How UAE NRIs Can Benefit

Since UAE has no personal income tax, most DTAA benefits flow to reduce your Indian tax liability:

Reduced TDS Rates: Instead of standard 30% TDS on various payments, DTAA rates often apply. For UAE residents, many payments get beneficial treatment.

Capital Gains Exemption: Recent tribunal rulings suggest UAE-resident NRIs can claim exemption on capital gains from Indian mutual funds under Article 13 of India - UAE DTAA - subject to documentation and potential disputes.

Dividend Tax Relief: UAE residents may claim reduced rates on dividend income from Indian companies.

Also Read - Best NRE Savings Accounts for UAE NRIs - Complete Guide

Documents Required for DTAA Claims

Tax Residency Certificate (TRC): UAE doesn't issue traditional TRCs like other countries. You'll need a "Certificate of Tax Residence" from Federal Tax Authority or a letter from your UAE employer confirming your residence status.

Form 10F: Must be filed electronically before claiming DTAA benefits. This declares your residential status and income details.

Practical Filing Process:

- Obtain TRC or residence certificate from UAE authorities

- File Form 10F online on income tax portal

- Submit both when claiming reduced TDS or filing ITR

- Keep copies for future years

Real DTAA Savings Example

Scenario: You earn ₹15 lakh capital gains from selling Indian mutual fund units

Without DTAA: Pay 12.5% LTCG tax = ₹1.87 lakh

With UAE DTAA: Potentially zero tax (subject to proper documentation)

Net Savings: ₹1.87 lakh

This requires professional guidance and proper documentation, but the savings are substantial.

Tax Rates and Calculation Framework

Understanding the rates helps you plan better.

NRI Tax Slabs for FY 2025-26

New Tax Regime (Now Default):

- Up to ₹4 lakh: Nil

- ₹4-8 lakh: 5%

- ₹8-12 lakh: 10%

- ₹12-16 lakh: 15%

- ₹16-20 lakh: 20%

- ₹ 20 -24 lakh 25%

- Above ₹15 lakh: 30%

Old Tax Regime:

- Up to Rs. 3 lakhs Nil

- Rs. 3 lakhs - Rs. 7 lakhs 5%

- Rs. 7 lakhs - Rs. 10 lakhs 10%

- Rs. 10 lakhs - Rs. 12 lakhs 15%

- Rs. 12 lakhs - Rs. 15 lakhs 20%

- More than 15 lakhs 30%

Key Differences for NRIs:

- No Section 87A rebate (unlike residents)

- Same surcharge rates apply (10% above ₹50 lakh, 15% above ₹1 crore)

- Health & Education Cess: 4% on tax plus surcharge

Special Rates for Specific Income Types

Income Type | Tax Rate | Additional Notes |

|---|---|---|

Dividends | 20% + cess | No exemption limit |

Interest (bonds) | 20% + cess | From Indian companies |

Royalties/FTS | 20% + cess |

ITR Filing: Process and Requirements

Mandatory Filing Scenarios

You must file ITR if:

- Total Indian income exceeds basic exemption limit (₹3 lakh old regime / ₹4 lakh new regime)

- You want to claim TDS refunds

- You're claiming DTAA benefits

- You have capital gains from Indian assets

ITR Form Selection

ITR-2 (Most NRIs):

- Salary, house property, capital gains

- Must be used if you have foreign assets

- Required for DTAA claims

ITR-3 (Business/Professional Income):

- Consultancy fees from Indian clients

- Professional services provided remotely

- Business income from Indian operations

ITR-1: Not available for NRIs, even for simple income

Filing Timeline 2025

- Regular Filing: July 31st, 2025 (subject to extensions - September 15, 2025Belated Return: December 31, 2025 (with ₹5,000 penalty)

- Revised Return: December 31, 2025

Documents Checklist

Always Required:

- Form 26AS (download from income tax portal)

- Bank statements for all NRE/NRO accounts

- PAN card copy

Income-Specific:

- Salary certificate if you worked in India

- Rental agreements and receipts

- Property sale documents for capital gains

- Investment statements (mutual funds, stocks)

For DTAA Claims:

- Tax Residency Certificate from UAE

- Form 10F acknowledgment

- Evidence of taxes paid abroad (if any)

👉 Tip:Start gathering documents in March itself. UAE document attestation can take time, especially during peak season.

TDS Rules That Impact Every NRI Transaction

Tax Deducted at Source affects most NRI financial activities in India.

