Understanding the RBI Guidelines for NRI Investing in India

You're browsing WhatsApp at 2 AM in Dubai, and someone shared another "breaking news" about RBI changing investment rules for NRIs. Again.

Your first thought? "What does this actually mean for my money in India?"

I get it. Every few months, there's a new circular, a budget announcement, or a "clarification" that sends the NRI community into a frenzy.

Half the information online is outdated, and the other half assumes you have a PhD in Indian tax law.

Here's what's actually happened in 2025, how it affects your investments, and what you need to do about it.

By the end, you'll know exactly which rules changed, whether your existing investments are safe, and how to stay compliant without losing sleep.

What Actually Changed in 2025: The Real Updates

Let me cut through the noise and tell you what's genuinely new.

Union Budget 2025 brought the biggest changes:

Income tax exemption increased from ₹5 lakh to ₹12 lakh under the new tax regime.

However, NRIs are excluded from this specific rebate under Section 87A, which is only available to resident Indians.

This means if you earn ₹8 lakh rental income from your Mumbai flat, you still pay tax on the amount above ₹4 lakh (the basic exemption limit for NRIs).

Capital gains tax rates were reduced - Long-Term Capital Gains (LTCG) tax dropped from 20% to 12.5% for properties held over two years.

This is excellent news if you're planning to sell that Pune apartment you bought in 2020.

Repatriation limits increased to $2 million per year from property sales without requiring prior RBI approval. Previously, larger amounts required tedious paperwork and delays.

👉 Tip: If you're planning to sell property in India, the timing is now more favorable due to lower LTCG tax rates.

RBI's Updated Master Direction (January 20, 2025):

The RBI issued updated guidelines on Foreign Investment in India, providing clarity on downstream investments by Foreign Owned or Controlled Companies (FOCCs) and share swap arrangements.

This primarily affects corporate investors but impacts NRIs with complex investment structures.

New Fixed Deposit Rules (January 2025):

Small deposits under ₹10,000 can now be withdrawn within three months, but you forfeit all interest. This adds flexibility for emergency withdrawals but at a cost.

Breaking Down Investment Categories Under New Rules

Let's walk through how these changes affect different types of investments.

Stock Market Investments

The core rules remain unchanged, but there are subtle improvements.

NRIs still need a PINS (Portfolio Investment NRI Scheme) account through one designated bank. The recent simplification means you no longer need a separate NRO PINS account - just the NRE PINS account.

What you can do:

Delivery-based trading in equity shares

Invest in IPOs with NRE/NRO accounts

F&O trading (equity/index only, no intraday)

Mutual funds and ETFs (except currency/commodity ETFs)

What's still restricted:

Intraday trading in equity shares

Investments in atomic energy, railways, and gambling sectors

Overall NRI investment limit remains 10% of any Indian company's paid-up capital

Real Estate Investments

This is where the biggest wins are for NRIs in 2025.

Tax Benefits:

LTCG tax reduced from 20% to 12.5%

Up to two properties can now be treated as self-occupied (exempt from notional rent tax)

Higher repatriation limits without RBI approval

What hasn't changed:

NRIs can buy residential and commercial properties but not agricultural land or farmhouses

All payments must be through NRE, NRO, or FCNR accounts

TDS on property purchases by NRIs remains at 20% on capital gains

Fixed Deposits and Banking

Interest rates haven't changed dramatically, but operational improvements have been made.

Interest remains tax-free in India

Fully repatriable

New small deposit withdrawal rules apply

TDS threshold for money transfers from relatives increased from ₹7 lakh to ₹10 lakh annually

Repatriation up to $1 million per financial year

👉 Tip: If your parents in India send you money, amounts up to ₹10 lakh per year are now TDS-free.

Mutual Funds and Investment Schemes

The mutual fund landscape remains largely stable, with one important exception.

US and Canada-based NRIs continue to face restrictions with certain AMCs due to FATCA/CRS compliance requirements. However, the pool of compliant fund houses is expanding.

PPF Restrictions Continue: NRIs cannot open new PPF accounts. Existing accounts can receive contributions until maturity (15 years) but cannot be extended.

Tax Implications You Can't Ignore

Here's where it gets critical. The 2025 changes affect your tax planning significantly.

Income Tax Changes

For Rental Income:

Basic exemption: ₹4 lakh (unchanged for NRIs)

Two properties can be claimed as self-occupied

Tax rates remain the same as resident Indians

For Capital Gains:

LTCG: 12.5% (down from 20%)

STCG: As per income tax slabs

TDS still deducted at 20% during sale; claim refund through ITR filing

For High-Income NRIs: Surcharge reduced from 37% to 25% for income above ₹5 crore, and dividend/capital gains surcharge capped at 15%.

