SBI NRI Bank Account in UAE: Types, Features & How To Open

State Bank of India (SBI) is one of the largest and trusted Indian banks. It offers a specialised suite of banking products and services tailored for NRIs. SBI has a strong presence with 21,000 branches in India, and an international network of 199 offices within 37 countries.

SBI places a strong emphasis on customer satisfaction and global connectivity. There is one main SBI branch located in Dubai International Financial Centre (DIFC) and two representative offices located in Bur Dubai and Abu Dhabi.

In this blog, we will be providing you with a step-by-step guide detailing how to open an SBI NRI account and useful features of an SBI bank account for NRIs.

Types of NRI Accounts Offered by SBI

SBI offers four types of accounts for NRIs, and choosing the right type of NRI account is especially important. This is because each type of account serves distinct purposes based on the source of income and the specific financial requirements.

Non-Resident Ordinary (NRO) Account is used to manage Indian income. Non-Resident External Account (NRE), Foreign Currency Non-Resident (FCNR), and GIFT City Account are used for foreign income. NRE and NRO accounts are denominated in INR. FCNR and GIFT City accounts are denominated in international currencies.

Read more about different types of bank accounts available for NRIs -Comparison of NRE, NRO, FCNR and GIFT City Accounts.

How to Open an SBI NRI Account

You can open an SBI NRI account through SBI's secure online banking platform. However, it is important to note that this process is limited to setting up new NRI accounts. It will not help you convert existing resident accounts to NRI accounts.

Documents Required

For opening an SBI account, you would need :

Valid Passport: First and last four pages, clearly showing your name, photo, date of birth, place of issue, and signature.

Valid Visa/Work Permit/Overseas Resident Card: Proof of your NRI status in the UAE.

Permanent Account Number (PAN) Card: Mandatory for financial transactions in India. If you don't have one, you might need to fill out Form 60.

Proof of Overseas Address: Utility bill, driving license, bank statement, or any government-issued ID showing your current UAE address.

Passport-sized Photographs: Recent ones, adhering to bank guidelines.

Initial Payment: A cheque or draft from your own account to activate/authenticate the account.

You will need to notarise these documents through:

An authorised official of a bank located in a Financial Action Task Force (FATF) compliant jurisdiction with whom the individual has a banking relationship

Notary Public (outside India)

Court Magistrate (outside India),

Judge (outside India),

Certified public or professional accountant (outside India),

Lawyer (outside India),

The Embassy/Consulate General of the country of which the non-resident individual is a citizen

Open your SBI NRI account offline

For opening your NRI account, you can visit an SBI branch when you are in India or in the UAE. You will have to bring the KYC documents when you visit the bank branch. You will have to fill out the account opening or the conversion form (required for converting a regular savings account to an NRO account). The bank will verify your documents once you submit them and notify you about the details of opening your account.

Open your SBI NRI account online

Opening your SBI NRI account is not completely online.

The first step is to visit the SBI NRI Services Website. Once there, you can head to the SBI NRI Online application portal.

In this portal, you can begin by clicking “Start New” under the Customer Information Section. This will require you to fill in your personal details. Upon completion, the page will generate an NRI Customer Reference Number (NCRN) - this number is important for later, so keep a note of this. Under the same section, there will be another tab titled “Additional Information”; fill this out, and you will receive an email with your NCRN and steps outlining further processes.

Next, you will be required to fill out the online application form given under the “Account Information Section”. Enter your previously generated NCRN number to link the details entered under the Customer Information Section.

This tab will require you to input information such as the type of account, applicant details, branch information (the branch where you wish to open the account), and the type of services required for the account. After filling out these details, the page will then generate an NRI account Reference Number (NARN) - also to be noted down for later use. As with the previous section, you will receive an email with the NARN and steps outlining further processes upon completion.

Once this process has been completed, you will have to either visit the SBI or courier your KYC documents to the branch.

Post verification of the documents, you will receive the information about your bank accounts.

Benefits of an SBI NRI Account

So far, we have talked at length about the process of creating an NRI account with SBI. But why SBI? Do they provide any additional benefits compared to other major banks? Let’s find out. There are many unique benefits for opening an SBI NRI bank account, these being:

SBI has a strong global reach with over 199 foreign offices in 37 countries, including representative offices in Dubai and Abu Dhabi, specifically to assist NRIs.

SBI has its own money transfer services for streamlined remittances like SBI Express Remit and SBI Rupee Express.

A unique feature known as “NRI Family Card”, which is kind of like a reloadable prepaid card linked to your NRI account, that your family can spend in India instantly.