Key TDS Rates for NRI Transactions

Section 195 (General NRI Payments):

- Rate: Applicable tax rate or 30%, whichever is higher

- No minimum threshold - applies to all taxable payments

- Covers rent, interest, professional fees

Property-Related TDS:

- Rent payments: 30% (tenant's responsibility)

- Property sales: 12.5% for sales after July 23, 2024

- Form 15CA: Required for payments above ₹2.5 lakh

Minimizing TDS Through Section 197

If your actual tax liability is lower than TDS rates, apply for a lower deduction certificate:

Application Process:

- Apply to Assessing Officer with Form 13

- Provide income details and tax calculation

- Show DTAA benefits if applicable

- Get certificate specifying lower TDS rate

Common Scenarios:

- Your total income falls in 5% slab but TDS is 30%

- DTAA provides for lower rates

- You have significant deductions that reduce tax liability

TDS Certificate and Credit Process

Form 16A: TDS certificate for non-salary payments

Form 26AS: Shows all TDS deducted against your PAN

ITR Credit: Claim excess TDS as refund while filing returns

Investment Taxation: Beyond Basic Rules

Mutual Fund Taxation for NRIs

Equity Funds:

- Long-term (1+ year): 12.5% on gains above ₹1.25 lakh

- Short-term: 20%

Debt Funds:

- Both short-term and long-term: As per income tax slabs

- No indexation benefit from April 2023

SIP Considerations: Each SIP installment is treated separately for holding period calculation.

Fixed Deposit Strategy

Interest Taxation:

- NRE FDs: Tax-free

- NRO FDs: 30% TDS, tax as per slab rates

- GIFT City USD FDs: Tax-free for eligible investors

Laddering Strategy: Consider FD laddering to optimize liquidity and tax efficiency.

Property Investment Tax Implications

Rental Income:

- Taxed as per slab rates after 30% standard deduction

- Additional deductions: Municipal taxes, interest on loan

Capital Gains:

- Long-term (24+ months): 12.5% without indexation

- Short-term: 20%

- Section 54 exemption: Available if you reinvest in residential property

Common Mistakes That Cost NRIs Money

Status Determination Errors

Mistake: Not tracking India visit days accurately

Impact: Wrong residential status determination

Solution: Maintain detailed travel log with passport stamps

Mistake: Ignoring deemed residency provisions

Impact: Unexpected tax liability on global income S

olution: Check if you're paying tax in any country; document it

Banking and Investment Structure Mistakes

Mistake: Using NRO accounts for foreign earnings

Impact: Unnecessary 30% tax on interest income

Solution:Convert resident accounts to NRE for foreign earnings

Mistake: Not claiming DTAA benefits

Impact: Overpaying taxes that could be reduced/eliminated

Solution: Get proper documentation and file Form 10F

Filing and Compliance Errors

Mistake: Not filing ITR when required

Impact: Penalties, inability to carry forward losses

Solution: File even if taxes are already deducted to claim refunds

Mistake: Wrong ITR form selection

Impact: Invalid return, notices from tax department

Solution: Use ITR-2 for most scenarios; ITR-3 only for business income

Advanced Tax Planning Strategies

Residential Status Optimization

For High-Income NRIs: Plan your India visits to stay below the 120-day threshold if your Indian income exceeds ₹15 lakh.

Transition Year Planning: When moving back to India, consider becoming RNOR first to limit global income taxation.

Income Source Management

Salary Planning: If you work for an Indian company remotely, negotiate for services to be deemed performed outside India.

Investment Timing:

- Time capital gains realization to manage total tax liability

- Use loss harvesting for tax optimization

Account Structure Optimization

Primary Structure:

- NRE accounts for all foreign earnings

- Minimal NRO accounts only for unavoidable Indian income receipts

- Consider GIFT City investments for additional benefits

Repatriation Planning: Structure investments to minimize repatriation restrictions and costs.

What's Changing in 2025: New Rules Impact

Income Tax Bill 2025 Updates

Good News: Residential status rules remain unchanged despite earlier speculation.

Key Changes:

- New tax regime becomes default (can opt out annually)

- Enhanced TDS recovery powers for tax authorities

- Simplified ITR forms expected

- Union Budget 2025 introduces new compliance measures

TDS Rate Updates

Property Sales: For transactions after July 23, 2024, TDS should be 12.5% instead of 20%. However, many buyers still deduct at old rates - you can claim refund.

Partner Remuneration: New Section 194T requires 10% TDS on payments to partners exceeding ₹20,000.

