How Much Gold Can I Carry From The UAE To India

This WhatsApp message from Priya in Dubai came at 2 AM UAE time last month. She was panicking about a gold purchase that should have been straightforward.

"Ankur, I'm flying to Mumbai next week with 50 grams of gold jewellery I bought in Gold Souk. My colleague scared me saying customs will seize it if I don't declare properly. I'm so confused about the limits - how much can I actually carry without getting into trouble?"

If you're living in the UAE and planning to carry gold to India, you're probably asking the same questions: What are the exact limits? How much duty will I pay?

What happens if I make a mistake?

Here's the thing: the rules are actually clearer than most people think, and there have been some major changes in 2024 that make carrying gold much more affordable than before.

By the end of this guide, you'll know:

Exact gold limits for men, women, and children

How the July 2024 duty reduction affects you

Smart strategies to minimize customs duty

What documentation you need to avoid problems

Common mistakes that land people in trouble

Let's clear up the confusion once and for all.

The Big Picture: Why Gold Rules Matter

Before we dive into limits, let me explain why the Indian government cares so much about gold imports.

India is the world's second-largest gold consumer, and Dubai's tax-free gold is significantly cheaper than Indian prices. Here are the two main reasons people buy gold in the UAE and bring it to India:

Why UAE Gold is Cheaper:

Zero GST advantage: Dubai imposes no GST on bullion and gold jewellery, while India charges 3% GST on gold

Lower import duties: Even after recent reductions, bringing gold personally can help minimize certain duty components (though this has strict limits)

The significant price difference means everyone wants to buy gold in Dubai and bring it to India. To control this influx and protect domestic jewellers, India has specific limits and duties.

But here's the good news: In July 2024, Finance Minister Nirmala Sitharaman announced a sharp cut in import duties on gold and silver, from 15% to only 6%. This is the biggest reduction in over a decade and changes the math significantly for travellers.

UAE to India Gold Duty-Free Limits: How Much Can You Carry

Let me give you the exact numbers. These are the amounts you can carry completely free of customs duty:

For Men:

Maximum weight: 20 grams

Maximum value: ₹50,000

Form required: jewellery only (not coins or bars)

Indian customs regulations specify that the duty-free allowance applies exclusively to pure gold including jewellery and gold bars [Source]

For Women:

Maximum weight: 40 grams

Maximum value: ₹1,00,000

Form required: jewellery only (not coins or bars)

For Children (Under 15 years):

Maximum weight: 40 grams

Form required: Jewellery, gifts, or ornaments

Additional requirement: Must carry identity proof showing relationship with accompanying adults

👉 Critical condition: You must have stayed abroad for at least 6 consecutive months to qualify for these duty-free limits.

Also read: Double Taxation between India and UAE

What Qualifies as "Jewellery"?

This trips up many people. For duty-free allowance:

Allowed: Necklaces, rings, bangles, earrings, chains

Not allowed: Gold coins, gold bars, gold biscuits

Not allowed: Gold jewellery studded with stones or pearls (complex rules apply)

What Happens When You Exceed the Limits?

If you're carrying more than the duty-free allowance, you'll pay customs duty on the excess amount. Here's where the 2024 changes make a huge difference.

Gold Import Duty for Travelers (as of August 2025)

This table maintains the original structure but has been completely updated with the official duty rates and rules as specified by Indian Customs.

Duration of Stay Abroad | Category of Traveller | Duty-Free Allowance (For Jewellery Only) | Customs Duty on Gold Exceeding the Allowance |

Less than 6 months | All Passengers | No Allowance. | Standard Rate: 39.6% applies to the entire value of all gold carried. |

6 months to 1 year | All Passengers | No Duty-Free Allowance. (This requires a >1 year stay) | Concessional Rate: 6.6% applies to the entire value of all gold carried (up to the 1 kg limit). |

More than 1 year | Female Passenger | Up to 40 grams of gold jewellery, value capped at ₹1,00,000. | Concessional Rate: 6.6% applies to jewellery beyond the allowance and all other forms of gold. |

More than 1 year | Male Passenger | Up to 20 grams of gold jewellery, value capped at ₹50,000. | Concessional Rate: 6.6% applies to jewellery beyond the allowance and all other forms of gold. |

More than 1 year | Child Passenger | No specific gold jewellery allowance. | Concessional Rate: 6.6% applies to the entire value of any gold carried. |

The Concessional Duty Rate (from Gold Import Scheme): This is for eligible passengers staying abroad for more than six months. The effective rate is 6.6%, which includes a 6% base duty (BCD+AIDC) and a 0.6% Social Welfare Surcharge.