TCS and Remittance Changes

Liberalized Remittance Scheme (LRS): TCS threshold increased from ₹7 lakh to ₹10 lakh annually. TCS on education loans under LRS has been completely removed.

Let's say you're sending ₹15 lakh abroad for your child's education. Previously, TCS would apply on ₹8 lakh (₹15L - ₹7L). Now, TCS applies only on ₹5 lakh (₹15L - ₹10L).

DTAA Benefits

India has DTAA agreements with over 90 countries, and these remain your best tool for tax optimization. The 2025 changes don't affect DTAA benefits, so continue leveraging them.

👉 Tip: Always check if your resident country has a DTAA with India before paying taxes twice on the same income.

Your Compliance Checklist

Based on the new rules, here's what you need to do:

Immediate Actions (Next 30 Days)

Review Your Investment Structure

Check if you have investments in restricted sectors

Ensure PINS account is active if you trade stocks

Verify your residential status for tax purposes

Update Banking Arrangements

Ensure you have only one PINS account as per current rules

Check if your NRE/NRO accounts are KYC compliant

Property Portfolio Assessment

If planning to sell, consider timing for lower LTCG rates

Evaluate self-occupied property declarations

Ongoing Compliance (Quarterly)

Tax Filing Obligations

File ITR if Indian income exceeds ₹4 lakh

Use extended 5-year window for updated returns (increased from 3 years)

Investment Monitoring

Stay within sectoral caps (10% of company equity)

Monitor repatriation limits

Documentation

Maintain FEMA compliance records

Keep DTAA claim documentation ready

Before vs After: What's Different

Aspect | Before 2025 | After 2025 | Impact for NRIs |

Tax Exemption | ₹5 lakh for residents | ₹12 lakh for residents only | NRIs still limited to ₹4 lakh basic exemption |

LTCG Tax | 20% on property | 12.5% on property | 37.5% tax savings on property sales |

Property Repatriation | Complex approvals beyond limits | $2 million annually without approval | Much easier fund repatriation |

TCS Threshold | ₹7 lakh | ₹10 lakh | Lower TCS on foreign remittances |

Self-Occupied Properties | One property | Two properties | Tax savings on notional rent |

Education Loan TCS | 0.5% TCS applicable | Completely removed | No TCS on education expenses |

PINS Account | NRE + NRO PINS needed | Only NRE PINS required | Simplified banking |

Sector-Wise Investment Limits Explained

Understanding where you can and cannot invest is crucial for compliance.

Allowed Sectors (With Limits)

Banking and Financial Services: Up to 74% FDI allowed

Insurance: Up to 49% FDI

Telecommunications: Up to 49% FDI with government approval

Pharmaceuticals: Up to 100% automatic route for greenfield investments

👉 Tip: Always check the latest FDI policy before making significant investments, as these limits can change.

Prohibited Sectors for NRIs

NRIs cannot invest in atomic energy, railways (except some specified activities), lottery business, and gambling.

Real Estate Restrictions:

Agricultural land and farmhouses remain off-limits

Plantation properties prohibited

Commercial real estate allowed with proper documentation

Common Mistakes That Could Cost You

After helping hundreds of NRIs navigate these rules, here are the mistakes I see repeatedly:

Banking Errors

Opening Multiple PINS Accounts: You can have only one PINS account with one designated bank. I've seen NRIs unknowingly open multiple accounts and face compliance issues.

Using Wrong Account Types: Using NRO account for repatriable investments or NRE for non-repatriable ones creates documentation nightmares.

Tax Planning Mistakes

Ignoring DTAA Benefits: Not claiming DTAA benefits leads to double taxation. Always file for treaty benefits if available.

Incorrect Residential Status: Many NRIs incorrectly assess their residential status, leading to wrong tax calculations.

Investment Structure Errors

Exceeding Sectoral Caps: Investing beyond 10% in a single company can trigger regulatory action.

Wrong Property Type: Attempting to buy agricultural land or farmhouses leads to legal complications.

👉 Tip: When in doubt, consult a SEBI-registered investment advisor familiar with NRI regulations.

