A Complete Guide to NRI Taxation, DTAA Benefits and ITR Filing

All residents of India are taxed according to the provisions of the Income Tax (IT) Act. NRIs are taxed on their Indian income, which they receive from interest, rent, dividends or capital gains.

In this blog, we will look into the different types of income taxable for NRIs, deductions and exemptions available for them, DTAA benefits, and the ITR filing process for them.

Understanding NRI Taxation in India

Assessment cycle

There are two important years concerned with income tax filing: the financial year and the assessment year. Financial year refers to the period in which the income is earned, i.e., 1st April 2024 to 31st March 2025. Assessment Year is the year immediately following the financial year in which your income is assessed and taxed by the government. For the income earned during 1st April 2024 to 31st March 2025, the assessment year will be 2025-26.

Residential status

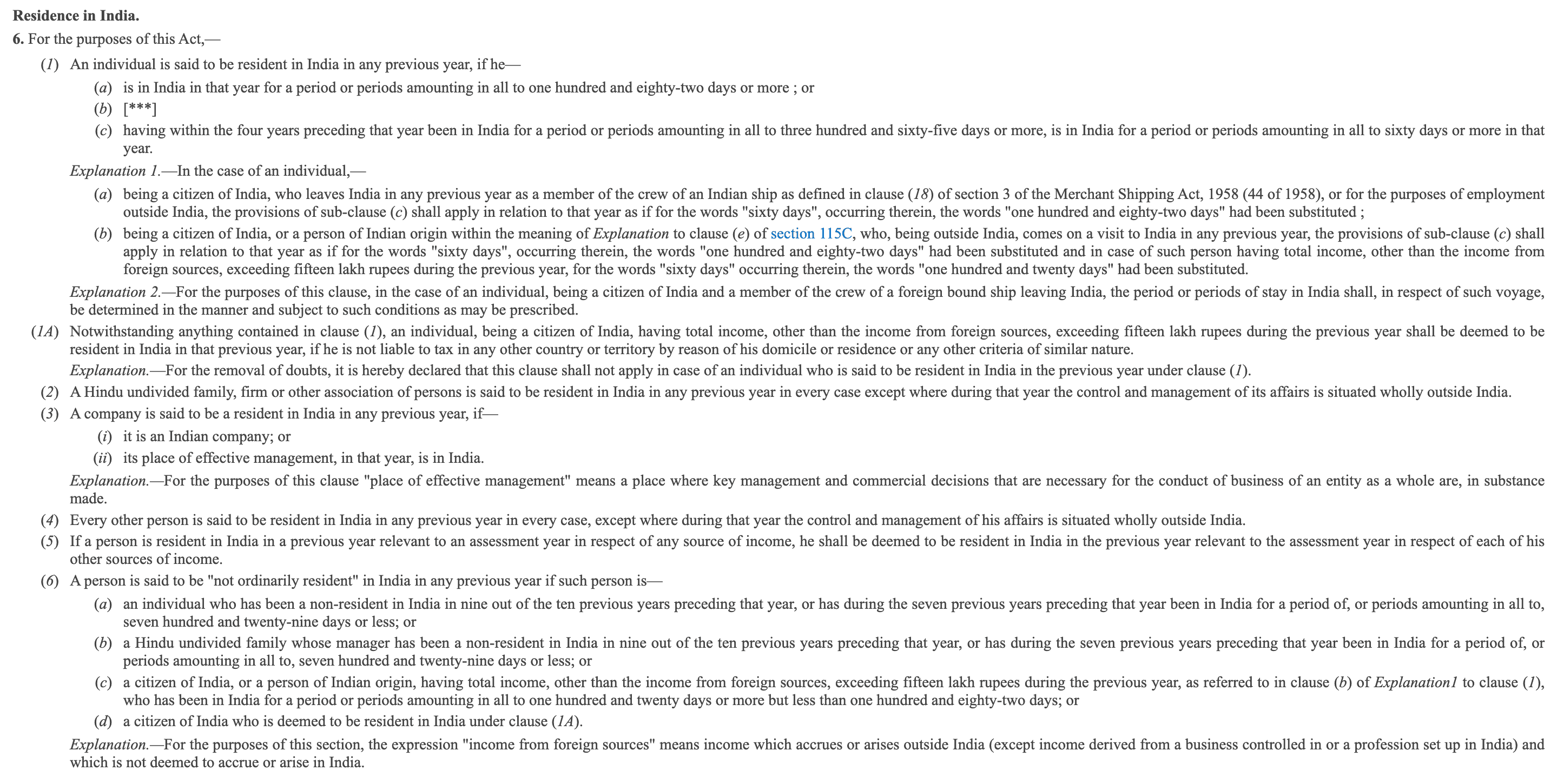

The number of days one spends in India determines their resident status in India. There are three different types of residential statuses for taxation, i.e., resident Indians, NRIs, and Resident but Not Ordinarily Resident (RNOR).

