TDS on Rent: Limits, How To Pay - Guide for NRIs

When an NRI rents property in India, the law places the responsibility on the tenant to deduct tax at source (TDS) and pay it to the Indian government. The tenant is required to be the "deductor" under Section 195 of the Income Tax Act, and the NRI landlord needs to be seen as complying.

This blog explains what NRIs need to know about what tenants need to do when it comes to TDS on rental income.

TDS Deducted on Rent to Pay NRI Landlords

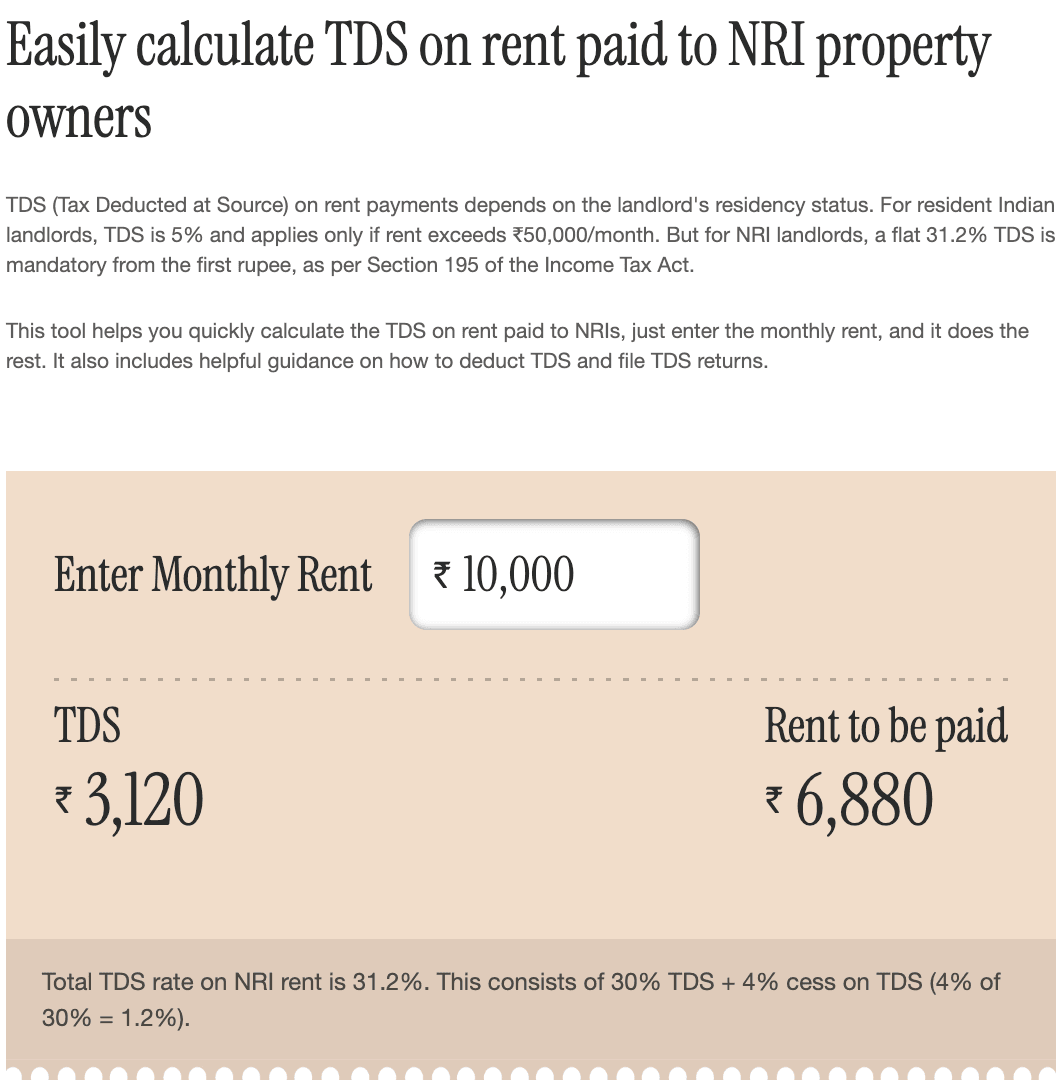

The entire rent payable to a non-resident Indian landlord has to have a tax deducted at source (TDS) at 30%. There is an applicable surcharge and cess to this. The actual tax liability will be dependent on the NRI landlord’s tax slab.

The major points for the tenant and NRI are:

- TDS Rate: 30% of rent + surcharge/cess (actually it is around 31.2% for an individual NRI). For larger amounts, the surcharge may add up.

- No Threshold: The TDS deduction for rent paid to a resident Indian has a threshold of ₹50,000/month. In case of NRIs, any rent amount will be subjected to TDS even for a nominal rent amount.

