Best UPI App for NRIs: Secure Payments Made Easy

With access to UPI and digital wallets, NRI digital payments in India have become simple and widely popular. Managing cash is a significant concern for NRIs (Non-Resident Indians) due to multiple reasons like the risk of theft, frequent visits to ATMs and ATM withdrawal fees, etc.

The Unified Payments Interface (UPI), a groundbreaking payment system developed by the National Payments Corporation of India (NPCI), offers a secure and streamlined bank-to-bank money transfer. And digital wallets act as intermediaries between bank accounts. Now, for NRI digital payment adoption to be possible, the first step is understanding these innovative solutions and how they work.

What are Digital Wallets & How Do They Make NRI Digital Payments Possible?

A digital wallet (e-wallet) is an electronic device, online service, or software application that allows individuals to pay for purchases with a smartphone. It stores all your bank and card information and lets you securely make purchases without the hassle of carrying cash or a card. To make a payment, you simply have to scan a QR code, confirm the payment amount, and enter your digital wallet PIN to complete the transaction.

Check the latest NRI money transfer rates for cost-effective and secure international transactions.

As an Indian living outside of India, you can simply download any popular Indian wallet and start making NRI UPI Payments. The only catch here is that to link to a wallet, you must either have an Indian bank account or a credit card issued in India.

5 Best UPI App for NRIs 2025

Now that you’re aware of the possibility of hassle-free NRI online payments, take a look at some of the most prominent digital wallets in India.

Paytm: The Cashless King

Paytm (पेटीएम), India's #1 online payment app is a one-stop solution for all your payment needs. It is the most common digital payment app in India. As per the company, over 50 Crore Indians trust it. From mobile recharge, bill payments, and ticket booking to online shopping, it lets you do many things.

Google Pay: Product of Google

Google Pay is a digital wallet developed by Google. The app has a simple and user-friendly interface that integrates with other Google services like Gmail and Google Maps, offering a smooth and unified experience. Moreover, Google’s security and trust add more credibility to NRI UPI payments.

PhonePe: India’s Largest Digital Payments App

The PhonePe app lets you use BHIM UPI. BHIM is built on the UPI platform by the NPCI, offering a simplified user interface for secure and convenient transactions. It was launched as part of the government’s initiative to promote cashless transactions and digital payments in India.

PhonePe provides a comprehensive suite that meets all your financial services needs like mobile recharges, bill payments, bank-to-bank money transfers, buying different insurance plans, gold and mutual fund investments, and more. The app instantly gained popularity due to its simplicity, fast processing speeds, and useful features.

Amazon Pay: Online Payment Service from Amazon

Amazon Pay is a part of the leading e-commerce portal Amazon India. It is not a separate application and provides seamless integration with Amazon India. This is primarily used by customers who make purchases on Amazon. In comparison to other digital wallets, it offers limited features but is a safe and quick option for shopping, recharge and bill payments.

MobiKwik: Pioneer of Digital Wallet Ecosystem in India

MobiKwik is an Indian payment service provider founded in 2009 that provides a mobile phone-based payment system and digital wallet. The use of the digital wallet revolution picked up pace after its launch. It offers services like bill payments, recharges, and money transfers. It lets users book movie tickets, pay for travel bookings, and invest in mutual funds.

Choosing the Right Digital Wallet & UPI App for NRI Digital Payments in India

With UPI, India remains the global leader in instant payments, accounting for 46% of all global instant payment transactions in 2022. The Indian digital payment system is not limited to these apps only, there are multiple other options available for NRI digital payments in India. Consider factors like security, user interface, brand credibility and rewards/ benefits before choosing the right digital wallet.

| Also Read:

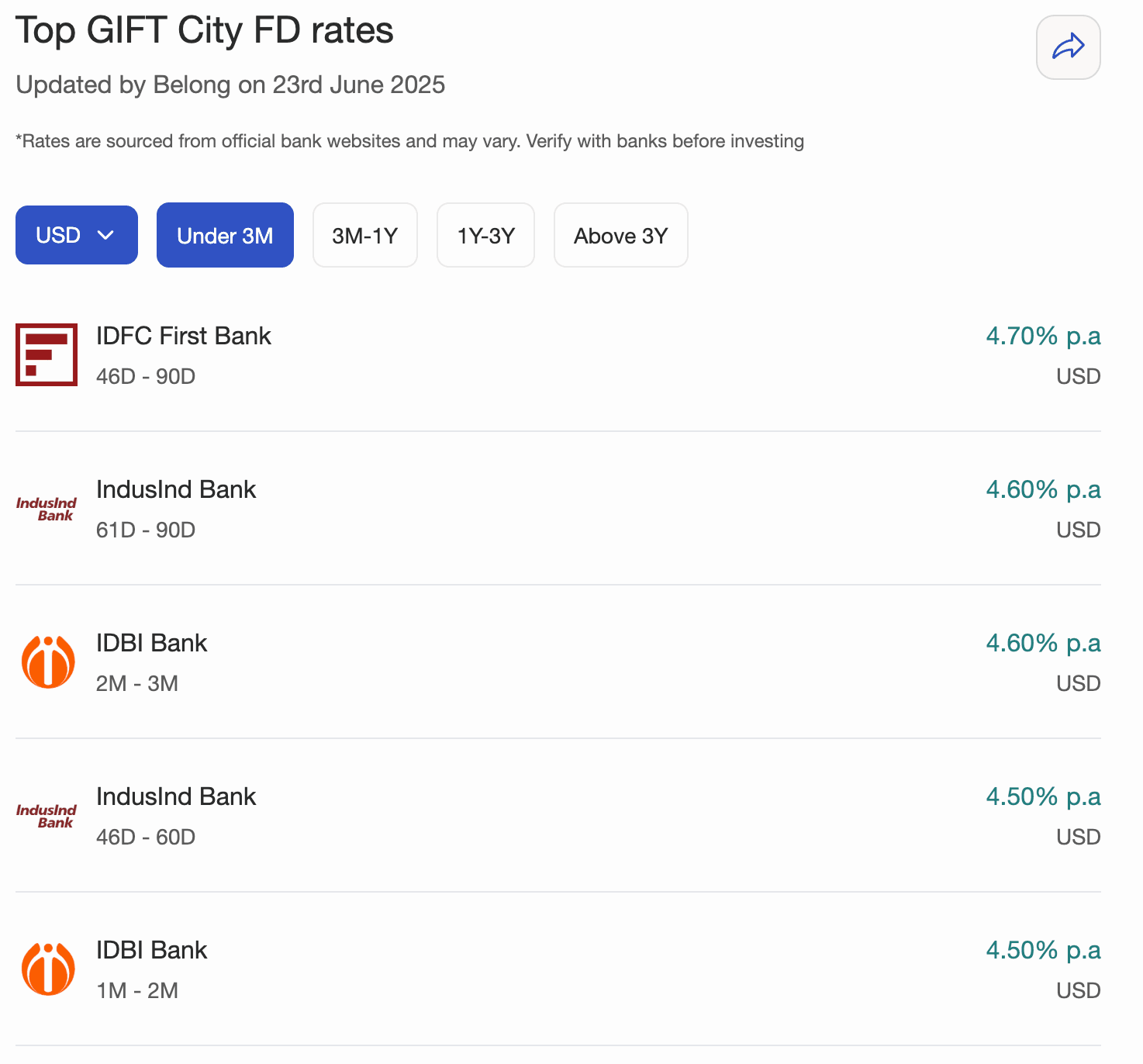

Compare NRI Fixed Deposit interest rates from top Indian banks with Belong's NRI FD Rate Comparison Tool

Comments

Your comment has been submitted