GIFT City Opportunities

Expanded Investment Options:

- USD-denominated deposits

- Tax benefits for eligible investors

- Simplified regulatory framework

Professional vs DIY: When You Need Expert Help

DIY-Friendly Scenarios

- Single source of Indian income (like rental from one property)

- Total Indian income under ₹10 lakh

- Straightforward DTAA claims with proper documentation

- No business or professional income

When to Consult Professionals

Complex Income Sources: Multiple properties, business income, professional fees, capital gains

High-Value Transactions: Property sales above ₹1 crore, significant capital gains

DTAA Optimization: First-time claims, disputed interpretations, tribunal matters

Transition Planning: Moving back to India, changing residential status

Choosing the Right Tax Advisor

Look for CAs with:

- Specific NRI taxation experience

- Knowledge of your resident country's tax laws

- Experience with your income sources (property, business, investments)

Your Action Plan: What to Do Next

Immediate Steps (This Week)

- Calculate your residential status for FY 2024-25

- Review your bank account structure - are you optimizing for tax efficiency?

- Gather your Form 26AS and check TDS deducted

- Document your travel dates for the current financial year

Medium-Term Planning (Next 3 Months)

- Get Tax Residency Certificate from UAE authorities if you haven't

- File Form 10F if claiming DTAA benefits

- Review investment portfolio for tax optimization opportunities

- Plan your India visits for the rest of the financial year

Long-Term Strategy (Next 12 Months)

- Optimize account structure based on your income sources

- Consider GIFT City investments for additional tax benefits

- Plan major transactions (property sales, investments) around tax implications

- Set up systematic documentation for future compliance

Key Takeaways

Let me summarize what you need to remember:

Your Tax Depends On:

- Days spent in India (residential status)

- Source of your income (Indian vs foreign)

- Type of bank accounts you use (NRE vs NRO)

- DTAA availability and documentation

Immediate Wins:

- Switch to NRE accounts for foreign earnings (saves 30% tax on interest)

- Get Tax Residency Certificate from UAE for DTAA benefits

- Track India visit days to maintain optimal status

- File ITR even if not mandatory to claim TDS refunds

UAE NRI Advantages:

- Zero personal income tax means DTAA benefits typically reduce Indian tax

- Potential capital gains exemption on mutual fund investments

- Favorable treatment under India-UAE treaty for various income types

Professional Help Needed For:

- Multiple income sources or complex investments

- Property transactions above ₹1 crore

- Business or professional income from India

- Disputed DTAA interpretations

Frequently Asked Questions

My salary gets credited to my Dubai account, but I work for an Indian company remotely. Is it taxable in India?

This depends on where the services are actually performed. If you work from Dubai for an Indian company, the income is typically not taxable in India. However, document your location during work (UAE residence visa, utility bills) and ensure your employment contract reflects UAE-based services.

I have both NRE and NRO accounts. Can I transfer money between them?

Yes, but only in one direction. You can transfer from NRE to NRO freely, but NRO to NRE transfers are restricted and require RBI approval above certain limits. For tax efficiency, minimize NRO balances and use NRE accounts for most transactions.

Can I claim capital gains exemption under Section 54 as an NRI?

Yes, NRIs can claim Section 54 exemption by reinvesting capital gains from property sale into another residential property in India. The property must be purchased within specified timelines and you must not sell it for at least 3 years.

My tenant is deducting 30% TDS on rent. Can I reduce this rate?

Yes, you can apply for a lower TDS certificate under Section 197 if your actual tax liability is lower. For example, if your total income puts you in the 5% tax slab, you can get a certificate for 5% TDS instead of 30%.

Do I need to report my UAE salary in Indian ITR filing?

As an NRI, you don't need to report foreign income that's not taxable in India. However, if you're claiming DTAA benefits or have become a resident, you may need to provide details for credit calculations. When in doubt, include it with proper DTAA claims.

Ready to optimize your NRI tax strategy? Start by understanding your current position, then systematically implement the strategies that make the most impact for your situation.

Want personalized guidance? Download the Belong app for SEBI-registered investment advice tailored to NRIs, or join our UAE NRI community to discuss strategies with fellow investors.

Need immediate support? Our advisors specialize in helping UAE-based NRIs navigate Indian tax and investment regulations while maximizing their financial efficiency.

The information in this guide is for educational purposes and reflects rules as of 2025. Tax laws change frequently and individual situations vary. Always consult qualified tax professionals for advice specific to your circumstances.

Comments

Your comment has been submitted