Old Tax Regime Vs New Tax Regime - What Should NRIs Choose

Last week, we got a call from Rahul, an IT professional working in Dubai. He was staring at his laptop at midnight, trying to decide between India's old and new tax regime

Rahul told us everyone says the new regime is simpler, but I'm paying ₹2 lakh home loan interest and have PPF investments. Which regime will actually save me money?"

If you're an NRI facing the same dilemma, you're not alone. With the new tax regime, many NRIs are confused about which option makes financial sense.

By the end of this guide, you'll know:

- Which regime saves you more tax based on your income and investments

- NRI-specific rules that most articles miss

- A step-by-step decision framework

- Real calculation examples for different income levels

Let's dive in.

Understanding the Two Tax Regimes

Unless you’ve been living under a rock, you’d know that there are two regimes. The old and the new.

But, what exactly is different?

Tax Slabs Comparison: FY 2024-25 and FY 2025-26

Here’s how the tax slabs stack up for both regimes, including the updated slabs for FY 2025-26:

Income Range (FY 2024-25) | Old Regime Rate | New Regime Rate | Income Range (FY 2025-26) | New Regime Rate |

|---|---|---|---|---|

Up to ₹2.5 lakh | 0% | — | — | — |

Up to ₹3 lakh | — | 0% | Up to ₹4 lakh | 0% |

₹2.5–5 lakh | 5% | — | — | — |

₹3–6 lakh | — | 5% | ₹4–8 lakh | 5% |

₹5–6 lakh | 10% | — | — | — |

₹6–9 lakh | 15% | 10% | ₹8–12 lakh | 10% |

₹9–10 lakh | 15% | 10% | — | — |

₹10–12 lakh | 20% | 15% | ₹12–16 lakh | 15% |

₹12–15 lakh | 20% | 20% | ₹16–20 lakh | 20% |

Above ₹15 lakh | 30% | 30% | ₹20–24 lakh | 25% |

— | — | — | Above ₹24 lakh | 30% |

👉 Heads-Up: For FY 2025-26, the new regime’s exemption limit jumps to ₹4 lakh, and slabs are tweaked to reduce tax for incomes up to ₹16 lakh. Old regime slabs remain unchanged.

Major Deductions: What You Can and Can't Claim

Old Tax Regime - Full Deduction Menu

- Section 80C: ₹1.5 lakh (PPF, ELSS, life insurance, home loan principal)

- Section 24(b): ₹2 lakh (home loan interest for self-occupied property), no limit for rental properties

- Section 80D: ₹25,000-₹50,000 (health insurance)

- Section 80G: Donations to approved charitable funds

- HRA: House Rent Allowance (if you pay rent in India for Indian-sourced income)

- Standard deduction: ₹50,000 for salaried NRIs

New Tax Regime - Minimal Deductions

The new regime is lean:

- Standard deduction: Rs.75,000 (salaried NRIs)

- Section 80CCD(2): Employer NPS contribution (up to 10% of salary)

- Section 80CCH: Agniveer Corpus Fund contributions

- Family pension deduction: Rs.25,000 (if applicable)

Critical Point for NRIs: No Section 87A Rebate

Here’s a big one most articles skip: NRIs don’t get the Section 87A rebate, unlike residents.

Residents: Get ₹12,500 rebate (old regime, income up to ₹5 lakh) or ₹25,000 (new regime, income up to ₹7 lakh). For FY 2025-26, residents get ₹60,000 rebate for income up to ₹12 lakh (new regime).

NRIs: Zero rebate in both regimes, meaning you pay tax from the first rupee above ₹2.5 lakh (old) or ₹3 lakh (new, FY 2024-25; ₹4 lakh for FY 2025-26).

This significantly changes the tax calculation for NRIs compared to residents.

Real Examples: Which Regime Wins?