Value of gold to be taken as per Tariff value fixed through notification from time to time.

The Duty-Free Allowance (from Baggage Rules): This is only for passengers staying more than one year and applies only to jewellery within the specified weight/value limits.

The Concessional Duty Rate (from Gold Import Scheme): This is for "eligible passengers" staying more than six months. It applies to all forms of gold (jewellery, coins, bars) up to a total of 1 kg.

Payment in Foreign Currency: The customs duty (whether 6% or 36%) must be paid in a convertible foreign currency.

Total Limit is 1 Kg: The total amount of gold an eligible passenger can bring under the concessional rate scheme is 1 kilogram. Anything beyond this limit would be subject to much higher duties or restrictions.

Myth Busted: The tiered duty rates (3%, 6%, 10%) are confirmed to be incorrect. The official rates are a flat 6% (concessional) or 36% (standard).

Scenario:

A female passenger who has lived abroad for 4 years is returning to India. She is wearing a single 30-gram gold necklace.

Assumptions: Customs assesses the value of gold at ₹7,200 per gram.

Value of Necklace: 30 grams x ₹7,200/gram = ₹2,16,000.

Step-by-Step Duty Calculation:

Step 1: Check for Duty-Free Allowance

Her Allowance: Up to 40 grams of jewellery with a value capped at ₹1,00,000.

The Problem: While the weight (30g) is under the 40g limit, the necklace's value (₹2,16,000) is much higher than the ₹1,00,000 value cap.

Result: The duty-free allowance is voided. The entire 30-gram necklace is dutiable.

Step 2: Determine the Duty Rate

Since her stay abroad was over 6 months, she is an "eligible passenger".

Result: She qualifies for the 6% concessional duty rate.

Step 3: Calculate the Final Duty

Dutiable Value: ₹2,16,000 (the full value of the necklace).

Duty Payable: 6% of ₹2,16,000 = ₹12,960.

This duty must be paid in a convertible foreign currency.

Key Takeaway: The low value cap on the "duty-free" allowance means most jewellery bought today will be fully dutiable.

Example 2: Mixed Gold (Jewellery + Coin)

This example shows how the rules are applied when a passenger carries different forms of gold.

Scenario:

A male passenger who has lived abroad for 10 years brings two items:

A small 10-gram gold chain for his child, valued at ₹72,000.

A 50-gram gold coin, valued at ₹3,60,000.

Step-by-Step Duty Calculation:

Step 1: Assess the Jewellery (Gold Chain) for Duty-Free Allowance

His Allowance: Up to 20 grams of jewellery with a value capped at ₹50,000.

The Problem: The chain's weight (10g) is within the limit, but its value (₹72,000) exceeds the ₹50,000 cap.

Result: The duty-free allowance is voided. The entire 10-gram chain is dutiable.

Step 2: Identify All Dutiable Gold

Gold coins and bars are always dutiable.

Total Dutiable Gold: 10 grams (from the chain) + 50 grams (from the coin) = 65 grams.

Step 3: Determine the Duty Rate

His stay was over 6 months, making him an "eligible passenger".

Result: The 6% concessional duty rate applies to the total value of all dutiable gold.

Step 4: Calculate the Final Duty

Total Dutiable Value: ₹72,000 (chain) + ₹3,60,000 (coin) = ₹4,32,000.

Duty Payable: 6% of ₹4,32,000 = ₹25,920.

This duty must be paid in a convertible foreign currency.

Maximum Carrying Limits:

You can't carry more than 1kg gold, even the ornaments.

For practical purposes:

Gold jewellery: Up to 1kg (with proper documentation and duty payment)

(On an individual basis and cannot be pooled with other passengers)Gold bars/coins: Maximum 1kg per person

Real example: Rajesh lives in Dubai but visited India for 2 months and returned to UAE just 4 months ago. If he carries even 10 grams of gold, he'll pay the higher duty rate since he hasn't completed 6 months abroad.