The resident Indians are taxed both on their Indian and foreign income. The NRIs and RNOR pay taxes only on their Indian income.

Resident status is defined under Section 6 of the Income Tax Act as follows:

Source: Section 6 of the Income Tax Act of 1961. Access the full text here.

Income Taxable for NRIs

The table below lists different types of income sources for NRIs and indicates whether they are taxable in India or not.

Type of Income | Taxable in India |

Salary earned in India | Yes |

Salary earned abroad | No |

Rental income from property in India | Yes |

Interest on NRO accounts | Yes |

Interest on NRE/FCNR accounts | No |

Capital gains on shares, property, or mutual funds | Yes |

Business income in India | Yes |

Deductions & Exemptions Available for NRIs

Different sections are in place to categorise the purpose and impose deductions with conditions, respectively. In the table below, we discuss all the deductions and exemptions available to NRIs.

Note that these exemptions are only applicable in the old tax regime.

Section | Purpose | Deductions | Conditions |

Section 80C | Investments & Savings | Life Insurance Premiums, Equity-Linked Savings Schemes (ELSS), Unit Linked Insurance Plans (ULIPs), National Pension System (NPS), Tax-saving Fixed Deposits (FDs), National Savings Certificates (NSC) | Maximum deduction of ₹1.5 lakh per year; NRIs can contribute to their existing PPF account, but they are not allowed to open a new account or extend the validity of their PPF account |

Section 80D | Health Insurance Premiums | Premiums paid for self, spouse, children, and parents | Deductions ranging from ₹25,000 to ₹1,00,000, depending on the premium paid for self, spouse, children and parents, depending on the age of the family and parents. |

Section 80E | Education Loan Interest | Interest on loans taken for higher education for self, spouse, or children (not the principal amount) | No upper limit; available for 8 years or until the interest is fully repaid, whichever is earlier |

Section 24 (b) | Home loan Interest | Interest on home loans is provided if it is a self-occupied residence | Maximum tax deduction of Rs 2 lakh |

Explore the NRI Taxation Rules to ensure compliance and optimise tax savings.

DTAA (Double Taxation Avoidance Agreement) Benefits for NRIs

Understanding DTAA and How it Helps NRIs

The Double Taxation Avoidance Agreement (DTAA) is a tax treaty between India and another country to prevent NRIs from being taxed twice on the same income. It provides relief in cases where income is taxable in both the resident country (where the NRI lives) and the source country (India).

Benefits of DTAA for NRIs:

Tax exemption: NRIs can claim full or partial tax exemption on income earned in one country, depending on the agreement.

Tax credit: If an NRI has paid tax in one country, they can claim a tax credit in their resident country, reducing the overall tax liability.

Special Tax Rates: Many DTAA agreements provide for a special/lower rate of tax on dividend, interest and royalty income.

How to Claim Tax Credit or Tax Exemption Under DTAA

To claim benefits under DTAA, the following steps have to be taken by NRIs:

Determine tax residency: Confirm your residential status as per the Indian Income Tax Act. To check your residential status, you can use Belong’s Residential Status Calculator. By answering a few simple questions, you get to know your residential status for taxation purposes.

Get a tax residency certificate (TRC): A TRC issued by the country of your residence is necessary to avail of benefits under DTAA.

File Form 10F: This form furnishes basic information regarding the taxpayer and the DTAA that applies.

Supporting documents: Maintain supporting evidence of income and taxes paid in the foreign nation.

DTAA Agreements with Major Countries

India has DTAA agreements with more than 85+ countries. These agreements mention in detail the various kinds of income and exemptions from taxation available under each of them. Tax is deducted at source in India when NRIs redeem their investment, like redeeming their mutual fund units. The NRI can then claim the tax which is deducted while filing their returns.

Step-by-Step Guide for NRIs to File Income Tax Returns (ITR)

Here is a checklist and step-by-step procedure for NRIs to file their Income Tax Return (ITR) in India.

1. KYC Documents

A PAN Card and a passport are mandatory for filing the income tax returns. Aadhaar card is an optional document. A passport is used to determine residency and calculate the number of days spent in India for residential status.