Let me show you three real scenarios to illustrate the decision:

Scenario 1: Young NRI with Minimal Investments

Profile: Priya, 28, software engineer in Abu Dhabi

- Income: ₹8 lakh from Indian sources (rental income, FDs)

- Investments: Minimal (₹50,000 in PPF)

- Home loan: None

Tax Calculation:

Particulars | Old Regime | New Regime |

|---|---|---|

Gross Income | ₹8,00,000 | ₹8,00,000 |

Standard Deduction | ₹50,000 | ₹75,000 |

80C Deduction | ₹50,000 | Not allowed |

Taxable Income | ₹7,00,000 | ₹7,25,000 |

Tax Liability | ₹62,500 | ₹51,250 |

Winner | New Regime saves ₹11,250 |

Why? Priya’s deductions are low (₹1 lakh total), so the new regime’s lower rates and higher standard deduction win

Note: Only people with salary income (including pensioners) can claim standard deduction. Not for business/professional income.

Scenario 2: Mid-Career NRI with Home Loan

Profile: Rajesh, 35, manager in Dubai

- Income: ₹15 lakh from Indian sources

- Home loan interest: ₹1.8 lakh

- 80C investments: ₹1.5 lakh (PPF, ELSS)

- Health insurance: ₹25,000

Tax Calculation:

Particulars | Old Regime | New Regime |

|---|---|---|

Gross Income | ₹15,00,000 | ₹15,00,000 |

Standard Deduction | ₹50,000 | ₹75,000 |

Home Loan Interest | ₹1,80,000 | Not allowed |

80C Deductions | ₹1,50,000 | Not allowed |

80D Deduction | ₹25,000 | Not allowed |

Taxable Income | ₹10,95,000 | ₹14,25,000 |

Tax Liability | ₹ | ₹2,81,250 |

Winner | Old Regime saves ₹1,12,750 |

Why? Rajesh’s ₹3.55 lakh deductions make the old regime a clear winner, despite its higher rates.

Note: Calculation of Tax Liability under New Regime

- Up to ₹4,00,000 → Nil

- ₹4,00,001 - ₹8,00,000 → 5% on ₹4,00,000 = ₹20,000

- ₹8,00,001 - ₹12,00,000 → ₹20,000 + 10% on ₹4,00,000 = ₹60,000

- ₹12,00,001 - ₹14,50,000 → ₹60,000 + 15% on ₹2,50,000 = ₹97,500

Basic Tax = ₹97,500

Health & Education Cess (4%) = ₹3,900

✅ Total Tax Liability (FY 2025-26) = ₹1,01,400

Note: Calculation of Tax Liability under Old Regime

- Up to ₹3,00,000 → Nil

- ₹3,00,001 - ₹6,00,000 → 5% on ₹3,00,000 = ₹15,000

- ₹6,00,001 - ₹9,00,000 → ₹15,000 + 15% on ₹3,00,000 = ₹60,000

- ₹9,00,001 - ₹10,00,000 → ₹60,000 + 10% on ₹1,00,000 = ₹70,000

- ₹10,00,001 - ₹12,00,000 → ₹70,000 + 15% on ₹2,00,000 = ₹1,00,000

- ₹12,00,001 - ₹14,50,000 → ₹1,00,000 + 20% on ₹2,50,000 = ₹1,50,000

Basic Tax = ₹1,50,000

Health & Education Cess (4%) = ₹6,000

✅ Total Tax Liability (FY 2024-25) = ₹1,56,00

Scenario 3: High-Income NRI with Multiple Properties

Profile: Anita, 42, consultant in UAE

- Income: ₹25 lakh from Indian sources

- Home loan interest for Rental property: ₹3 lakh (no limit in old regime)

- 80C investments: ₹1.5 lakh

- Health insurance: ₹50,000

Tax Calculation:

