Repatriable vs Non-Repatriable NRI Fixed Deposits: Key Differences Explained

If you're an NRI wondering where to park your money in India without getting tangled in tax hassles or repatriation limits, this blog is for you. Let’s break down two common options – Repatriable NRI Fixed Deposits and Non-Repatriable NRI Fixed Deposits, and help you figure out which one fits your needs best.

Because when it comes to growing your savings, details matter.

What are NRI Fixed Deposits?

Before jumping into the comparison, let’s get the basics right.

As an NRI (Non-Resident Indian), you can't open regular resident savings or FD accounts in India. You need special NRI accounts, namely NRE, NRO, FCNR, or GIFT City accounts. You can open NRI Fixed Deposits (FDs) using these accounts.

But not all NRI FDs are created equal.

A Non-Resident Ordinary (NRO) bank account is meant for holding the Indian income, like rent, investments in stock markets, etc., of the NRI. They are denominated in Indian rupees and allow a repatriation limit of 1 million USD per year. The interest income from the NRO account is taxable.

Non-Resident External (NRE) bank account is meant for holding overseas income and is denominated in Indian rupees. The interest earned on an NRE account is not taxable, and it allows for easy repatriation.

Foreign Currency Non-Resident (FCNR) account is meant for holding foreign income in international currencies like USD, Pound, Dirham, etc. The interest earned on FCNR is tax-free and allows for easy repatriation like an NRE account.

A new type of bank account, the GIFT City Bank account, has emerged recently. GIFT City bank accounts offer FDs, which are similar to FCNR FDs in terms of accepting foreign currency deposits and repatriability.

So, what are the factors that influence repatriability in NRE, NRO, FCNR and GIFT City FDs?

Let’s unpack that.

1. Source of Funds and Account Type

- Repatriable NRI FDs are typically opened through NRE (Non-Resident External), FCNR and GIFT Cityaccounts. These are funded using foreign income, i.e. your earnings abroad.

- Non-Repatriable NRI FDs are linked to NRO (Non-Resident Ordinary) accounts. These are meant for your Indian income, like rent from a property, dividends, or pension.

2. Repatriation Rules: Can You Take the Money Back?

- With NRE, FCNR and GIFT City FDs, there’s no cap. You can repatriate both the principal and interest freely in any currency.

- With NRO FDs, things get complicated. You’re allowed to repatriate only up to USD 1 million per financial year, and that too after paying taxes and submitting documents like Form 15CA and 15CB.

If you plan to send money abroad later, NRE is the way to go.

3. Tax Implications: The Big One

- The interest earned on NRE, FCNR and GIFT City FD is 100% tax-free in India. There’s no income tax or TDS deducted in these types of accounts.

- NRO FD interest, however, is fully taxable. The tax liability depends on the tax slab of the individual. Banks deduct TDS at 30% + surcharge, and you’ll need to file taxes in India. You can claim relief via DTAA (Double Taxation Avoidance Agreement) if your resident country has a DTAA with India. But it involves paperwork.

NRE/FCNR and GIFT City FDs win again. Tax-free interest = higher post-tax returns.

4. Interest Rates: Pretty Even Playing Field

Most Indian banks offer similar interest rates for both NRE and NRO FDs. As of 2025:

HDFC Bank: 6.60% for tenure greater than 1 year

SBI: 6.25% for tenure between 1 year to 2 years

ICICI Bank: 6.50% for tenure between 18 months to 2 years tenure

Axis Bank: 6.250% for 1 year 10 days tenure

But remember, while rates may be similar, your actual return on NRO FDs is lower due to taxes.

FCNR FDs have a slightly higher interest rate. But if you are looking for shorter tenures GIFT City FDs are the best for you.