High interest on FCNR Deposits (one of the best rates among Indian Banks) that are protected against rupee exchange value fluctuations.

SBI NRI Account Interest Rates & FD Options

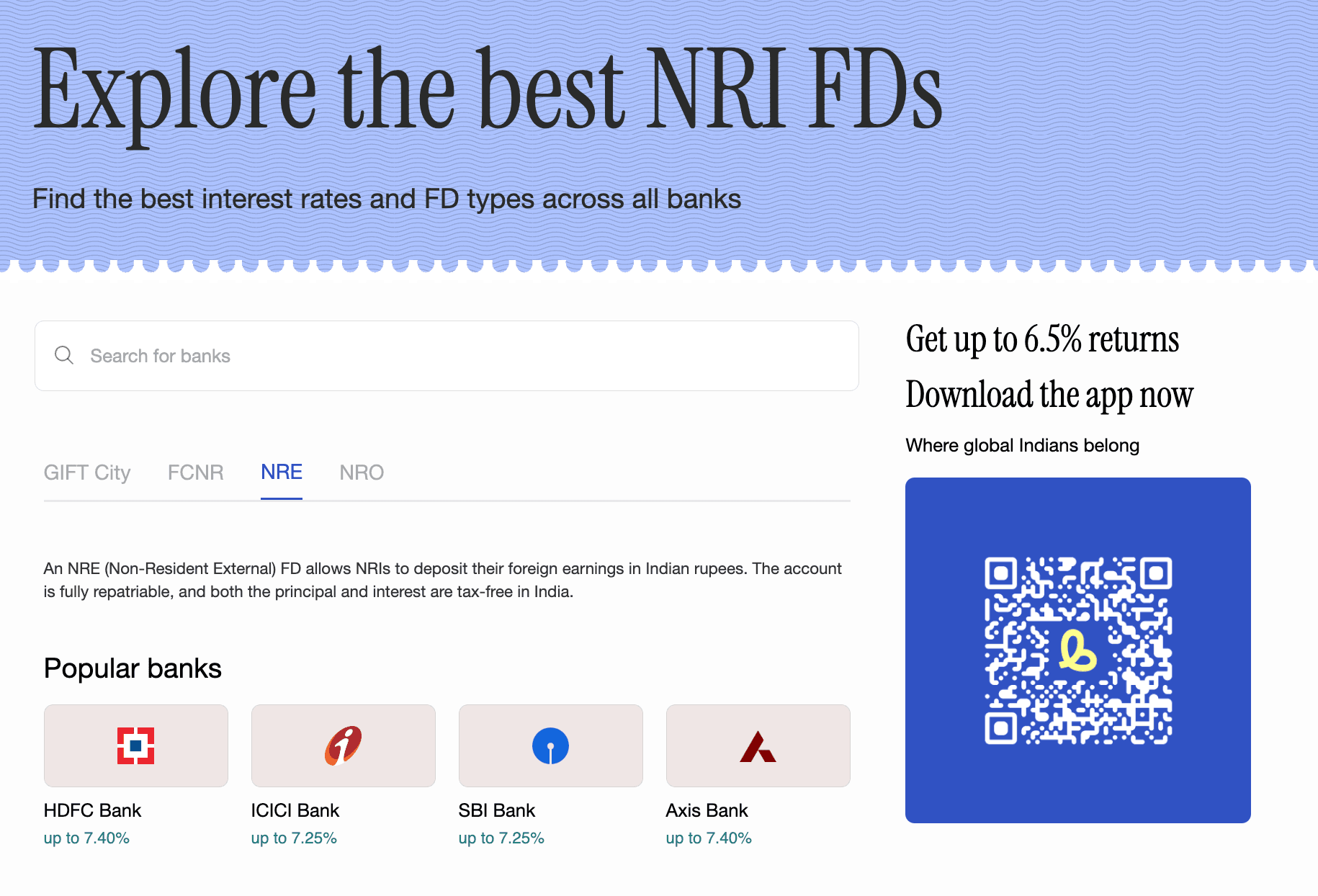

Use our FD Comparison Tool to pick the most rewarding fixed deposits across different maturities for your laddering strategy.

You can check the latest interest rates of SBI NRE, NRO, FCNR, and GIFT City accounts using Belong’s FD tool. This tool will provide you with the latest information on the interest rates.

SBI’s NRI accounts and innovative products fulfil the needs of NRIs looking for bank accounts. With its large network of branches, it will ensure that you get the best service.

Also Read:

Comments

Your comment has been submitted