Your Next Steps

The 2025 rule changes generally favor NRIs, especially those with property investments or high-value remittances. Here's what to do now:

This Week:

Review your property portfolio for sale timing optimization

Check your PINS account status with your bank

Assess if you need to restructure any investments

This Month:

Consult a tax advisor about LTCG optimization strategies

Update your investment documentation

Review your DTAA claims for past years

This Quarter:

File any pending ITRs to claim refunds from the new rules

Optimize your investment structure based on new limits

Plan your 2025-26 investments considering the new landscape

The key is staying informed without getting overwhelmed. These changes generally make investing from abroad easier and more tax-efficient, but proper planning is essential.

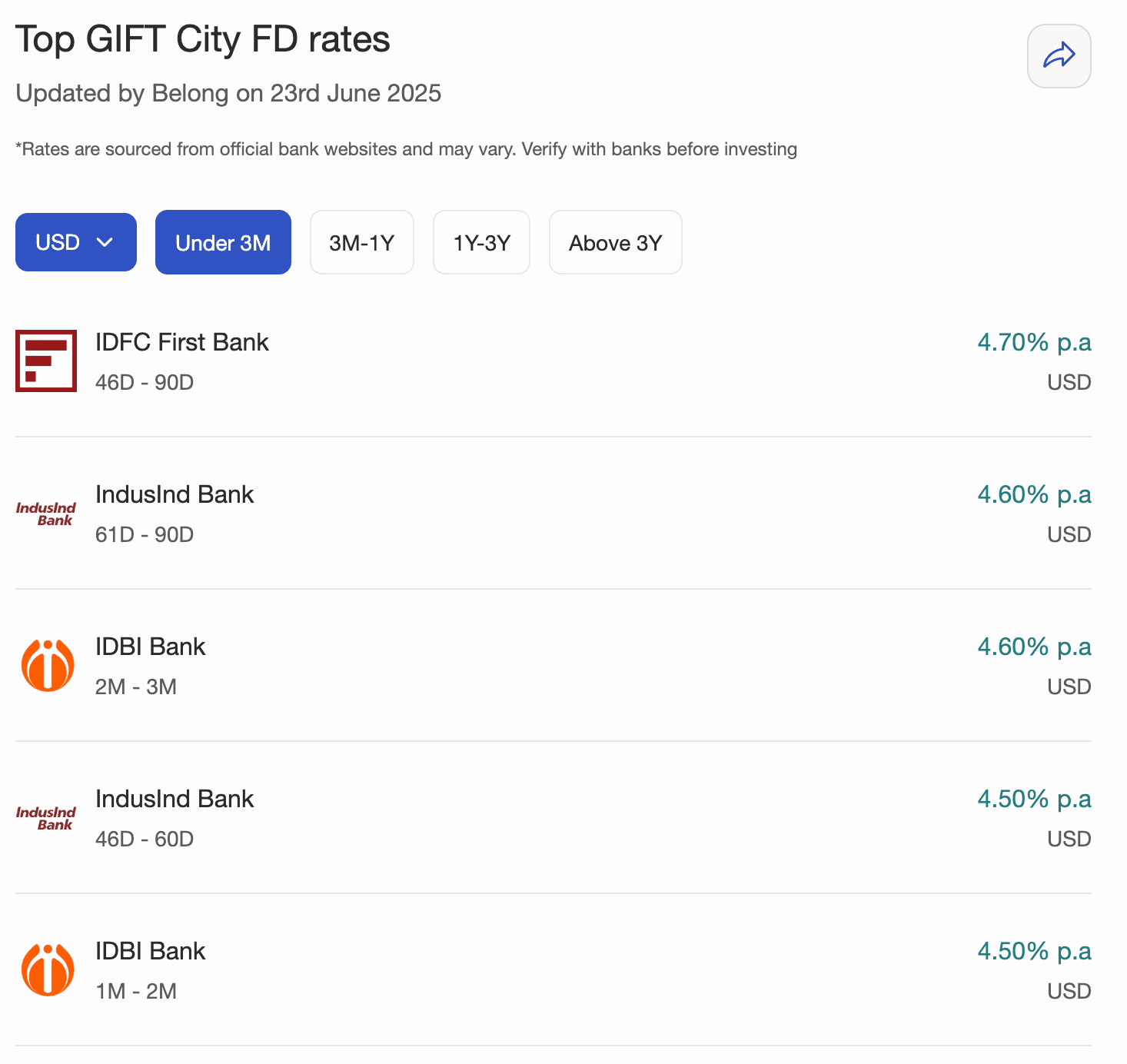

You can compare GIFT City FD Rates with Belong's NRI FD Calculator.

Comments

Your comment has been submitted