2. Income Tax Login Credentials

Get access to the income tax e-filing portal. If you have not registered previously, create an account using PAN as the username. Update your Indian address and foreign address in the portal

3. Documents required

NRO bank account statement of the financial year (for interest earned and Form 16A for TDS deductions)

Salary income (if earned from India, including Form 16 from the employer)

Rental income (rental agreement and rent receipts)

Capital gains from the sale of property, PMS or stock market investments (receipts from the sale of these properties)

Dividends and other income received from India

Section 80C investments (LIC, PPF, ELSS, NSC, etc.)

Home loan interest certificates, medical insurance premiums and education loan interest receipts

Real estate taxation documents like property sale agreement, Form 16B (if TDS deducted by buyer), lower TDS certificate (if applied under Section 197 to reduce liability), and capital gains calculations

Details of foreign assets (if classified as a resident,) like bank accounts held, foreign salary or business income, or income from foreign stocks, mutual funds or real estate.

4. Tax Filing Process for NRIs

Get all the documents as applicable for you from the documents above

Log in to the Income Tax portal and select the relevant form applicable (ITR-2 or ITR-3 is usually applicable for NRIs)

Check for any discrepancies in Form 26s (TDS) or Annual Information Statement (AIS), or Taxpayer Information Summary (TIS)

Submit the return before the due date (31st July 2025) to avoid any penalties

E-verify your ITR using Aadhaar OTP, net banking, or a digital signature certificate for digital signing

Relevant forms:

ITR-1 is not applicable for NRIs.

ITR-2 and ITR-3 are applicable for NRIs. ITR-2 is meant for those having income from salary, rent, dividends, mutual funds and stock market investments. ITR-3 is meant for those having profits/income from business.

Common Mistakes to Avoid

Selecting the wrong ITR form.

Missing out on declaring capital gains or rental income.

Incorrect claims for DTAA benefits without proper documentation.

Failing to verify the ITR within 30 days of filing.

Additional Tips:

If taxes are deducted in both India and a foreign country, use Form 67 to claim DTAA relief.

File your ITR before the deadline, usually 31st July of the assessment year.

Keep a copy of your filed return and acknowledgement for future reference.

Penalties & Late Filing Charges for NRIs

NRIs have to file their Income Tax Return (ITR) in India if they receive taxable income. Failure to file timely or underreporting income will incur a penalty and interest under the Income Tax Act. A detailed analysis follows:

Penalties for delayed filing of ITR as per Section 234F

- ₹5,000 in case of filing of ITR after the due date (generally 31st July) but on or before 31st December.

- For individuals having an income of less than ₹5 lakh, the fee for late filing is ₹1,000.

Charges of interest for delay in tax payment

- Section 234A – Interest for Delay in Furnishing of ITR

- Interest at 1% a month is levied on the pending tax amount from the due date until the date of filing.

- Section 234B – Interest for Default in/Short Falling of Advance Tax

- Here, if the advance tax payment made is not up to 90% of the total tax due, interest of 1% per month is levied on the default amount from the due date to the actual date of payment.

- Section 234C – Interest for Deferral of Advance Tax

- In this case of default in paying advance tax instalments, the same 1% per month interest is levied on the delayed payment.

How to Avoid These Penalties

File in time before 31st July or apply for an extension if needed.

Pay advance tax every quarter so as not to pay interest under Sections 234B and 234C.

Important ITR Filing Dates for NRIs

NRIs (Non-Resident Indians) must file their Income Tax Returns (ITR) if they possess taxable income in India. It is important to know the deadlines to avoid penalties and interest payments.

1. Filing NRI Tax Return Due Dates

Normal ITR Filing: 31st July of the assessment year (For the financial year 2024-25, the due date will be 31st July 2025). The deadline for filing the returns may change in different assessment years.

Tax Audit Cases: If your income needs a tax audit (e.g., business income above a limit), the timeline is up to 31st October of the assessment year.

2. Extension Options

The Income Tax Department does not usually offer extensions for individuals. The government extends the deadline in unexpected circumstances, such as system failures or a pandemic.

Tips to Avoid Late Fees and Penalties

Mark the 31st of July deadline in your calendar to remain compliant.

Make advance tax payments if due to save on interest charges.

Have all necessary documents, such as Form 16, bank statements, and investment proof, ready for hassle-free filing.

Utilise the e-filing portal or recognised tax websites for easy submission.

Filing taxes on time helps NRIs avoid penalties and stay compliant with Indian laws. In addition, NRIs should track tax filing deadlines, report income accurately, and use deductions. To make tax filing smooth and stress-free, you should seek expert advice when needed.

Comments

Your comment has been submitted