👉 Smart tip: Keep track of your travel dates. Immigration stamps in your passport determine your eligibility.

Required Documentation: Don't Get Caught Without These

Here's what you absolutely need to carry:

Essential Documents:

Purchase invoices with details of:

Purity of gold (22K, 24K, etc.)

Weight of each item

Purchase price and date

Seller details

Valid passport with UAE residence visa

Emirates ID (carry copies)

For children: Birth certificate or school ID proving relationship with adults

At Indian Customs:

Declare gold if you exceed duty-free limits

Go to the Red Channel for declaration

The customs duty charges for carrying above limit gold should be paid in a convertible foreign currency.

👉 Pro tip: Take photos of all documents and store them in cloud storage as backup.

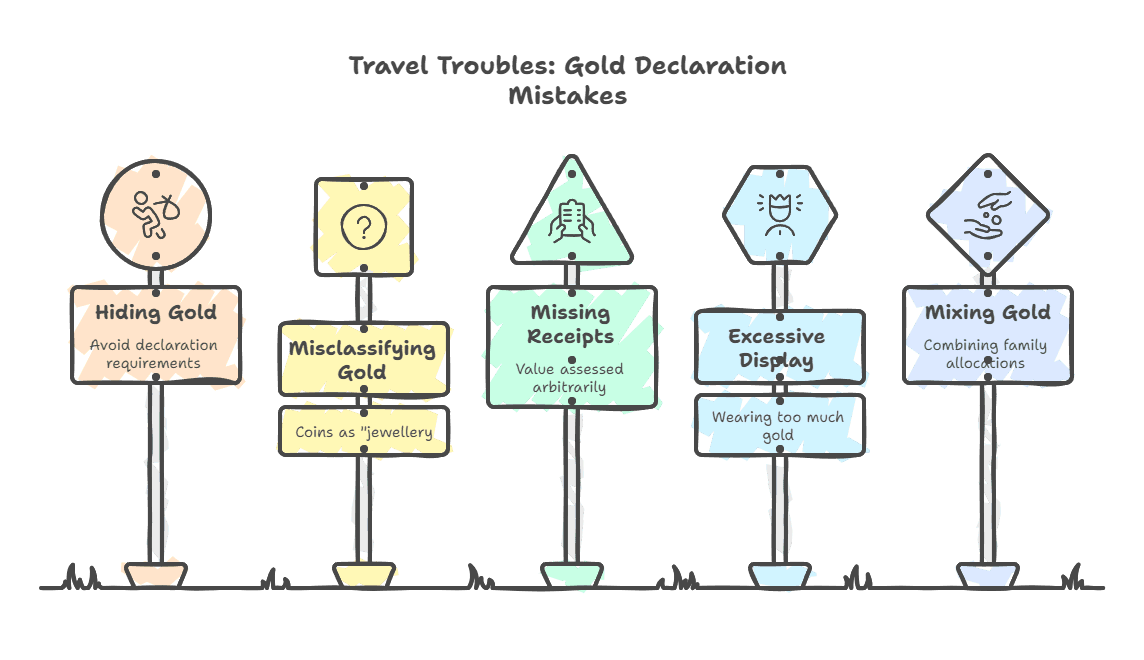

Common Mistakes That Get People Into Trouble

Mistake 1: Hiding Gold to Avoid Declaration

What happens: Complete confiscation, heavy penalties, possible legal action Smart approach: Always declare excess gold. The 6% duty is much better than the consequences of hiding.

Mistake 2: Carrying Gold Coins Thinking They're "Jewellery"

What happens: No duty-free allowance, full duty on entire amount Smart approach: Import of duty-free gold is applicable only for gold jewellery and does not include gold coins, gold bars, or gold biscuits.

Mistake 3: Not Keeping Purchase Receipts

What happens: Customs may assess value arbitrarily, usually higher than actual cost Smart approach: Always carry original bills, even for small purchases.

Mistake 4: Wearing Too Much Gold During Flight

While personal jewellery is allowed, wearing excessive amounts can raise suspicion. Pack properly and carry documentation.