Particulars | Old Regime | New Regime |

|---|---|---|

Gross Income | ₹25,00,000 | ₹25,00,000 |

Standard Deduction | ₹50,000 | ₹75,000 |

Property Interest | ₹3,00,000 | Not allowed |

80C Deductions | ₹1,50,000 | Not allowed |

80D Deduction | ₹50,000 | Not allowed |

Taxable Income | ₹20,00,000 | ₹24,25,000 |

Tax Liability | ₹5,85,000 | ₹7,18,750 |

Winner | Old Regime saves ₹1,33,750 |

Also Read - Taxation on Rental Income in India for NRIs

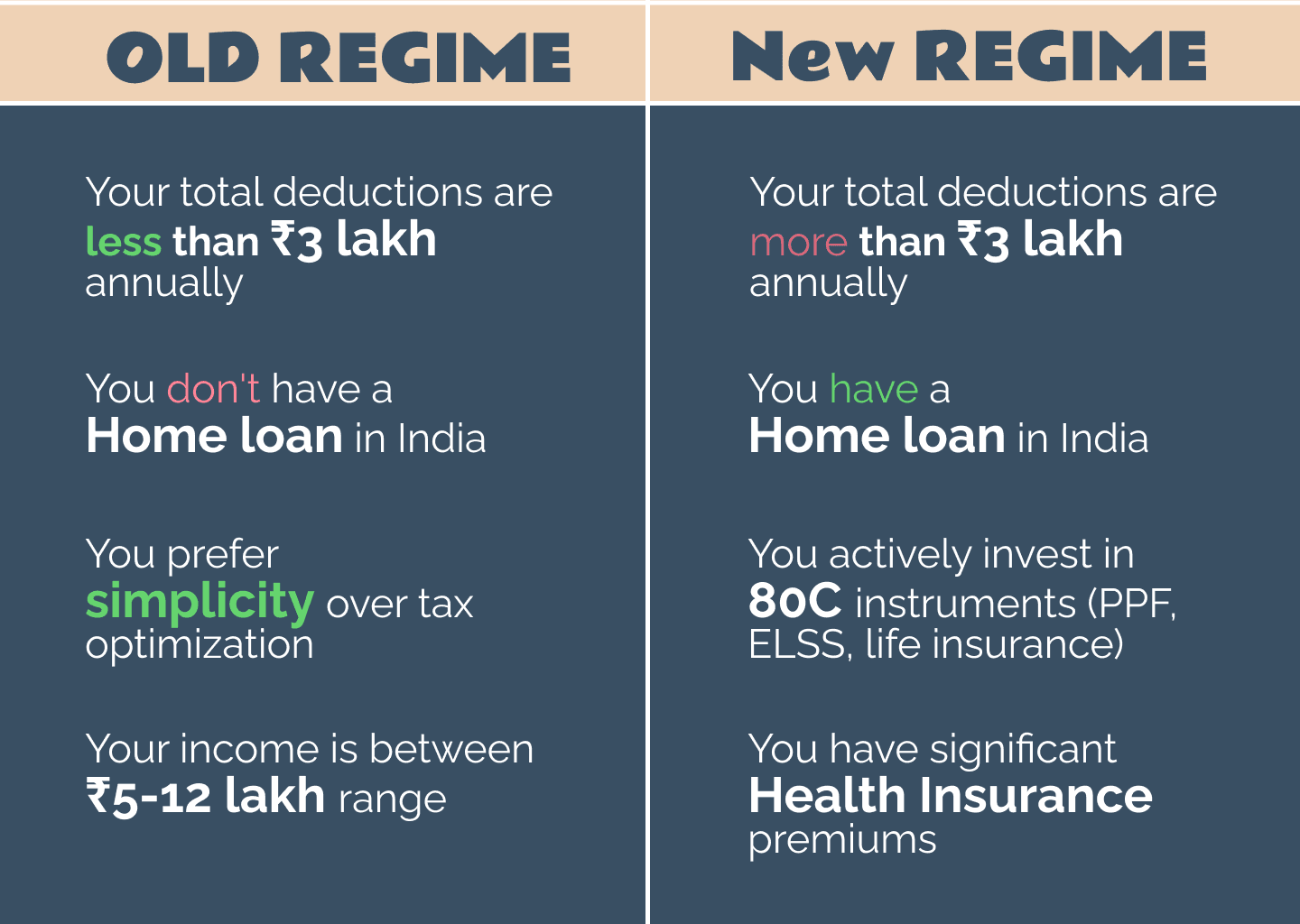

How to Choose: Your Decision Framework

Based on my analysis of hundreds of NRI tax cases, here's your decision tree:

👉 Pro Tip: Use our Compliance Compass to calculate your tax liability under both regimes before deciding.

