NRI Property Rules, Capital Gains and Legal Documentation

The Indian real estate market is attracting many Non-Resident Indians (NRIs). Real estate as a sector has been growing rapidly in India and gives a good avenue for NRIs looking to invest in India and settle in India.

One of the factors driving the NRI’s confidence in the real estate sector is the Real Estate (Regulation and Development) Act, 2016 (RERA Act). This act protects the interests of homebuyers and ensures transparency and accountability in the real estate sector.

NRIs find difficulty in managing their property in India due to compliances, and taxes around managing their property. We will look into rules and compliance around managing property in India.

NRI Real Estate Rules: Eligible Property Types Explained

NRIs and OCIs can purchase residential and commercial properties in India without the special approval of the RBI. Before investing, it’s important to know the types of property which NRIs can own in India.

NRIs can own the following property types in India:

Residential property: Apartments, villas, plots, and under-construction homes

Commercial property: Offices, retail shops, and commercial plots

Gifted property: Residential or commercial property received as a gift from a relative (resident Indian, NRI, or OCI)

Inherited property: Any type of property, including agricultural land, if inherited legally

NRIs can not own the following property types in India:

Agricultural land

Plantation property

Farmhouses

Note: You can own these restricted properties only if inherited or received as a gift. Direct purchase is not allowed.

All payments for the purchase of property should be through formal banking systems. One can use their NRE, NRO, or FCNR(B) accounts to make transactions for the purchase.

Selling Property in India as an NRI

As an OCI or NRI, you are allowed to sell any commercial or residential property in India. You can sell it to:

Indian resident

Another NRI

OCI (Overseas Citizen of India)

But if the property is a farmhouse, plantation, or agricultural land, then the conditions are different. Such property cannot be sold to another foreign national or NRI, even if you own it legally. These lands can only be sold to Indian nationals who are located in India.

After the sale is done, the majority of NRIs wish to remit the funds to their home country. RBI and FEMA allow it, but with certain conditions depending on the manner in which you acquired the property.

Repatriation with NRO account

In this case, the buyer deposits the amount in your NRO bank account. From this account, you can send up to USD 1 million per financial year after taxes abroad or to your country of residence. This limit applies to any kind of property, irrespective of whether it is bought for rupees or foreign currency.

Repatriation from NRE or FCNR(B) account

In this case, if you bought the property from an NRE or FCNR(B) account, then you are allowed to repatriate up to the original purchase amount, even if it exceeds the annual limit of USD 1 million. This rule is applicable only up to 2 residential properties in your lifetime.

Example: You purchased a flat in India for ₹1 crore using your NRE account. Years later, you sold it for ₹1.5 crore. You can repatriate ₹1 crore (your original investment) without touching your $1 million yearly cap. The remaining ₹50 lakh can either be repatriated under the $1 million limit or kept in India.

Note: The USD 1 million limit is per financial year and is individual-specific and not for every property. If you sell multiple properties, all the remittances should stay within the annual limit, unless the additional repatriation from your NRE or FCNR(B) applies.

To transfer the sale proceeds, the bank will ask for some documents such as 15 CA and CB forms, proof of capital gains tax and TDS, original purchase documents, and a copy of the sale deed.

NRI Legal Rights & Documentation

NRIs and OCIs enjoy the same property rights as resident Indians. Property, both residential and commercial, in India can be legally owned, leased, rented, gifted, or inherited by you.

Power of Attorney

If you are abroad, there is no need for you to be physically present for the property transactions. You can grant a Power of Attorney (PoA) to an individual whom you trust in India.

They can represent you for the purposes of registering the property, taking possession, signing rent or sale agreements, or dealing with legal matters. The PoA needs to be attested and apostilled (an official certificate that verifies the authenticity of documents for international use) in the country where you reside in order to be effective in India.

Key Legal Checks and Documents Every NRI Must Prepare

Prior to purchasing property in India, it's necessary to check a few important legal documents to prevent fraud or ownership issues. These checks guarantee that the property is legally valid and completely compliant with Indian laws.

Title deed: It makes sure that the seller has full ownership of the property.

Approved building plan: It confirms that construction is approved legally.

Encumbrance certificate: This guarantees that the property has no loans or legal suits.

RERA registration: It is compulsory for under-construction properties.

Property tax receipts: Ensure there are no dues with the local authorities.

On making a purchase, NRIs should have the following documents with them

Passport or OCI card

PAN card: Required for all property-related financial transactions

NRE, NRO, or FCNR(B) account details: Payments must be made through these accounts.

KYC documents: It is required by banks and builders.

If you are renting out the property, a valid rental agreement and power of attorney, if someone else is managing it on your behalf, and TDS compliance are important.

Capital Gains and TDS on NRI Property Transactions

Taxes play a huge role, and it can be confusing. Under Indian tax law, NRIs pay capital gains tax on property sale just like residents.

If you sell the property after holding it for more than 2 years, it comes under long-term capital gain (LTCG) tax, which is taxed at 12.5% (without indexation benefits).

If you sell the property after holding it for 2 years or less, it comes under Short-term capital gain (STCG) tax, which is taxed at your slab rates (which for NRIs can be up to 30% plus surcharge).

No capital gains arise at the time of inheritance - tax is applied only on the sale of inherited property.