- Lower‑TDS Certificate: An NRI landlord can approach the Income Tax Department (AO) for a "lower withholding certificate" under Section 197. If this certificate is issued, the tenant can deduct TDS at a reduced rate. But until this certificate is issued, the entire TDS amount has to be withheld.

Process to Deduct TDS on Rent Paid to NRI Landlords

The tenant has to manage tax forms and deadlines seriously. Tenants must do the following to deduct TDS correctly:

Verify NRI Status: The tenant must first verify whether the landlord is actually an NRI for that year (preferably in writing).

Get TAN: The tenant has to obtain a Tax Deduction and Collection Account Number (TAN) prior to deducting tax. One can apply online through the NSDL website and check it in the income tax portal.

Deduct TDS Monthly: Deduct 30% of the amount (along with cess) on each rent payment. For example, if rent is ₹50,000 per month, TDS would be ₹15,600 (31.2% including cess) every month.

Deposit Tax on Time: The withheld tax should be deposited with the government by the 7th of the next month. For example, June 5 rent should have its TDS deposited on July 7. Delays bring interest and a penalty.

Quarterly TDS Returns: The tenant should file an e-TDS return (Form 27Q) for payments to his NRI landlord quarterly. For instance, the quarter April-June return is to be filed by July 31.

Issue TDS Certificate: The tenant has to give a Form 16A (TDS certificate) to the NRI landlord within 15 days of filing each return.

Keep Records: Take duplicates of the rent agreement, rent receipts, TDS challans (Challan 281), and bank statements.

Rental Agreement and Proof of Payment: Retain signed lease/rent agreement, rent receipts, and payment proofs from the bank.

Other Documents: The tenant's bank or tax consultant may require copies of the landlord's NRI identification (passport/OCI card). The NRI landlord must provide their tax residency certificate only if they wish to claim the treaty benefit.

Penalty for Not Deducting TDS on Rent Paid to an NRI Landlord

If the tenant doesn't deduct or deposit TDS correctly, there are heavy penalties. The tax authority considers the unpaid TDS as the tax liability of the tenant (under Section 201). In particular:

1. Penalty under Section 271C

The tenant is liable to be penalised an amount equivalent to the TDS amount.

2. Interest

Delayed deposit of tax deducted carries interest (generally 1.5% per month) until repayment.

3. Prosecution under Section 276B

Willful failure to remit TDS may even result in prosecution and imprisonment (3 months to 7 years). (E.g., the courts have held that delayed deposit of TDS may attract criminal proceedings.)

4. Advance Tax Liability

Even if the tenant paid gross rent without withholding, the NRI landlord is still liable to pay tax on such income. According to tax regulations, the landlord would then have to pay advance tax on the entire rent (or self-assessment tax with interest). In simple words, the NRI cannot avoid tax liability because the tenant defaulted – the tax is still the landlord's liability.

5. Repatriation Hold-Up

Banks and the RBI will not allow NRIs to repatriate rental income until they see that taxes have been accounted for. Any shortfall or missing TDS certificate can block the NRI’s repatriation of rent.

In short, non‑compliance hurts both parties: the tenant faces fines and possible jail time, and the NRI may face tax demands and delays in getting money out of India.

TDS Filing Mistakes for NRI Landlords & How to Avoid Them

1. Assuming No TDS for Small Rents

Tenants should remember that any rent payment to an NRI needs to have TDS. Tenants should not overlook the TDS withholding just because the rent is small.

2. Mixing Up Resident vs NRI Rules

The ₹50,000/month limit for residents doesn't apply to NRIs. Even though your rental agreement was entered prior to the landlord's departure from India, so long as the landlord is a non-resident for the year, TDS rules are applicable.

3. Neglecting to Confirm NRI Status

Always take a yearly declaration or evidence that the landlord is an NRI. The rules will change once the landlord becomes a resident. Maintain documentation (e.g., a copy of stamp-out in passport, or a yearly NRI declaration).

4. Missing Deadlines

It is compulsory to file TDS returns and deposit by the 7th of the month. It's expensive to file late. Use reminders or expert assistance to file on time.

5. Overlooking Required Certificates

Once TDS has been paid, do not forget to issue Form 16A to the NRI within 15 days from the due date of the return. Keep evidence of the same.

6. Poor Documentation

Failing to keep rent receipts, lease copies, or TDS challans can cause problems if tax authorities ask. Keeping records will help if there is some conflict with the IT department at a later stage.

By being cautious of these traps and verifying every step, both NRI landlords and tenants can spare themselves from making costly errors.

--------------------------------------------------------------------------------

You can also read

- Highlights of Union Budget 2025-26

- Benefits of Working in GIFT City Companies

Comments

Your comment has been submitted