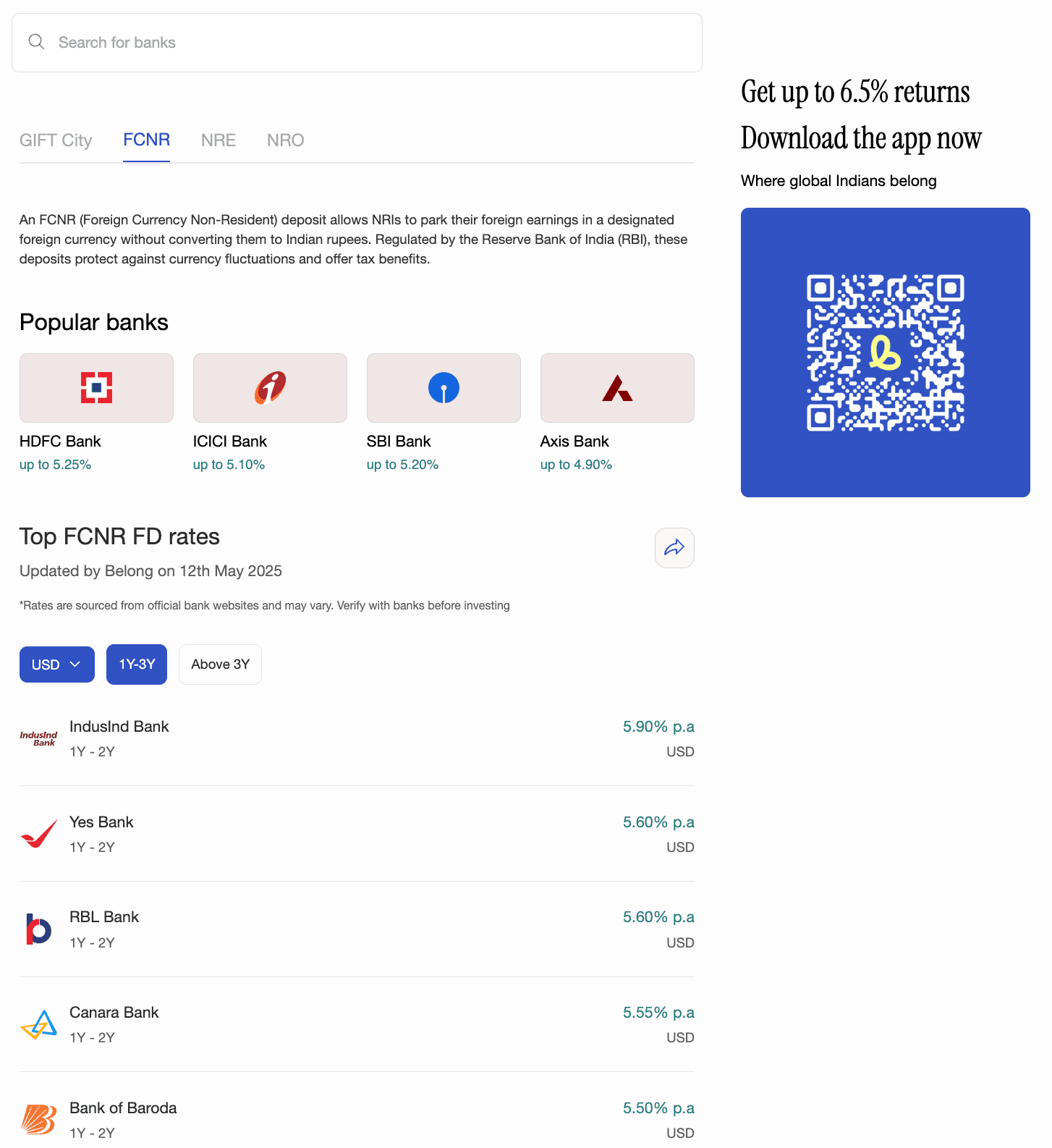

You can check out the latest interest rates on NRE, NRO, FCNR and GIFT City FDs using Belong’s NRI FD comparison tool.

5. Currency Risk: INR Fluctuations Affect Both

Both NRE and NRO FDs are INR-denominated. You lose out on your savings if the Indian rupee depreciates against major world currencies.

If you want to avoid the INR depreciation, consider FCNR(B) deposits or GIFT City deposits, which are in USD, GBP, EUR, etc., but that's another story.

6. Tenure & Flexibility

- NRE FDs usually require a minimum of 1 year. If you break it earlier, there is a penalty to be paid. The same case applies to FCNR FDs.

- NRO FDs can be as short as 7 days and go up to 10 years. GIFT City deposits are similar in this aspect to NRO FDs. They offer shorter tenures for deposits.

Both allow premature withdrawals (with penalties) and loans against FDs.

If flexibility is important, NRO FDs and GIFT City FDs offer shorter tenures.

7. Joint Holding Rules

- NRE FDs and FCNR FDs can only be held jointly with relatives (who are resident Indians) or other NRIs or PIOs.

- NRO FDs can be held jointly with resident Indians, which is useful if you're supporting family back home.

8. Documentation & Ease of Opening

All the types of FDs can be opened through online processes or via bank branches and require similar documentation:

- Passport & Visa

- Overseas and Indian address proof

- PAN or Form 60

- Proof of remittance or Indian income

Top banks like SBI, ICICI, HDFC, Axis Bank, etc. offer dedicated NRI services to make this process easy.

Comparison Table: Repatriable vs Non-Repatriable NRI FDs

Feature | NRE FD (Repatriable) | NRO FD (Non-Repatriable) | FCNR FD (Repatriable) | GIFT City FD (Repatriable) |

|---|---|---|---|---|

Linked Account | NRE (foreign income) | NRO (Indian income) | NRE (foreign account) | GIFT City account |

Tax on Interest | Tax-free | Taxable at slab rate with TDS deducted @30% TDS | Tax-free | Tax-free |

Repatriation | Fully repatriable | USD 1 million/year limit | Fully repatriable | Fully repatriable |

Joint Holder | Only with NRI/PIO | Can include Indian residents | Only with NRI/PIO | Only with NRI/PIO |

Minimum Tenure | 1 year | As short as 7 days | 1 year | As short as 7 days |

Currency Risk | Yes | Yes | No | No |

Ideal For | Tax-free growth & full fund transfer | Earning from Indian assets | Tax-free growth & full fund transfer | Tax-free growth & full fund transfer |

Still confused about what’s legally allowed for your NRI status?

Take our quick NRI Compliance Pass check to ensure you're on the right side of Indian laws.

Which NRI FD is Best for You?

Choose NRE FDs/FCNR FDs and GIFT City FD if you earn abroad and want tax-free returns with full repatriation freedomOpt for NRO FDs if you have income in India

Each serves a different purpose. If you're an NRI with dual income sources, you may even need both. Being mindful of tax compliance, INR depreciation, and your holding period should guide the decision to choose the FD.

| Also Read:

Comments

Your comment has been submitted