In case of TDS (Tax deducted at source), rules differ for NRIs.When an NRI sells property in India, the buyer must deduct TDS on the payment before handing over the money. As per Section 195 of the Income-tax Act, the buyer withholds tax at:

12.5% (plus cess) on the entire sale price if it’s a long-term capital asset.

30% (plus cess) if it’s short-term.

The NRI seller can file an Indian tax return and can claim deductions and any refund if excess TDS was paid.

Note: If the sale exceeds ₹50 lakh and the seller is an NRI, the higher 12.5%/30% rate applies. The usual 1% TDS under Section 194-IA (for residents) does not override Section 195 for non-residents.

Not sure where to invest? Understand the key differences between GIFT City FD, FCNR, NRO, and NRE options.

On the other hand, if an NRI earns rental income from Indian property, the tenant must deduct TDS at 30% (plus cess). That is, rent payments to an NRI landlord are taxed at 30%.

Other taxes: NRIs must also pay regular property taxes to local authorities as applicable. Stamp duty at the time of purchase is higher in some states for NRIs/non-residents, so that is a factor when buying.

Tax compliance is complex but manageable. NRIs face capital gains tax and mandatory TDS by buyers/tenants. The upside is that tax rates and exemptions are similar to those for residents. Keeping receipts and working with a CA can ensure you neither overpay nor face difficulty with the system.

You can also read:

--------------------------------------------------------------------------------

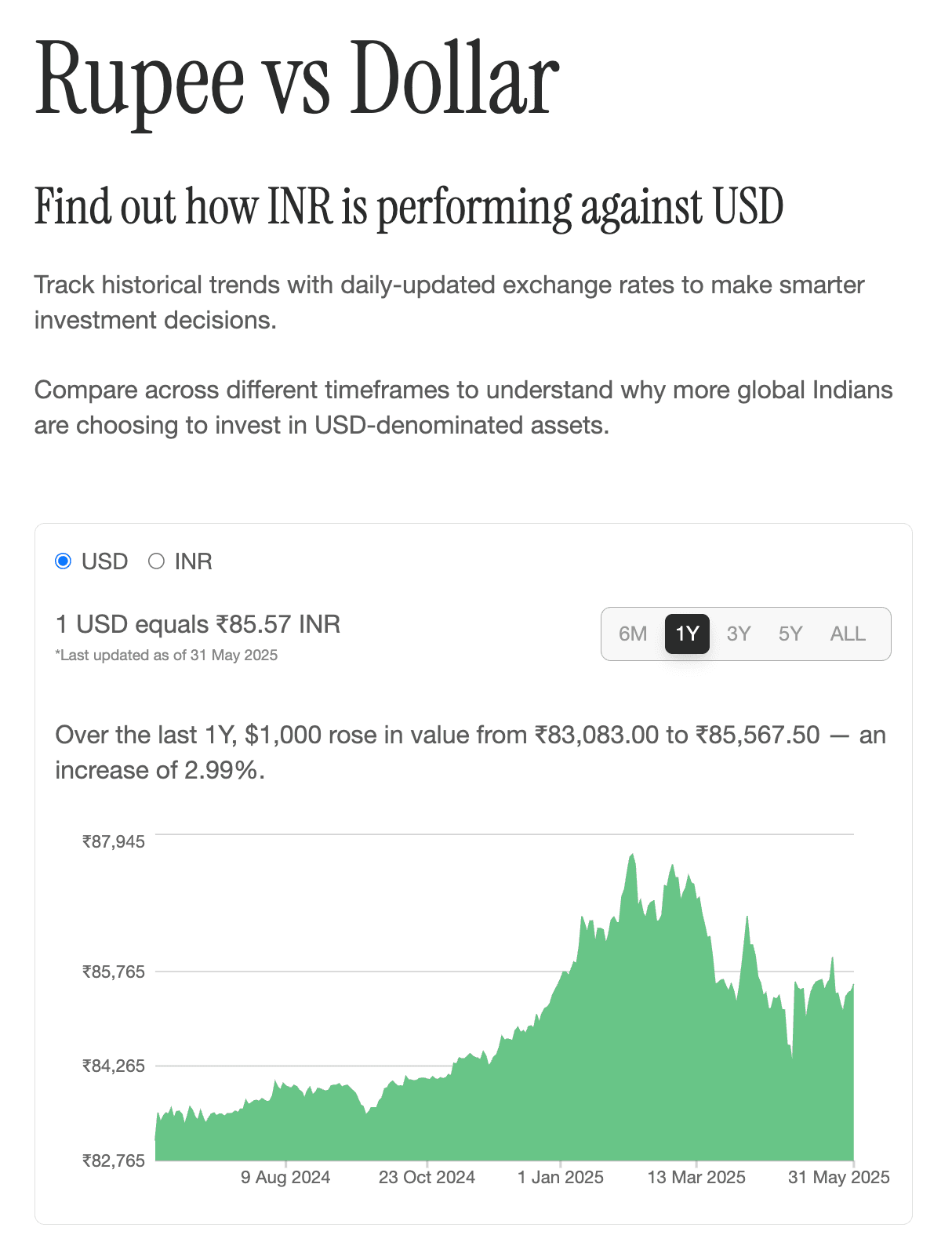

Monitor Rupee vs Dollar trends with ease. Belong's currency tracker empowers NRIs to understand INR to USD conversion & protect their wealth.

Find out how INR is performing against USD with Belong's Rupee vs Dollar Tracker

Comments

Your comment has been submitted