NRI-Specific Considerations

Now, what’s in it for NRIs? Is tax calculated differently for NRIs? Let’s take a look.

1. Default Regime Selection

The Finance Act 2023 has amended the provisions of Section 115BAC w.e.f AY 2024-25 to make new tax regime the default tax regime. As an NRI, you need to actively opt out if you want the old regime.

2. How to Opt Out

For non-business income earners (most salaried NRIs):

- Simply select "Yes" for "opting out option" in your ITR-1 or ITR-2

- No need to file Form 10-IEA

For business income:

- Must file Form 10-IEA before the due date

- Once you opt out, switching back has lifetime restrictions

3. Residential Status Impact

Your tax obligations depend on whether you're:

- Non-Resident: Only Indian income taxed

- Resident: Global income taxed (with DTAA benefits)

4. DTAA Considerations

India has Double Taxation Avoidance Agreements (DTAAs) with many countries. Your regime choice doesn't affect DTAA benefits, but optimal regime selection can reduce your overall tax burden.

Important Updates for FY 2025-26

Looking ahead, here are the changes in FY 2025-26:

- Enhanced rebate limit: ₹12 lakh (up from ₹7 lakh) under new regime for residents

- Increased rebate amount: ₹60,000 (up from ₹25,000) for residents

- NRI impact: Still no rebate for NRIs under either regime

👉 Planning Tip: These changes favor residents heavily. As an NRI, your regime choice should focus on deductions rather than rebates.

Step-by-Step: Making Your Choice

Step 1: Calculate Your Deductions

List all your eligible deductions:

- Home loan interest (₹2 lakh limit for self-occupied)

- 80C investments (₹1.5 lakh limit)

- Health insurance premiums

- Other Chapter VI-A deductions

Step 2: Use the 3 Lakh Rule

If your total deductions exceed ₹3 lakh, old regime likely wins. If below ₹3 lakh, calculate both scenarios.

Step 3: Project Future Years

Consider your investment plans:

- Planning to buy property in India?

- Increasing PPF contributions?

- Health insurance needs growing?

Step 4: Factor in Simplicity

New regime means:

- No need to maintain deduction proofs

- Simpler ITR filing

- Less tax planning required

Common Mistakes NRIs Make

1. Ignoring Rental Property Rules

Many NRIs don't realize that home loan interest on rental properties has no limit under the old regime, making it highly beneficial.

2. Not Planning Multi-Year Impact

Your regime choice should consider 3-5 year investment plans, not just current year tax.

3. Forgetting About Form 10-IEA

Business income earners who miss Form 10-IEA deadline get stuck with the new regime.

4. Assuming Resident Tax Rules Apply

Many articles discuss Section 87A rebates, which don't apply to NRIs.

Bottom Line: Your Action Plan

Here's your action plan:

For Income ₹5-12 Lakh & Minimal Deductions: → Choose new regime for simplicity and lower rates

For Income Above ₹12 Lakh & Significant Investments: → Stick with old regime to maximize deduction benefits

For Property Investors: → Almost always choose old regime due to unlimited interest deduction on rental properties

Not Sure? → Calculate both scenarios using actual numbers, not assumptions

Join our NRI community WhatsApp group to get advice from other NRIs who have successfully set up joint accounts

Disclaimer: This article provides general guidance based on current tax laws. Tax laws change frequently, and individual circumstances vary. Always consult with a qualified tax advisor for personalized advice.

Sources:

Comments

Your comment has been submitted