Mistake 5: Mixing Family Gold

Don't combine gold for multiple family members in one bag. Each person should carry their own allocation separately.

Also read: Indian Banks in the UAE.

Smart Strategies to Maximize Your Allowance

Family Coordination:

If traveling with family, distribute gold optimally:

Male + Female + Child: Combined duty-free allowance of 100 grams

Each person should carry their allocation separately

Maintain separate purchase receipts

Timing Your Purchase:

Best time to buy in UAE: During Dubai Shopping Festival (January-February) for better prices

Best time to travel: Ensure you complete 6 months abroad before carrying significant gold

Form Selection:

Choose jewellery over coins/bars for duty-free benefits

Consider getting coins converted to simple jewellery pieces if needed

Recent Changes You Must Know About

July 2024 Budget Impact:

The 2024-25 Union Budget unveiled several pro-gold policy measures. Total customs duty on gold was lowered from 15% to 6% and that on gold doré has been reduced to 5.35% from 14.35%. This is the sharpest reduction on record and the lowest since June 2013.

What this means for you:

Carrying excess gold is now much more affordable

Reduced incentive for gold smuggling

Higher legal compliance expected

Impact on Gold Prices:

The reduction of gold's import duty brought domestic gold prices lower 6% m/m, with y-t-d gains now at 10%

This means the price difference between Dubai and India has reduced, but Dubai is still attractive for bulk purchases.

Step-by-Step Process at Indian Customs

If You're Within Duty-Free Limits:

Choose Green Channel (Nothing to Declare)

Keep purchase receipts handy in case of random checks

Usually, you'll walk through without issues

If You're Exceeding Limits:

Choose Red Channel (Goods to Declare)

Fill out customs declaration form

Present purchase invoices and weight certificates

Pay duty in foreign currency (USD, AED, etc.)

Get customs receipt for your records

Proceed to exit

👉 Important: Failure to declare excess gold can lead to confiscation, penalties, and legal action under the Customs Act of 1962.

Alternative Options If You Want to Carry More

Commercial Import:

For quantities above personal limits, consider formal import procedures through authorized dealers (much more complex but legal).

UAE Gold Refund:

The government of the UAE provides a concession for Indian Passengers, allowing them to reclaim a refund of 5% of the VAT paid towards the purchase of gold. However, this does not apply to NRIS.

Unfortunately, NRIs don't get this benefit, but residents of other countries might.

Practical Tips from Real Experience

At Dubai Gold Souk:

Always ask for proper invoices with purity details

Verify weight on their scales before purchase

Keep all receipts in one folder for easy access

Packing for Travel:

Carry gold in hand luggage, never in checked bags

Use jewellery boxes or pouches for organization

Keep documents in easily accessible location

At Indian Airport:

Allow extra time for customs processing if declaring

Be honest and cooperative with officials

Keep calm even if questioned — you're following rules

What to Do If Something Goes Wrong

If Customs Questions Your Gold:

Stay calm and provide all documentation

Explain your purchase clearly

Don't argue; cooperate fully

If You Face Penalties:

Understand the exact violation

Ask for written explanation

Consider legal consultation for significant amounts

If Gold is Confiscated:

Get receipt for confiscated items

Understand redemption process

Consult with customs lawyer if needed

Bottom Line: Your Gold Carrying Strategy

For small amounts (within duty-free limits):

Keep proper documentation

Choose jewellery over coins/bars

Ensure 6-month foreign stay

For larger amounts:

Calculate 6% duty cost vs benefit

Plan family allocation if traveling together

Keep substantial documentation

Budget for duty payment in foreign currency

Remember: The July 2024 duty reduction makes carrying gold much more affordable than before. A 6% duty is manageable for most people, and the legal certainty is worth more than the savings from attempting to hide gold.

Your Next Steps

- Track your travel dates to ensure 6-month eligibility

Get proper documentation for any gold purchases

Budget for duty if carrying excess amounts

Stay updated: Gold import rules can change. Follow our blog for the latest updates on Indian customs regulations.

The information in this guide is based on current Indian customs regulations as of July 2025. Rules can change, so always verify latest requirements before traveling.

Sources:

Comments

Your comment has been submitted